Yesterday marked an alarming turn in the cryptocurrency market as crashes in the Bitcoin and Ethereum markets led other top digital assets to sustain big losses as well. Presently, Bitcoin is trading at about $40,100 after a recovery from the massive decline seen yesterday, in which the price of the world’s top cryptocurrency fell to around $30,000. Ethereum, on its part, is performing worse than Bitcoin as at the filing of this report as the second digital asset according to market cap is seeing a 24-hour loss of around 3.7% and trading at $2,700.

Total liquidation figure almost reaches $8 billion

While it looks like the worst part of the crash is behind us, the price crash caught many leveraged traders on guard and resulted in a large number of liquidations. According to Bybt, over 690,000 traders were liquidated in the last 24 hours and the value of liquidated funds reached almost $8 billion in the same timeframe.

The bearish sentiment that contributed to the recent plunge in the price of digital assets has been attributed to the comments made by Elon Musk, the CEO of electric car manufacturer Tesla.

Over the weekend, Musk took to Twitter, where he released several tweets that questioned the energy use of Bitcoin. In an interview with The Block, a trading firm executive mentioned that the price swings were bound to happen since most traders were short gamma.

He pointed out that the bearish sentiment is very high at the moment, and many traders are looking to cut their risk and take their cash when the price of the digital asset drops below $40,000. He also said that BTC sentiment wasn’t negatively impacted just by Elon Musk’s tweets, but also by U.S. regulator SEC’s hesitancy towards approving a Bitcoin ETF.

Crypto exchanges witness outages

In the midst of the extreme volatility in the market, several crypto exchanges suffered outages yesterday. The affected platforms were said to have had to deal with a massive influx in the number of traders.

While the outages lasted, traders saw delays in their withdrawal requests as most of them were looking to escape the bloodbath that is currently decimating the crypto sector. A good example is Voyager Digital, which pointed out that applications were still in maintenance mode yesterday. In its tweet, Voyager said that most exchanges were having problems with connectivity.

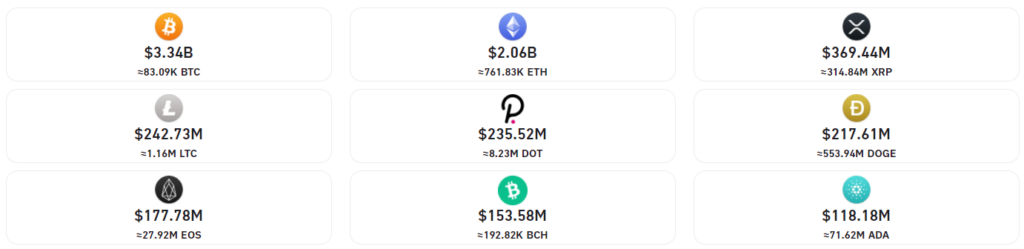

Along with Bitcoin, the majority top digital assets saw a massive bearish run which saw most of them post double-digit losses.

The Ethereum blockchain also struggled under the load as users flocked to the platform in an effort to salvage the value of their holdings. The major reason for the congestion on the Ethereum network was associated with the activities of the decentralized finance traders, with most of them withdrawing their gains overtime or taking what is left of their investments in the assets. The congestion was accompanied by surging transaction costs, which meant that many users couldn’t afford to make transactions.