Key takeaways:

- Bitcoin bounced back from the $17.6K weekend low today and reclaimed $20K

- Ethereum followed in the footsteps of BTC and surged by nearly 10% in the last 24 hours

- Synthetix was today’s big gainer, surging into the cryptocurrency top 100 on the tailwind of 75% 24-hour gains

Bitcoin reclaims $20K, Ethereum $1K as the bearish trend is put on hold

During the weekend, the price of Bitcoin dropped below the $18,000 mark and hit a 19-month low of $17,700. Much like Bitcoin, Ethereum and other digital assets also plunged to their respective multi-month lows as the cryptocurrency market cap shrunk to $852 billion.

Bitcoin’s drop below $20K represented a noteworthy juncture as the world’s largest crypto fell below its 2017’s ATH price range of roughly $20K, meaning that whoever bought BTC after December 2020 was in the red on their spot investment.

However, the bottom was quickly rejected and Bitcoin recuperated most of the losses accrued during the weekend’s action on Monday. Bitcoin is trading at $20,800 at press time, up 5.4% for the day. To see how BTC could perform going forward, check our automatically generated Bitcoin price predictions.

Like Bitcoin, Ethereum lost double digits on the weekend and dropped to its lowest point in more than a year. It wasn’t for long though, as the world’s second largest crypto surged back above $1,000 and hit $1,158 at press time, showing a 24-hour change of 9.3%. To see how ETH could perform going forward, check our automatically generated Ethereum price predictions.

Today’s run saw several major tokens surge by double digits – Aave gained roughly 18%, Avalanche 15%, Polygon 13%, and Solana 11%. However, arguably the most successful coin today was Synthetix’s SNX.

Synthetix becomes top 100 market cap asset

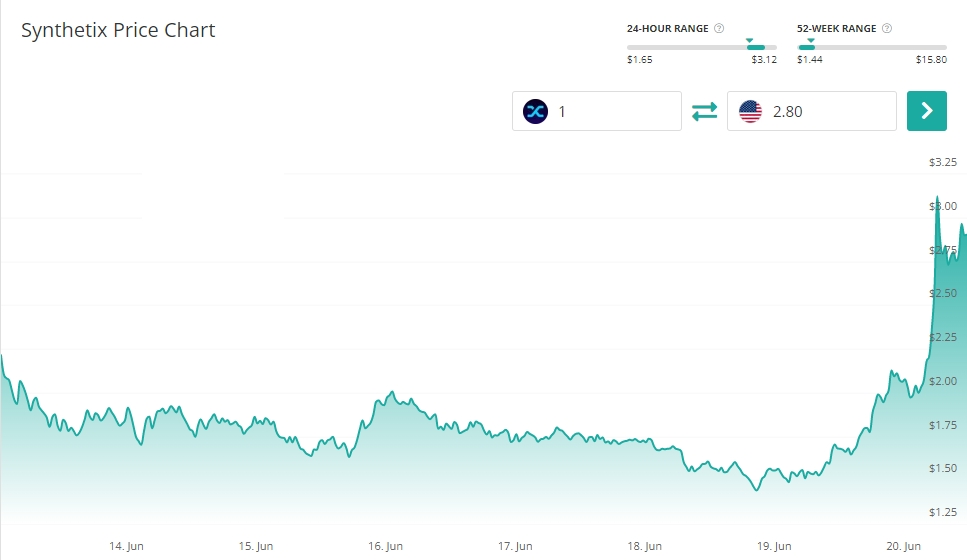

Synthetix gained roughly more than 70% today, which pushed it into the group of the 100 largest market cap tokens. SNX hit a cycle high of $3.12 earlier today but retraced to $2.80 by press time.

Synthetix is a DeFi network based on Ethereum that lets users access highly liquid synthetic assets called “synths”. Synths are derivatives products that can provide market exposure to a variety of assets. For instance, sBTC tracks the price of Bitcoin, sETH the price of Ethereum, and so on.

Today’s impressive price surge of SNX can be attributed to the overall growth of the platform, which averages $100 million in daily trading volume via Atomic Swap on 1inch and Curve Finance, and high usage on a variety of decentralized futures and options platforms.

It will be interesting to observe whether SNX will manage to retain its market momentum in the coming days. In the meantime, take a look at our Synthetix price predictions for more information.