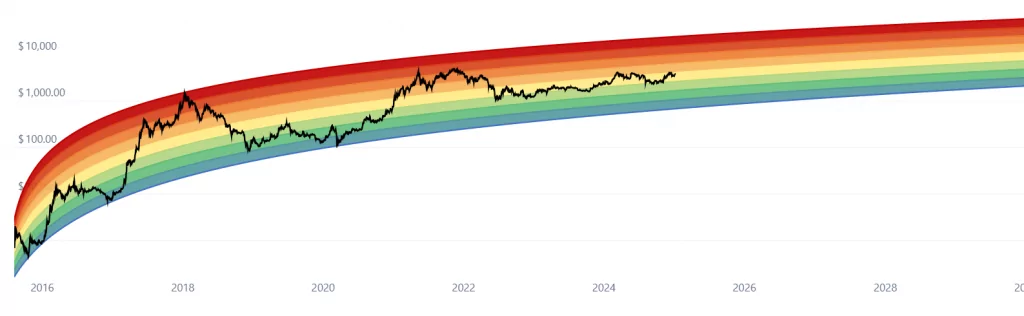

The Ethereum Rainbow Chart is a graphical representation of ETH price movements over time. Generally speaking, it displays the likelihood of Ethereum trading in a specific price range based on the currency’s historical price activity.

With the Ethereum Rainbow Chart, you can determine whether the price of ETH is overvalued or undervalued at any given time. This allows you to make informed investment decisions, compare the performance of ETH between different time periods, and gain insights into ETH price movements.

In this article, we will explore what the Ethereum Rainbow Chart is, how it works, and how it can be utilized to make informed investment decisions.

What is the Ethereum Rainbow Chart?

The Ethereum Rainbow Chart is a visual representation of historical price trends for Ethereum. It utilizes a color-coded spectrum to categorize price ranges based on logarithmic percentage growth. The chart provides a comprehensive view of Ethereum’s price movements over time and allows users to identify potential buying or selling opportunities.

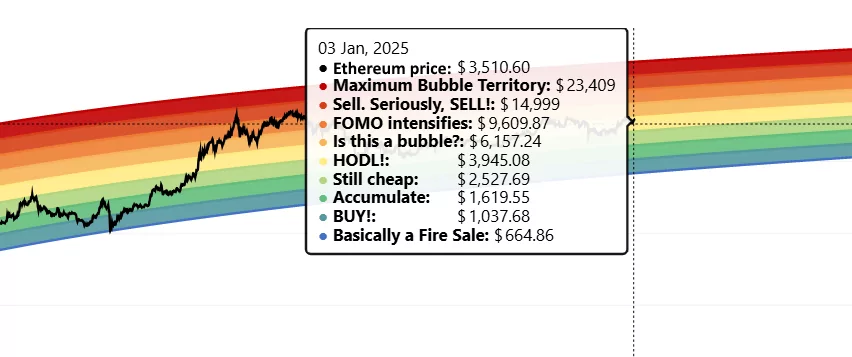

There are nine color bands on the Ethereum Rainbow Chart, with each one representing price resistance and support levels based on historical price activity. Hot colors (shades of red and orange) indicate that ETH is overbought, yellow represents a neutral price band, and cold colors (green and blue) indicate that ETH is undervalued.

- Dark red: The ETH price is extremely high, signaling an imminent price crash

- Red: ETH is highly overbought, investors should seriously consider taking some profits

- Dark orange: Buyers have the clear advantage in the market

- Light orange: The market is balanced

- Yellow: The best course of action is to hold

- Light green: Ethereum is likely slightly undervalued

- Green: Investors should consider accumulating more ETH

- Light blue: A great opportunity to add more ETH to your portfolio

- Blue: ETH is highly undervalued

How does the Ethereum Rainbow Chart work?

The Ethereum Rainbow Chart is created by plotting Ethereum’s price on a logarithmic scale and assigning different colors to specific price ranges. It uses the concept known as logarithmic regression, which assumes that the price of Ethereum will experience ever-bigger moves in absolute terms, but ever-smaller in relative terms.

It is worth noting that the Rainbow Chart relies on historical price data exclusively and doesn’t take into account news or other developments that might have an impact on ETH’s price. In this sense, the Ethereum Rainbow Chart is designed to analyze ETH price movements in a vacuum.

How to use the Ethereum Rainbow Chart?

Interpreting the Ethereum Rainbow Chart involves analyzing the position of the current price within the color-coded spectrum. If the price is located in the hot color bands, you could consider selling ETH, as it is likely overbought, and the price could fall in the near future. On the other hand, if ETH is changing hands in oversold zones, you could consider buying ETH or holding onto your existing coins to sell them at a higher price down the line.

The Rainbow Chart shouldn’t be your only source of information when making investment decisions. Instead, you should rely on a combination of different tools, keep up to date with the latest news and market trends, and use the chart only as a complementary investment tool.

One of the best ways to complement insights gained by the Rainbow Chart is to use our Ethereum price prediction algorithm, which takes into account market cycles and technical indicators to produce ETH price forecasts informed by market trends and investors’ sentiment.

Pros and cons of using the Ethereum Rainbow Chart

There are several advantages and disadvantages when it comes to the Ethereum Rainbow Chart. Here are the benefits and limitations of the Ethereum Rainbow Chart:

The pros of the ETH Rainbow Chart:

- Offers a visually appealing way to analyze price trends

- A long-term perspective on the cryptocurrency’s performance

- Identify potential entry and exit points for ETH trades, optimizing buying and selling decisions

The cons of the ETH Rainbow Chart:

- Past price trends may not accurately predict future performance

- Understanding the chart is open to subjective interpretation

- The chart may not capture sudden price movements caused by market volatility or external factors

The bottom line: The Rainbow Chart allows you to analyze ETH price moves easily, but don’t rely on it exclusively

The Ethereum Rainbow Chart serves as a valuable tool for investors and traders seeking to understand and analyze the price trends of Ethereum. By providing a visual representation of historical price movements, it offers insights into potential buying and selling opportunities.

However, it is important to remember that the chart should not be solely relied upon for investment decisions. It is advisable to combine its analysis with other fundamental and technical indicators and maintain a comprehensive understanding of the cryptocurrency market.

If you are in search of additional investment ideas, check our weekly-updated list of best cryptocurrencies to buy based on current events and market trends.