Key takeaways:

- Bitcoin lost over 10% of its value in the span of 12 hours, after being up 4% earlier in the day

- Options contracts and Russia’s central bank’s recent call for a ban on crypto might be the main culprits for the sudden market pullback

- The total crypto market capitalization has decreased by roughly 7% in the last 24 hours and dropped below $2T for the first time since last September

Big selloff pushes the price of Bitcoin to a six-month low

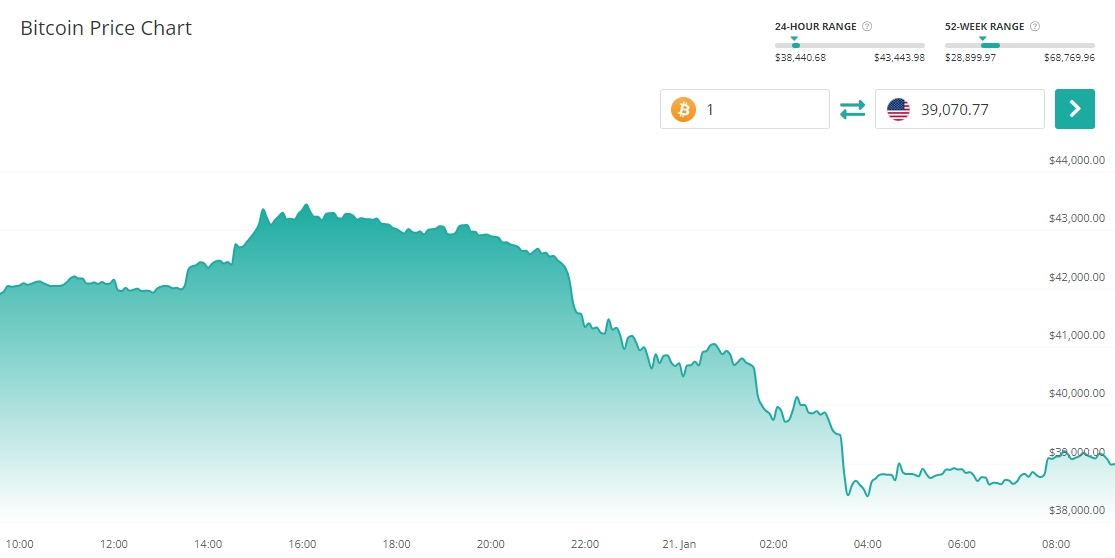

After struggling to break out of the narrow trading range between $41,300 and $43,400 for the past week, Bitcoin experienced a sharp decline in its value in the last 24 hours that saw the world’s largest crypto plummet to price levels not seen since last August.

Bitcoin managed to momentarily push past the $43K level earlier in the day, but the modest upward trend was unfortunately short-lived. In the proceeding 12 hours, Bitcoin lost 11% of its value and hit a six-month bottom of $38,440. BTC has since pulled off a modest recovery and is changing hands at $39,100 at the time of this writing.

What’s behind the sudden drop?

Some members of the crypto community attributed the sudden dip in prices to selling done by Bitcoin options traders. More than $132 million in gains were to be had if BTC’s price dropped below $41,000, according to InvestAnwsers, which boasts almost 100k Tweeter followers and over 400k subscribers on Youtube.

Russia’s central bank calling on a blanket ban on crypto, which would outlaw all crypto-related activities in the country apart from basic crypto ownership might have also played a part in swinging the market sentiment.

Generally speaking, both the stock and crypto market still haven’t shaken off the negative sentiment that was sparked by the Fed roughly two weeks ago, when it announced an interest rate hike. At the time, Bitcoin shed 10% of its value and dropped from $46,800 to $42,300 in the span of 6 hours.

As is always the case when it comes to sudden price movements, it is nearly impossible to pinpoint the exact reason for the broader behavior of market participants. It is worth noting though, that more often than not, digital assets’ prices follow a somewhat predictable pattern. After a prolonged period of sideways trading activity, as was the case for Bitcoin in the last two weeks, one of the following two things usually occur: either the price of a particular asset starts rallying, or the price experiences a steep and sudden decline.

The total crypto market cap drops below $2T as virtually all coins record high single-digit loesses

On the tailwind of Bitcoin’s sudden 11% drop, Ethereum and other alternative digital currencies also experienced sharp declines in their value, which dropped the combined valuation of all cryptocurrencies in circulation below $2 trillion for the first time since September. Solana, Cardano, and Avalanche were particularly hard hit all three Layer 1 projects lost nearly 10% of their value and drop to their respective multi-month lows.