Key takeaways:

- Crypto venture capital firm Andreessen Horowitz has raised $4.5 billion for its new cryptocurrency fund

- A third of the capital will be allocated for seed investments and the remaining two thirds for venture investments

- The fund will invest in Web3, DeFi, NFTs, and cryptocurrency infrastructure

Andreessen Horowitz launches its fourth crypto fund during what it says is the “golden era of Web3”

Leading cryptocurrency investment firm Andreesen Horowitz (a16z) launched its fourth digital assets-oriented fund last week. Dubbed “Crypto Fund 4”, the new investment vehicle will pursue investments across a plethora of crypto and blockchain use cases.

Out of the total of $4.5 billion allocated for the new fund, $1.5 billion will be reserved for seed investments, while the remaining $3 billion for venture investments. With the launch of the new massive venture capital fund, the firm’s total funds raised across the four crypto funds amount to more than $7.6 billion.

According to an official statement, the fund will explore investment opportunities in Web3 games, decentralized finance, decentralized social media, Layer 1 and Layer 2 infrastructure, community governance, non-fungible tokens (NFTs), and more. The company also remarked that we are “entering the golden era of Web3.”

Earlier this year, Andreessen Horowitz raised $9 billion for a trio of venture, growth, and bio funds. Moreover, the company launched a $600 million venture capital fund in May to pursue investment opportunities in the gaming sector and the metaverse.

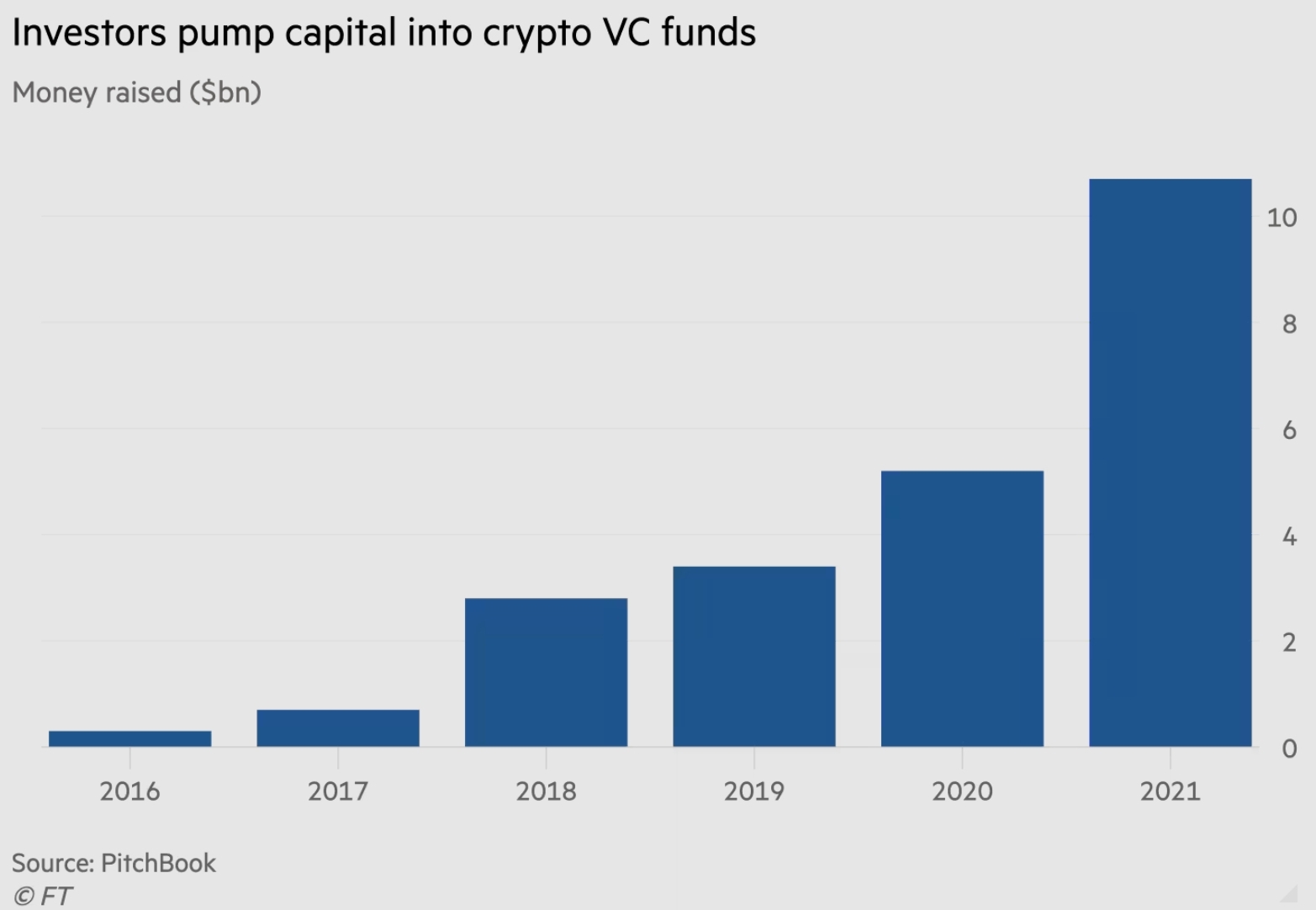

Per a Financial Times report from earlier this year, venture funds are flowing into crypto at an accelerated pace as of late. In 2021, the money that flowed into crypto VC funds–like a16z’s suite of products–more than doubled compared to the year prior.