- Clandeno (CLD) is projected to reach $100 by 2030 due to strong utility, long-term liquidity lock, and significant whale investor interest.

- Optimism (OP) token unlocks potentially cause downward price pressure amidst a market cap of $2.04 billion.

- Solana (SOL) faces uncertain prices due to political uncertainties and market volatility despite its robust technical foundation.

Rapid developments are one phenomenon freely associated with the global cryptocurrency markets, and among the most notable events is the impressive trajectory of Clandeno (CLD), the anticipated liquidation of Optimism (OP) tokens, and the uncertain prices of Solana (SOL). As the cryptocurrency markets shift, crypto investors are keenly observing these movements on-chain to make rapid informed decisions.

Optimism (OP) Braces for Dump Post-Significant Liquidation

Optimism (OP), an Ethereum Layer 2 scaling solution, is facing a critical period after its OP token unlocks set for June 30. Boasting a market cap of $1.87 billion, Optimism released about 31.34 million OP tokens, equating to 2.88% of its circulating supply, valued at approximately $56.73 million.

This significant increase in supply is expected to cause downward pressure on prices. Data from the Token Unlocks App indicates that 26% of the locked amount has already been unlocked, equivalent to 1.13 billion OP.

As of today, the OP price showed a 0.55% jump in value, trading at $1.67. However, the market anticipates a bearish turn due to the influx of new tokens. Investors are closely monitoring the potential impacts on Optimism’s tokenomics and preparing for possible liquidations. The anticipated release of nearly $118 million worth of coins into the market could significantly influence OP prices and market sentiment.

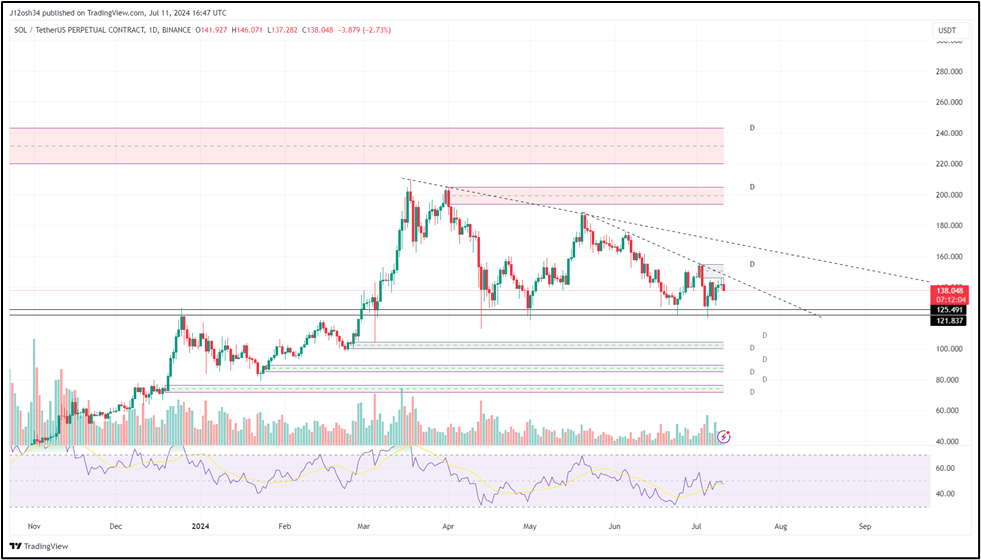

Solana (SOL) Prices Remain Uncertain Amid Market Volatility

Solana (SOL), known for its high throughput and low transaction costs, has been a favorite among investors looking for scalable blockchain solutions. However, it is not immune to the broader market pressures exacerbated by political uncertainty.

Image Source: Solana (SOL) 1-Day Chart | Tradingview

Solana (SOL) has found support at the $125 level but has struggled to break above the $156 resistance zone, and has been rejected by a slant resistance, much less achieving the four-digit prices some had predicted. While the Relative Strength Index (RSI) is at 48 having been resisted by the 50 level Solana (SOL) price begins to plummet back to its established $125 Solana (SOL) price support level.

Crypto Investors are however wary of the potential for increased Crypto supply and the implications of the Mt. Gox Bitcoin redistribution. These factors contribute significantly to the overall uncertainty in the market affecting not just Solana (SOL) but the entire crypto space.

Clandeno (CLD) Set for Remarkable Growth

Clandeno (CLD) is emerging as a promising player in the decentralized e-commerce platform space, aiming to revolutionize how products are bought and sold using various cryptocurrencies. With a robust utility-driven model, Clandeno (CLD) is not just another speculative Crypto asset as some might presume but a token with real-world applications that provide a solid foundation for its value.

The recent Initial Coin Offering (ICO) of Clandeno (CLD) has caught the attention of whale investors, largely due to Artificial Intelligence (AI) predictions of a staggering 1000X surge in just weeks. This optimistic forecast has fueled excitement and significant investment in the token. The strong interest from investors is bolstered by Clandeno’s (CLD) commitment to locking liquidity for 20 years, ensuring stability and long-term growth. As the token’s presale progresses, market analysts are optimistic about Clandeno (CLD) reaching the ambitious target of $100 by 2030.

To find out more about the Clandeno presale, visit their website here.

Disclaimer: The views and opinions presented in this article do not necessarily reflect the views of CoinCheckup. The content of this article should not be considered as investment advice. Always do your own research before deciding to buy, sell or transfer any crypto assets. Past returns do not always guarantee future profits.