Last week marked the end of the brief bullish period, as nearly all cryptocurrencies faced a hefty price readjustment. With leaders like BTC and ETH down by more than 11% and 16% in the past 7 days respectively, most altcoins followed the same trend with even higher weekly losses. Consequently, the total cryptocurrency market capitalization slipped from $1.21 trillion back to $1.06 trillion, which is roughly the same as the total market valuation from four weeks ago.

3. Aave (AAVE)

Aave is an Ethereum-based decentralized lending and borrowing platform that started out under the name “ETHLend”, a project launched by Stani Kulechov in 2017. Aave supports almost 20 different tokens and has unique and sophisticated features such as flash loans that make it stand out from its competitors. While Aave initially launched on Ethereum, the protocol has expanded to the Fantom, Avalanche, Polygon, Optimism, Arbitrum, and Harmony networks over the last couple of years and is now available on 7 chains. AAVE token is the protocol’s native token, which grants holders governance rights as well as discounts when interacting with Aave protocol. While the protocol is completely open source, its code is regularly audited by third parties and has been repeatedly deemed secure. With the launch of its third iteration – “Aave v3” – the protocol established itself as the third largest DeFi protocol in terms of TVL. According to DeFi Llama, there are currently more than $6.45 billion locked in the Aave protocol.

Aave token holders asked to commit to Ethereum’s Proof-of-Stake consensus chain after the Merge

In light with Ethereum’s imminent transition to proof-of-stake (PoS) the Aave (AAVE) tokenholders have been asked to participate in an Aave Request for Comment (ARC) on August 18. The ARC in question calls for Aave users to ”commit” to Ethereum Mainnet running under the proof-of-stake consensus over any Ethereum fork running an alternative consensus as their primary network. Furthermore, after the Merge, the Aave DAO running on Ethereum PoS chain should be considered as the “canonical” governance system. A supporting vote will also give the Community Guardian the power to shut down Aave Deployments on any forks arising from the Ethereum Paris Hard Fork that are not the official PoS Mainnet. The DAO’s position will be determined via this governance vote, which will be launched soon. Nevertheless, Aave builders expect a clear and loud support for PoS consensus as they consider it virtually impossible to sustain a viable Aave Market on any Ethereum fork running on alternative (not PoS) consensus. Since Aave’s commitment to PoS would enable the platform’s continued growth, a positive governance vote on that matter could cause AAVE price to increase. At the same time Aave v3 reached its peak amount of borrows and repayments this month since its launch in March 2022, which exceeded $100 million daily for the first time. Nevertheless, Aave v2 still accounts for most of the protocol’s TVL. While it might take time for v3 to reach v2’s TVL, the novel version of Aave protocol is already surpassing the older counterpart in terms of usage.

2. EOS (EOS)

EOS is a blockchain platform that allows users to deploy smart contracts, run decentralized applications (DApps) and issue custom tokens. It launched its mainnet in June of 2018, following a record-breaking initial coin offering (ICO), in which more than $4 billion were raised for the chain’s development. While many other platforms such as Ethereum, TRON, etc., offer the same features, EOS aims to distinguish itself from the competition through its improved scalability and faster transaction speeds. The chain utilizes a delegated proof-of-stake (DPoS) consensus model and boasts with the capacity to perform over 3,000 transactions per second (TPS).

EOS price at two-month high following the announcement of a new incentive program

EOS was one of the rare coins to finish the week in the green. In fact, its 16% price increase in last 7 days was enough for EOS to claim the title of the best performing coin of last week from the top 100 cryptos. Currently EOS is trading at a two-month high price of over $1.50. But what is fueling this uptrend, while all other coins are headed south? Well, for starters, the EOS Network Foundation revealed and opened registrations for its Yield+ incentive program last Sunday, August 14. The program’s aim is to attract decentralized finance (DeFi) applications that generate returns for their users and boost activity and TVL of the EOS ecosystem. Since the announcement of Yield+ there has already been a noticeable increase in demand for EOS tokens, but the real spike is expected on August 28, when rewards to DeFi protocols that have attracted investors and increased EOS’s TVL will be activated.

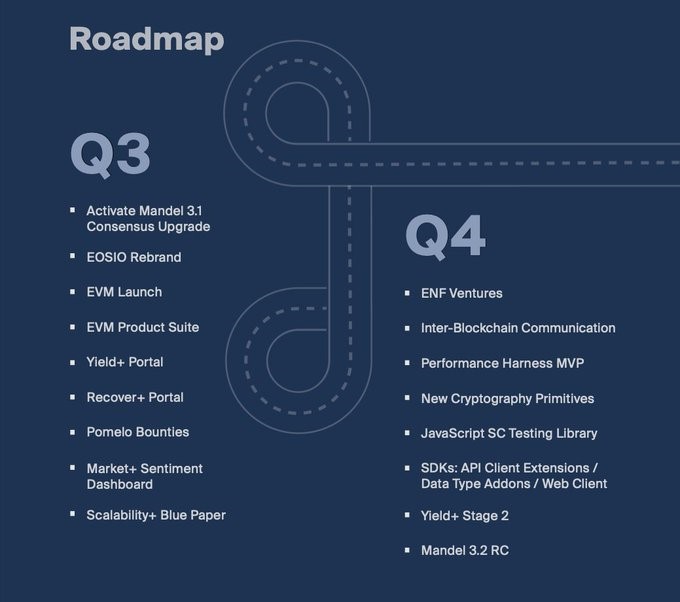

In addition, the EOS network will soon rebrand to EOSIO to further distance itself from Block.One, the company that originally designed the network. In addition, the EOS community is currently preparing for the v3.1 Mandel Consensus upgrade, which is currently scheduled for September 21. The upgrade, which will occur via a hard fork will feature a shift to Antelope as the underlying blockchain framework. Antelope is a community-run open framework for building next-generation Web3 products and services that utilizes DPoS, just as EOS does now. Lastly, given its packed roadmap for Q3 and Q4, EOS seems like a good coin to hold also in the mid to long-term. Among other things, the EOS developers plan to introduce new cryptography primitives and add an inter blockchain communication feature in Q4.

Ethereum (ETH)

Ethereum is an open source blockchain that pioneered smart contract functionality in 2015. The decentralized network operates in a fast, immutable, and trustless manner. Ether (ETH), which is currently the second-largest cryptocurrency by market capitalization, is Ethereum’s native asset. Although it can also be used as a medium for the transfer of value between different Ethereum addresses, it is more commonly used to execute various smart contracts. The Ethereum blockchain has enabled several blockchain-powered innovations, including ICOs, DeFi, NFTs, and DAOs. The Ethereum blockchain also hosts countless ERC20 tokens with different utilities – these include Exchange tokens (OKB, HT, UNI), DeFi tokens (LINK, MKR, COMP, SNX, etc.) and several stablecoins such as USDC, DAI, TUSD, and USDT. Ethereum is currently nearing the end of the process of transition from proof-of-work to a proof-of-stake blockchain. Once Ethereum 2.0 is fully launched, the network will be able to perform more transactions at a higher speed than today. Hopefully, this will also lower the network fees, which are a well-known Achilles’ heel of Ethereum ecosystem.

CME will roll-out Ethereum options trading just days before “The Merge” is set to take place

Leading our Top Coins to Watch list for the third time in the past five weeks is Ethereum – the network’s long anticipated grand finale of the transition from PoW to PoS slated for mid-September has been the biggest story in crypto for the past couple of months. The anticipation for “The Merge” keeps growing, with the price of ETH briefly surpassing $2,000 earlier this month. In addition, Ethereum has hit its 8-month high price in comparison to BTC in mid-August. Several analysts are citing clearer roadmap and a finally determined Merge date (currently estimated to execute on September 15th) as one of the key reasons why ETH is outperforming BTC lately. In addition, the CME Group, one of the largest derivatives providers in the world, recently announced it plans to launch Ethereum options trading. If the new financial product successfully passes the regulatory review, the options trading will commence on September 12, just a few day before The Merge. The ETH options launch comes after CME introduced micro-sized ETH options in March this year and ETH futures in December 2021. Despite all the development around it, Ethereum is currently in a short-term bearish trend as it fell from $2,000 to $1,640 in one week. Technical analysis shows that ETH would have to reclaim $2,000 for the bull run to regain momentum, while it will enter an even deeper bear market if it drops beneath the 50-day SMA line, that currently lies at the price of around $1,500 per coin.