Key takeaways:

- China and some developing countries, such as Iran, are using domestically mined Bitcoin to circumvent tariffs and U.S. sanctions.

- Most of the cryptocurrency transactions are converted to USD, meaning that the U.S. experiences considerable USD outflows and has no practical way of preventing this trend.

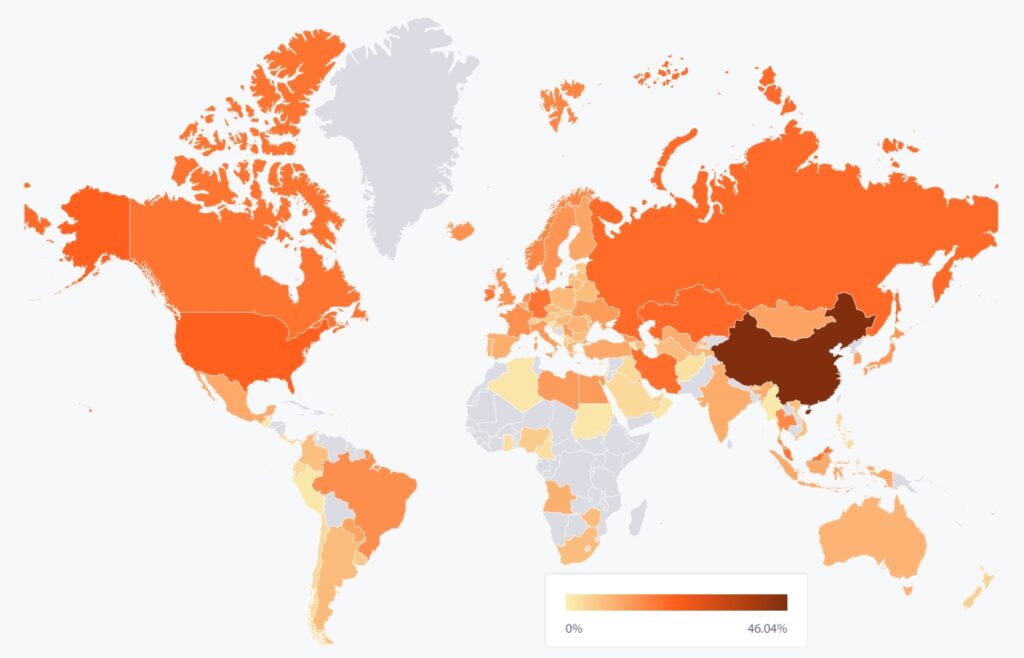

- Chinese Bitcoin mining crackdowns have shaken up the world’s hashrate distribution, but China still controls by far the biggest piece of the pie.

“Trade wars are good, and easy to win,” famously tweeted former U.S. President Donald Trump early in 2018. Fourth year into the trade dispute and many billions lost across each state’s economy as well as up to 245,000 jobs lost on behalf of the U.S. in the meantime, the trade war with China doesn’t seem like such a good idea anymore.

China has played the whole situation out to perfection each step of the way and greatly benefited from the whole mess. The country circumvented the sanctions and high tariffs by exporting products through its neighboring Asian countries and other allied intermediary countries around the world. Not only that, the Beijing government has found a way to siphon money from the U.S. via the cryptocurrency industry as well.

Bitcoin mining is a very lucrative business

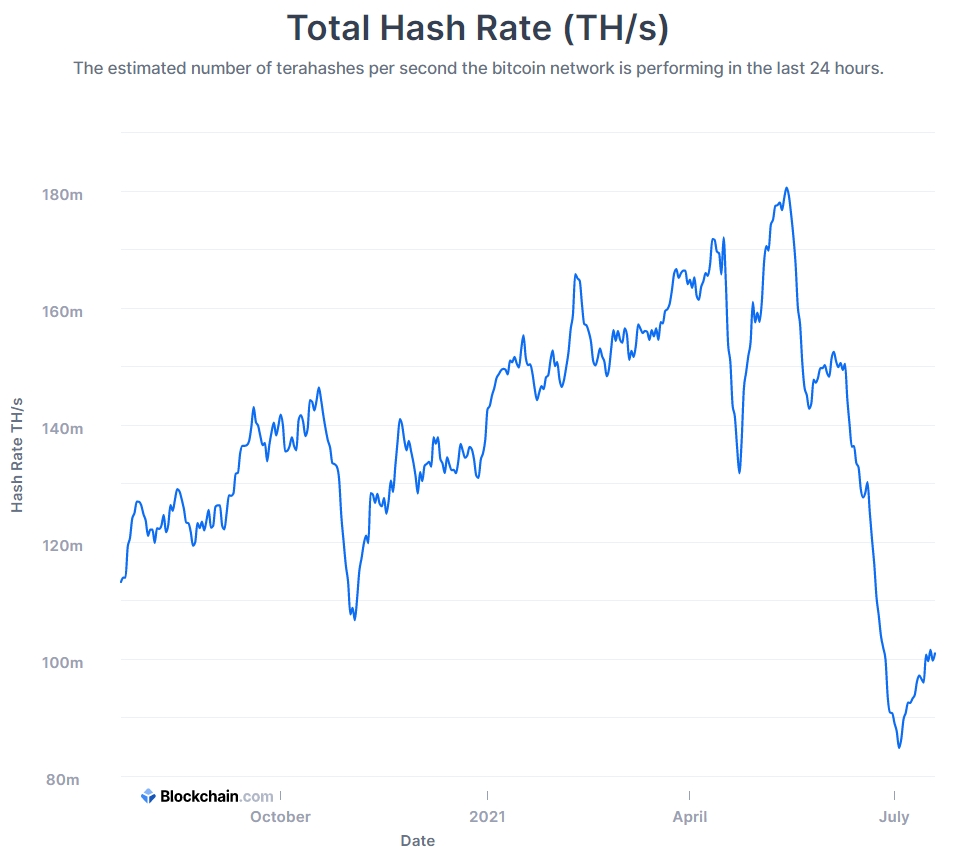

It is common knowledge that most of the Bitcoin mining operations are located within the borders of China. The Asian superpower hosts 65% of all bitcoin farms. Each day 900 Bitcoin are mined, which amounts to a daily revenue of $31 million. Paper napkin math shows that in a year, BTC miners have earned approximately $10 billion over the last year.

Accounting for China’s share of hashrate distribution over the last 12 months, this means that Chinese-based miners have turned a profit of up to $7 billion since the end of last June.

Chinese crackdowns have disrupted the markets but the government has no intention of outright banning Bitcoin

The approach Chinese authorities have undertaken in regards to crypto is hard to understand. On one hand, the cheap electricity costs have attracted miners across the world to build their mining infrastructure within the country. Additionally, as a part of its 5-year policy plan, the country has explicitly embraced blockchain as pivotal technology for guaranteeing continued economic growth.

On the other hand, Beijing has repeatedly imposed various restrictions on the crypto industry, by restricting banks and other payment service providers from offering the ability to make crypto transactions and, most recently, a crackdown on Bitcoin mining businesses. The crackdowns have had a devastating effect on the Chinese miners, which is evident by looking at the data from Cambridge Bitcoin Electricity Consumption Index (CBECI). The world’s hashrate share of Chinese miners has dropped from 65% to 46%, from April ‘20 to April ‘21. The total hashrate also dropped drastically following the news of Chinese crackdowns.

Looking more closely at the provinces that have been impacted by the crackdowns, a pattern quickly emerges. It seems that the authorities are trying to relocate mining operations to provinces that have an abundance of hydropower resources, thus making the mining cheaper and, more importantly, more environmentally friendly.

China is well aware that the USD reigns supreme when it comes to cryptocurrency investments. It has no intention of outright banning BTC, since doing so would relinquish its power over the crypto markets and consequently losing a part of its grip over the U.S. dollar.

Who will benefit from the exodus of Bitcoin miners?

The United States is quickly turning into the most likely candidate for fleeing Bitcoin miners and is already controlling a 17% share of the global hashrate. Several developing countries are looking to Bitcoin to circumvent the U.S. imposed sanctions, such as Iran, or simply to try and capitalize on the growing trend, like in the case of El Salvador, which has recently passed the so-called “Bitcoin Law”, essentially making BTC a form of legal tender.

U.S. officials are well aware of the problem cryptocurrencies pose to the USD hegemony. It allows its hostile nations, such as Iran or China, to weaken the U.S. dollar on the global stage by allowing payment for imported goods with domestically mined digital currencies, while at the same time banning the coins generated abroad.

The U.S. is in a precarious position, as the public uproar caused by banning cryptocurrencies would be huge. For the time being, it can only try to make crypto-assets less appealing to limit the USD outflows accrued by crypto transactions.