Key highlights:

- Aura Finance is an innovative DeFi protocol that increases the liquidity-providing yield and governance power of Balancer protocol users

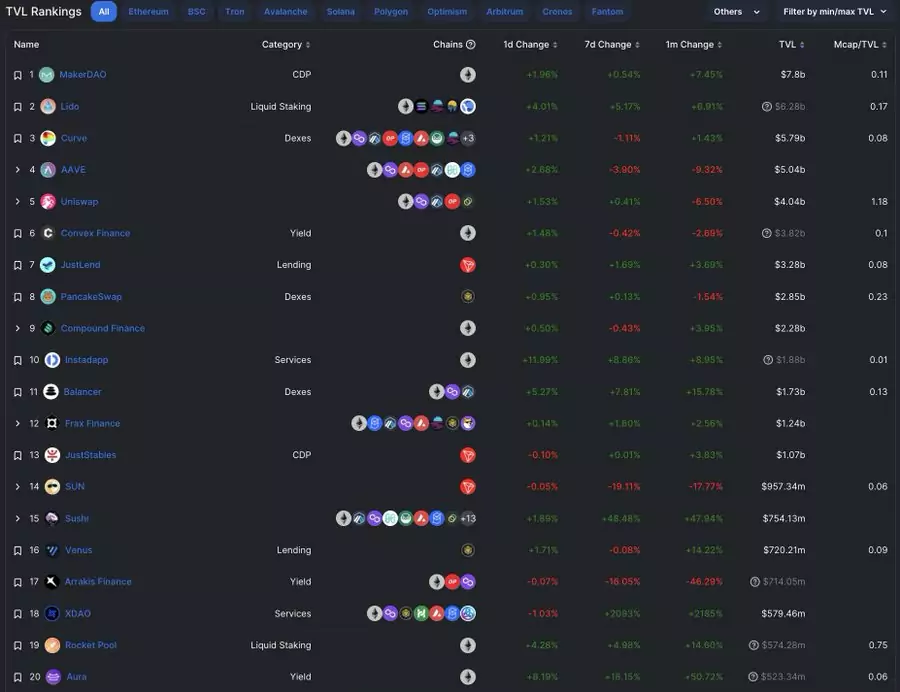

- Aura, which has collected more than $ 500 million TVL in just 4 months, has become one of the top 20 DeFi platforms in this field

- The protocol, which attaches great importance to the security of users and funds, has not encountered any hacking incidents, although it has increased its recognition

- Liquidity pools in Aura offer users an average of 29.78% APY return opportunities

Aura Finance is an autonomous DeFi platform developed for Balancer (BAL) users to increase their governance power, yield and the way they benefit from DeFi. Launched in June 2022, the project has quickly become one of the key players in the DeFi ecosystem, with more than $500 million TVL. Aura Finance, which surpassed popular DeFi projects such as SushiSwap, Synthetix, Yearn Finance, Abracadabra, GMX and dYdX, managed to rank among the top 20 DeFi protocols.

In the list presented by DeFi Llama by analyzing the current data of hundreds of DeFi projects, Aura Finance was included in the top 20 DeFi protocols in terms of total value locked with $528.29m. Currently only supporting the Balancer protocol, Aura may soon expand its influence and presence to other DeFi ecosystems.

Great Success in the Bear Market

While many crypto projects are losing value and experiencing disruptions under the bad effects of the bear market, Aura, which has been on the market for four months, has reached $500 million TVL, a very big milestone. DeFi ecosystem, which had 170-billion-dollar TVL in November 2021, has seen more than a 69% decline since then and currently has a 51.59 billion-dollar TVL.

Working as a yield-optimizing protocol, Aura has seen more than a 100% TVL increase in the last five weeks. Having managed to accumulate more than $250 million TVL since mid-September, the protocol has become the fastest-growing project among the top 50 blockchain DeFi platforms.

Fund Security is the Focus of Aura Finance

Cyber attackers exploiting DeFi protocols by exploiting smart contract vulnerabilities stole more than $3 billion in cryptocurrencies this year before 10 months were up. Developing high-security standards against strong attacks by hackers, Aura has not experienced any hacking events since its launch.

The Aura Finance (AURA) platform currently consists of 37 liquidity pools. While the average APY rate was above 33% until a few days ago, it is now around 29.8% with increasing interest and TVL. While liquidity providers earn veBAL rewards, NFT collections and various benefits have been created for AURA token holders in the protocol.

More About Balancer

Running on the Ethereum blockchain, Balancer is a DeFi protocol in which each Balancer pool works as a liquidity provider, a self-balancing weighted portfolio, and a price sensor. In the protocol that works as AMM, investors can follow arbitrage opportunities and benefit from Balancer’s Smart Order Router and earn high returns from their portfolios.