Key takeaways:

- Institutional investments dropped by 95% from their ATH in 2021, according to the latest CoinShares report

- Investors withdrew money from Ethereum products over concerns about the network’s transition to Proof-of-Stake

- CoinShares concluded that despite the drop, it is encouraging that investors are still choosing to invest in crypto, despite the hawkish FED and broader economic issues

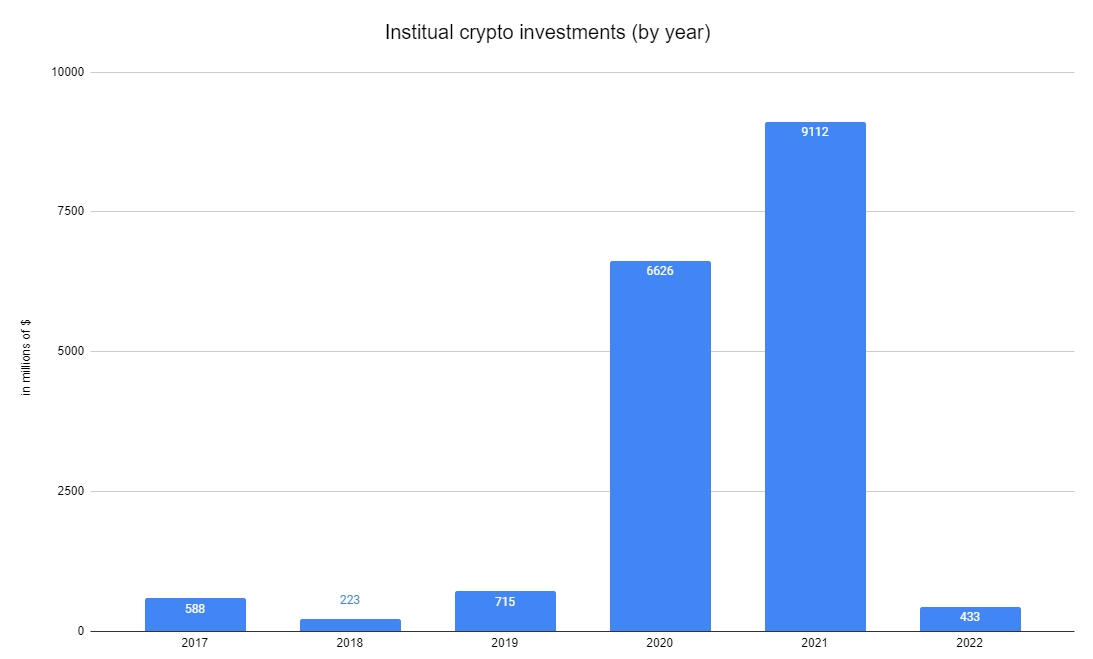

Institutional crypto flows in 2022 fell to the lowest levels since 2018

The price of Bitcoin and virtually all digital assets plunged by high double digits last year, leading to the total crypto market cap dropping to $800 billion, down from the $3 trillion high in 2021.

The latest report from CoinShares, Europe’s largest digital asset investment and trading group, showed that the drop in market prices was reflected in investors’ sentiment as well. Whereas institutional crypto inflows reached their all-time high of more than $9.1 billion in 2021, the investments dried up in 2022, falling to just $433 million. That’s a massive 95% drop in a single year.

The $433 million figure is the lowest amount that investors have spent on crypto projects since 2018, when there was only $233 million invested during the course of the year.

ProShares, the company behind the Bitcoin Strategy ETF (BITO), accounted for the biggest shares of total inflows in 2022, with $320 million. On the other hand of the spectrum, investors withdrew $529 million from 3iQ’s crypto investment products, which include Bitcoin and Ethereum offerings.

While Bitcoin net investments amounted to $288 million, Ethereum investments saw net outflows of $402 million. The main reason for ETH outflows was investors’ concerns about the transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS) consensus algorithm, according to CoinShares.

Despite the big year-over-year decline in investments, CoinShares noted that it is “encouraging” to see investors choosing to invest, “In a year where bitcoin prices fell by 63%, a clear bear market precipitated by irrational exuberance and an overly hawkish FED.”