Solana gas fee – that is, the cost for each transaction – amounts to about $0.02275 (0.00015 SOL). This amount includes the base fee as well as the so-called prioritization fee.

Solana has emerged as a standout in the cryptocurrency market, particularly noted for its low gas fees. Unlike Ethereum, where gas fees can fluctuate dramatically, Solana’s transaction costs are remarkably stable and affordable, typically costing just a couple of cents per transaction. This affordability is partly due to Solana’s innovative Proof-of-History (PoH) consensus mechanism, which enhances efficiency and scalability.

In this article, we are going to examine how Solana gas fees work and what’s average price of transaction on the Solana network.

How much is the average Solana gas fee?

The average Solana gas fee costs between $0.003 and $0.030. The exact cost is influenced by network activity, which directly depends on how many transactions are being handled at the same time.

It’s worth noting that there are two types of Solana transaction fees a user has to be aware of. Here’s a brief description of each:

- Base fee: A fixed cost of making transactions on the Solana network. This fee amounts to just 0.000005 SOL (about $0.001 at current rates).

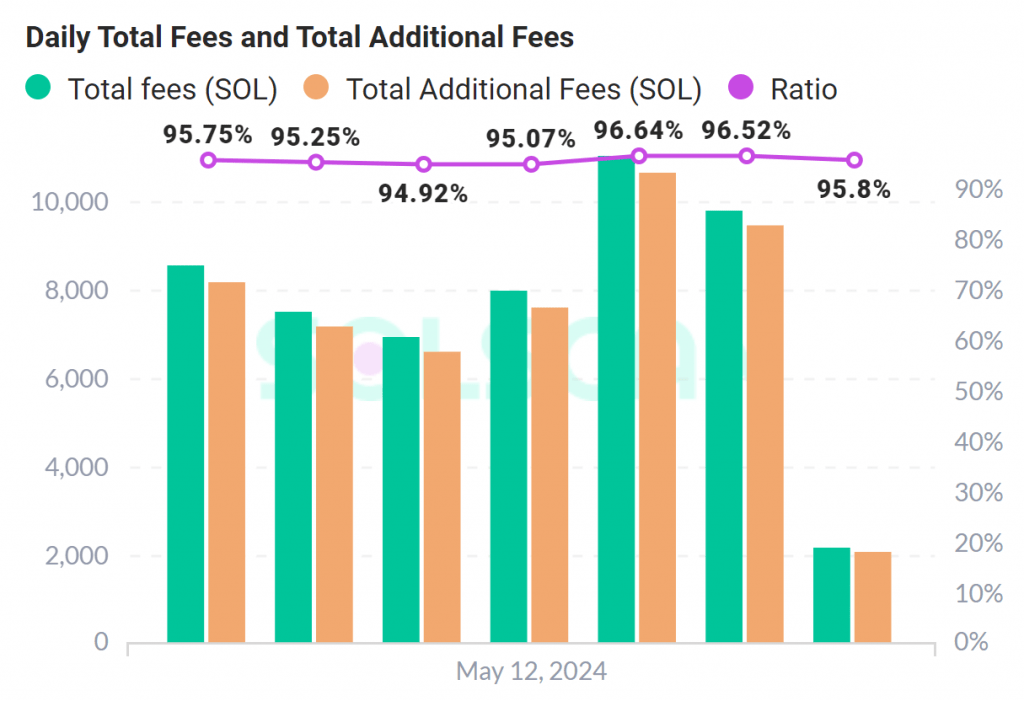

- Additional (prioritization) fee: Users can opt to pay an additional fee to prioritize their transactions. This feature ensures that time-sensitive transactions are processed swiftly. Currently, the additional fee amounts to 0.000145 SOL, or $0.02175 (about 96% of the average transaction cost on the Solana network).

It’s worth noting that there’s also a vote fee, which is paid daily by validators. This fee grants validators the right to participate in Solana’s consensus system and is the same no matter the SOL stake. As of May 15, the vote fee on Solana costs

Solana’s fee-burning mechanism

Solana’s fee-burning mechanism is an integral part of its economic model, contributing to both network sustainability and the long-term value proposition of SOL.

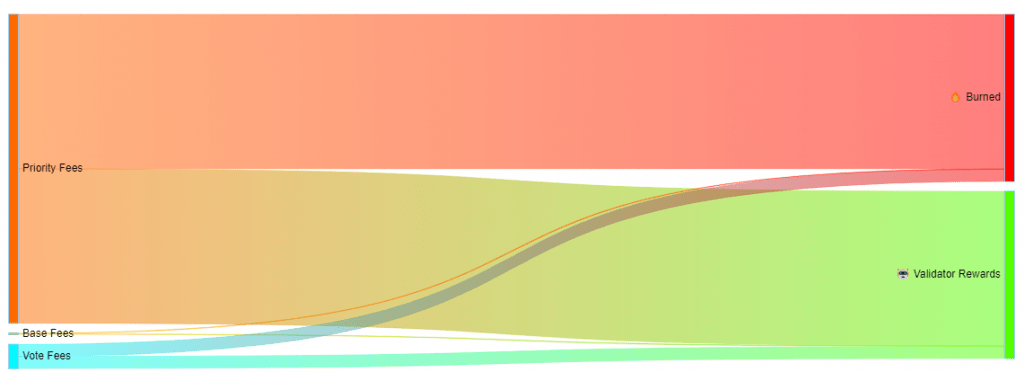

Half of all transaction fees collected on the network are burned, meaning they are permanently removed from circulation. This deflationary mechanism reduces the total supply of SOL over time.

The remaining 50% of the transaction fees are distributed to validators. This not only incentivizes validators to maintain the network but also ensures that the network remains secure and operational. The distribution of fees to validators ensures that they are compensated for their work, maintaining a high level of security and efficiency on the network.

By reducing the supply of SOL, the burning mechanism helps to preserve and potentially increase the value of the remaining tokens. This is beneficial for all SOL holders as it creates a deflationary pressure on the token.

Benefits of Solana’s low fees

The low cost of transactions makes Solana accessible to a broader audience, fostering wider adoption. In addition, affordable fees encourage more developers to build on Solana, enhancing its ecosystem with diverse applications and services. Finally, the fee-burning mechanism contributes to the long-term value proposition of SOL by potentially reducing its supply over time.

These benefits have certainly played an important role in making Solana one of the most active blockchain ecosystems in the crypto space. They have also played a very important role in reviving the SOL ecosystem after its massive collapse in 2022. After crashing by more than 90% due to its affiliation with the disgraced FTX exchange, SOL quickly regained its footing and now sits as the 5th largest crypto asset on the market.

The bottom line

Solana’s low gas fees, combined with its robust infrastructure, make it a formidable competitor in the blockchain space. Its economic model not only ensures affordability but also incentivizes network participation and sustainability. As the cryptocurrency landscape evolves, Solana’s cost-effective and efficient transaction mechanism positions it as a leading choice for developers and users seeking a reliable and scalable blockchain solution.

Solana’s low gas fees have also contributed to the rise of meme coin projects on the blockchain in recent months. Projects like Dogwifhat, Mew, and Bonk are just a few examples of meme coins issued on Solana that have skyrocketed in value recently. Check our article for a complete overview of meme coins that could be the next Shiba Inu.