The introduction of Bitcoin (BTC) in 2009 transformed the world’s perception of asset management and upended the financial system.

In today’s age of Blockchain, the financial sector is transforming how it manages transactions. This increases the appeal of cryptocurrencies, supported by the anticipated economic recovery.

However, we cannot ignore the volatility of cryptocurrencies, so we will give you some strategies to balance your crypto and traditional investments.

The Rise of Blockchain and Its Impact on Asset Management

Blockchain technology has always been a staple for the cryptocurrency market. As a digital ledger, it stores all crypto transactions to track the market changes while hiding users’ identities.

Analysts estimate the total spending on blockchain solutions will reach $19B by FY24. Meanwhile, its market size is projected to expand to $1.2T by FY30 at a compound annual growth rate (CAGR) of 82.8%. Of these, 9% are attributed to the distributed ledger system due to higher demands for smart contracts, immutable records, and supply chain audits.

These are the challenges and opportunities financial systems can get from blockchain technology.

Opportunities in Blockchain

The capital market is the primary recipient of blockchain technology’s positive spillovers. Among these advantages, asset identification will be the crown jewel. It will be safer to trade stocks online as it will be easier for investing platforms to record and check asset ownership and maintenance history.

Asset tokenization will also apply to other investment types. With blockchain, digital tokens will represent investors’ ownership or rights to these assets. This tokenization will enable fractional ownership and improve liquidity for investors and asset issuers.

Additionally, blockchain will make it easier to execute trade orders. This can be supported by smart contracts to automate transactions without a third party like a broker. Investors can manage orders, apply for bank loans, and do cross-border transactions automatically and quickly. As such, there will be lower costs and a shorter waiting time for transaction completion.

More interestingly, blockchain can be integrated into IoT devices, enabling you to track and analyze real-time information on asset management and market changes. That way, you can execute prompt and data-driven responses whenever and wherever you are.

Challenges in Blockchain

The main challenge in blockchain technology revolves around security issues. Due to cryptographic deficiencies, consensus system problems, and smart contract glitches, it can also be vulnerable to cyber attackers.

Another potential problem is the increased energy consumption. This will be more evident in investors mining cryptocurrencies. It can affect electric bills and device depreciation. As such, they may face other expenses when using blockchain for their portfolio management.

Balancing Cryptocurrencies and Stocks

As stocks and cryptocurrencies heat up, returns become more attractive, but risks must not be discounted. Here are some ways to balance your crypto and stock investment.

Assess your risk appetite and goals

Both cryptocurrencies and stocks have inherent risks associated with high volatility and sensitivity to macroeconomic changes. Cryptocurrencies are at least thrice as volatile as stocks, making them riskier. However, their historical returns are much higher, making them viable investments.

Given this, you must assess your risk tolerance and investment goals. Doing so can help you create an efficient capital allocation that minimizes risks and derives decent gains.

Use financial metrics

In connection with the first tip, you must measure and compare their returns and volatility by using specific financial metrics. Sharpe Ratio can be helpful with Efficient Allocation Frontier to help you make particular allocations.

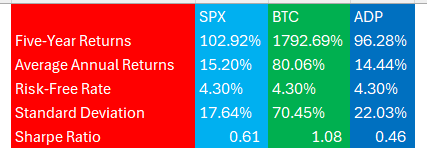

The table below shows Bitcoin’s performance relative to the S&P 500 (SPX) and Automatic Data Processing, Inc. (ADP).

Computed by the Author

Concerning returns, Bitcoin is the apparent winner. However, investors must be aware of its volatility. Its price can change by 70% in less than a month. As such, it is essential to consider balancing cryptocurrencies with traditional investments like stocks to manage risks and returns efficiently.

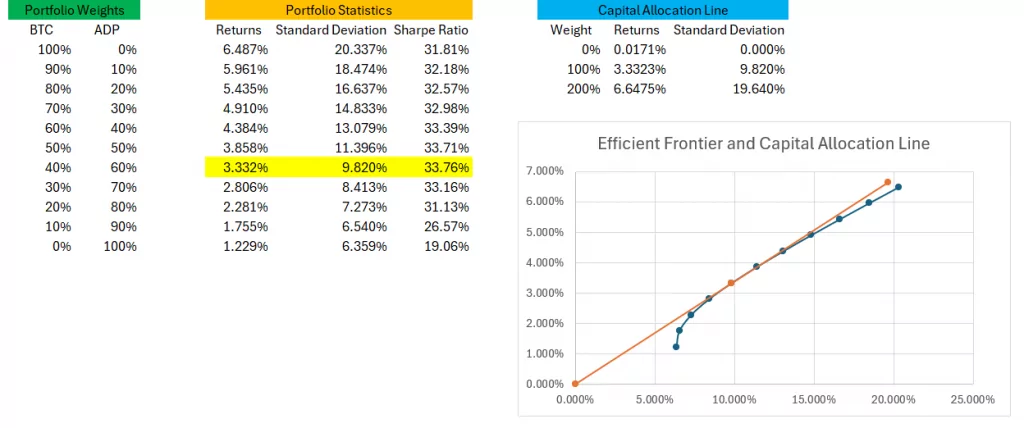

For a more specific allocation, we can use the Efficient Frontier.

Computed by the Author

The optimal allocation is 40% to Bitcoin and 60% to ADP. That way, risk and returns will be balanced. The capital allocation line, represented by the orange line, proves this. The 100% point is tangent to the efficient frontier’s allocation.

Watch out for market trends

As investors, we must continually update ourselves on recent market and macroeconomic trends. We have seen how inflation has affected stocks and cryptocurrencies in the past four years. Hence, we can take immediate action, such as buying and selling investments at an optimal price.

Takeaways

Trading cryptocurrencies today can be more profitable than you think. With the recovering economy and increasing popularity of blockchain, more opportunities will come along the way. Yet, risks remain apparent, which should require investors to diversify their portfolios. Hence, venturing into traditional investments can help optimize investment management.