There are several ways to identify and purchase new cryptocurrencies before they are listed on exchanges. These methods include participating in token presales, initial exchange offerings, crypto airdrops, or engaging in Launchpool and Launchpad campaigns on Binance and other crypto exchanges.

Being early in the crypto market is crucial for achieving the kind of returns that have attracted speculators to cryptocurrencies. Once a cryptocurrency is listed on major exchanges, it is often too late to reap the substantial gains that early investors seek.

In this guide, we will explore how to buy new crypto before listing and highlight tools to find new crypto projects with potential.

How to find and buy new crypto before listing?

To buy new crypto before listing, you have two primary options: use DEXes (decentralized exchanges) to purchase tokens from projects not yet listed on major centralized exchanges or participate in crypto presales for projects that have not launched their tokens.

Before proceeding, it is essential to understand that investing in new crypto projects is highly risky, and the likelihood of losing money is greater than making a profit. Conduct thorough research before making any investment decisions, and never invest more than you are willing to lose.

1. Find new tokens on the blockchain

To discover where to find new crypto projects before listing, start by identifying new cryptocurrencies and purchasing them via decentralized exchanges. Ethereum is hands down the most active platform for new blockchain projects, making it a good starting point. There are several tools that can help in your endeavors, including:

- Block explorers: Learning to use block explorers is crucial for on-chain activities. Block explorers track all blocks and transactions for a particular blockchain, offering a complete overview. For Ethereum, familiarize yourself with Etherscan to gain an edge in the market.

- DEX data aggregators: DEX data aggregators are valuable for finding promising new cryptocurrencies. DEXTools, for example, helps identify the most traded cryptocurrencies on decentralized exchanges and the biggest gainers, providing insights into potential projects worth exploring.

- DeFi portfolio trackers: Tracking successful investors and their investments can lead you to promising new crypto projects. DeFi portfolio trackers like DeBank offer a more digestible presentation of blockchain data and support multiple blockchain platforms.

- Blockchain analytics platforms: Analyzing blockchain activity from a broader perspective is possible with platforms like Dune Analytics. Users can write custom queries and create dashboards to visualize blockchain-sourced data, making it easier to identify promising projects.

2. Participate in crypto presales

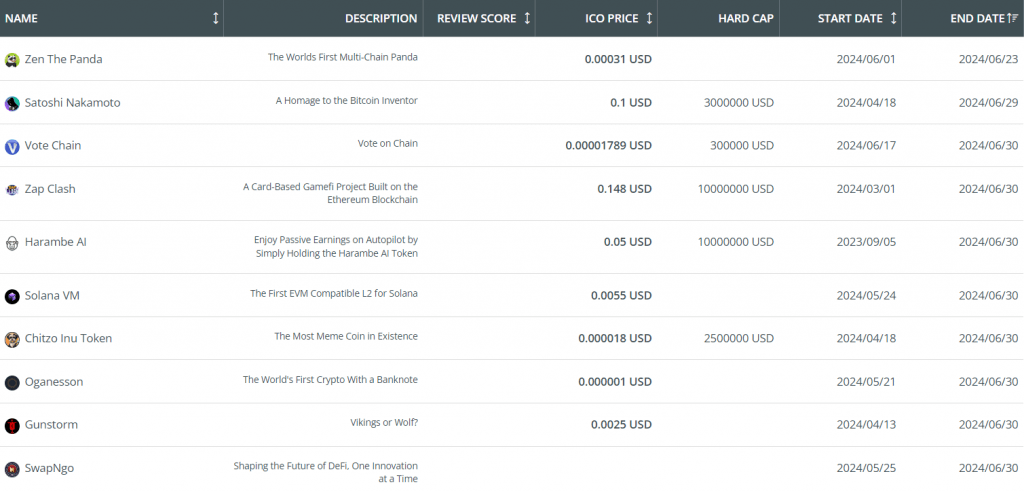

Another method to find new crypto to invest in is through token presales. Presales offer tokens for sale before their official launch and can be public or private. CoinCheckup provides an up-to-date token sale list and curates a list of the best ICOs to invest in, sorted by various settings and sale types.

High-quality projects often conduct public token sales, though thorough research is essential to mitigate risks. Platforms like CoinList offer token sales for reputable projects, although they may have more restrictive requirements, including KYC processes.

3. Participate in Launchpads and Launchpools

Before listing a token, exchanges might allow users to earn or buy the token through Launchpad or Launchpool campaigns. Binance pioneered this practice, which other exchanges – like Bybit, KuCoin, MEXC, Gate.io, and others – now adopt.

- Launchpad: A Launchpad is a token sale platform hosted by a crypto exchange. Users typically need to hold a certain amount of the exchange’s native token to participate. Tokens are bought at a predetermined price before listing on the exchange.

- Launchpool: A Launchpool allows users to earn new tokens by staking coins. The featured token is usually listed shortly after the staking program concludes.

4. Stay on top of crypto airdrops

Participating in airdrops is another way to obtain new cryptocurrencies before they list on exchanges. Airdrops distribute free tokens for promotional purposes or fair distribution. Crypto airdrop listing sites aggregate upcoming airdrops and provide eligibility instructions. Additionally, interacting with DeFi protocols without tokens yet might qualify you for retroactive airdrops if they launch a token later.

5. Following news and communities

Staying updated with relevant news sites and crypto communities can help you find new crypto projects early. Following forums and social media platforms provides valuable information for those willing to invest the time. Keeping a broad range of channels and groups can lead to discovering promising cryptos before their launch.

Conclusion

Finding new crypto projects to invest in is feasible with platforms like CoinCheckup, which offers a comprehensive token sale calendar. Tools such as Etherscan and DEXTools can help identify new crypto projects before they are listed on major exchanges.

For additional tips on cryptos that hold significant promise based on their recent trading activity, check the list of 8 meme coins that could be the next Shiba Inu.

If you are seeking general advice about cryptocurrency investment, we recommend you to check out our weekly-updated list of the best cryptos to buy. It features a healthy mix of up and coming projects and established digital assets.