Key takeaways:

- Binance Margin is a leveraged crypto trading platform that enables traders to increase their exposure to markets

- With Binance Margin trading, users can borrow funds to increase their trading positions and magnify their trading results

- Binance Margin offers several advantages, including multiple-asset collateral, hundreds of trading pairs, low trading fees, and several risk-management tools

- Crypto margin trading can be risky, so it is mostly recommended for experienced and strategic traders, as well as those who are willing to learn quickly and trade responsibly

The majority of experienced crypto traders understand the importance of leveraged trading. The biggest benefit, of course, is that it creates opportunities for higher returns. Margin trading, specifically, allows experienced traders to easily increase their positions and generate higher returns with each trade. Personally, I believe that Binance offers the best opportunities for crypto margin traders.

I’ve used Binance Margin on several occasions, and I must say, I love the product. Binance’s margin offering makes it possible for any active trader on the platform to borrow funds to increase their trading positions. In addition, I’ve been able to amplify trading profits using Binance Margin. A word of advice, though – crypto margin trading can be quite risky.

What you need to know about Binance Margin

In the simplest term, Binance Margin can be defined as the margin trading feature of Binance. In other words, it is a Binance feature that supports margin trading. On the other hand, margin trading can be defined as a trading strategy that involves using funds provided by a third party to trade assets. In the crypto world, it involves borrowing crypto assets to increase positions and magnify trading results.

Binance Margin, in essence, involves borrowing funds from Binance to increase trading positions, thereby magnifying trading results. The feature is mostly used by experienced traders when they see good trading opportunities but have limited funds in their trading accounts to take full advantage of the opportunity. The feature allows them to borrow assets to increase their capital and make more profits from successful trades.

Before moving on from this section, it is important that I reiterate that margin trading can be quite risky. In fact, it carries more risk than spot trading, primarily because the trader borrows capital from a third party and is more prominently exposed to market movements due to leverage.

Just as profits are magnified in successful trades, losses are increased in unsuccessful ones. Users must pay back whatever they borrow, even if they lose a trade. Again, users must have some form of collateral before accessing funds for margin trading on Binance.

Spot Trading vs. Margin Trading

To help you understand and appreciate margin trading better, I need to explain the major difference between spot trading and margin trading.

Spot trading is the commonest trading strategy in the crypto world as well as in the wider financial market. It involves the direct purchase or sale of an asset such as cryptocurrency, stock, bond, commodity, or even currency. In the crypto market, spot trading involves the direct buying or selling of digital assets like BTC, ETH, BNB, and other altcoins.

Margin trading, as we have earlier explained, involves borrowing funds from a third party to increase trading positions. For instance, I notice a potentially profitable trade, and my initial deposit is small. To increase the profit I can take home from the trade, I can borrow funds from Binance to increase my capital.

Spot trading basiscs

Without further ado, here are the primary principles of spot trading:

- It involves the direct purchase or sale of asset(s)

- It is ideally suitable for long-term investments

- It is a basic form of investing and the commonest trading method

- Spot trading is risky but generally less risky than margin trading

Margin trading basics

Here are the primary principles of margin trading:

- It is a form of leverage trading where traders take advantage of third-party funds

- It can significantly magnify trading results

- It is ideal for short-term trading opportunities

- Margin trading is considerably riskier than spot trading since it involves the use of third-party capital

Before moving on from this section, it is important to state categorically that I use spot trading when making long-term crypto investments. Of course, it is more sensible to use my money to buy assets I intend to HODL. However, when I speculate on short-term price moves and believe that a meaningful profit opportunity exists, I can use Binance Margin rates to take more from a single trade.

Pros of using Binance Margin

From what we’ve covered so far, you should know the key benefits of using Binance Margin. For the sake of emphasis, I will highlight some of the advantages of the feature as follows:

- With Binance Margin, traders can enter profitable trades with as much as 10 times the assets in their wallets

- Binance Margin trading allows users to open long and short positions

- Binance Margin is one of the most reliable tools for capitalizing on market volatility (this is especially true for experienced traders)

- Margin can be responsibly used as a hedge investment in a portfolio

- Binance Margin offers several risk-management tools to protect traders and the platform too

Cons of using Binance Margin

Here are some of the disadvantages of using Binance Margin:

- Margin trading is generally riskier than spot or normal trading – it can yield devastating results when used irresponsibly

- Binance Margin traders with lower VIP levels may have to pay high transaction fees

Why I use Binance Margin

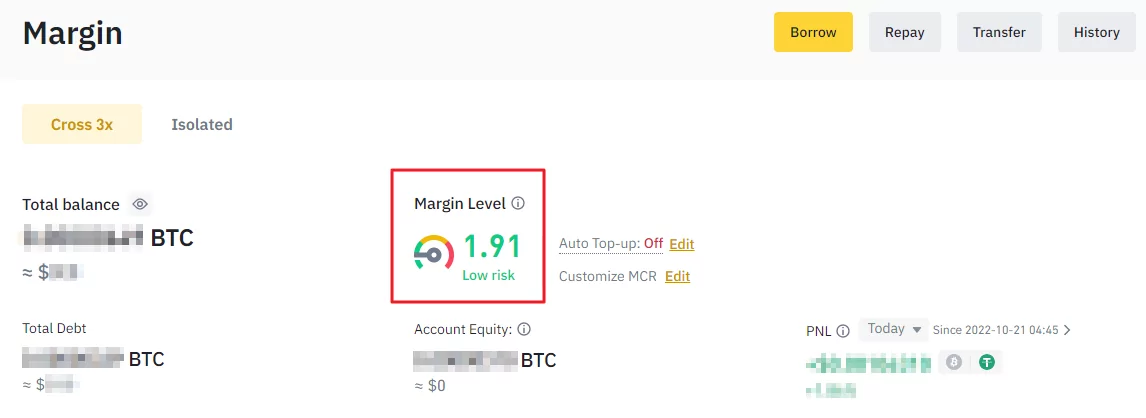

As stated previously, Binance is my favorite platform for margin trading. The margin level Binance offers is incredible, and that’s just one of the many reasons I use the platform.

Without further ado, here are some of the major reasons I use Binance Margin:

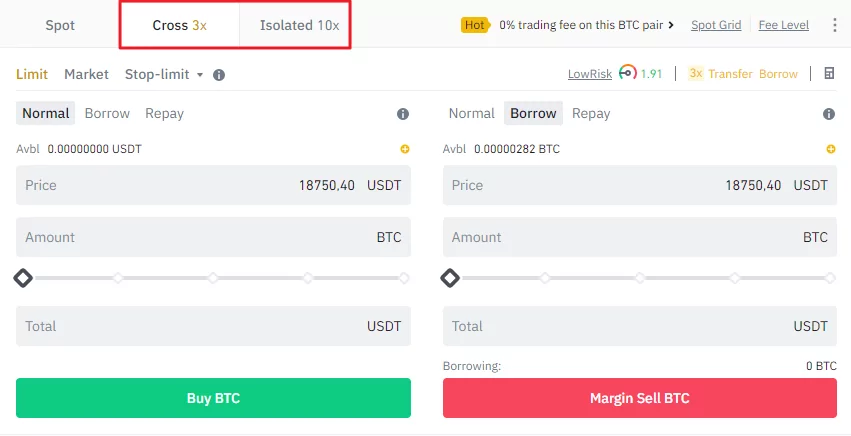

Up to 10x leverage

On several occasions, I’ve been able to significantly improve my buying power and accompanying profit by using Binance Margin. It’s quite simple. I may have 1000 USDT and borrow an extra 2000 USDT to enter a trade I believe will yield significant profit. If the trade is successful, I can easily pay back the loan and interest (Binance Margin rates are always friendly) and keep the huge profit. With isolated margin, I can trade with as much as 10x leverage and make a huge profit.

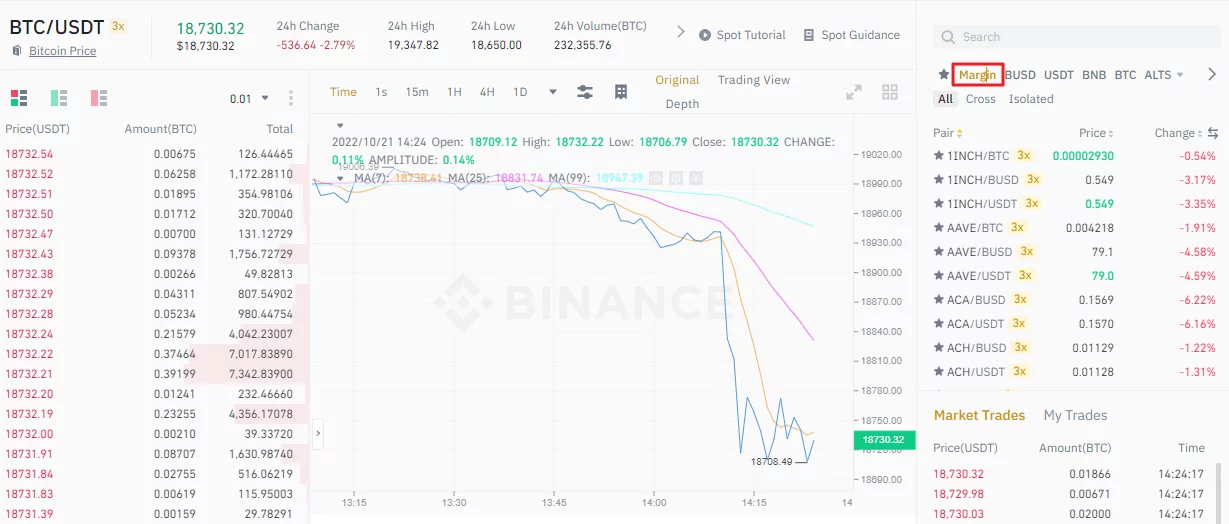

600+ trading pairs

As the world’s largest cryptocurrency exchange, Binance offers hundreds of trading pairs, even for margin traders. Most platforms that support margin trading offer few trading pairs, but with Binance Margin trading, I get the opportunity to enjoy leverage trading of more than 600 trading pairs. The multitude of options allows me to choose the pairs I’m comfortable with at all times. Of course, this improves the likelihood of getting favourable results and magnifying them constantly.

Flexibility in trading strategy

Considering that margin trading comes with opportunities and challenges, the ability to switch through trading modes comes in handy at all times. Personally, I enjoy the flexibility of choosing between cross-margin and isolated margin while using the Binance Margin feature. Cross margin offers me more flexibility and isolated margin helps me manage risks better. The Binance Margin trading interface makes switching between the two modes easy.

Multi-asset collateral

Another factor that limits crypto traders from taking full advantage of margin trading is the class of assets required as collateral. While many platforms have restrictions, Binance Margin allows for multi-asset collateral. What this implies is that traders can deposit multiple assets as collateral to borrow and trade on Binance. I always love the fact that I can deposit different assets like BTC, ETH, and USDT as collateral when trading on Binance. Losing out on opportunities is almost impossible.

Low fees

Almost every experienced crypto trader I know tries to minimize the costs of trading at every possible chance. I know that with Binance Margin, I enjoy some of the lowest possible fees in leverage trading. Binance Margin rates are always friendly, and I pay the fees happily at all times. Most of the established and highly liquid coins like ETH may be provided at a 3.33% yearly interest rate. Daily interest rates can be as low as 0.02% for many coins, and, of course, I enjoy lower hourly interest rates regularly.

Several risk-management tools

Binance understands the importance of protecting its users and the entire ecosystem. It provides a good number of risk management tools for all traders, and some of these tools are specifically helpful for margin traders. Stop-limit orders, for instance, is peculiar to Binance Margin trading. I’m particularly impressed by the “cooling-off period” feature that helps traders to take a break at the right time and avoid losing more on bad days. It is the biggest tool in margin trading for responsible trading. The Binance insurance fund is another impressive protective feature.

Binance Margin – Final Thoughts

It is safe to assert that Binance Margin trading is one of the best things to happen to me in the crypto trading scene. It comes with some elements of risks, but the results are always worth it. Imagine entering a trade with as much as 10x your deposit and generating 10x leveraged profit. It is always fun and rewarding.

Anyone with crypto trading experience can take advantage of Binance Margin to amplify trading results. Everything about the feature, including Binance Margin lending limits, is impressive. With the right strategy, an experienced trader can benefit a lot, just like I’ve done on several occasions. The key is to understand Binance Margin properly and trade responsibly at all times.