Nvidia (NVDA) is a global leader in designing and developing graphics and computational technologies. With an estimated market capitalization exceeding $3.01 trillion, the company operates through two primary business segments: Graphics and Compute & Networking. Through these segments, the company offers graphic solutions to various industries, including gaming, artificial intelligence, data centers, and automotive.

Nvidia owns several innovative technologies that are regularly used by both businesses and everyday consumers. Among them are GeForce GPUs, CUDA parallel computing, and TensorRT for deep learning. By consistently delivering outstanding performance, innovation, and stability, Nvidia has experienced steady growth, creating value for both customers and shareholders.

In the following sections of this article, we will explore Nvidia’s stock price forecast for 2040 and 2050, as well as factors that could potentially influence the stock’s future growth.

Key Takeaways:

- We will explore 3 separate forecast scenarios for Nvidia’s potential price, each with a different annual growth rate: 5% yearly growth, historical S&P 500 ROI (11.1%), and historical Nasdaq-100 ROI (15.2%).

- Based on these scenarios, the stock price forecasts for 2040 range from $273 to $1,203

- Applying the same growth rates, the forecast for 2050 ranges from $444 to $4,951

Here is an overview of Nvidia’s stock price predictions under various growth scenarios.

| 2025 | 2030 | 2040 | 2050 | |

| Nvidia Stock Forecast (5% yearly growth) | $131 | $168 | $273 | $444 |

| Nvidia Stock Forecast (S&P 500 historical 11.13% ROI)* | $139 | $235 | $676 | $1,943 |

| Nvidia Stock Forecast (QTEC historical 15.2% ROI)** | $144 | $292 | $1,203 | $4,951 |

Based on NVDA stock price of $125.

*The S&P 500 Index has increased at a compound rate of 11.13% over the past 50 years.

**First Trust NASDAQ-100-Technology Sector Index (QTEC) has increased by 15.2% CAGR since its founding in 2006.

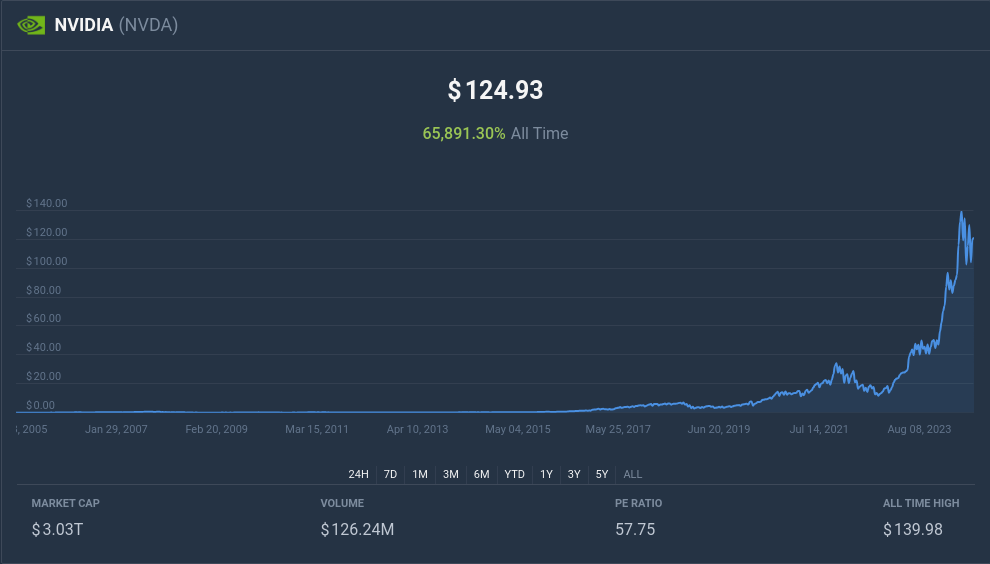

Nvidia stock price history

Nvidia (NVDA) debuted on the Nasdaq exchange on January 22, 1999, with an initial share price of $12. The company has experienced astronomical stock growth since then, undergoing four splits in 2000, 2006, 2007, 2023 and most recently in 2024, when the shares split 10 to 1.

Nvidia’s stock has endured many challenges like the dot-com crash of 2000-2001, which saw shares crash 83% from the peak in March 2000 to the trough in September 2001. More recently, Nvidia experienced a prolonged bull run from 2016 to early 2024, during which its stock surged an impressive 11,800%. The stock began this year on a strong bullish trend, gaining 49% and becoming the third most valuable public company in the world. Currently, NVDA is priced at $125 per share.

Nvidia stock forecast for 2040

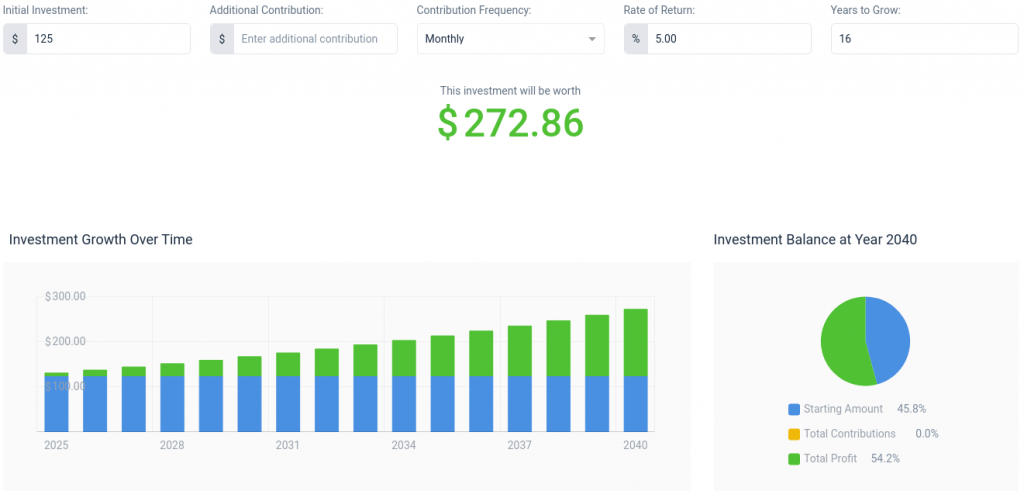

Nvidia’s stock price prediction for 2040 is uncertain and influenced by various factors, including market conditions, competition, and global events. One way to estimate its future value is by examining Nvidia’s historical performance or the overall stock market trends. Additionally, different models and tools, such as CoinCodex’s profit calculator, can help you estimate potential returns based on your initial investment.

Let’s begin with a conservative 5% annual growth rate, reflecting the average growth of the global economy. Using this metric, Nvidia’s stock price could potentially reach around $273 per share by 2040, representing a 218% increase from its current price.

The S&P 500 index has delivered an average annual return of 11.13% over the past 50 years. If Nvidia’s stock were to grow at this same rate, its price could reach $676 per share by 2040.

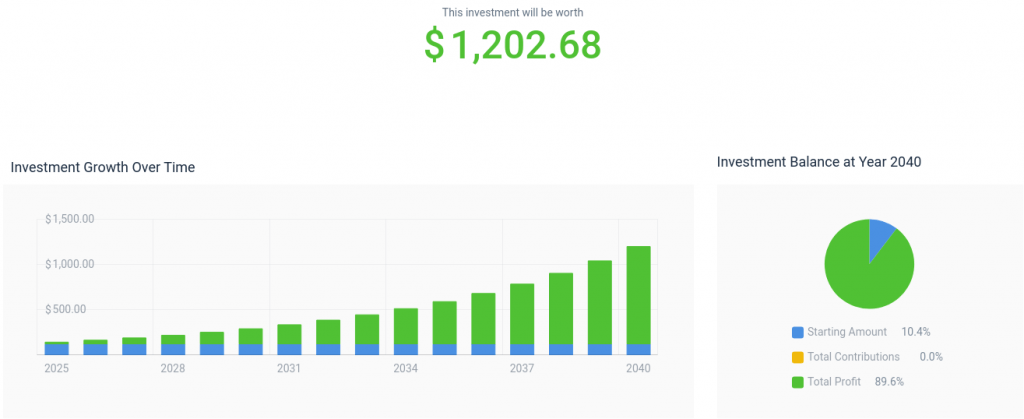

If Nvidia matches the 15.2% average annual return historically achieved by the tech-focused NASDAQ-100 index since 2006, its stock price could reach around $1,203 per share by 2040, representing nearly a 1,000% increase from current levels.

Nvidia stock forecast for 2050

If we maintain our moderate 2040 prediction of 5% annual growth in Nvidia’s revenue and earnings, we can extend this scenario further to estimate the stock price in 2050.

By 2050, Nvidia’s share price could reach an impressive $444 per share if the stock maintains a 5% annual growth rate over the next 26 years. This would represent a substantial increase from its current price.

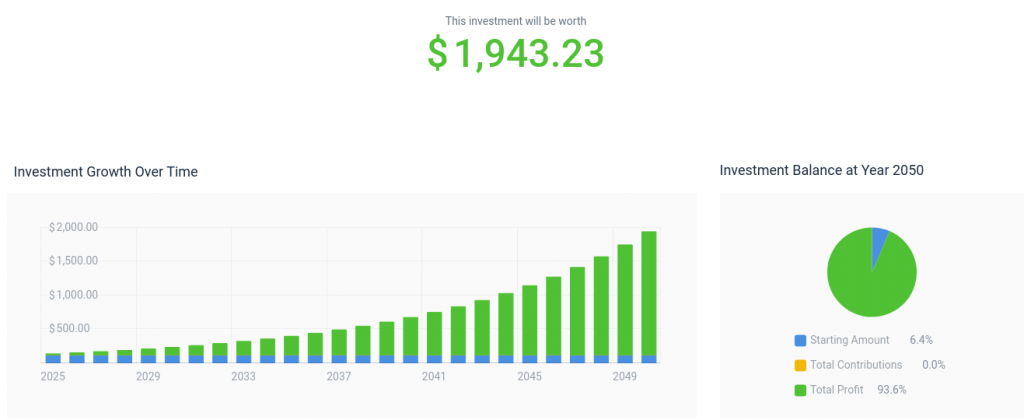

By applying the S&P 500’s 11.13% historical average return on investment to Nvidia, it would result in a potential $1,943 per share by 2050. That would result in a yield of $1818 per share bought at today’s price.

Lastly, if we apply the NASDAQ-100 15.2% average annual return over time to Nvidia’s stock, we could see the price per share potentially reach $4951 by 2050.

Nvidia’s potential catalyst for growth

Nvidia is well-positioned to become a key player in enabling the emerging metaverse and virtual worlds, offering immense profit potential in the coming years. With the continued development of its Omniverse platform, which facilitates 3D simulation and collaboration, Nvidia is tapping into a metaverse market that could generate billions in annual value by 2030. Even capturing a small portion of this market could significantly boost Nvidia’s revenue and profits.

Additionally, Nvidia is rapidly gaining importance in the automotive industry through its Drive platform and partnerships with the likes of Mercedez-Benz, Toyota, and Volvo. By providing useful features such as AI, data processing, infotainment and automation technologies to power next generation vehicles, Nvidia expanded its automotive revenue from $8 billion to $11 billion in a mere year, from 2020 to 2021. Nvidia is well positioned to be the leading company in utilizing the power of AI for transportation as autonomous vehicles become mainstream in the 2020s.

Nvidia’s established role in supplying GPUs and Grace CPUs to data centers signals strong growth as demand rises for AI acceleration, machine learning, and other data-intensive applications. With data center revenue expected to grow at a 30% CAGR through 2025, fueled by rising cloud infrastructure investment, Nvidia is well-positioned to capitalize on AI and big data trends, making it one of the top stocks overall.

Nvidia price prediction for 2025

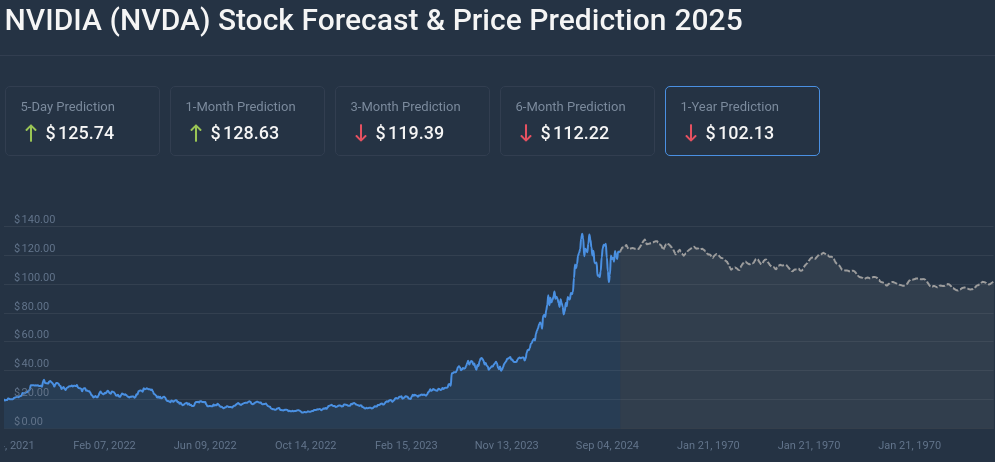

According to CoinCodex’s NVDA stock forecast, Nvidia stock is currently predicted to face a 17% decrease in price a year from now, with the price steadily declining throughout this time. This would mean that the price of Nvidia’s stock would diminish from the current $125 down to roughly $102.

Please note that these predictions are solely based on historical data and current market conditions.

The bottom line

As long as Nvidia manages to maintain its current leading position in AI and graphics, as well as emerging key platforms like the metaverse, while capitalizing on the rapidly growing autonomous vehicle adoption, the company seems perfectly positioned to sustain its revenue growth throughout 2040, 2050 and possibly well beyond that.

If you are interested in the potential growth of the world’s most popular e-commerce platform, check out our Amazon stock forecast for 2040 & 2050.