Key takeaways:

- Bitcoin sets a two-week high and is trading just below its peak value

- 5 out of the top 100 digital currencies have renewed their all-time highs

- The total cryptocurrency market cap has surpassed $2.9 trillion for the first time

The historic cryptocurrency market bull run is in full swing and shows no signs of slowing down. The cumulative value of more than 10,000 digital assets we list at CoinCheckup has reached $2.93 trillion on the heels of Bitcoin’s 6% price increase and broader altcoin surge led by Ethereum.

Bitcoin is exchanging hands close to its peak value

After trading in a relatively tight range over the course of last week, the price of Bitcoin has increased by more than 6% on Monday and surpassed the $66,000 level for the first time since BTC reached its all-time high on October 20.

Today, Bitcoin surged to the two-week high of $66,365, just shy of its all-time peak value of $66,931. Despite the price of the oldest cryptocurrency retracing to $65,865 in the last couple of hours, BTC is still exchanging hands just 1.5% removed from its ATH. Given the enormous momentum behind digital assets, the $70,000 psychological barrier is likely to fall very soon. The sentiment was shared by Cameron Winklevoss, founder of Winklevoss Capital Management and Gemini cryptocurrency exchange on Twitter:

Bitcoin is up 22% in the past month and 141% since the beginning of the year (at the current market rates).

Ethereum sets a new all-time high of $4,764

The world’s second-largest crypto has been on a very steady uptick since the start of October – the price of ETH has increased from $3,000 to the current price peak with relatively low volatility. Today, ETH reached a new ATH of $4,764, good for a $562 billion market cap and 19.1% market dominance.

Over the course of the last week, ETH has improved by over 9% with very few setbacks on the way as the price of ETH never swung by more than 5%. The smart contract platform and arguably the most important blockchain for the continued development of the crypto industry has attracted a lot of market interest over the course of the year. At the time of this writing, ETH is up more than 550% year-to-date (YTD).

Goldman Sachs’ Global Markets managing director Bernhard Rzymelka recently shared his mid-term outlook on Ethereum and revealed that he believes ETH’s price surge to $8,000 will be fueled by investors looking for a viable hedge against inflation. Another piece of positive news that came out last week and likely contributed to Ethereum’s rally is the announcement of CME Group adding Micro Ether futures to its product portfolio in December-

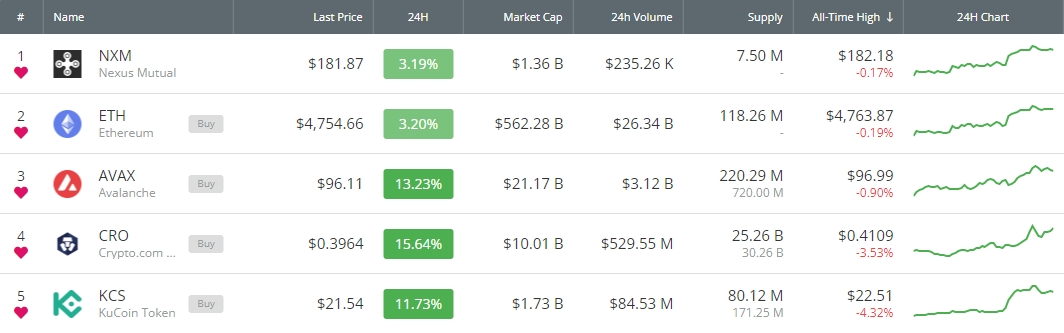

Avalanche, NXM, and exchange tokens CRO and KCS renew their ATH

The market success of Ethereum and Bitcoin has reignited rallies among several blockchain projects, which has led to multiple tokens reaching higher than ever before. Arguably the most significant project on the list is the decentralized finance (DeFi) platform Avalanche (AVAX), which has overtaken Terra and Uniswap on its path to a new ATH and thus became the 12th largest crypto by market cap. Among the reasons for the ongoing market success of AVAX is definitely Friday’s Grayscale announcement of potentially adding Avalanche to its product family of supported crypto assets.

Perhaps a bit surprisingly, centralized exchange (CEX) tokens Crypto.com Coin (CRO) and Kucoin Token (KCS) have both gained more than 10% today and set their new respective ATHs. After China’s blanket ban on crypto, many predicted the downfall of centralized exchanges and their native tokens, but it now seems that the predictions were vastly exaggerated. Other exchange tokens have been also performing very well in the last couple of weeks; most notably Binance’s BNB which has, earlier today, come very close to surpassing its peak value set in mid-May.

The last spot on the list of digital currencies that have managed to reach new peak values in the last 24 hours is occupied by Nexus Mutual (NXM), a blockchain alternative to insurance and a newcomer to the crypto top 100.