Key takeaways:

- TRON DAO Reserve has withdrawn 2.5 billion TRX from Binance, likely to decrease the access to liquidity available to potential TRX short sellers

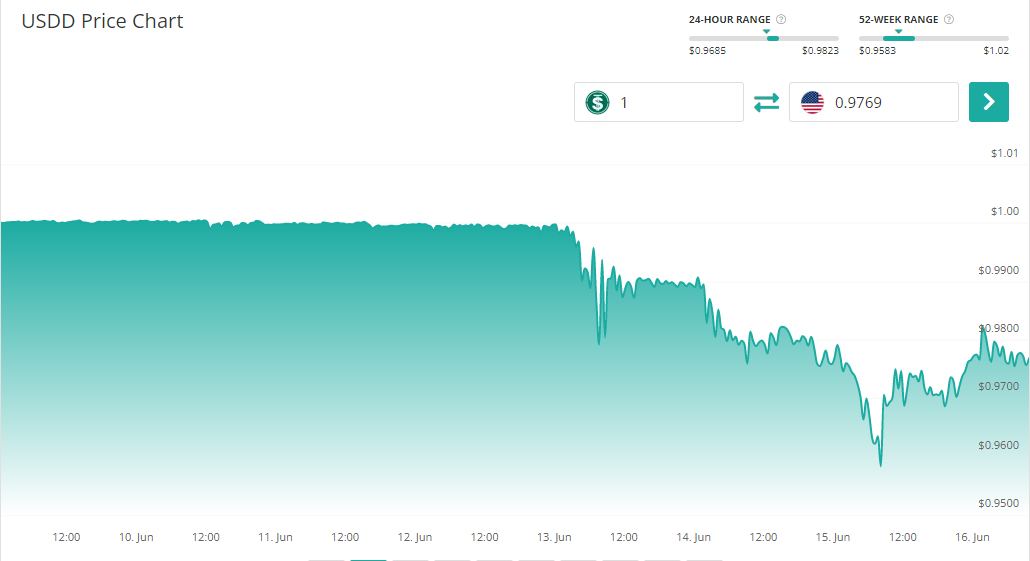

- The move comes at the time when USDD stablecoin is struggling to reestablish its $1 peg

- The DAO has increased the over-collateralization ratio of USDD to more than 300% in the past week

TRON DAO Reserve is making it more difficult for traders to short TRX

TRON DAO Reserve is doing everything in its power to ensure the survival of its USDD stablecoin amid the bearish market conditions. Recall that USDD lost its $1 peg on Monday and slipped further away from its intended value in the subsequent days. At its lowest point on Wednesday, USDD was changing hands at $0.958. The stablecoin has since recovered some of its value and is trading at $0.975 at press time.

To prevent a more considerable de-peg, TRON DAO Reserve announced a series of measures to combat the falling price in the last couple of days. First, it tried to put USDD holders’ minds at ease by injecting 700 million USD Coin (USDC) into the reserve fund. By doing so, it managed to raise the over-collateralization level of USDD from roughly 250% to above 300%.

Now, the TRON organization has announced another move to further “safeguard” the stablecoin project. The DAO will withdraw 2.5 billion TRX from Binance in order to lower the total liquidity available to traders for short-selling the asset.

The USDD algorithmic stablecoin operates similarly to TerraClassicUSD (USDTC), which suffered a monumental collapse last month, during which the value of Luna Classic (LUNC) and USTC fell by more than 99%. In total, roughly $60 billion was lost in the Terra ecosystem’s market collapse.

The USTC depeg was caused by a textbook example of a bank run scenario – as the USTC started losing its value, the selling pressure increased and further decimated the price of the stablecoin. Since $1 worth of USTC was guaranteed to be redeemable for $1 of LUNC, and vice versa, the LUNC token collapsed in unison with the algorithmic stablecoin. In addition to the arbitrage mechanic, there were not enough assets backing USTC to provide enough liquidity and prevent the price from collapsing.

The TRON team helmed by the founder Justin Sun is determined to not let the same scenario unfold with USDD. For this reason, the DAO increased the value of assets backing the 723 million USDD in circulation to roughly $2.2 billion and withdrew nearly $150 million worth of TRX from Binance. At the time of writing, USDC accounts for the largest share of assets backing USDD, with $1 billion. The remaining reserves are split among TRX, Bitcoin, and Tether.