Are you looking to invest in cryptocurrencies but unsure which one to buy? With so many options available, it can be overwhelming to decide how to invest your money. That’s why we’ve compiled a list of the best crypto to buy now, based on factors such as project developments, price performance, and market capitalization, as well as the overall potential for growth.

In this article, we’ll take a closer look at the most promising cryptocurrencies, including staples such as Bitcoin and Ethereum, and a combination of several other promising crypto projects. We’ll discuss their features, advantages, and potential drawbacks, as well as provide insights into market trends. Whether you’re a seasoned investor or just starting out, this article will help you make an informed decision about the best crypto to buy now.

So, let’s dive in and explore the best cryptocurrencies to invest in April 2025:

- Bitcoin – The world’s oldest and largest crypto

- Hyperliquid – Decentralized perpetuals exchange with an efficient order book

- Solana – Smart contracts platform with high speeds and low fees

- Raydium – Solana-based DEX and AMM with order book integration

- XRP – The leading crypto remittance solution

- Ethereum – The leading DeFi and smart contract platform

- Berachain – A unique Proof-of-Liquidity platform

- BNB – The native coin of the Binance exchange

- Toncoin – A blockchain designed by Telegram and run by its community

- Avalanche – A leading “Ethereum killer”

- Cardano – One of the largest blockchain ecosystems

- Hedera – Crypto network based on the Hashgraph algorithm

The best cryptos to buy right now: Discover top investments for April 2025

The following three cryptocurrency projects highlight our investment selection thanks to important developments and upcoming events that make them especially interesting to follow in the near future. These projects are updated each week based on the most recent developments and trends taking place in the crypto market.

1. Bitcoin

Bitcoin (BTC) is the original decentralized digital currency, enabling peer-to-peer transactions without the need for intermediaries such as banks or financial institutions. It was created in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto. Bitcoin was the first digital currency to eliminate the double spending problem without resorting to any central intermediaries.

Bitcoin transactions are recorded on a public ledger called the blockchain, which is maintained by a network of computers around the world. This means that the transactions are secure and transparent, as anyone can view them, but they are also anonymous, as the identity of the participants in the transaction is not revealed.

Bitcoin is often referred to as “digital gold” or a store of value, as it has a limited supply of 21 million coins, and its value is determined by market demand. Some people also see it as a hedge against inflation or a way to diversify their investment portfolio. It is by far the largest cryptocurrency by market cap in the industry, accounting for the value of more than 50% of all digital assets in circulation combined, making it arguably the most popular crypto to buy.

Why Bitcoin?

At the start of the month, Bitcoin dropped from $88,000 to $75,000. The large drop followed a broader market selloff sparked by the US enacting high tariffs on a couple of dozen countries, including China, Germany, and Japan, to name a few. The tariffs – announced on April 2 as a part of the so-called “Liberation Day” – have had a very negative impact on stocks, crypto, as well as traditional safe haven assets like gold. On top of that, the US dollar also lost value against a basket of other currencies.

However, Trump later partially walked back on its original plan, announcing that the US would freeze tariffs for 90 days. Risk on assets exploded in value, and Bitcoin followed suit, rebounding from $75,000 to $85,000. While the macro situation is far from rosy, the recent events show that things can change very quickly. For example, Trump could very be using high tariffs as a bargaining chip and will eventually lower the levies once favorable terms are reached with other countries. In addition, the Fed could soon lower interest rates, which would also be a very strong bullish indicator for stock and crypto investors.

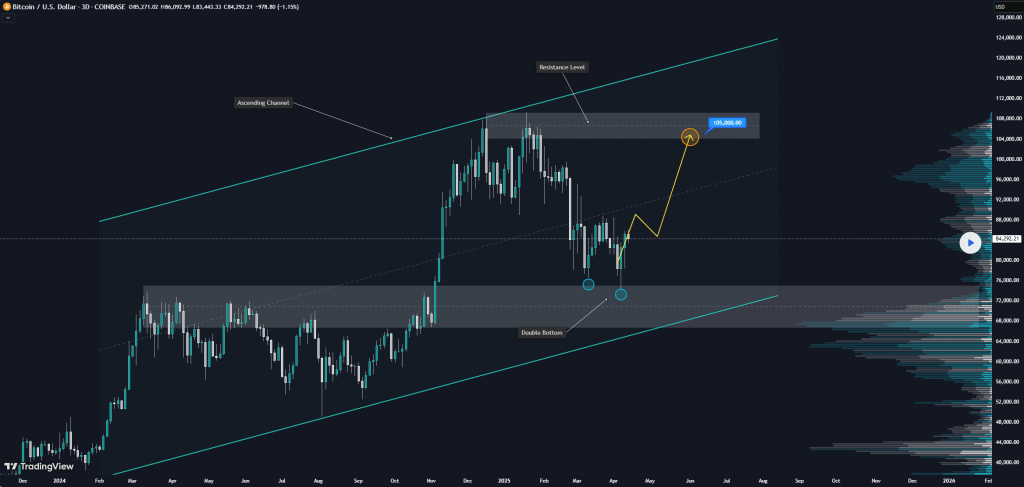

From a technical perspective, analysts see further upside. According to crypto analyst DanielM on TradingView, “Bitcoin is displaying strong bullish potential after forming a clear double bottom around the significant support zone near $74,000.” He added, “The current market structure implies a bullish continuation toward the significant resistance zone around $105,000.” The analyst credits “regulatory clarity” and “institutional adoption” as the main catalysts.

2. Hyperliquid

Hyperliquid is a decentralized perpetual futures exchange built to rival centralized trading platforms in speed, liquidity, and user experience—all while remaining fully on-chain. Unlike traditional DEXs that often struggle with performance bottlenecks, Hyperliquid uses a custom high-performance layer-1 blockchain specifically optimized for trading. This allows it to offer ultra-low latency, high throughput, and a seamless trading experience without relying on external validators or rollups.

One of Hyperliquid’s key innovations is its order book-based model, which is uncommon among decentralized platforms. While many DEXs use automated market makers (AMMs), Hyperliquid implements a central limit order book (CLOB), giving traders more control over order execution and tighter spreads. This design makes it particularly appealing to professional and high-frequency traders who expect the responsiveness of centralized exchanges but want the trustlessness of DeFi. Its deep liquidity pools and tight integration with crypto-native assets further enhance its trading dynamics.

Why Hyperliquid?

The Hyperliquid protocol hit 200,000 transactions per second in March 2025 and consistently handles over $100 million in daily trading volume. These metrics are not only a technical achievement but a sign of real user adoption. The recent launch of HyperEVM has turbocharged growth by enabling developers to deploy Ethereum-compatible smart contracts, transforming Hyperliquid into a full-fledged Web3 ecosystem with over 100 active dApps across DeFi, GameFi, AI, and more.

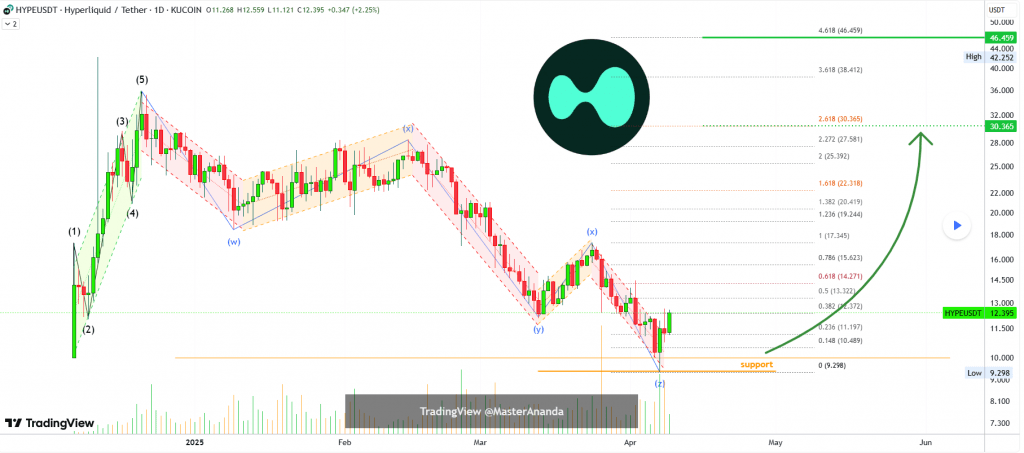

With deflationary tokenomics, HYPE has also become a strong performer in the market, gaining over 65% between April 7 and April 18, at a time when most other cryptos traded sideways or in the red zone. Analysts set short-term targets between $13.50 and $18.50, while longer-term projections suggest $46 is possible by year-end. According to a trading analysis done by MasterAnanda on TradingView, “Hyperliquid is good as long as it trades above support.” In other words, as long as HYPE is trading above $9.3, we can assume that bulls have the upper hand.

3. Solana

Solana is a smart contract platform known for its distinctive architecture, enabling it to handle thousands of transactions per second while maintaining very low costs. It accomplishes this by using a combination of a unique Proof-of-History algorithm and a Proof-of-Stake consensus mechanism. SOL, the native cryptocurrency of the platform, is one of the cheapest to transfer, with users typically paying less than $0.001 per transaction.

Founded in 2018 by Anatoly Yakovenko, Solana’s mainnet went live in March 2020 and experienced a surge in adoption throughout 2021. Despite a significant drop in value during the 2022 bear market, Solana remains one of the most robust ecosystems in the cryptocurrency space and continues to be seen as a potential candidate for significant future growth.

Why Solana?

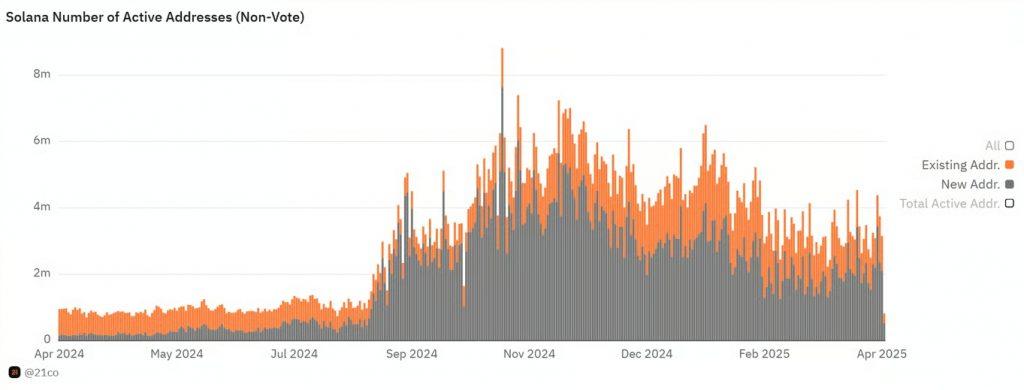

Solana presents a compelling opportunity for crypto investors at the moment, especially after a sharp price correction from its all-time high of $295 earlier this year. Currently trading at a roughly 55% discount, SOL is offering a potential entry point for those who believe in its long-term value. Despite the broader market downturn that has impacted most altcoins, Solana’s fundamentals remain strong. On-chain activity is still remarkably high, with millions of daily transactions and active addresses. This consistent usage reflects a healthy and engaged user base, which is a critical indicator of network utility and long-term viability.

Beyond the numbers, the Solana ecosystem is thriving with innovation. The blockchain is home to a wide array of promising projects, particularly in the rapidly expanding DePIN sector, which includes ventures like Helium, Hivemapper, and Render Network. Solana also continues to dominate in the memecoin and DeFi sectors, boasting high-profile protocols like Jupiter, Raydium, and Drift. The combination of ultra-low transaction fees and scalable infrastructure makes Solana an attractive platform for both developers and users. This momentum, coupled with the upcoming Firedancer upgrade (slated for Q2 2025), which could push transaction throughput to 1 million per second, further strengthens Solana’s technical outlook.

Perhaps the most bullish catalyst on the horizon is the likely approval of a Solana ETF in the U.S., with six asset managers already in the running and strong odds according to prediction markets. An ETF would provide mainstream investors with easy access to SOL through regulated financial products, which could significantly boost demand.

It’s also worth noting that Solana was one of four coins (next to ETH, ADA, and XRP) that was recently included in the United States Digital Asset Stockpile, a crypto reserve initiative aimed at strengthening the country’s ties with crypto. For all the aforementioned reasons, Solana might be a good buy for those who believe in its underlying potential despite the recent price drops.

4. Raydium

Raydium is a decentralized exchange (DEX) and automated market maker (AMM) built on the Solana blockchain, designed to provide fast, low-cost, and efficient token swaps. Unlike typical AMMs, Raydium integrates directly with Serum, Solana’s order book-based DEX, giving it a unique hybrid model. This allows Raydium users to tap into the liquidity of Serum’s entire order book while also benefiting from the instant trades and yield farming features of traditional AMMs.

Raydium stands out for its capital efficiency and composability. Liquidity providers on Raydium not only earn fees from swaps but also gain exposure to broader market activity on Serum. Additionally, Raydium supports launchpads (via AcceleRaytor), dual yield farms, and ecosystem partnerships that help new projects bootstrap liquidity. Its ultra-fast transaction speeds—thanks to Solana’s architecture—make it a viable option for traders and projects seeking scalable DeFi infrastructure. The native token, RAY, is used for staking, governance, and participating in liquidity pools and launchpad events.

Why Raydium?

Raydium stands as one of the most important players in the Solana ecosystem, offering a dynamic blend of decentralized exchange functionality and liquidity provision. As the first AMM on Solana, Raydium has helped launch and support numerous projects by offering deep liquidity and a trusted launchpad. It holds a position similar to that of Uniswap in Ethereum’s early days, giving it a foundational role in Solana’s DeFi growth.

Built on Solana, Raydium inherits high-speed infrastructure with block times under 500ms and throughput of up to 65,000 TPS—far ahead of Ethereum’s capabilities. Since the start of 2024, the volume of trades on Raydium skyrocketed. At the same time, the total value of locked funds exploded, growing from $164 million TVL to over $1.2 billion TVL at the time of writing.

The technical edge, combined with income-generating features like staking and yield farming, makes RAY more than just a speculative asset. It’s a utility-rich token embedded in a growing ecosystem, appealing to both DeFi enthusiasts and long-term investors looking for exposure to Solana’s momentum.

5. XRP

XRP is a digital cryptocurrency that was created by Ripple Labs in 2012. It is used as a means of payment and transfer of value on the Ripple payment protocol, which is designed to enable fast and secure transactions between financial institutions as well as individuals.

XRP is unique in that it is not based on the blockchain technology used by many other cryptocurrencies. Instead, it uses a distributed consensus ledger called the XRP Ledger, which is maintained by a network of validators. This allows for faster transaction processing times and lower fees compared to traditional payment methods.

XRP has been popular among cryptocurrency traders and investors due to its high liquidity and clear potential for broader adoption, especially as a remittance solution. However, it has also been the subject of controversy and legal action, with US regulators alleging that it is a security and should thus be subjected to securities regulations. This has somewhat hindered the potential of XRP as an investment, and handcuffed Ripple’s growth as a company.

Why XRP?

After years of prolonged legal battles, the Securities and Exchange Commission (SEC) dropped its case against Ripple. This is a markedly positive development for the fintech firm, which has been embroiled in legal proceedings since December 2020. There are several reasons why investors welcomed the news with great excitement.

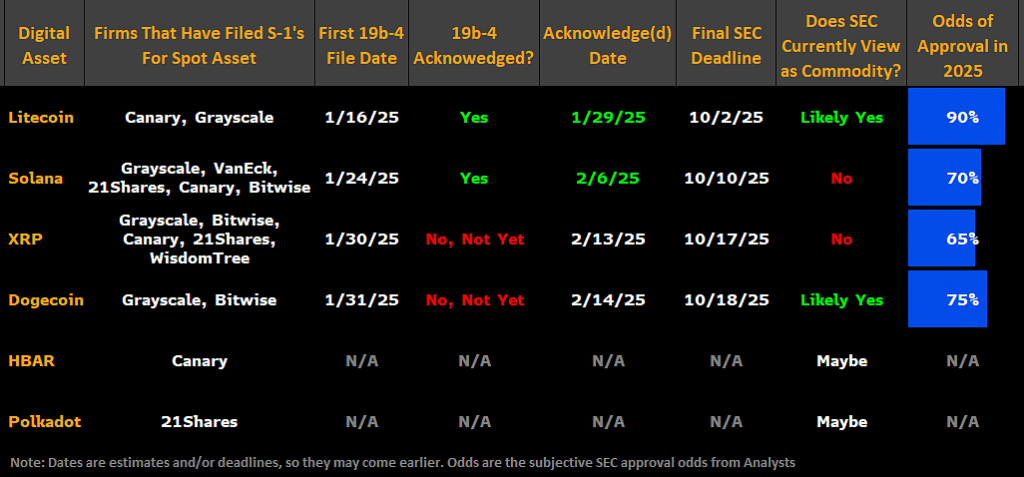

Ripple is now able to pursue its lofty goals of going public, while the XRP cryptocurrency has a higher chance of getting approved for a spot ETF. The main barrier before was the SEC case, and with that out of the way, the company is free to pursue its long-term plans.

In other news for Ripple, the company has announced a new partnership in the international payments sector. Ripple is teaming up with Chipper Cash, a payments platform focusing on the African market. Through the partnership, Ripple will help facilitate cross-border transactions into Africa with its Ripple Payments solution.

Ripple Payments users the XRP cryptocurrency to enable faster and cheaper international payments compared to traditional financial networks. Chipper Cash, which has five million users across nine African countries, says that the partnership will give its customers the ability to receive remittances much faster than what was possible previously.

In addition to Ripple’s expanding partnerships, the administration change in the US, and especially the accompanying shakeup at the helm of the Securities and Exchange Commission (SEC), has provided positive tailwinds for XRP. It now seems more likely than ever that a spot ETF for the XRP cryptocurrency will be approved in 2025. In fact, Polymarket users are betting that XPR ETF has an 80% chance of launching this year.

That’s not too far off from the claims made by analysts. According to Bloomberg ETF specialists James Seyffart and Eric Balchunas, XRP has a 65% chance of approval. They had noted that the main headwind XRP was facing is the Ripple vs SEC lawsuit, but that is now a thing of the past.

6. Ethereum

Launched in 2015 by Vitalik Buterin and a team of developers, Ethereum is a decentralized, open-source blockchain platform that allows developers to build decentralized applications (dApps) and smart contracts.

Ethereum has a wide range of use cases beyond just a store of value or medium of exchange. Ethereum’s smart contract functionality allows developers to build dApps that can run without the need for intermediaries, like centralized servers or institutions.

The Ethereum platform has gained widespread adoption and has become the backbone of the decentralized finance (DeFi) industry. DeFi applications built on Ethereum allow users to access financial services without relying on traditional banks or financial institutions. Ethereum’s smart contract functionality has also enabled the creation of non-fungible tokens (NFTs), which have gained popularity in the digital art and gaming worlds.

While Ethereum has a strong community and has been highly influential in the cryptocurrency industry, it also faces challenges, such as scalability issues and high gas fees. These issues have spurred the development of various Layer 2 scaling solutions. In the long run, future updates are supposed to massively increase Ethereum’s throughput bringing the transaction per second (TPS) figure from 15 to 100,000.

Why Ethereum?

Ethereum has arguably been the most disappointing cryptocurrency during the 2024-2025 bull run. It hasn’t managed to hit a new ATH while Bitcoin, Solana, and many others did, and overall, the coin has been struggling while others surged.

But the upcoming Pectra upgrade, Trump’s inclusion in the crypto reserve plan, and bullish predictions about ETH’s future might reignite investors’ interest. Let’s start with the Pectra upgrade, which is slated to go live on the mainnet on May 7.

The upgrade is designed to improve the network’s performance and user experience. One of the key changes is an increase in the number of data blobs available, which helps Layer-2 networks operate more efficiently. Pectra also makes smart accounts available to all users by allowing them to upgrade existing accounts. Additionally, the upgrade increases the maximum staking limit for validators, introduces security improvements, separates the validator key from the withdrawal key, and more.

Some analysts, like CryptoELITES on X, believe that the upcoming upgrade and the sharp drop ETH experienced over the past couple of days are actually signs that the bottom might be in. If that’s indeed the case, now might be the time to invest in ETH. For context, the coin hasn’t traded this low since early 2023.

7. Berachain

Berachain is a Layer 1 blockchain that’s fully compatible with the Ethereum Virtual Machine (EVM) but introduces a unique Proof-of-Liquidity (PoL) consensus mechanism. Unlike traditional Proof-of-Stake systems, PoL rewards users who provide liquidity, aligning validator incentives with broader ecosystem growth.

The native token BERA is used for gas and staking, while governance is handled via BGT, a soulbound (non-transferable) token distributed to liquidity providers. This ensures that governance power stays with active participants rather than passive holders or speculators.

By embedding liquidity provisioning into its core architecture, Berachain aims to create a more engaged, sustainable, and DeFi-friendly blockchain ecosystem—offering a fresh approach to user incentives and network security.

Why Berachain?

Berachain presents a compelling case for investors looking to invest in a relatively new and innovative project. Its recent rollout of the Proof-of-Liquidit system marks a significant evolution in on-chain governance. Instead of passively staking tokens, users contribute to DeFi liquidity pools and earn BGT, Berachain’s soulbound governance token. According to the team, this system not only decentralizes decision-making but also incentivizes real economic activity within the ecosystem, creating a stronger feedback loop between users, developers, and validators.

The PoL approach allows staked assets to remain active and usable, a significant improvement over traditional Proof-of-Stake models where assets are often locked in unproductive ways (though restaking initiatives like EigenLayer are changing this paradigm). With BGT emissions tied to validator influence, the system naturally prioritizes validators who align with liquidity providers, encouraging cooperation and ecosystem health over pure token accumulation.

Following the success of Boyco, its pre-launch liquidity platform, Berachain’s mainnet launch saw over $3 billion in total value locked (TVL) — a clear show of confidence in the platform’s economic design. Moreover, Berachain has attracted serious capital, with $142 million raised in two funding rounds led by crypto-native VCs like Polychain Capital and Framework Ventures.

8. BNB

BNB (formerly Binance Coin) is a cryptocurrency created by the popular cryptocurrency exchange Binance. Binance is the largest cryptocurrency exchange in the world, allowing users to buy, sell, and trade a wide range of digital assets.

BNB was initially one of the ERC-20 tokens on the Ethereum blockchain but has since migrated to its own blockchain, known as BNB Chain. BNB is used as a utility token within the Binance ecosystem and has a variety of use cases. For example, users can use BNB to pay for transaction fees on the Binance exchange, receive discounts on trading fees, participate in token sales on Binance Launchpad, and purchase goods and services from merchants that accept BNB as payment.

One of the unique features of BNB is that it has a deflationary model. Binance uses a part of its profits each quarter to buy back and burn BNB tokens, reducing the total supply of the token over time. This mechanism is designed to create scarcity and increase the value of BNB over time, with the end goal of reducing the circulating supply of BNB from the initial 200 million to 100 million BNB.

Why BNB?

BNB has enjoyed quite a bit of market interest recently, having risen 13% between March 10 and March 17. There are several reasons for this, including the first-ever institutional investment in Binance and increased blockchain activity on the BNB Smart Chain.

On March 12, Binance announced that the Abu Dhabi-based investment firm MGX committed to a $2 billion investment in the crypto exchange giant. “MGX’s investment in Binance reflects our commitment to advancing blockchain’s transformative potential for digital finance,” said Ahmed Yahia, Managing Director & CEO at MGX, and added that as institutional adoption accelerates, “the need for secure, compliant, and scalable blockchain infrastructure and solutions has never been greater.”

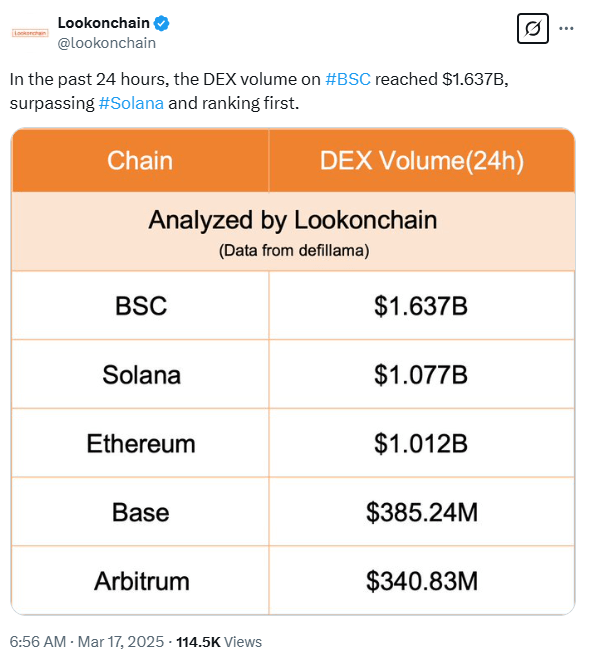

Meanwhile, the on-chain data shows that BNB Smart Chain has seen increased traffic when compared with other top smart contract platforms. As of March 17, BSC cleared over $1.6 billion in DEX trading volume, whereas Solana and Ethereum both trailed behind the first-placed BSC by roughly $600 million.

It’s worth noting that the price and blockchain activity recorded a notable increase since the February roadmap release for 2025. In it, the BNB Chain team highlighted low latency, more types of transactions, elimination of potentially malicious MEVs, and smart wallet features as the main updates slated for this year.

9. Toncoin

Toncoin is a platform consisting of multiple components. One of its main components is the TON Blockchain (with TON standing for “The Open Network”), which supports Turing-complete smart contracts, upgradable blockchain specifications, and multi-cryptocurrency value transfers. The TON Blockchain incorporates unique features such as a self-healing vertical blockchain mechanism and Instant Hypercube Routing, which ensure fast, reliable, scalable, and self-consistent operations.

The native cryptocurrency of the Open Network is Toncoin, which is used to facilitate deposits to become a validator and cover transaction fees and gas payments (fees incurred from smart contract message processing). Its integration with the Telegram messenger app, which has over 900 million users, gives it high levels of exposure, which virtually no other cryptocurrency enjoys.

Initially, the Open Network was launched as the Open Telegram Network by the Telegram team but was later rebranded as the community took over the development of the project. Telegram withdrew from development in 2020 after the litigation with the Securities and Exchange Commission (SEC), which accused the company of selling unregistered securities.

Why Toncoin?

In August 2024, Telegram founder Pavel Durov was arrested in France, and his passport was confiscated. Now, nearly 8 months later, Durov has gotten his passport back and he is free to leave the country at his own discretion. The release of Durov has had a notable impact on the price of Toncoin, which shot up over 20% after the news broke.

Before his arrest, Toncoin was one of the hottest cryptos in the market, growing from $2.33 at the start of 2024 to $6.85 at the time of Durov’s arrest. Between his August ordeal and mid-March 2025, the coin lost most of the gains and was trading at just $2.66 in early March. That’s a gain of just 14%, which is significantly less than other major projects in the space in the same time period. For example, XRP jumped by over 300%, BNB by more than 100%, and BTC by nearly 80%.

With Durov cleared of any wrongdoing, it’s not unreasonable to assume that Toncoin could again see considerable growth. Telegram remains one of the most popular messaging apps around and is the only major social platform that directly integrates with blockchain technology.

10. Avalanche

Avalanche is a cryptocurrency and blockchain platform designed to provide high-speed, low-cost transactions for decentralized applications (dApps) and enterprise use cases. The Avalanche network is built on a DAG-optimized consensus mechanism called Avalanche, which uses a novel approach to achieving consensus among nodes on the network. This allows the network to process transactions quickly and efficiently, with the potential for over 4,500 transactions per second (TPS).

Avalanche uses its native token, AVAX, as a means of value transfer and to pay for transaction fees on the network. AVAX can also be staked by node operators to help secure the network and earn rewards in the form of additional tokens.

One of the key features of Avalanche is its support for interoperability between different blockchains, which allows for the transfer of assets and data between different networks. This is achieved through a technology called the Avalanche-X bridge, which enables cross-chain communication and allows developers to build dApps that can interact with multiple blockchains.

Why Avalanche?

On March 6, Ava Labs and Balancer teams published a proposal to deploy Balanced v3 on Avalanche. Balancer is an AMM protocol that allows users to exchange tokens and provide liquidity to pools in a decentralized and permissionless way. The platform has been described as a self-balancing portfolio and price sensor. The vote on the proposal will end on March 11.

The proposal, authored by the Ava Labs team in collaboration with the Balancer team, seeks community support for deploying Balancer V3 on Avalanche’s C-Chain to enhance the DeFi ecosystem. The deployment aims to leverage Balancer’s multi-asset pools and custom hooks to improve onchain liquidity for both crypto-native and real-world assets.

Some of the key objectives the deployment of Balancer V3 aims to achieve are immediate integrations with major protocols like Aave and BENQI to boost liquidity and yields for liquidity providers (LPs), streamline trading for both long-tail and traditional financial assets tokenized on Avalanche, and enhancing liquidity and offering advanced market-making capabilities will position Avalanche as a leading destination for DeFi projects.

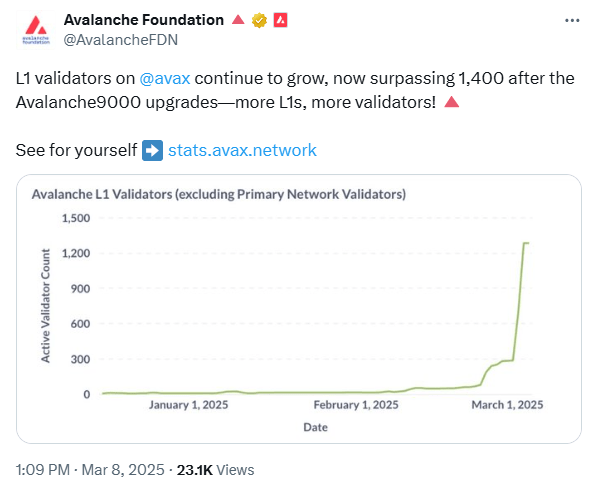

It’s worth noting that the number of Avalanche validators experienced a sharp increase following the Avalnche9000 upgrade in February, growing to about 1,300 in a span of just a couple of weeks. This speaks to the network’s expanding DeFi presence, which the Balancer deployment aims to further improve on.

11. Cardano

Cardano was founded by Charles Hoskinson, one of the co-founders of Ethereum, and his team. The main goal of Cardano is to provide a secure, scalable, and sustainable infrastructure for the development of decentralized applications (DApps) and smart contracts.

Cardano’s blockchain is built using a unique layered architecture, separating the settlement layer from the computation layer. This design approach aims to improve the efficiency, flexibility, and security of the platform. The settlement layer is responsible for handling transactions and maintaining the cryptocurrency (ADA) ledger, while the computation layer is used for running smart contracts and executing DApps.

The platform utilizes a consensus algorithm called Ouroboros, which is a type of proof-of-stake (PoS) mechanism. This means that validators (also known as stakeholders) are selected to create new blocks and validate transactions based on the amount of ADA they hold and are willing to “stake” as collateral.

Cardano has a strong focus on academic research and peer-reviewed development. The team emphasizes scientific rigor and evidence-based protocols to ensure that the platform is secure, scalable, and capable of handling complex use cases.

Why Cardano?

Last week, Cardano founder Charles Hoskinson tweeted about a mysterious meeting that he would have to attend in Florida. “Sorry I’ll miss ETH Denver but I had to go to Florida for a thing,” Hoskinson wrote on X. Rumors quickly started circulating about a potential meeting with President Donald Trump and his administration.

The rumors were confirmed to be true on Sunday, after Trump announced that ADA would become a part of the new crypto reserves, along with BTC, ETH, XRP, and SOL. The price of Cardano absolutely exploded on the news, moving from 60 cents to a local high of $1.10 over the course of just six hours.

Following the news, Hoskinson jokingly tweeted whether Cardano should change the name to “America’s Digital Asset”, obviously pretty happy with his cryptocurrency being included in the new crypto reserve plan. He also managed to land a small jab at Gemini, highlighting the fact that the American exchange since doesn’t have ADA listed.

Trump announcing ADA as a crypto reserve asset is major news for the Cardano community and could play a pivotal role going forward. It’s also easy to make the argument that ADA could actually end up being the biggest benefactor out of all five coins due to its smaller market capitalization.

On the technical front, it’s worth noting that Cardano recently unveiled a new Cardano Improvement Proposal (CIP), the CIP-113. According to Cardano developer Matteo, the improvement proposal has been actively developed for more than a year and is currently being finalized. CIP-113 establishes a new standard for interoperable securities, real-world assets (RWAs), and stablecoins on Cardano, enhancing DeFi capabilities. It also introduces smart accounts linked to stake credentials for secure token management.

12. Hedera

Hedera (previously called Hedera Hashgraph) is a public distributed ledger and cryptocurrency platform that differs from traditional blockchain technology. Instead of a linear chain, it uses a directed acyclic graph (DAG) called “hashgraph” which allows for faster transaction speeds and higher scalability. This architecture enables Hedera Hashgraph to process transactions in parallel, significantly reducing the time and energy required compared to blockchains.

The platform supports smart contracts, file storage, and offers strong finality, with transactions confirmed within seconds. The native cryptocurrency of the Hedera network is HBAR. It is used to power decentralized applications, pay for transaction fees, and secure the network through staking. Hedera aims to provide a more efficient, secure, and fair digital economy, positioning itself as a next-generation platform for a wide array of applications.

Why Hedera?

HBAR has been one of the most impressive cryptocurrency performers recently despite the relatively poor performance over the past couple of days. When looking at longer time periods, HBAR’s performance is nothing short of impressive – the coin gained more than 520% over the past 3 months, which leads all major cryptos (apart from certain meme coins).

Last week, the Hashgraph Association announced a partnership with Taurus to enhance secure custody, staking, and tokenization of Hedera’s HBAR cryptocurrency and other assets. The collaboration aims to make Hedera’s ecosystem more accessible to financial institutions globally, focusing on regions with clear regulatory frameworks, such as Europe, Asia, the Middle East, and Africa.

In related news, Hedera co-founder and other higher-ups at the project attended the first ever “crypto ball,” a gala event celebrating Trump’s upcoming inauguration. In addition to Hedera, the event saw participation from notable individuals from other major US-based crypto projects such as Coinbase, Kraken, Ripple, Crypto.com, MicroStrategy, and many more.

Best cryptocurrencies to buy at a glance

| Native Asset | Launched In | Description | Market Cap* | |

| Bitcoin | BTC | 2009 | A P2P open-source digital currency | $1.68 tln |

| Solana | SOL | 2020 | Smart contracts platform with high speeds and low fees | $52.9 bln |

| Hyperliquid | HYPE | 2024 | Decentralized perpetuals exchange with an efficient order book | $5.32 bln |

| Raydium | RAY | 2021 | Solana-based DEX and AMM with order book integration | $603 mln |

| XRP | XRP | 2012 | The leading crypto remittance solution | $103 bln |

| Ethereum | ETH | 2015 | The leading DeFi and smart contract platform | $180 bln |

| Berachain | BERA | 2025 | A unique Proof-of-Liquidity platform | $452 mln |

| BNB | BNB | 2017 | The native coin of the Binance exchange | $80.3 bln |

| Toncoin | TON | 2020 | A blockchain designed by Telegram and run by its community | $7.46 bln |

| Avalanche | AVAX | 2020 | A leading “Ethereum killer” | $6.78 bln |

| Cardano | ADA | 2017 | One of the largest blockchain ecosystems | $19.6 bln |

| Litecoin | LTC | 2011 | Silver to Bitcoin’s gold | $5.14 bln |

| GMX | GMX | 2021 | Decentralized derivatives exchange | $111 mln |

| Jupiter | JUP | 2021 | A leading DeFi aggregator on Solana | $939 mln |

| Hedera | HBAR | 2018 | Crypto network based on the Hashgraph algorithm | $4.91 bln |

Best crypto to buy for beginners

If you are just starting out in crypto, it is advisable to stick to cryptocurrency projects that are less prone to volatility and are generally more established. While this approach does have a downside, as it becomes much more difficult to expect triple-digit or larger gains, the major upside is that you are not exposed to projects that have a chance of failing and, thus, losing your entire investment.

In order to identify projects that are stable and thus feature low volatility, you can start by following the parameters listed below:

- The crypto asset has a market capitalization that places it into the cryptocurrency top 100 (roughly $1 billion as of late 2024)

- The crypto asset is available for trading on the best crypto exchange platforms and can be exchanged for fiat currencies

- The crypto asset boasts healthy liquidity ($100M/day and more), which allows you to execute buy and sell orders quickly and without slippage

- The crypto asset is part of a reputable crypto project with clear goals, a realistic roadmap, and products and services that look to address real-world problems

Some of the best cryptos to buy for beginners are those that follow the above criteria and have earned their standing in the crypto market due to robust security, popular products and services, and clear growth potential. Some beginner-friendly crypto investments are:

- Bitcoin

- Ethereum

- Litecoin

- Cardano

- BNB

It is worth noting that cryptocurrency investments are inherently risky, even if you stick to the biggest and most reputable projects. The reason for this is simple – the crypto sector is relatively new, and the landscape might look completely different in the future.

Best crypto for long-term

When deciding which cryptocurrency to buy for the long term, it’s important to consider projects that are well-established, have a strong community, are highly liquid, have a large market cap, and have a clear reason for existing (such as solving a real-life problem, introducing new functionality, etc.). Without these characteristics, a project might fail to survive in the long term, rendering it a bad long-term investment.

It is worth noting that, typically, most long-term crypto investors are looking for projects that have the potential to generate decent returns but also provide a degree of investment stability. Roughly speaking, only the largest cryptocurrencies fit the bill, as others have a low market cap and liquidity that doesn’t bode well for a long-term commitment (unless you’re prepared to take on more risk).

In addition to Bitcoin and Ethereum, there are a number of other cryptocurrencies that fit the criteria of being low-risk, long-term crypto investments.

If you are planning to hold onto your digital assets for a longer period of time, it is best to take care of crypto custody yourself. Holding large amounts of crypto on an exchange can be risky, as we’ve seen over the years with the collapse of high-profile exchanges like Mt. Gox and FTX. Use one of the reputable crypto hardware wallets to store your crypto. Ledger hardware wallets, for instance, allow you to manage your crypto holdings easily and provide a much higher degree of security than crypto exchanges or even software crypto wallets.

Best place to buy crypto

One crucial aspect to consider when choosing which platform to use to buy crypto is the range of cryptocurrencies and trading pairs available. Since different exchanges support varying digital assets, it’s important to choose a platform that accommodates the specific cryptocurrencies you intend to trade.

Additionally, assessing an exchange’s liquidity and trading volume is essential. Higher liquidity generally results in improved price stability and faster trade executions. Furthermore, it is prudent to examine the fees charged by the exchange, encompassing deposit, withdrawal, and trading fees. Comparing fee structures across different exchanges can help you identify the most cost-effective option that aligns with your trading style. With that said, here are some of the best exchanges on the market right now:

- Binance – The best cryptocurrency exchange overall

- KuCoin – The best exchange for altcoin trading

- Kraken – A centralized exchange with the best security

By diligently considering these factors, you can make an informed decision and select a cryptocurrency exchange that meets your requirements for security, variety, liquidity, and affordability.

How we choose the best cryptocurrencies to buy

At CoinCheckup, we provide real-time prices for over 22,000 cryptocurrencies, with the list growing by dozens each day. As you can imagine, making a selection of a dozen top cryptocurrencies to buy out of such an immense dataset can be difficult and will for sure lead to some projects that should be featured being omitted. To minimize the chance of that happening, we follow certain guidelines when trying to identify the best cryptocurrencies to invest in.

Availability

One of the most important factors for any cryptocurrency investment is the crypto asset’s availability, meaning how easy it is to buy and sell it across various cryptocurrency exchanges. We tend to stay away from assets that are not available on major exchanges and require complex procedures to obtain.

Market Capitalization

Another important metric for identifying whether a crypto project is worth covering its market cap. A high market cap means that the project has reached a certain level of adoption from users, making it less risky to invest in.

Growth Potential

While this metric is mostly subjective, it is still an important metric on which we curate our selection. We won’t feature projects that we think are stagnating or have no real upside in the future.

Purpose and Use Case

We consider the purpose and use case of cryptocurrency, particularly in a real-world setting. Some cryptocurrencies focus on specific industries or applications, such as decentralized finance, gaming, or supply chain management.

Team and Development

The team and people involved in the project can tell you a lot about the potential of a particular cryptocurrency project. We examine the team’s experience, expertise, and track record and evaluate the development activity and updates to ensure the project is actively maintained and evolving.

The bottom line: What crypto should you buy right now?

The decision of which crypto to buy now is dependent on your own risk profile and investment goals. For some, investing in a crypto asset with a proven track record like Bitcoin is the only type of exposure to crypto they are willing to take on.

Meanwhile, those with a higher risk tolerance might see Bitcoin as too stable, looking instead toward newer and smaller projects that carry a higher degree of upside.

If you are looking for more investment ideas, check out our crypto price predictions section.