Staying true to its dynamic and evolving nature, the crypto sector has recently witnessed the rapid rise of a new technology: AI Web3 agents. Best described as intelligent, self-operating software systems, they are capable of reshaping how people interact with decentralized technologies.

For starters, they can execute complex financial strategies with unprecedented precision and efficiency, transcending the human limitations of constant market monitoring and decision-making — thus introducing a new foundation for intelligent, round-the-clock financial management.

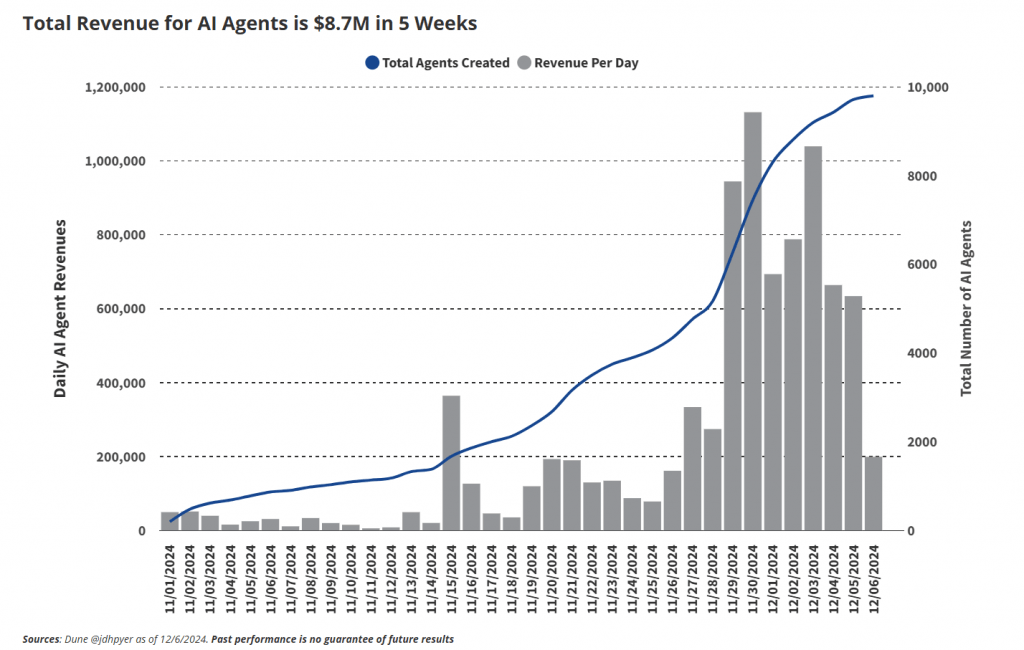

In fact, as of December 2024, these agents have already established a significant foothold within the global blockchain fray, with approx. 10,000 of them have gone live across various networks. Moreover, Industry experts predict an exponential growth trajectory for these offerings, with some reports anticipating over 1 million operational agents by the end of 2025.

These numbers aren’t simply whimsical but rooted in hard facts. For example, several reports suggest that the AI agents market attained a valuation of $5.4 billion last year, a figure that is set to surge to $50.31 billion by 2030. All of this has been fueled by advancements in automation technologies, natural language processing, and cloud computing infrastructures.

Mitigating risks through intelligent automation

While the crypto market is undoubtedly notorious for its high levels of volatility and operational complexities, AI Web3 agents — through their deployment of advanced ML algorithms and real-time data processing capabilities — are able to execute automated stop-loss orders, detecting and responding to market movements faster than any human trader.

Additionally, by continuously monitoring blockchain activities, social media sentiment, and exchange order books, they can identify suspicious patterns that might signal potential market manipulations, protocol exploits, or impending price crashes. Last but not least, these agents are also capable of instantaneously rebalancing asset allocations across multiple blockchains, tokens, and yield-farming opportunities.

They can optimize investment strategies by analyzing real-time performance metrics, volatility indicators, and cross-chain correlations, ensuring that investment portfolios remain resilient and adaptable in the face of rapidly changing market conditions. And, while there are a few platforms trying to meld these seemingly disparate realms under one roof, they have had to often compromise on certain security aspects.

Amidst all of these developments, Giza has emerged as an essential infrastructure provider powering such autonomous financial markets. The platform is designed to unify the fragmented decentralized finance (DeFi) ecosystem while enabling efficient capital flow without continuous human intervention.

Giza’s innovative approach is built on three core technological innovations that set it apart from traditional financial platforms. First is a semantic abstraction layer that transforms complex protocol interactions into standardized operations, allowing agents to reason about and execute financial strategies naturally.

Secondly, there is an advanced agent authorization layer, constructed atop a smart account infrastructure, enabling non-custodial agent operations through granular permission management. This means users maintain complete control of their assets while granting agents specific operational authority through session keys and programmable authorization policies.

The platform’s third critical innovation is a decentralized execution layer, secured through its EigenLayer integration, creating quantifiable consequences for malicious behavior while simultaneously incentivizing correct execution through protocol rewards.

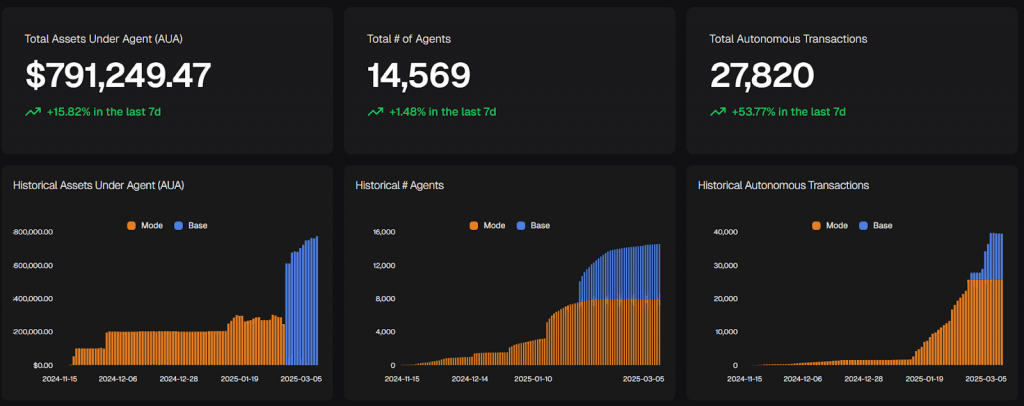

Lastly, it bears mentioning that Giza’s flagship product, ARMA — touted as Web3’s first autonomous financial agent — has already showcased the transformative potential of this approach. Operating 24/7 across multiple protocols, ARMA currently manages over $700,000 (achieved in just three weeks), deployed 14,500+ financial agents, and executed 27,000+ autonomous transactions without any human input.

Moreover, the platform’s strategic partnerships with leading blockchain ecosystems like Base, EigenLayer, Starknet, AAVE, and Morpho have further validated its technological prowess and market potential.

Exploring the future of AI Web3 agents

Market predictions suggest that tokens associated with AI agents could reach a total market capitalization of $60 billion by the end of this year. Therefore, as this convergence of AI, DeFi, and the blockchain continues to occur, it will be interesting to see how the future pans out.

For now, the coming few years promise an ecosystem where financial management becomes more accessible, efficient, and intelligent for everyone. In this context, AI Web3 agents stand at the forefront of this revolution, offering a glimpse into a world where autonomous systems work tirelessly to optimize investors’ financial strategies and mitigate risks. Interesting times ahead!