Key takeaways:

- 17th quarterly burn was the largest in terms of dollar value, surpassing 15th burn by over $44 million

- Binance plans to eventually remove half of BNB supply from circulation and decrease total supply to 100 million BNB

- Over its four-year-long life span, BNB has grown to become the 3rd largest digital asset

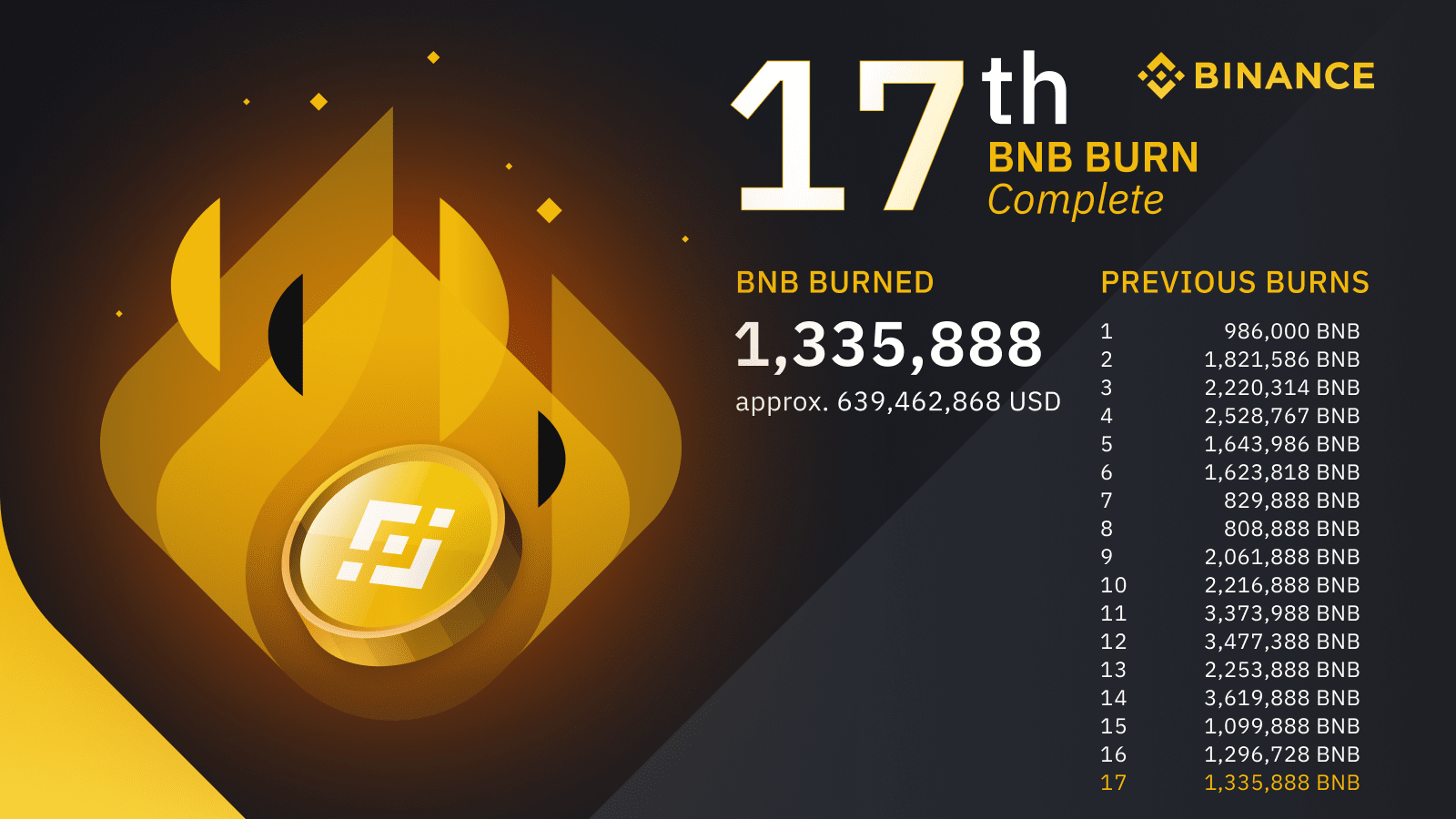

Binance has announced the successful completion of the 17th quarterly token burn, which forever removed 1,335,888 BNB (equivalent to $639,462,868) from circulation. The largest cryptocurrency exchange has burned more than 30 million BNB via its token burning program, worth approximately $14.7 billion at current market rates.

BNB burn program will continue until 50% of the total supply is removed from circulation

When BNB was created in 2017, 40% of the total BNB supply was reserved for the Binance team. The team’s 80 million BNB allocation has been used exclusively for scheduled quarterly burns and nothing else. Binance’s goal is to remove all of the team’s BNB from circulation and decrease BNB’s total supply to 100 million coins, down from the initial figure of 200 million.

The 17th token burn was more significant than the 16th one, both in terms of BNB burned and dollar value. Additionally, the latest BNB burn was the largest quarterly event in USD figures, ahead of the previously largest 15th burn by more than $44 million. In terms of BNB tokens destroyed, the 14th burn still reigns supreme, with over 3.6 million tokens removed from circulation.

Binance Coin was launched via an initial coin offering (ICO) in July 2017. Out of 200 million tokens, 50% was allocated for public sale, 40% to the founding team, and the final 10% went to so-called angel investors. Binance uses a fifth of its quarterly profits to buy and burn its native tokens, which increases scarcity and ups the value of BNB.

On this day four years ago, BNB was trading near its all-time low, at $1.33 per coin. Since then, the price of BNB has increased by a staggering 36,616%. BNB is the 3rd largest digital asset with a market cap dominance of 3.19% and a market valuation of $83 billion.

While many centralized exchange tokens were hit hard by the news of China banning crypto, Binance’s BNB has shown its resiliency and remained mostly unaffected. Furthermore, the recently launched Binance Smart Chain Growth Fund has contributed to BNB’s stellar performance this year. Despite BNB losing almost 30% since its ATH in mid-May, it remains one of the best-performing crypto assets of 2021, up 1,223% YTD at the time of this writing.