Key takeaways:

- Algorand experiences a miny rally in the last 10 hours, gaining more than 15%

- Following the announcement of Polygon integration with a major consulting firm, Ernst & Young, MATIC sees strong upward momentum

- Ethereum is quickly approaching its September peak value, gains more than 6% in the last 24 hours

During a relatively modest trading volume day, Algorand and Polygon have performed the best among the cryptocurrency’s top 20 largest projects by market capitalization. Ethereum is also experiencing quite an uptick, the second-largest crypto is now up more than 6% for the day and over 20% in the last three days of trading.

Algorand price surges by more than 15% in the last 10 hours

While Algorand has experienced a lackluster market performance over the last seven days, ALGO has awakened from the slump and surged by more than 15% over the last 10 hours of trading to reach $2.20 at the time of this writing. Taking a step back, and analyzing the month-long period, Algorand has been on a tear. ALGO was trading below $1 USD ($0.98 to be exact) at the end of August and has since exploded by more than 100%.

The announcement of a massive 150 million ALGO fund (worth over $330 million at current market rates) by the Algorand Foundation certainly contributed to the rise in value. The recently launched fund is looking to boost decentralized finance (DeFi) development by providing 100M ALGO in liquidity incentives and 50M ALGO towards grants. Investment firm SkyBridge Capital recently announced that it had raised $100 million for the newly created fund.

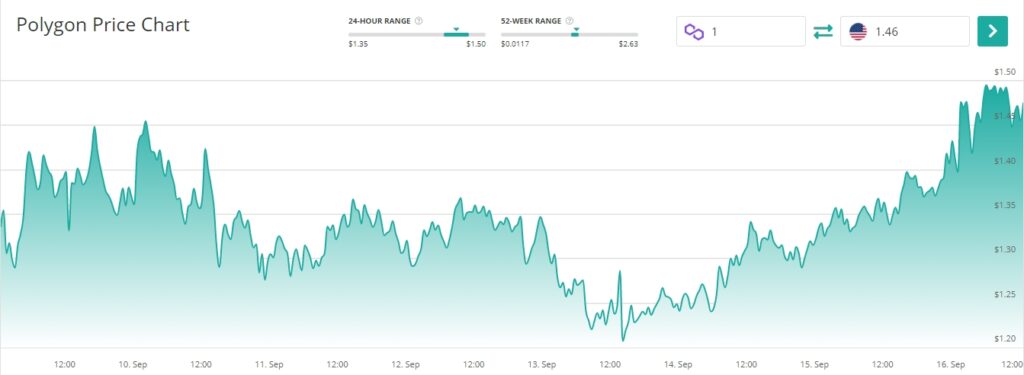

Polygon sees 20% gains over the last three days

The native cryptocurrency of the Polygon network, MATIC, has experienced rapid growth over the last 72 hours. MATIC was trading at $1.21 on September 14 and has since risen to reach $1.46 for a total increase of over 20%. The three-day rally has helped MATIC reach its highest price since the flash crash that happened at the beginning of last week.

Polygon, formerly known as Matic Network, is a blockchain platform that provides interoperability solutions and a highly scalable framework for the development of ETH-compatible chains. Ernst & Young, an international consulting firm with over 300,000 employees, has recently announced the integration of its blockchain services with Polygon. The consulting behemoth revealed that Polygon will provide its enterprise clients with faster and easier to scale transactions paired with quick settlement tines and stable fees.

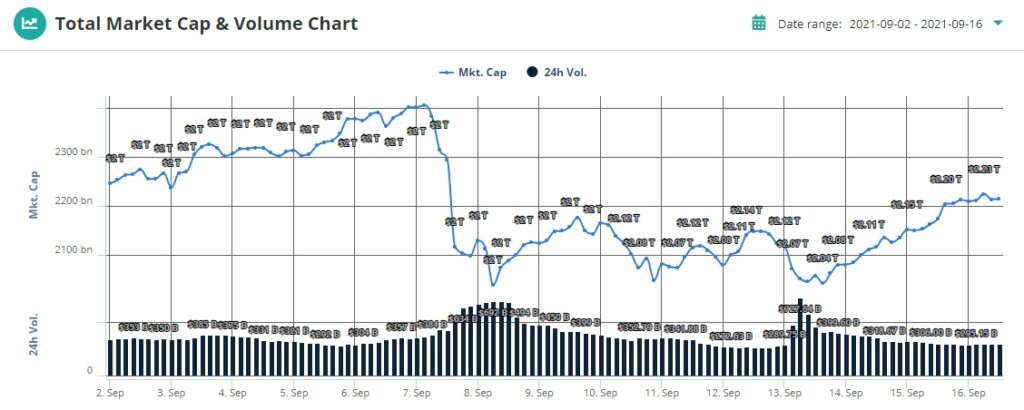

Ethereum is showing bullish signs, the market is recovering quickly from Monday’s Litecoin “pump and dump”

As soon as the news of Litecoin partnering with Walmart was revealed to be fake, the prices of all crypto assets took a big hit, leaving a “candle” pattern, which can be seen on the above graph of Ethereum for the last 7 days. ETH has dipped below $3,200 at the lowest point on September 13. However, since then, the second-largest crypto has managed to quickly regain lost ground and surpass the $3,600 mark. At the time of this writing, Ethereum is up more than 15% in the last three days.

Generally speaking, the crypto market has shown a great deal of resilience over the last two weeks. Following the massive drop that occurred following a cascade of “long” liquidations, the market has managed to recover more than half its losses since September 8. Litecoin fiasco could also leave the market in a much worse state than it did. It will be interesting to observe how things will pan out in the coming weeks.