Key takeaways:

- The total cryptocurrency market capitalization shrank by roughly 10% today, which represents a more than $230 billion drop

- Growing uncertainty over inflation rates, new covid variant, and Kazakhstan’s BTC mining outage are the main culprits for the market pullback

- Close to $900 million worth of “longs” and “shorts” was liquidated in the last 24 hours

Bitcoin and other digital currencies have undergone a massive market pullback in the last 24 hours, which plunged virtually all coins in the red zone. The value of all digital assets in circulation has diminished by roughly 10%, leaving the total market cap standing at $2.09 trillion at press time.

A myriad of macroeconomic factors contributed to the market crash. The most notable were Fed preparing an interest rate hike, Kazakstan-based Bitcoin miners going offline, and new covid variant discovery in France.

Bitcoin drops to $42K, a price level not seen since September

Bitcoin has been trading in a relatively tight range in the first week of 2022. Earlier today, however, the price of the world’s largest crypto dropped below $46,000 and from then on continued on a quick downward slide towards $42,000. In the span of just 3 hours, Bitcoin lost 8% of its value and bottomed out at a four-month low of $42,500.

Ethereum and other altcoins were hit harder than BTC

Most digital currencies have performed even worse than BTC over the past 24 hours. Ethereum lost 11.7% of its value and is changing hands at $3,350 at the time of this writing. While Ethereum’s downswing wasn’t as sudden as Bitcoin’s, the second-largest crypto ultimately ended up shedding more value.

Apart from SafeMoon, 99 out of the top 100 largest cryptocurrencies by market capitalization are posting negative returns today. Severable notable double-digit losers include Polkadot (-13.3%), Avalanche (-12.5%), Solana (-12.7%), and Terra (-11.3%).

A wave of crypto liquidations wipes out nearly $900 million from futures markets

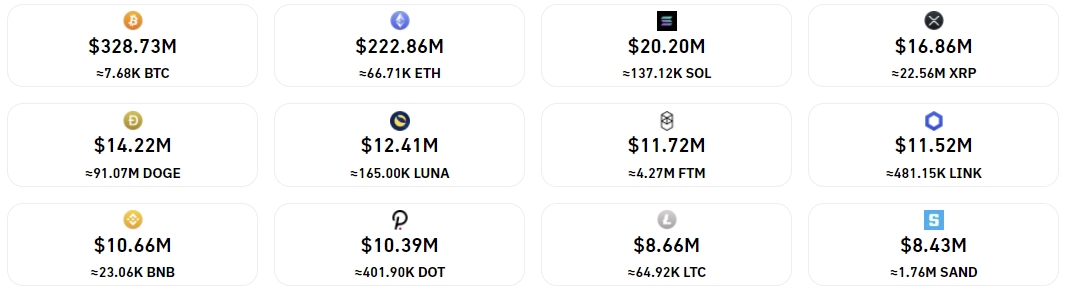

Derivatives traders are especially exposed to the high degree of market volatility. In total, $889 million worth of futures contracts has been liquidated in the last 24 hours, with approximately 90% share of them being long positions.

According to blockchain analytics firm Coinglass, the largest share of liquidations took place on the OKEx crypto exchange ($266M), followed by Binance ($247M) and FTX ($166M).

With economic uncertainty over growing inflation rates and concerns over the new covid variant looming in the air, the markets are most likely headed towards a period of high volatility and unpredictability.