Key takeaways:

- Binance’s share of the Bitcoin spot market grew from 45% to 92% during 2022, according to a Jan. 3 report by Arcane

- Arcane highlighted Binance as the clear winner of 2022 and wrote that “Binance is the crypto market”

- Next to Binance, OKX is another crypto exchange that had a fair share of market success in 2022

Binance extends its dominance as crypto trading volume dips

Crypto analytics company Arcane Research released a new report about the state of digital assets markets on Tuesday. One of the most interesting takeaways presented in the report was the fact that Binance further solidified its position as the leading crypto exchange, and by a very considerable margin at that.

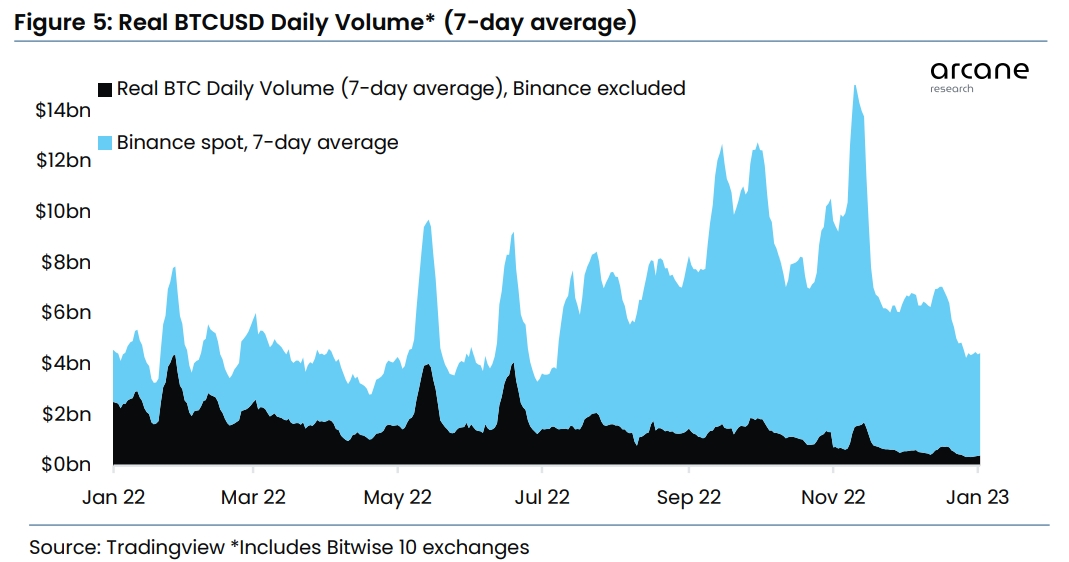

Binance’s share of the Bitcoin spot market trading volume surpassed 90% on December 28, more than double what it was at the beginning of 2022 (from 45% to 92%).

At the same time, Binance recorded robust performances across its exchange offering. BTC futures dominance grew from 47% to 61%, while the volume of perpetual crypto contracts increased from 56% to 66%. Other metrics, such as stablecoin dominance and the share of open interest, also improved, albeit by a smaller relative margin.

Drawing from these results, Arcane crowned Binance as “the winner of the year” and added that the growth coincided with Binance removing trading fees for Bitcoin spot trading pairs. “No matter how you look at it in terms of trading activity, Binance is the crypto market,” summarized Arcane.

OKX pulls off an impressive recovery

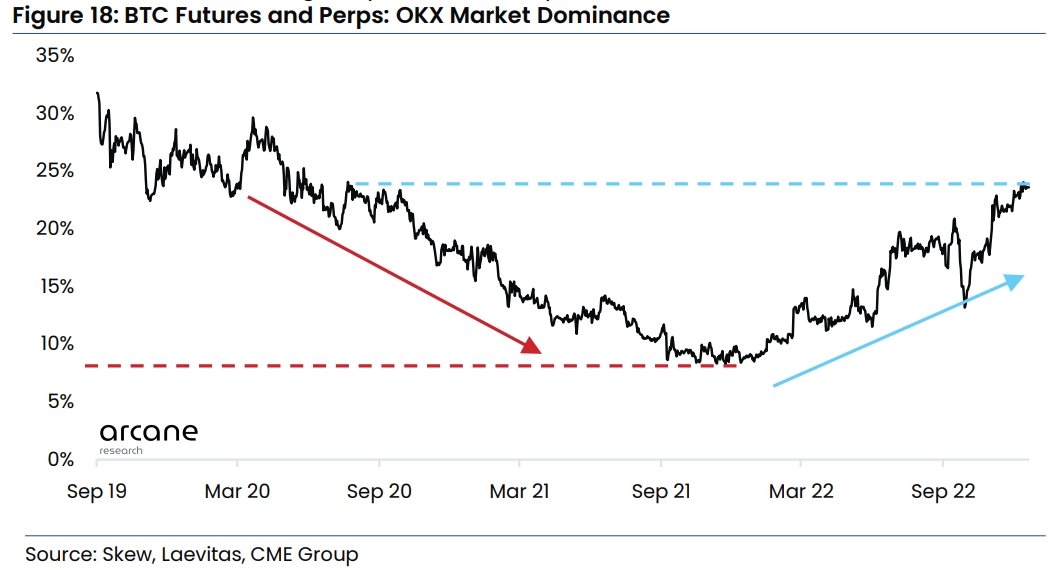

In addition to Binance, OKX was one of the companies that saw its fair share of success in 2022. Following a highly problematic 2021, which saw a severe decrease in OKX’s market share after the China crypto bans, the company saw a resurgence last year. OKX emerged as one of the leading derivatives platforms, having grown its market share from 8% to 25% over the course of the year.

The market performance of the exchange’s OKB native token closely mirrored the recovery of OKX. The price of OKB grew by 175% in the past 6 months, which elevated the token among the 10 largest market cap currencies. The price forecast for OKB is notably bullish in the short term, as our prediction algorithm predicts another 30% increase in the next month.

Despite some optimism brewing, Arcane thinks that the high interest rate environment in 2023 will persevere and limit the upside potential of digital assets during the next year. Overall, Arcane presented a reserved outlook for 2023:

“This will be a year to accumulate and build exposure. It will be a year for the patient, and we do not anticipate prices nearing former all-time highs in 2023. We believe BTC and ETH will increase their relative strength in the market and that altcoin returns will be subdued for most of the year.”