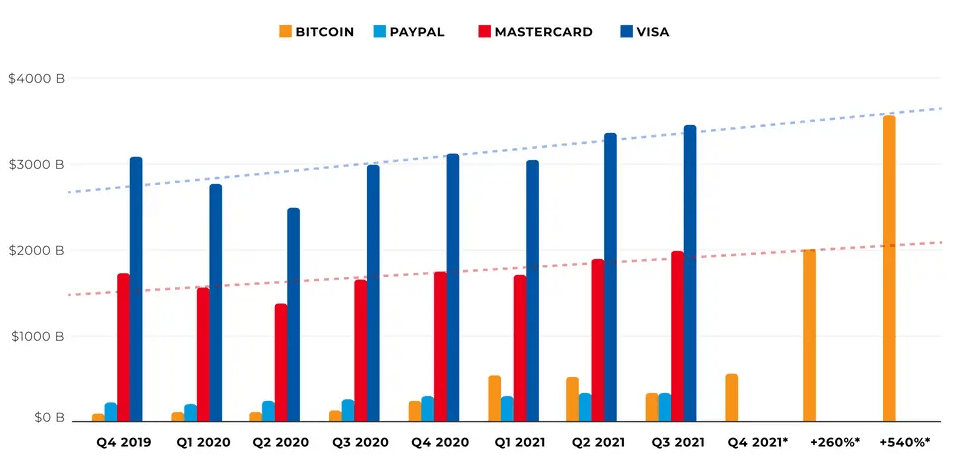

Key takeaways:

- Bitcoin network facilitated $489 billion worth of transactions on average per quarter, while PayPal did $302 billion in the same time frame

- Mastercard and Visa are still firmly in the lead in terms of dollar value transferred on their networks

- Bitcoin could become the biggest payment facilitator if the use of Lightning Network becomes more widespread

Bitcoin reached new heights this year – not only did the world’s largest crypto conquer a new peak value, but it also managed to overtake payment processing giant PayPal in terms of dollar value transferred on its network.

Bitcoin has processed 62% more in transactions than PayPal, Mastercard and Visa remain firmly in the lead

The data from the recent Blockdata report showed BTC facilitated 62% more transactional volume (in terms of USD, not in terms of the absolute number of transactions) than PayPal. The new finding shows Bitcoin adoption has been steadily picking up the pace over the last couple of years.

Throughout 2021, Bitcoin did an average of $489 billion in transactions on a quarterly basis. In the same time frame, PayPal did $302 billion. Mastercard and Visa are leading the pack processing an average of $1.8 trillion and $3.2 trillion per quarter respectively.

The rising number of transactions facilitated on the Bitcoin network point to increasing adoption that is only going to pick up steam once the use of Lightning Network becomes more widespread. Blockchain analytics firm Arcane Research, for instance, predicts the number of Lightning Network users will climb to 800 million in the next decade.

Blockdata’s researchers were impressed by the rapid growth of Bitcoin compared to traditional payment processors:

“It’s impressive how Bitcoin, as a 12-year-old decentralized network, is 27% of the way in terms of one metric (volume processed) compared to Mastercard, a company founded in 1966, especially when you take into account that this is a decentralized movement.”

If the performance of Bitcoin transactions improves in terms of speed and scalability, Bitcoin could challenge Mastercard and Visa as the top dog when it comes to the total value of settled transactions on its network.

The rising popularity of Bitcoin can also be recognized when looking at the number of non-zero BTC balance addresses, which reached a new all-time high above 38 million last week, according to Glassnode.

Not only is the number of BTC users growing, but the supply of BTC is distributed among retail and large-scale investors in a healthy manner. The data curated by blockchain analytics company The Block shows that only 11% of BTC supply is held by large holders (defined as addresses that contain more than 0.1% of supply). For reference, 42% of Ethereum (ETH) supply and 29% of Cardano (ADA) is concentrated in the hands of large holders.