KuCoin is known as the “People’s Exchange” for a solid reason – all KCS holders earn from the platform usage.

Launched in September 2017, KuCoin Exchange is already the biggest altcoin exchange, with over 700 assets and 1,200+ trading pairs. In addition, it is a top 5 crypto exchange overall within the entire industry. In the short time running, KuCoin has already managed to attract well over 18 million users in 207 different countries.

KuCoin Token (KCS) is the native token behind the cryptocurrency exchange. It is a utility token that has several use cases in the entire KuCoin ecosystem. For example, it can be used for paying trading fees on the KuCoin Exchange and also provides a 20% discount on those trading fees.

In addition to this, any user that holds at least 6 KCS tokens gets a daily bonus reward from the KCS Bonus incentive mechanism. The reward comes from the 50% share of KuCoin’s daily trading fee revenue, which is distributed proportionally across all holders.

Other use cases include taking part in IEOs on KuCoin Spotlight and collateralizing KCS to take out loans from the platform in USD and VND.

KuCoin recently closed Series-B funding round, which took their evaluation past $10 billion. As a result, their upcoming expansion plans will certainly help the exchange and the token grow.

This article will briefly cover some potential fundamental driving forces for the KCS token and outline where it could trend in the coming years.

KCS Potential Fundamental Drivers

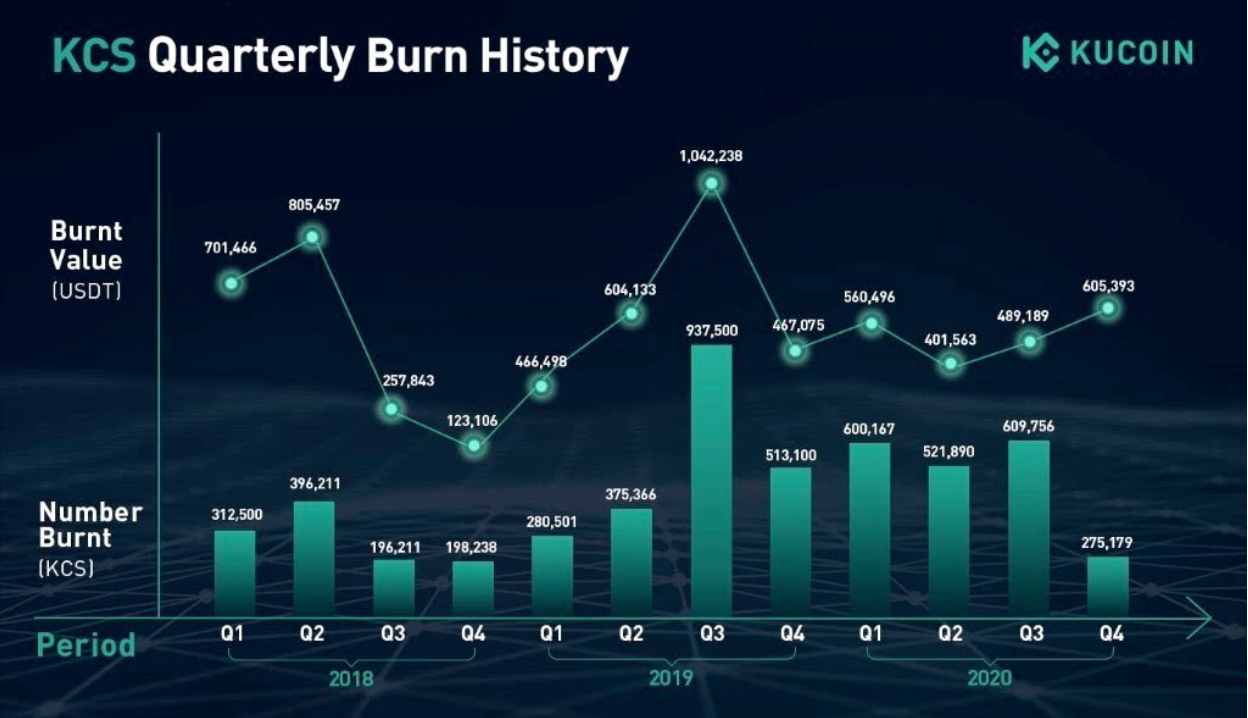

One of the main driving forces behind KCS is the quarterly burn that occurs. From January 2021, KCS decided to change the quarterly burn to a monthly burn. In total, 200 million KCS were created at launch and the burn is intended to continue until 50% of the total supply has been removed.

In the new monthly burn, 10% of the net profit will be applied to the buy-back of KCS;

In March 2022, the KuCoin team released the KCS whitepaper to announce the new KCC ecosystem. KCC will be its own native chain and will bring KuCoin into the DeFi world. It will be a high-performance platform that can boast higher throughput and lower transaction fees than Ethereum.

As the KCC chain grows, all fees on the chain will be paid in KCS, helping provide further use-case for the growth of KCS.

The last strong fundamental driving force that might help KCS run higher is that they recently announced a $150 million pre-Series B Funding round – taking its valuation all the way up to $10 billion. The funding round was led by Jump Crypto and saw the participation of some big industry players such as Circle Ventures, IDG Captial, and Matrix Partners.

The new influx of capital will allow KuCoin to truly expand beyond the realms of “just” a cryptocurrency exchange. Instead, with the new funding, KuCoin can expand its presence in Web 3.0, GameFi, Defi, and NFT platforms.

Johnny Lyu, CEO of KuCoin, stated the following on the matter;

“The vote of confidence from prominent investors, including Jump Crypto and Circle Ventures, solidifies our vision that one day everyone will be with crypto. KuCoin is built for all classes of investors, and we believe these new investors and partners will contribute to making KuCoin synonymous with a reliable and trustworthy gateway into crypto space.”

KuCoin Price History

Like the majority of the crypto market, the growth of KuCoin was truly exponential in 2021. The coin started the year beneath $0.8 as it started to surge as high as $20 in the first few months of the year. From there, KCS fell lower in April but managed to hold the support level at around $5.

It took a few more months for KCS to finally break above $20 again. Officially, it happened in the first week of November, which allowed KuCoin to surge through the winter to reach the all-time high price of $28.77 in the final week of November.

More specifically, KCS found resistance at a 1.414 Fib Extension level and started to roll over from there.

In 2022, like the majority of the cryptocurrency market, KCS started to plummet as it dropped back beneath $20 and headed lower through April. In June 2022, KCS fell back beneath $10.

KuCoin Price Forecast Medium Term Outlook – 2023

Looking ahead, once the US Interest Rate hikes cease and Bitcoin (BTC) starts its recovery, the first few points of resistance are expected to be around $10, $15, and $20. Beyond $20, the resistance is located at $25.15 (1.272 Fib Extension), $27.90 (1.414 Fib Extension), and $30.

It is unclear if KCS can break $30 through 2023. It entirely depends on overall market conditions as the entire altcoin market is highly correlated to Bitcoin. However, if Bitcoin does recover quickly, the $30 level should not act as overpowering resistance for KCS.

KuCoin Price Forecast Long Term Outlook – 2025

The price potential for KuCoin over the long term takes it well above $50. After the resistance at $30 is breached, local resistance is then expected at $34.10 (1.272 Fib Extension – green), $35, $36.90 (1.414 Fib Extension – green), and $40.

Above $40, resistance is located at $41, $42.50, $46.28, and $50.

Conclusion

Predicting the price forecast so far into the future for any token is extremely difficult. However, once the overall cryptocurrency market recovers and BTC heads back to its all-time highs, there is no reason why KuCoin could not smash past $50 in the coming months and continue further higher.

In addition to this, the fundamental drivers behind KCS will all help the coin break its all-time high during the next market recovery.