Key takeaways:

- BTC and ETH dropped below their key respective support levels but have since rebounded

- The crypto market cap currently stands at $2.45T, more than $500B removed from its ATH

- Only 9 out of the top 200 cryptocurrency assets have been trading in the green; REQ leads the charts with over 200% 24-hour gains.

Yesterday’s positive market momentum, which saw Bitcoin (BTC) and Etheruem (ETH) reach their respective weekly highs, has unfortunately turned into a sea of red over the last 24 hours. The total cryptocurrency market capitalization has shrunk by roughly 10%, with numerous coins experiencing double-digit losses.

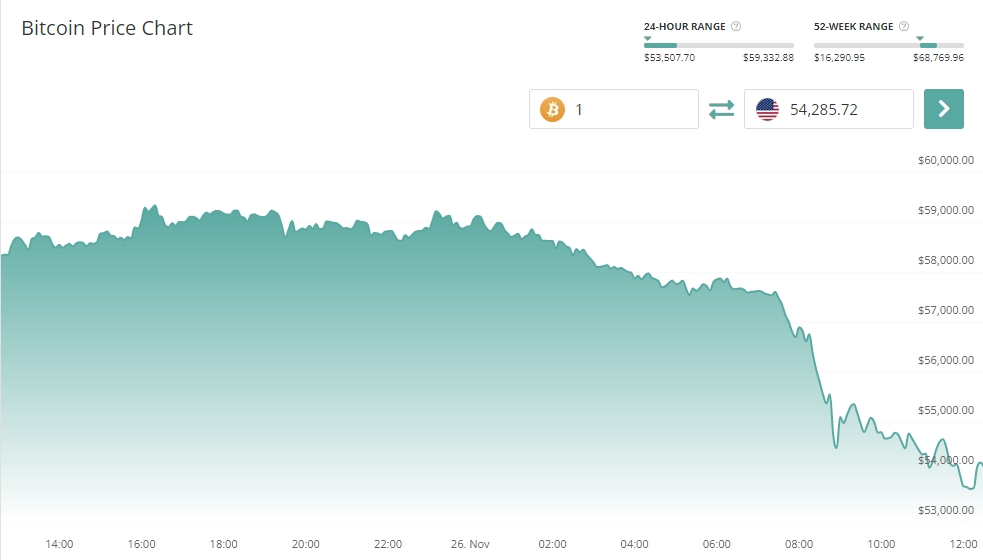

Bitcoin drops below $54,000, Ethereum below $4,000

The market drop was accompanied by severe selling pressure of the two biggest digital currencies. Bitcoin has unsuccessfully tried to reclaim the crucial $60,000 price level over the last ten days. After trading less than $700 removed from the elusive price barrier yesterday, the price of Bitcoin tumbled to a six-week low of $53,687 earlier today.

A swift and unexpected decline in the value of Bitcoin saw more than 180,000 traders lose their long positions, with $186 million worth of BTC ‘longs’ liquidated in the last 24 hours, according to market liquidation data compiled by Coinglass.

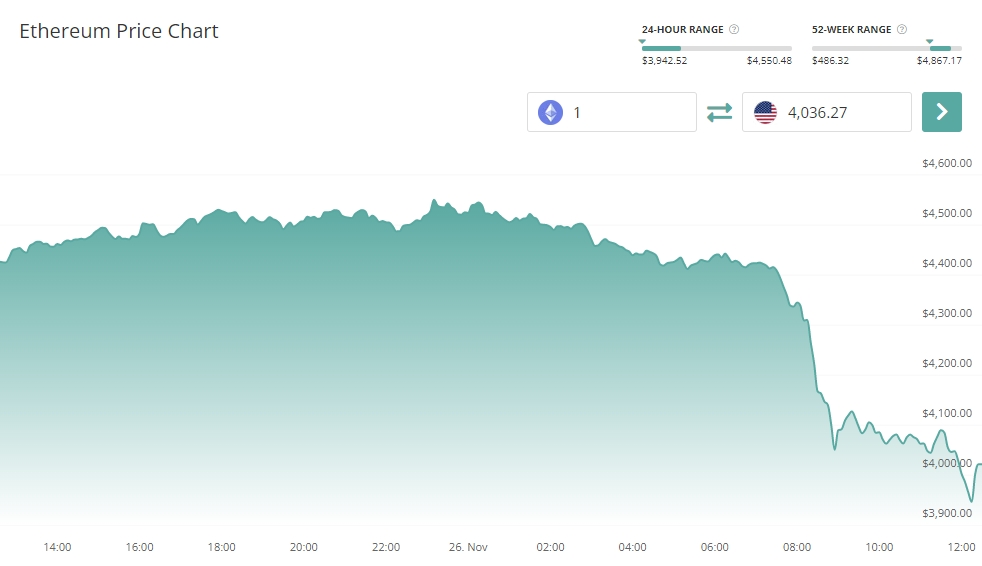

Turmoil in Bitcoin markets reverberated across the crypto sector. Ethereum, which was trading at its peak value just two weeks ago, lost 9% and was trading below the psychological $4,000 level for a brief period earlier today. ETH managed to recover some of its losses at the time of this writing and is currently exchanging hands at $4,051.

While the cumulative value of Bitcoin ‘shorts’ and ‘longs’ usually far surpasses the value of ETH margin positions, the recent market downturn saw a roughly equal amount of BTC and ETH trading positions liquidated. For reference, ETH traders lost $170 million worth of ‘longs’ this time around.

Only 9 out of the top 200 cryptocurrencies are trading in the green as the crypto market cap shrinks to $2.45T

In total, the sudden downturn erased almost 10% of the market’s value across different blockchain projects. Crypto.com Coin (CRO) and Avalanche (AVAX) suffered the most significant losses in the crypto top 100 by market cap, dropping roughly 18% each, while only 9 out of the top 200 crypto assets managed to remain in the green.

With more than 200% gains, Request Network’s (REQ) performance is undoubtedly a highlight of the day. Despite the bearish trend permeating the markets, several other projects managed to achieve high double-digit gains. Hive Token (HIVE) gained 66%, Storj (STORJ) increased by 48%, while Golem (GLM) and Vulcan Forged (PYR) round up the list of five largest gainers with 26% price increases.