The past year will undoubtedly go down in history as a pivotal period in the history of crypto. Bitcoin (BTC) and Ethereum (ETH) all-time highs puled the cryptocurrency market cap past $3 trillion, while the surge in popularity of non-fungible tokens (NFT) and metaverse projects pushed the crypto firmly into the mainstream.

Here’s a recap of the biggest news stories and market moves that played the most crucial parts in shaping 2021 into one of the most important years in the history of blockchain.

The cryptocurrency market cap surged to $3T on the tailwind of Bitcoin and altcoins historic performances

At the beginning of 2021, the combined value of all digital assets in circulation was “only” $865 billion, which crypto aficionados welcomed with great enthusiasm as it marked the highest market valuation of digital currencies up until that point.

However, the 2021’s wild ride was just getting started. The first week into January, the market cap had already reached the $1 trillion milestone. The rally continued for the next four months and the market cap broke $2 trillion in April before ultimately reaching the $2.55 trillion mark in May. A massive crash ensued, which saw the markets lose over $500 billion in the span of 48 hours and ushered in a relatively long period of consolidation which lasted throughout summer.

However, bulls woke up in mid-July and digital assets resumed their furious rise to new price peaks. On the 11th of October, the crypto market cap touched $3 trillion for the first time and many crypto analysts were convinced that a $100K Bitcoin by year’s end is inevitable. However, market dynamics and regulatory uncertainty repeatedly expressed by US policymakers pushed the market’s value down to $2.3 trillion by the end of the year.

Bitcoin hit a new ATH despite Beijing’s regulatory clampdowns

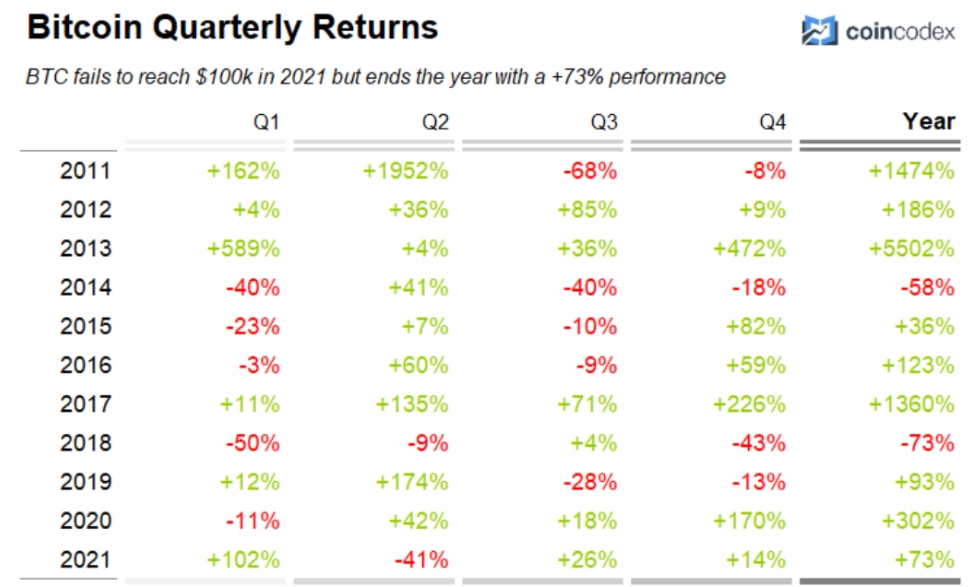

Bitcoin’s opened the year with a bang – the world’s largest digital asset broke the $40,000 level in the first week of 2021. The massive rally continued until April when BTC broke $60,000 for the first time and reached a then high price point of $64,800.

May was a particularly bad month for crypto and BTC was no exception – its price had more than halved in the span of two weeks. A series of regulatory crackdowns on the Bitcoin mining industry in China has contributed to the bearish trend and kept BTC in the $30K range for the first half of the summer.

By August, the market sentiment has completely shifted and BTC resumed its rally. The oldest digital currency managed to peak in November, posting the all-time high price of $68,770. While the price of BTC retraced to the $48,000 range since then, this value still represents by far the highest value at year’s end in its 13-year history.

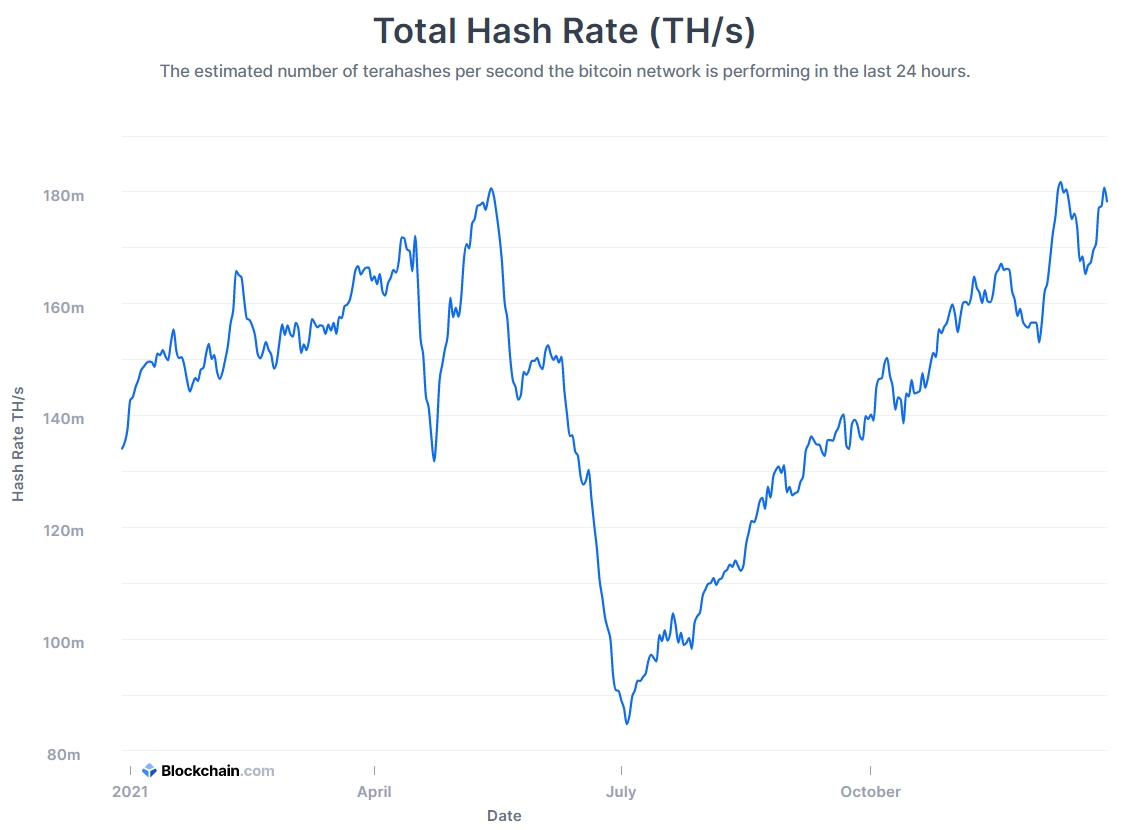

Another important aspect, which we’ve already briefly mentioned in the above paragraphs, is the massive drop and subsequent recovery of the BTC hashrate. When China began its expansive process of shutting down crypto mining operations within the country’s borders back in May, the hashrate output of China-based miners accounted for nearly three-quarters of the global Bitcoin network computational power. This figure had dropped down to virtually zero in a couple of months.

As a result, the BTC hashrate shrunk by almost 70%, bottoming out at a two-year low of 57.47 EH/s on June 27. Eventually, other countries picked up the slack, and the influx of migrating Chinese mining businesses pulled the global hashrate production to 190.97 EH/s on December 6, a striking distance from a previous ATH recorded before Chinese authorities had intervened.

2021 will go down in history as the year when Bitcoin was recognized as a nation’s legal tender for the first time. On September 7, El Salvador embraced Bitcoin as a legal currency after the country’s Legislative Assembly passed the so-called “Bitcoin Law” in June 2021.

Ethereum led broader altcoin resurgence and significantly outperformed BTC

Whereas Bitcoin gained “only” 75% during 2021, the price of Ethereum increased by over 420% in the same time period.

The price of ETH surged from $734 on January 1st, 2021, to an all-time high price peak above $ 4,800, before retracing to $3,800 by the end of the year.

Ethereum’s impressive market performance was in large part fueled by the London hard fork upgrade, which introduced deflationary mechanics into the monetary supply of the second-largest cryptocurrency. The London network upgrade has highly anticipated and set the stage for the eventual transition to a Proof-of-Stake (PoS) consensus mechanism with the launch of Ethereum 2.0 slated for 2022. To date, more than 1 million ETH tokens have been forever removed from circulation thanks to EIP-1599 burning mechanics.

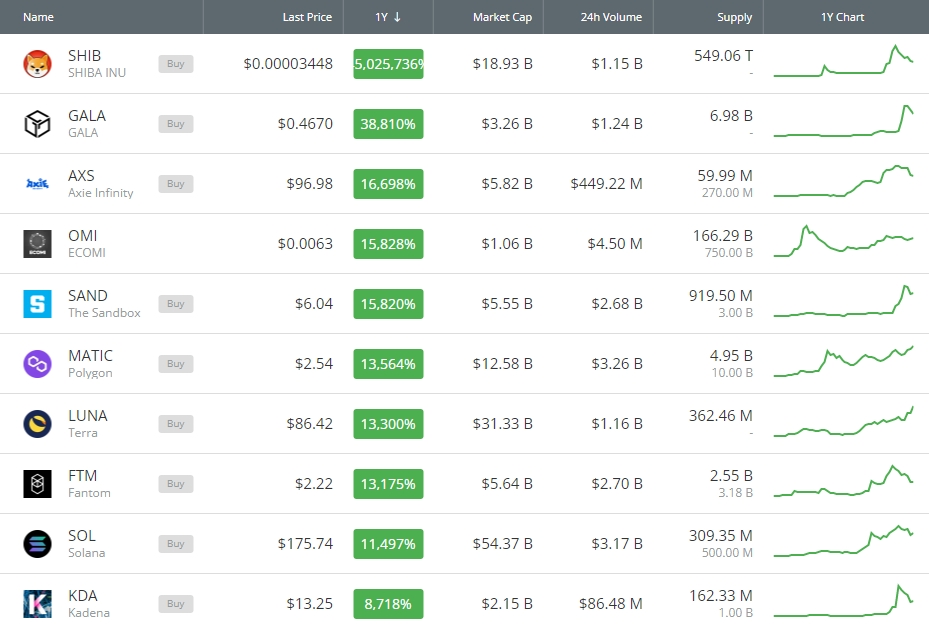

Numerous altcoins followed in the footsteps of Ethereum. Solana (SOL) catapulted into the 5th spot in the cryptocurrency market cap rankings after gaining over 11,500% throughout the year. Terra’s (LUNA) rise to the top was even more impressive as the platform focused on digital price stability gained over 13,300% in 2021. Other notable gainers include Avalanche (AVAX), which managed to enter the crypto top 10, and Shiba Inu (SHIB), which was by far the largest crypto mover of the year, with over 45 million percent gains.

NFTs experienced a massive surge in popularity

NFTs have grown to become one of the hot commodities not only among crypto enthusiasts but also among a wide range of celebrities and digital artists who have taken advantage of the new technology to utilize unique monetization methods and new ways of connecting with fans.

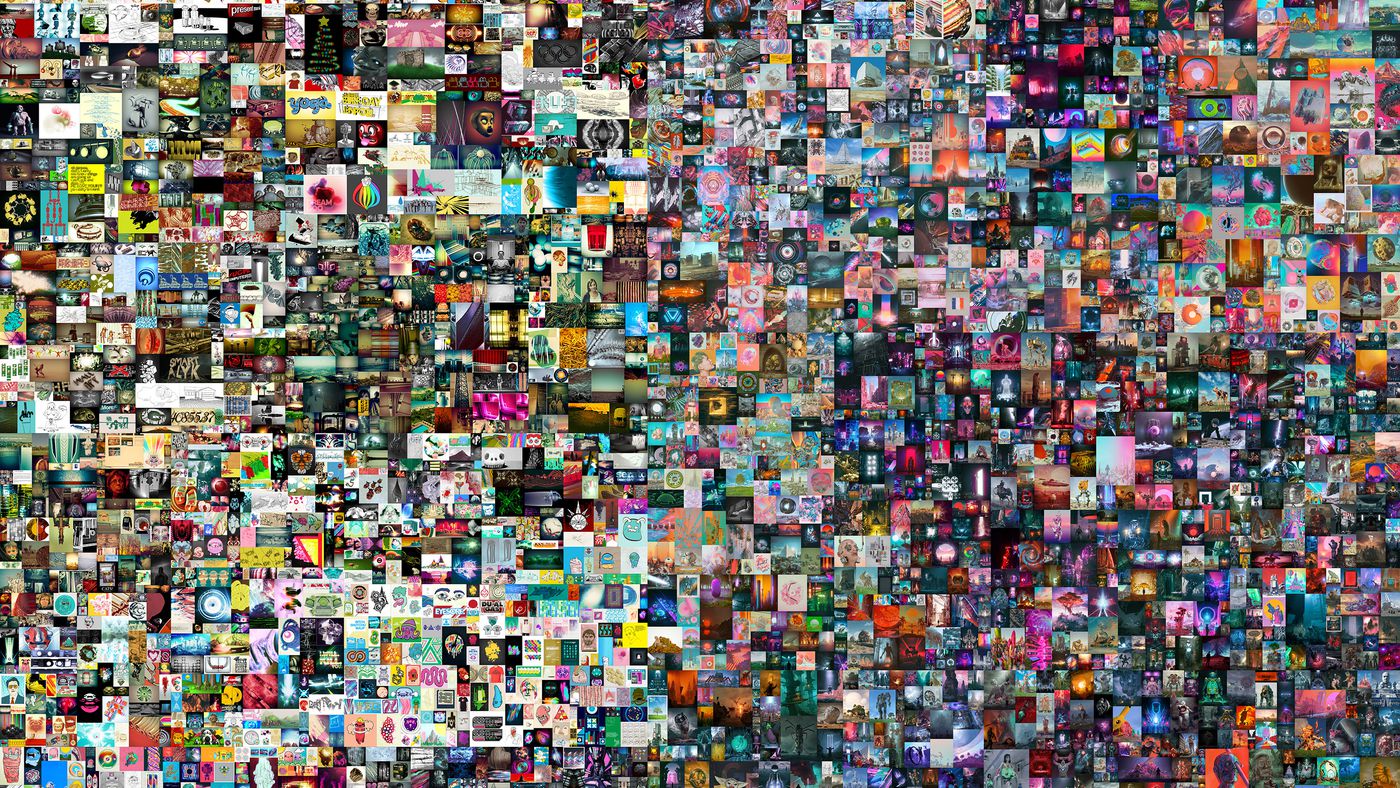

Earlier in the year, a piece of digital art named The First 5000 Days by a prolific artist Mike Winkelmann, who goes by the pseudonym Beeple, was sold for a record-breaking $69.3 million. The digital collage sold as an NFT in an auction held by Christie’s is an image of 21,069 by 21,069 pixels in a .jpg format containing precisely 5,000 digital images in a mosaic.

The rise of NFTs attracted many critics, who have cited the high environmental costs and the lack of inherent value as the main point of contention in regards to the new technology. The criticism is not unfounded as most NFTs currently reside on the power-hungry Ethereum Proof-of-Work (PoW) network.

Due to the high energy costs and gas fees associated with transactions on the Ethereum platform, several competing blockchains that offer higher transactional throughput and lower costs have risen to prominence throughout the year. Proof-of-Stake (PoS) chains Solana and Tezos (XTZ) have benefited the most as their modest carbon footprint makes for an excellent choice for housing NFTs.

However, the upcoming transition of Ethereum to the PoS consensus model via the ‘2.0’ upgrade slated for early 2022 will likely come just in time for Ethereum to retain its top spot as the number one platform for NFTs.

The rise of metaverse and blockchain gaming projects

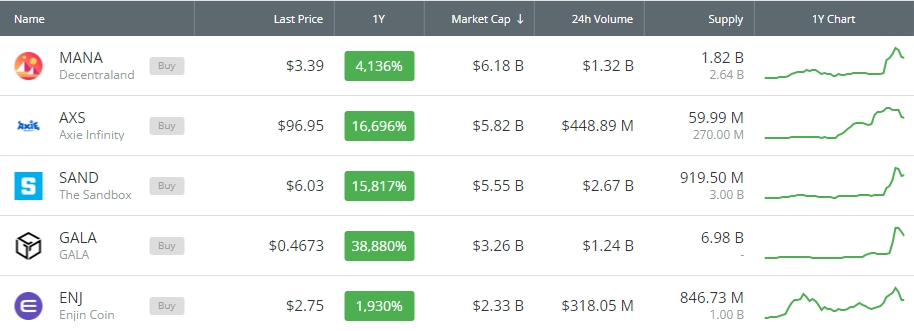

The surge in popularity of metaverse projects was among the biggest news stories of the past year. While the blockchain gaming and metaverse projects received a lot of attention throughout the year, Facebook’s rebranding to Meta took things to a new level. As the social media giant showcased its commitment to the metaverse, many projects in the crypto industry started rallying.

No other blockchain-powered metaverse projects received as big of a boost by Facebook’s rebranding as GALA (GALA), which gained more than 38,900% over the year. Nothing showcases the popularity of blockchain gaming as taking a look at the top 10 best performing digital assets of 2021 – three out of the ten largest movers belong to the crypto gaming sector, including the aforementioned GALA, Axie Infinity (AXS), and The Sandbox (SAND).

The hype surrounding metaverse projects can be seen by the massive amount of sales that NFT related to gaming projects are generating. Blockchain Gaming Alliance (BGA) reported that NFT games produced $2.32 billion in revenue in the third quarter of 2021, accounting for 22% of all NFT trading volume during the quarter, while the number of wallets used for gaming-related transactions grew from roughly 29,500 at the beginning of 2021 to 754,000 by the end of September.

Additionally, unique digital collectibles are setting new price records seemingly on a weekly basis. For instance, a single piece of Axie Genesis Plot sold for an eyewatering amount of 550 ETH, worth $2.5 million at the time of acquisition.

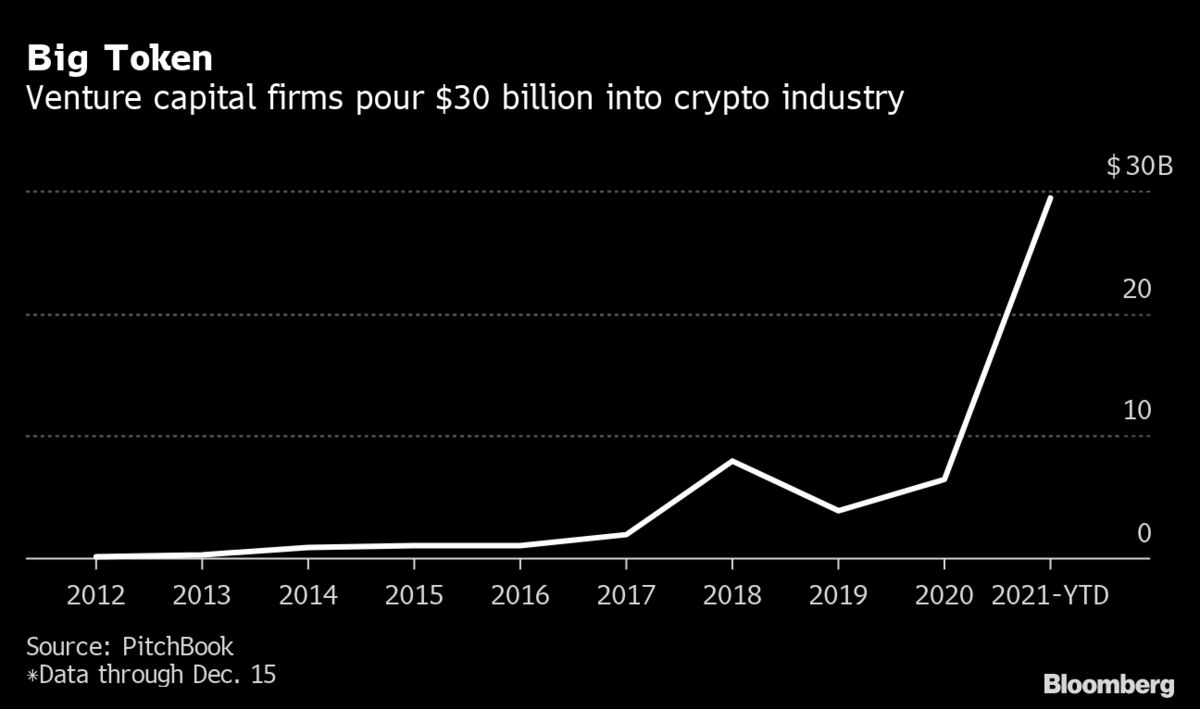

2021 was the year of the institutional investor

Perhaps the most significant trend that took place in 2021 was the meteoric rise in the amount of institutional capital flowing in the crypto industry. Business Insider reported that venture capital that flowed in crypto nearly quadrupled the previous record of $8 billion in 2018 and reached $30 billion. That’s more than all previous years combined.

A large part of the massive $30 billion that was invested in crypto by venture capitalists in 2021 came in a series of most prominent founding rounds: the FTX crypto exchange collected $900 in Series B funding, blockchain gaming startup Forte raised $725 million, fintech MoonPay raised $555 Million, NFT-focused Dapper Labs collected $305 million. Bitcoin services firm NYDIG topped the list with a massive $1 billion haul.

The past year saw the cryptocurrency sector get tangled with traditional markets more than any year before. The Coinbase digital asset trading company became publicly traded in April and quickly saw its market valuation rise beyond $80 billion as investors quickly flocked to the newly traded shares.

Tesla, the biggest vehicle manufacturer in the world, made headlines when it announced it bought $1.5 billion worth of BTC in February and later started accepting BTC as a payment method. The automotive giant quickly reversed its decision, citing environmental concerns as the main reason. Microstrategy was another publicly-traded company that made huge investments into Bitcoin over the year. The company sits on the biggest BTC stash of all public companies – it holds over 122,000 BTC worth roughly $6 billion at current market rates.

Furthermore, institutional investors welcomed the launch of the first US-traded Bitcoin futures-based exchange-traded fund (ETF) in October. ProShares’s Bitcoin Strategy ETF (BITO) saw an impressive market launch as investors poured nearly $1 billion into the fund during its first trading day on the New York Stock Exchange (NYSE). Many market analysts and the broader crypto community thought the launch of the first BTC futures ETF meant the first spot ETF was just around the corner.

Unfortunately, the Securities and Exchange Commission (SEC) didn’t waiver on its multi-year long stance of not allowing a physical Bitcoin ETF to be traded in the US.

A non-futures ETF would be a game-changer for institutional-scale investors unwilling to use cryptocurrency exchanges or other crypto-based products to expand their exposure to Bitcoin and other digital assets. Let’s hope that 2022 will finally be the year that the long-awaited BTC spot ETF finally gets approved.

Final thoughts

Unfortunately, the final days of December will leave a sour taste in the mouths of many members of the community due to significant price drops and a growing bearish sentiment. However, focusing on the immediate past is not a good strategy, especially in a fast-paced industry such as crypto. In the long-term, various technological breakthroughs and institutional embrace of digital assets that took place in 2021 are bound to cement the sector at the forefront of technological innovation and provide ample favorable investment opportunities for years to come.

The blockchain industry finished the year in a significantly better spot than it started the year in. Let’s hope for more of the same in 2022.