Key takeaways:

- Bank for International Settlements (BIS) will allow banks to store up to 1% of their aggregate assets in “unbacked” digital currencies like Bitcoin

- The exposure limit, which is currently set at 1%, is subject to change

- BIS is a global central bank governing body owned by central banks pursuing global financial stability

Leading international financial institution updates guidelines regarding banks’ crypto reserves

The Bank for International Settlements (BIS), a global central bank governing body, is seemingly getting ready to welcome Bitcoin (BTC) and other cryptocurrencies into the reserve assets fold, by allowing banks to keep up to one percent of their reserves in digital currencies.

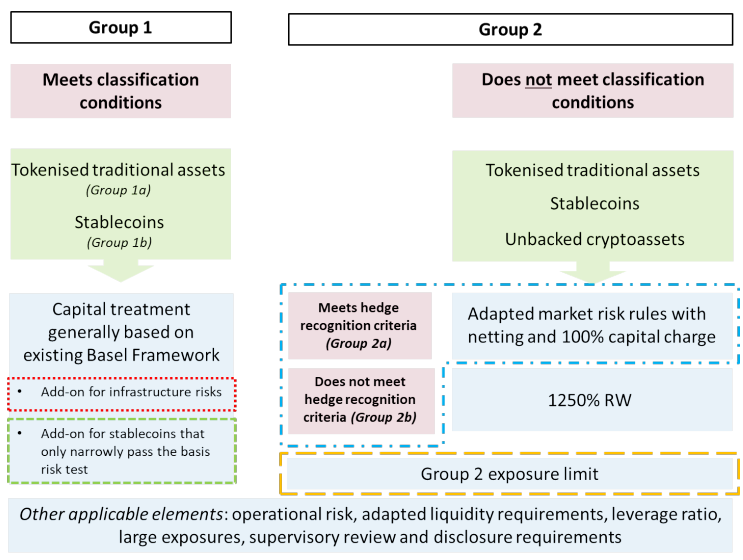

According to the Basel Committee on Banking Supervision (BCBS), banks should limit their overall exposure to “Group 2 crypto-assets” to 1 percent of shareholders’ capital. The limit will be periodically reviewed and adjusted if deemed necessary.

Group 1, includes assets that meet classification criteria and include “effective stabilisation mechanisms.” These include tokenized traditional assets and stablecoins.

Group 2, on the other hand, includes various tokenized assets, stablecoins, and unbacked private digital currencies like Bitcoin and Ethereum (ETH) that don’t meet the agency’s classification conditions.

An excerpt from the BSC document published in June 2022 reads:

“Banks’ exposures to Group 2 cryptoassets will be subject to an exposure limit. Banks must apply the exposure limit to their aggregate exposures to Group 2 cryptoassets, including both direct holdings (cash and derivatives) and indirect holding (ie those via investment funds, ETF/ETN, special purpose vehicles).”

In related news, the US central bank held an inaugural conference on the international role of the US dollar in June. A write-up on the conference was published on Tuesday. The panelists – consisting of top researchers, policymakers, and market experts – concluded that the role of the US dollar as the global reserve asset can effectively be bolstered by the proliferation of digital assets in the medium term.