I’ve talked in the previous article about the history of cryptocurrencies and how they came to be. Now it’s time to move on, and see exactly how do you get to invest in the crypto market.

This piece covers most of the steps you need to take before investing into cryptocurrencies, how to stay safe and what to look for before making an investment.

You probably have a credit card that you use day to day, and you have the impression that there’s a sum of money available on it. However, credit cards don’t store any fiat money such as dollars or euros by themselves. They are coupled to a bank account and can spend the money on the account, as well as borrow money from the bank.

The amount of money shown on your bank account balance is theoretically yours, but in reality it is actually an IOU (i.e. I Owe You).

Essentially, the bank uses your money as a resource to give loans to other customers, but promises to give it back to you on demand. In the United States, banks are required by law to hold reserves of up to 10% of the money they owe.

If everyone tries to get their money out of the bank at the same time, there’s a huge problem (fancy the stories shared earlier in the book?). Some countries have no reserve requirements at all.

Cryptos share some of the concepts we’re all already used to. First of all, think of cryptos as virtual cash… and where do we keep cash if not under the mattress? Well… in wallets.

There you go, cryptos are stored in virtual wallets. You can set up crypto wallets online for free. You’re free to spend any money in your wallet however you please.

PRO TIP: Different crypto currencies require different wallets. Some wallets support different cryptos (e.g. both Bitcoin and Ethererum), but always make sure to read their documentation and follow instructions carefully, especially when you make transfers from one place to another.

I’ll talk about exchanges in a minute or so, but since I’m here, I’d like to stress the fact that money you keep in an exchange offered wallet is also an IOU, and thus at risk.

Once you get a little bit of experience moving cryptos around between wallets, you should, by all means, move cryptos out to wallets you have full control of.

In terms of wallet choices, as you might have imagined, there’s a vast number of options here too. If you feel you have an appetite for research, go ahead and Google “bitcoin wallet” and do your own research.

For the less patient of you, I’ll simply recommend two options for Bitcoin:

https://blockchain.info/wallet/#/signup

https://bitpay.com/wallet

They are both popular options and are available both for your desktop/laptop as well as your smartphone.

Please take a minute and set up your wallet before moving on. In a weird way, it’s pretty fulfilling, as this is your first step into the crypto world.

Congrats, you now have a fresh new crypto wallet that’s dying for some action. Let’s give it some!

Here are some of the options for getting your first bitcoin (or fraction of, because at the time of this writing, one bitcoin is priced at around ~$10,500 USD).

At this stage, I strongly recommend using the smallest amount of money required by the choice of funding you make below, just so you test the waters and get a feeling of it.

1. Using a Bitcoin ATM

This is my favorite means of getting paper money (cash) converted into bitcoin and stored into your new virtual wallet, and that’s because it’s fast and fulfilling. For small amounts it probably doesn’t need any ID verification.

You do however need to find a nearby physical ATM and travel to it to make it happen, so that’s the only inconvenience.

Head over to https://coinatmradar.com/ to check out if there’s any ATM available in your nearby vicinity.

2. Buy Bitcoin at an online market

Similar to stocks and traditional currencies, cryptos are traded at online markets called exchanges. At a market, there are people who buy and sell, everyone naming their price out loud, virtually. Exchanges take care of the hassle of pairing the buyers and the sellers and making ends meet.

To join the market, you’ll need a computer or smartphone and a bank account. I know, I know, you’re thinking… wait a second, aren’t we trying to create a new system (yes, by buying into the crypto market you’re essentially participating in the creation of a new, alternative financial system for the world; exciting, right?) that doesn’t need banks anymore?

Well, we’re not there yet… banks are so ubiquitous in our day to day lives but their ways of doing business the same old way are numbered.

As a sidenote, banks are looking at adopting blockchain technology on their own (see The Enterprise Ethereum Alliance at https://entethalliance.org/ for instance).

Since there are many exchanges out there, the same way as there are likely multiple fruits and vegetables markets in your area, I’ll try to help you find one that’s convenient for you.

Ideally, you should look for exchanges in your own country, since they more readily work with the currency you are already so familiar with, are in your local language and help you provide information required by regulators further down the road.

Exchanges are required by regulators to put you through a process called Know Your Customer (i.e. KYC), meaning you have to fill in forms with your personal details such as your full name, date of birth, phone number, permanent/residential address, as well as upload photos of your passport/national id card or driver’s license.

Some even ask you to take a selfie with these documents and upload them to their system. This process can take anywhere between 24h and up to 3 weeks in case of high demand. Please be patient, it is not that the exchanges enjoy hiring staff to check all the documentation, but it makes the entire system safer for everyone and helps prevent money laundering and other financial crimes, and keeps you safe as well.

PRO TIP: You’ll probably want to set up multiple exchange accounts and go through the identity verification process with them. It can be frustrating and time consuming, but once you’re set up, you’re good to go.

PRO TIP: Most exchanges only offer bank account wire transfers for funding your trading account, but there are some that also offer funding through a credit card. Beware that going through a credit card ends up costing you significantly more than the bank account option.

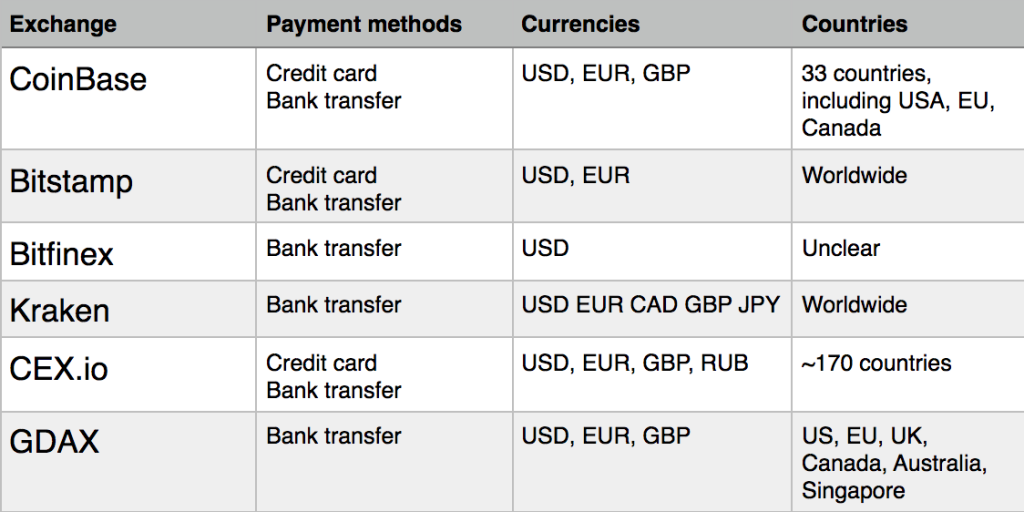

Here are some of the most popular exchanges at the time of this writing:

Disclaimer: the table above can suffer changes often. It’s best you do your own researching starting with Google “best bitcoin exchange”, go through some of the top results (avoid the ads), and see which exchanges come up most often, read reviews and form an opinion.

3. Buy directly from other people in your area

Just the same way you can check out classified ads for products or services in your area, either in the newspaper or online, and meet in person with the seller, you can also buy bitcoin from other people using cash.

Head over to www.localbitcoins.com and find out if there are people willing to sell you Bitcoin for cash in your area. Make sure to check out their reviews (better safe than sorry) and their price, since prices there can vary wildly. Then get in touch using the website and set up a meet and greet.

Show up, hand over the cash and your bitcoin wallet address, wait for the confirmation, and you’re done.

I would however advise you to first go through a more popular option (see above) and once you got your first amount of cryptos, try to send it to a friend to see how it actually works. Once you’ve learned that, you’re free to try buying or selling it to other people in your area.

4. Other means of payment

Head over to the excellent website https://www.buybitcoinworldwide.com/ to find if there are other methods available for you.

Disclaimer: Be aware that some of the information might be outdated, as the whole eco-system is growing and adapting fast.

I bought some, now what? How do I use them? What if I want to sell them back to traditional currency?

That depends on your goals for getting cryptos:

- You can simply hold forever and let your heirs have them, or give them away to charity.

- You can sell them back to traditional currencies if you consider you’ve made enough profit or want to liquidate a specific coin from your portfolio, the same way you’ve bought them.

- You can also use them to pay for goods and services at merchants who accept them directly, or you can sign up for a debit card that allows you to use cryptos at any merchant or ATM that supports the debit card you’ve got.

Do I have any options other than Bitcoin? What are some examples of other cryptos and their purpose?

I believe it’s now the right time to invite you over to our website, www.coincheckup.com, and click the Analysis tab up at the top, to take a look at the work we do to bring clarity and take the guess-work out of the options available out there.

Feeling dizzy with the variety? I know… but let’s work through this together.

Cryptos aim to solve a lot more challenging problems other than money. I’ll go ahead and give some illustrative examples:

Steem: provides a social media platform that rewards content creators for their contributions

SingularDTV: its goal is to reshape the entertainment industry (film and TV content) to be more fair, efficient and transparent

EnergyCoin: its goal is to facilitate local and renewable energy production, enabling communities to produce and trade energy

PinkCoin: the wallet allows you to earn interest, and it allows you to automatically donate to charities at zero cost

Ethereum: a global computer that is able to run smart contracts, which is computer code that ensures execution with certainty. Most of the above mentioned cryptos actually run on top of the Ethereum network.

Disclaimer: the above are not investment advice, but merely some examples of alternate uses of the blockchain technology underlying cryptos.

Have I talked about how to choose other coins later in the book, and so can I point the read to that section?

Are cryptos any better or worse than other investment types?

There’s no single best investment instrument, as all have pros and cons, and it largely depends on multiple factors, such as your psychological makeup, where you live, the laws and regulations in your country etc.

I’ll describe the pros and cons for each, in turn:

Real estate

Pros:

- feels real, you can touch it, you can see it

- has been profitable for decades

- has intrinsic value: you can use it to sleep, grow food or animals and sustain yourself (depending on the type of property)

- can generate a steady income by renting it out

Cons:

- liquidity and profitability varies by geographical location

- may require a lot of paperwork and larger amounts of cash than other instruments to get started

you have to pay for it tax annually - selling a property for cash is not as fast as with other instruments

- in very rare cases, it can be taken away by your government, through nationalization

Stocks

Pros:

- with stocks, you get an ownership in a company, and in a way, its employees go to work everyday for you

- you can get an annual return of around 10%, on average

- very liquid, quick and easy to buy and sell

- some stocks can generate returns of 20-50% a year

Cons:

- can be very volatile, and are subject to the company being invested to demonstrate good performance

- stock holders get paid last if a company goes bankrupt

Government Bonds

Pros:

- are guaranteed to generate a return on investment

- typically fluctuate less than stocks

- can provide a more stable, although smaller return

Cons:

- are poor instruments under high inflation (i.e. printing more money)

- even though their returns are guaranteed, it is still just a promise of a government to pay you back (some countries have defaulted on their bond payments in the past)

provide lower returns than other instruments - long-term bonds can suffer from price fluctuations when interest rates change

Gold

Pros:

- can be purchased both in physical form, as well as “on paper” through an ETF (search for GLD ETF on Google)

- a very good instrument to protect purchasing power when the monetary system is in danger, or failing altogether

- in case of political trouble (such as a war or revolution), unless the government decides to confiscate your gold (see below within this section), it is the safest way to provide for yourself

- it is recognized globally as valuable, so pretty much anyone is willing to accept it as payment for goods and services

- it doesn’t require any Internet, electricity or other infrastructure to work as payment

Cons:

- not very profitable in general, it typically goes in the opposite direction of the stock market

- may be difficult to find a trusted source to buy

- it is risky to store at home or travel with it, especially in larger quantities

Foreign currency exchange (i.e. forex)

Pros:

- potential for fast returns

- Less potential for insider price manipulation

- more simplified tax rules that can make tax calculations easier

Cons:

- complex price determination process due to the large number of factors that can influence it, such as global politics or economics, that can be difficult to analyze

- high volatility – with no control over macroeconomic and geopolitical developments, one can easily suffer huge losses in the highly volatile forex market

Cryptos

Pros:

- difficult or impossible for governments and central banks to control

- unlike traditional currencies, their supply is limited and there’s no printing extra coins

- you have complete control over how, when and how much you spend to anyone in the world

- transaction fees do not depend on the amount you transfer, unlike with banks

- transactions are much faster, sometimes near-instantaneous, unlike with banks

According to BitPremier CEO Austin Jacob, “Bitcoin also goes through predictable market events, like the halving events in Bitcoin, which ease investment decisions, whilst tending to remain stable in the face of international political crisis'”

Cons:

- require an internet connection to operate

- extremely volatile, can rise and fall abruptly and rapidly

- lack of widespread adoption

- difficult to understand and get started with

- at risk from hackers and scammers (see the section How do I protect myself from hackers and scams?)

So what’s your best investment option?

Unfortunately, this is not a question I can answer for you. You can try all of them and see what feels and works best for you. Time will tell.

Savings accounts nowadays diminish in value over time. Some offer returns of less than 1% a year, so they don’t even cover inflation. Other such accounts offer negative returns, so they basically cost you money to hold your savings there.

You can also decide whether you want to be an active or passive investor.

An active investor is checking news, price movements and market sentiment often. A passive investor does their research less often, like every 6-12 months, and if things seem right, they don’t touch their portfolio.

As promised above, I’d like to share how gold can be confiscated by governments:

Because of its physical properties, gold can be easily confiscated by the authorities. Just late last year [2016], Indian authorities confiscated gold from its citizens and households amidst an ongoing investigation into money laundering and a crackdown on illicit financial activities.

In an analytical blog post entitled “Clarification on India’s Gold Confiscation,” Armstrong Economics founder and CEO Martin Armstrong explained that gold and other assets can be seized by the authorities in India if citizens and households cannot prove those assets were purchased with taxed money. He wrote:

[…] An investor’s ownership of gold could be disputed, seized by authorities and confiscated from rightful owners. With bitcoin, such confiscation is not possible without terminating the entire cryptographically-secured network, which is not possible given its hash power and distributed nature.“The Indian society relies on cash for more than 90% of transactions, and nearly every aspect of daily life has been effected. This was a bold action to force the economy into a fully taxed society all for the benefit of the government, of course. The gold ownership is allowed provided you prove you bought it with taxed money.”

For many reasons including portability, security, liquidity and efficiency, bitcoin has overtaken gold as the premier global safe haven asset and long-term investment. An increasing number of professional, retail and institutional investors are purchasing bitcoin to hedge against global economic uncertainty and market instability.

India was not the only one to interfere with its citizens gold deposits. It was also the case of USA, between 1933 and 1974, when it made it illegal to own gold.

I’ve heard about ICOs, but what are they?

Akin to stock market Initial Public Offerings (IPOs), ICOs are an acronym for Initial Coin Offerings, and they are essentially a capitalization instrument for startups to secure funds in order to grow.

If you are unfamiliar with IPOs, here are a few recognizable examples:

Facebook (NASDAQ:FB) was one of the most-hyped IPOs in history. It listed on May 1, 2012 and raised $16.007 billion. This social media technology company’s launch was riddled with trading issues and questionable information-sharing accusations. Nevertheless, it still became the largest technology IPO in U.S. history.

Visa Inc. (NYSE:V) rounds out the top five. This debit and credit card processing company entered the public market on March 18, 2008, and raised $17.864 billion—no small feat during a global financial crisis. It is the largest IPO for any U.S.‑based company.

General Motors (NYSE:GM) debuted on November 17, 2010 after emerging from a bankruptcy filing one year earlier. This U.S.-based car manufacturer raised $15.774 billion in its initial public offering.

The initial public offering (IPO) is the first time that a private company offers it’s stock to the open public. In general, IPOs are issued by smaller, younger companies in need of capital for expansion, but they can also be done by large, privately owned companies looking to become publicly traded.

Similarly, ICOs have taken the crypto market by storm in 2017

They are a mean of crowdfunding centered around cryptocurrencies, which can be a source of capital for startup companies.

In contrast to the IPO, where investors buy shares of a company, in an ICO, they buy coins. These coins can increase their value in time if the business becomes successful.

These coins come in the form of tokens, that can be bought for other cryptocurrencies such as bitcoin or ethereum. These tokens become functional units of cryptocurrency if or when the ICO’s funding goal is met and the project launches.

Some of the most successful ICOs in 2017 are Tezos($232 million), EOS.io($185 million), Bancor ($153 million), Status ($95 million) or TenX($80 million).

How do I choose among all the coins and ICOs out there?

Look for highly skilled teams

Similar to stocks and government bonds, look at the teams behind the companies or the elected officials behind governments, respectively.

Are they trustworthy and experienced? Have they demonstrated performance in past positions?

Looking for highly skilled teams is very important when researching an ICO. You have to see if the management team will be able to implement the solution, and lead the entire company in the proper direction.

While members of the team can be replaced by the management, they will probably be there all along. Take a look at the companies they’ve founded in the past. Have they succeeded or have they failed? See why it happened.

Look for transparency and how often they communicate updates

Companies raising investments have a very important responsibility to keep the people who trusted them with their money informed.

The same goes with ICOs.

Take a look at their website and community accounts and see how often do they communicate updates. Another very important thing in terms of updates is their GitHub development activity. Software projects need to see constant development in order to succeed. Make sure the dev team is there and working on the project.

Follow the latest news on their development on CoinTelegraph, CoinDesk and other high profile crypto news websites.

Check out their investment statistics on CoinCheckup.com

Follow the news on CoinTelegraph, CoinDesk and other high profile crypto news websites.

These coins seem to go up and down like crazy, am I safe?

If you know yourself to be emotional, set up a hard rule for yourself to avoid checking out the prices every minute of every day. Instead, take a look at it every week and even if it goes down, don’t freak out, this is normal market dynamics.

The crypto market will grow and become less volatile over time, but at the time of this writing, it still displays great swings, similar to micro-cap stocks or worse.

You have the chance to be an early adopter and investor into a technology as great as the Internet itself. If you truly believe that, buy into it and don’t sell. Do not attempt to time the market or trade based on hunches. I’m dead serious about this, you will lose.

As a rule of thumb, when you decide to join the market try to look at some charts and keep an eye for a market drop. That’s when cryptos are more or less at a discount and it’d be a good opportunity for you to join the market. However, you should already have transferred traditional currency to your preferred exchange (this can take 1-3 days, which is enough time for the market to go in the other direction if it gains momentum), so you’re ready to trade.

I recommend you bookmark https://coincheckup.com and check it daily whenever you intend to trade. It shows green for growth, and red for drops.

Never invest borrowed money

Never invest money you can’t afford to completely lose

How do I know if it’s the right time to buy or sell? Where do I track the price of cryptos? What’s a good basic investment strategy?

You don’t really know the right time to buy or sell. You can’t time the market, and it’s foolish to think you can.

Photo source: https://jamesaltucher.com/

Set up some targets that make sense to you. Some cryptos can grow 10% in a week. If they do that and it makes you happy, you can sell.

Just the same way, they can drop 10% in a single day. If you feel ready for it, you can buy. It might still drop further. Do not sell, just hold until it goes high enough again. This can take a day or a month. Be patient.

First decide if you want to buy a batch all at once, buy a little bit every week or month (paycheck day for for example). If you can, invest 10% of your income in financial instruments. If you want to be on the safe side, limit your crypto investment to 10% of your general investment portfolio.

Go to coincheckup.com and check out the list of top coins by market, analysis and other metrics. For starters, don’t spread your portfolio too thin. Choose 3-5 cryptos to work with and write down how much you are willing to allocate in percentages.

For example, Bitcoin 40%, Ethereum 40%, Litecoin 10%, IOTA 5%, OmiseGO 5% (just an example, not investment advice).

If you have time, you should research their websites, read the CoinCheckup analysis, understand what they do, check out a few YouTube reviews and generally do as much due diligence as you can

Write down all the information you find in an Excel sheet, in a notes file, or a notebook.

Build a list of the exchanges/markets you need in order to build your portfolio. Try to keep the list as short as possible, to avoid extra fees and verification procedures.

Some coins allow you to buy directly via traditional currencies such as USD, EUR, JPY and so on. Others only offer options to buy via BTC (Bitcoin), ETH (Ethereum) or other cryptos. In the latter case, you’ll have to first buy the base crypto (BTC, ETH) and then exchange it for the final crypto you want.

Go ahead and set up exchange accounts if you don’t have them already. Check their limits and go through the verification process if needed. Be patient.

Transfer traditional currency from your bank account to the exchange that sells cryptos for your USD, EUR, JPY etc. Start executing your portfolio.

I prefer ETH for secondary crypto purchases, as it is faster and cheaper to transfer to other exchanges than Bitcoin. ETH is not the fastest out there, but it’s one of your best friends for the purpose here.

https://steemit.com/cryptocurrencies/@martinreddot/what-i-ve-learned-from-investing-usd100-in-each-top-100-cryptocurrencies-month-1

How do I protect myself from hackers and scams?

One of the first questions you might ask is: are crypto wallets secure? That depends. An exchange or online wallet is always going to be less secure than an offline wallet, no matter how allegedly secure the former are.

A joke that often goes around in my world as a software developer is that the best virus protection for your computer is to unplug it from the Internet. Pretty much the same goes for these wallets.

Remember: no matter what wallet you use, provided you do have the keys to it, always make sure to keep them safe and backed up preferably in multiple physical locations.

Unlike the keys to your house, where you can break in the door, recovering your money from a wallet you’ve lost the keys to is no longer possible, so you lose your money.

How do these keys look like? They are simple combinations of letters and numbers.

Here’s an example of a bitcoin private key:

5HpHagT65TZzG1PH3CSu63k8DbpvD8s5ip4nEB3kEsreAnchuDf

And here’s an example of a bitcoin wallet address:

1EHNa6Q4Jz2uvNExL497mE43ikXhwF6kZm

Good to remember: your wallet address is public and can be shared with anyone without worry. Your private key, however, should be guarded to the best of your abilities.

The private key is required in order to transfer funds out of your wallet.

Your address(public key) can also be shown as a QR-code if you’re using a paper wallet or a software wallet for mobile devices.

WALLET BACKUPS

Beware of scams and tricks

Since these concepts are quite foreign looking for beginners, it can be easy to fall into the traps (some of them quite sophisticated) of scammers and manipulators online.

Always double check the source of any communication that might even seem official, and make sure it is legit and coming from a trusted source.

Just the same way you shouldn’t trust an email from an unknown source asking for money or passwords, you shouldn’t trust unknown sources in the crypto world either.

Scammers sometimes even clone entire websites to make you think you are in the right place. This happens with regular bank websites as well, so it’s a double warning to make sure you are safe. Always check the full link you are on by looking at your browser window address bar.

If you are unsure, google the website first and access it from the google search results.

Two-factor authentication

Similarly to banks and other security-conscious institutions, most exchanges and even wallets offer so-called two factor authentication. This provides a double layer of security and requires a separate code from you in order to access the system.

Banks rely on paper-based codes, hardware tools protected by a PIN, or SMS security codes sent to your phone. In the crypto world, you’ll find email, SMS or Google Authenticator based verifications.

How does Google Authenticator work? You simply install the Google Authenticator application on your phone, from your official application store, for free.

Tap the button to add a new code and scan the square barcode (also called QR code) on the website you are setting up two factor authentication on. As a result, you’ll be presented with a number consisting of 6 digits that changes every few seconds for security purposes.

When you’re asked to input your verification code into an exchange’s website, you simply open the application on your phone, type the code you see into the exchange website, and finalize the process.

PRO TIP: Typically, when exchanges show you the QR code to scan, you’ll be shown a textual key as well, which represents the code behind the QR image. Make sure to copy that key to a secure location as well, in case your phone gets stolen or broken.

Final suggestion, make sure your phone has a strong code to open itself as well (1234 is not a safe code).

PRO TIP: Never share your keys and passwords with anyone, no matter what.

If you are very security conscious, you can look at more advanced wallet options such as:

- A hardware crypto wallet

- A paper crypto wallett

What other safety precautions should I take?

If you intend to hold coins for a period longer than 1 month, move them out of exchanges into your own wallets.

On February 28, 2014, Mt. Gox filed for bankruptcy. Shortly before that, the online Bitcoin exchange froze user accounts and shut down all services. To their surprise and dismay, hundreds—if not thousands—of users lost access to their Bitcoin.

Your account balance simply represents a digital IOU from the exchange, claiming they have your Bitcoin on hand should you choose to use it.

Online exchanges do this because they need to have liquidity. It’s easiest for them to treat each bitcoin they hold as equal—despite the fact they are owned by different users—so that they can process buys, sells, & transfers internally without having to process those transactions on the block chain.

This works well for an exchange, but makes for lousy long-term storage.

Does the government or banks have my back if things start to take a downturn?

No, but in reality, you’re not really safer with traditional investments. Bank bail-ins, bail-outs… using tax money.

How do I send cryptos to my spouse?

The easiest way is when you both have a mobile wallet application that offers QR barcodes. I highly recommend you avoid typing wallet addresses manually, as they are a cumbersome cobweb of letters and numbers, and it’s easy to make a mistake.

Instead, use QR codes or copy, paste and send the wallet address over email, WhatsApp, Facebook Messenger or whatever other means of messaging is comfortable for you. This is totally safe.

Be patient. If nothing seems to happen or if there’s an error message, try to check out your transaction history to see if it’s not already there, to avoid double transactions.

What does the future look like? Where do I go from here Who do I reach out to if I have any questions?

Learning never ends, and the markets never stop moving. We’ve just scratched the surface of cryptocurrencies and their use. Stick around the CoinCheckup Blog and we’ll make sure to bring you some of the best cryptocurrency market information and data out there.

Acknowledgements

I would like to extend my gratitude to all the people who’ve made this article series possible:

Jeroen Erné

Raluca Andreea Păduraru

Ursula Yvonne Sandner

Andrei Varga

Adrian Gligor

Simona Constantinescu

About the author

Valentin Bora is a serial entrepreneur and software developer, with a background in computer science and psychology.

In 2017, he has co-founded https://coincheckup.com, a research website aimed at bringing clarity in the cryptocurrency world, together with his co-founder, Jeroen Erne.

During 8 years in the web development business together, Valentin and Jeroen have built hundreds of websites, including large scale projects for multi million dollar businesses.

Resources

https://en.wikipedia.org/wiki/Initial_coin_offering

Young, J. (2017). It Only Takes One Judge to Confiscate Gold. [online] The Merkle. Available at: https://themerkle.com/it-only-takes-1-judge-to-confiscate-gold/

Kristina Zucchi, C. (2017). Top 10 Largest Global IPOs Of All Time. [online] Investopedia. Available at: http://www.investopedia.com/articles/investing/011215/top-10-largest-global-ipos-all-time.asp

John Meese. (2017). Why You Should Never Store Bitcoin In An Online Exchange – John Meese. [online] Available at: http://johnmeese.com/you-never-own-bitcoin/