Key takeaways

- Bitcoin hashrate on December 6 surpassed the network’s peak computational capabilities from May 2021, before Beijing began its clampdown on the mining industry

- Following the shut down of China-based mining operations, the BTC hashrate dropped by 70%, which was coincidentally the share of global hashrate originating from China at the time

- The US accounts for the biggest share of BTC computational power, ahead of Kazakhstan and Russia

Bitcoin hashrate, which is based on the computational power of crypto miners participating in the process of securing the network, has reached numbers not seen since China shut down its cryptocurrency mining in a series of regulatory clampdowns earlier this year.

Bitcoin miners were forced to migrate to new locations to evade Chinese authorities

When Beijing began an extensive operation to shutdown crypto mining facilities within the country’s borders back in May, the hashrate output of China-based miners accounted for more than 70% of the global Bitcoin network computational power. Today, the share of China-generated BTC hashrate is virtually zero.

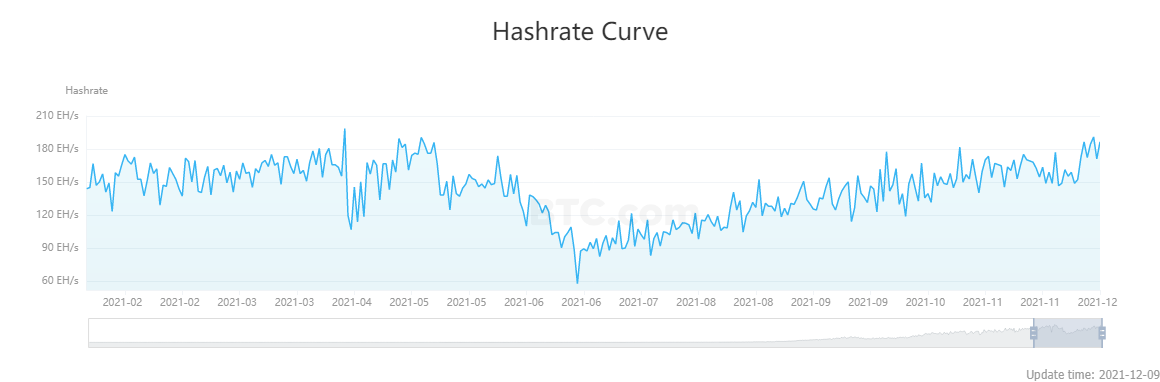

According to data from BTC.com, in the time period between May and June, when Bitcoin mining operations were slowly going offline one after another, the Bitcoin hashrate had dropped from May’s peak of 190.55 exahashes per second (EH/s) to a two-year low of 57.47 EH/s on June 27.

Since then, countries around the world have picked up the slack, and in the span of six months, the global Bitcoin hashrate has recovered and reached 190.97 EH/s on December 6. For reference, the all-time peak hashrate production was recorded on April 15 at 198.51 EH/s.

At the moment, the biggest share of Bitcoin computational power resides within the United States, which has become the top spot for new mining operations due to the abundance of cheap energy and massive infrastructure investments. According to data from Cambridge Bitcoin Electricity Consumption Index (CBECI), the US leads global hashrate output with a 35% share ahead of Kazakhstan’s 18% and Russia’s 11%.

Bitcoin is by far the biggest proof-of-work (PoW) network, requiring an exuberant amount of electricity to stay online. The second-largest crypto, and still running on PoW consensus mechanism, Ethereum’s power requirements and computational capabilities pale compared to Bitcoin. For reference, Ethereum hashrate output on December 6 was 902.88 TH/s, over 200,000 times smaller than Bitcoin’s hashrate production on the same day.