Key takeaways:

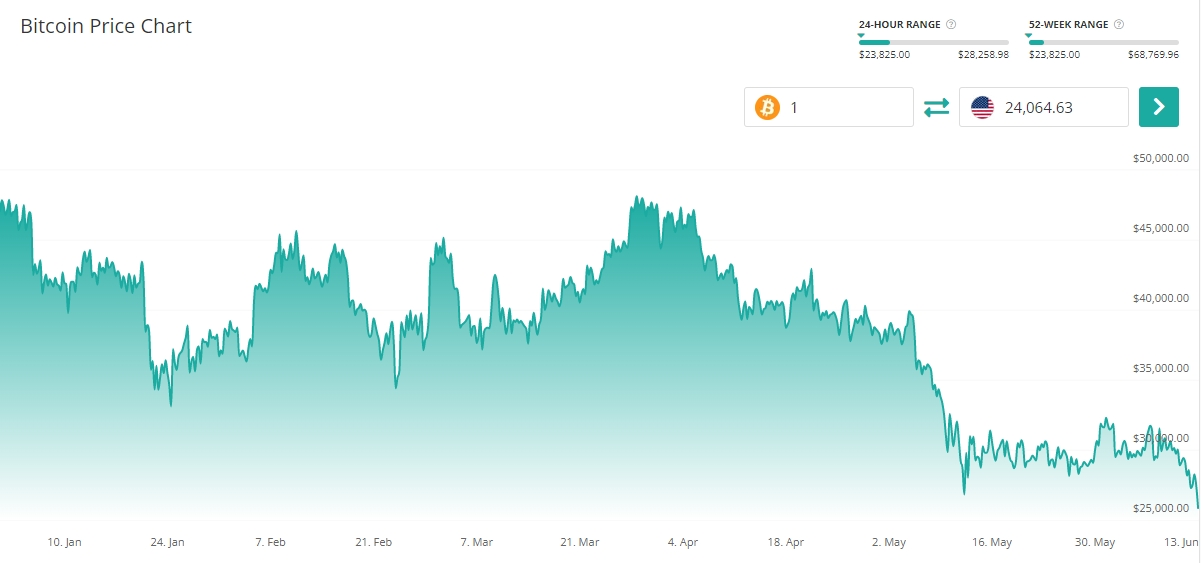

- Bitcoin lost more than 20% in the last 7 days and dropped below the $25,000 price level

- Ethereum and other major altcoins are showing negative double-digit 7-day price changes

- More than $870 million in futures contracts has been liquidated due to the sudden price decrease

A selloff in the crypto markets sees BTC and major altcoins dip by double digits in the past week

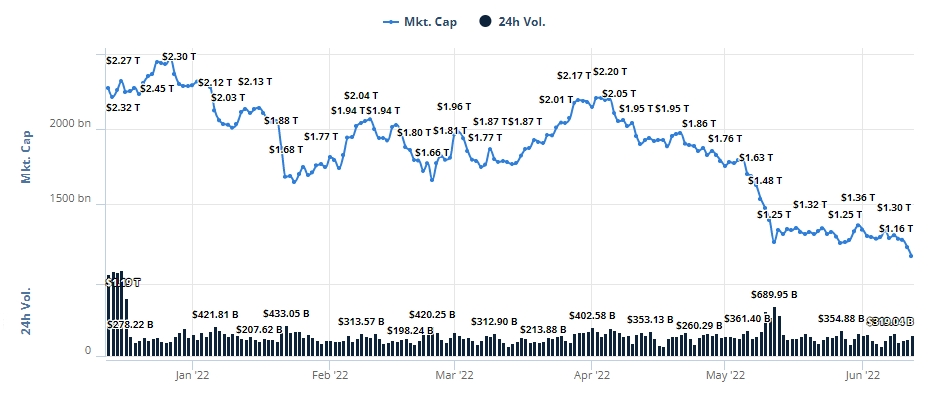

The cryptocurrency market has been in a state of gradual decline over the past couple of months. The interest rate hike designed to reign in the growing inflation and as a result, a generally conservative approach to investing, has led to a considerable drop in the value of virtually all risk-off assets, from tech stocks to digital currencies.

The crypto sector has been especially hard hit by the tightening of the monetary policy and the collapse of the Terra ecosystem last month, which has thoroughly shaken the markets and saw $60 billion evaporate from the market.

Against a backdrop of broader economic uncertainty, Bitcoin has not performed well over the last two months. In fact, over the past weekend, the world’s largest crypto lost roughly 20% of its value and plunged to its lowest price point since December 2020.

Similar to Bitcoin, other cryptocurrencies have been in a state of free fall over the past week. Virtually every top 20 altcoin has lost double digits. Here’s is a quick rundown of 7-day price changes of some of the most popular digital currencies: Ethereum (-35.1%), BNB (-27.3%), XRP (-22.6%), Cardano (-28.2%), Solana (-36.7%), Dogecoin (-33.8%).

Due to significant losses accrued across the spectrum, the total cryptocurrency market cap is currently barely holding on to the $1 trillion valuation. For context, at its all-time high last November, Bitcoin alone boasted a market cap of more than $1.3 trillion.

Due to a sudden drop in the value of the largest cryptocurrencies, more than $870 million worth of futures contracts were liquidated in the last 24 hours. According to data from Coinglass, Bitcoin traders were hit the hardest, having lost more than $360 million over the course of the day. Ethereum traders were not far behind, with over $320 million in cumulative losses accrued due to “shorts” and “longs” liquidations.

With the market sentiment being notably negative and the Fear & Greed index showing extreme fear levels, it is safe to assume that it will take some time before the bulls retake the upper hand. For more information about a potential trend reversal, you can follow live Bitcoin price predictions and price forecasts of other digital assets listed on CoinCheckup in each coin’s respective Predictions tab.