With the first quarter of 2021 already behind us we are now already looking forward towards what Q2 2021 will bring. In Q1 2021 cryptocurrencies became a trillion-dollar asset class for the first time, as the total market capitalization of the sector climbed from $777 billion to $1.87 trillion. Will the bull market continue or is a market correction behind the corner? Will the non-fungible token (NFT) hype cool down or will the sector find new, unprecedented use cases for these tokens? And most importantly for the up-and-coming investors, which coins are the most likely to end in the green, perhaps even outperform the industry’s average growth? To answer this question, we advise you to continue following our Top 3 Coins to Watch series.

1. Bitcoin

Although we believe Bitcoin does not need much introduction and that all eyes would be on it even if it were not featured on our list, here is a short summary of the history and key characteristics of the first truly decentralized digital currency. The world’s pioneer cryptocurrency was launched by pseudonymous figure named Satoshi Nakamoto in 2009 and has a capped supply of 21 million coins. The decreasing miner block rewards makes the cryptocurrency scarcer with time, ensuring a deflationary nature.

Bitcoin sees Continued Growth for the Sixth Month in a Row – $100,000 by the End of the Year Now Sounds Pretty Reasonable

Bitcoin, the world’s largest cryptocurrency by market capitalization, is often referred to as the crypto market health barometer, since Bitcoin’s performance influences the general sentiment across the whole crypto space. This means that altcoins are thriving when Bitcoin is bullish and vice versa, when Bitcoin dips, altcoins are usually hit even harder. Nevertheless, the market barometer is indication very favourable and bullish market conditions. Bitcoin has managed to keep its price above $50,000 since March 6, this is 31 consecutive days or a whole month. In addition, Bitcoin is seeing continued growth for already more than half a year. March was already the 6th month in a row that BTC managed to close in the green.

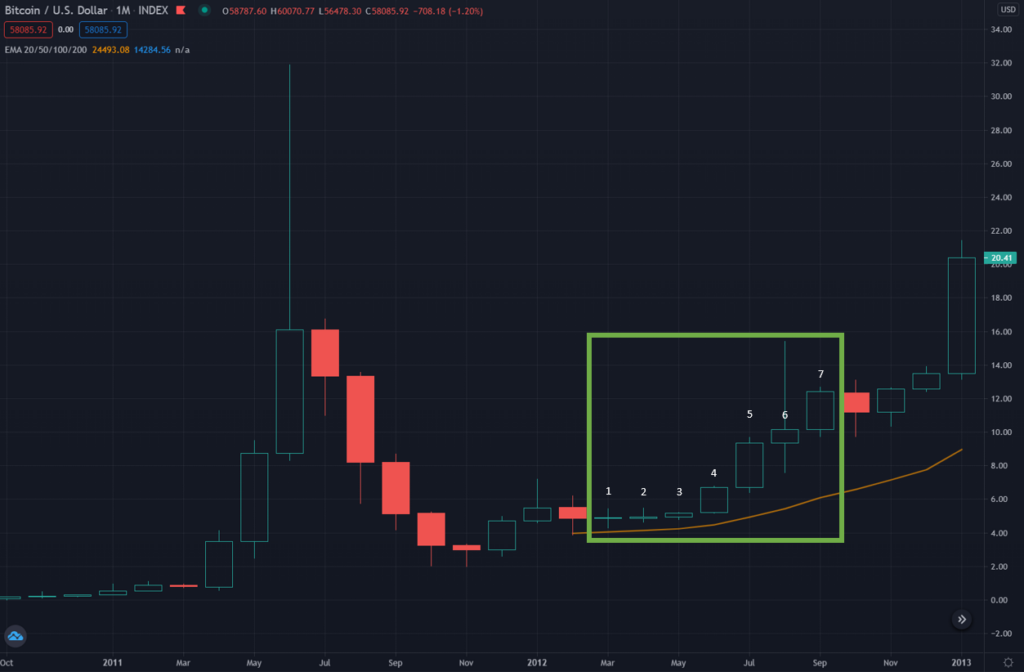

Furthermore, Bitcoin’s monthly candles continue to stay within a very steep ascending channel. Will Bitcoin end April in the green too? According to historical data, which shows Bitcoin gained 51% on average in April over the past 10 years, and options open interest, which shows that many investors are betting on $80,000 by the end of April, this seems quite likely. If BTC closes April with a green candle, this will be the first time that we would see seven 7 straight green candles, since September 2012, when Bitcoin gradually climbed from $4.30 to $15.4 over the course of seven months. It is unbelievable that Bitcoin was once trading at such a low price less than 10 years ago.

While Bitcoin’s market capitalization, which is currently around $1.1 trillion, continues to grow, quite the opposite is happening to the BTC market dominance, which is just slightly above 55%. According to one analysis this could be explained by the fact that investors are converting their Bitcoin into large market cap altcoins in an attempt to maximize their profits.

In addition to long-term retail investors buying up almost every dip, Coinbase exchange money flow indicates that U.S. institutions are still accumulating. The popular cryptocurrency exchange has lately been seeing increased volumes followed by huge outflows to BTC cold wallets. Cryptocurrency analyst Willy Woo recently speculated:

“Maybe an unannounced institution is buying, maybe it’s a private hedge fund or many of them. But there’s certainly a lot of buying going from Coinbase which tends to be U.S. institutions.”

Finally, the bullish price predictions are getting even more bullish. One year ago, people who claimed that Bitcoin is going to hit $100,000 or more were called dreamers and unrealistic Bitcoin bulls. Today, this number seems well within reach. Mike McGlone, senior commodity strategist at Bloomberg, recently tweeted that Bitcoin seems to be transitioning to a risk-off digital reserve asset:

The attached picture shows that in the most bullish scenario Bitcoin could end 2021 with a price as high as $400,000. JPMorgan’s analysts remain a bit more conservative, predicting Bitcoin to reach a price of $130,000 in the long-term. The long-term price target has recently been bumped down from $148,000 as the price of gold, which plays an important role in JPMorgan’s projections, dropped. Nevertheless, this price predictions are coming from institutions that did not even approve Bitcoin a bit more than a year ago.

2. ChainLink

ChainLink provides data and price oracles, which are essential for the normal function of smart contract-enabled blockchain platforms. ChainLink’s price and real-world data oracles have seen numerous implementations and their popularity is still increasing. Their oracle service is one of the most reliable and trustworthy services available and the connection with smart contracts is end-to-end secured, leaving very little space for the manipulation of the execution of smart contracts. The platform incentivises providers of good data feeds while the nodes that submit bad data will see their staked LINK tokens slashed. The project launched in 2017, when it also raised $32 million of funding through an ICO.

Substrate module Brings ChainLink’s oracles to Polkadot Network

The popular crypto oracle provider ChainLink recently announced arguably the biggest news from this project for this year – its expansion to the Polkadot environment. The ChainLink team revealed on April 2, that their oracles are now available in the form of a “pallet” on the Polkadot environment:

The ChainLink oracles being available in the form of a native Substrate “pallet” means that developers of any Polkadot or Kusama parachain can now seamlessly and super-easily integrate ChainLink oracles into their blockchains through a simplified library. You could also say that pallets are “like drag-and-drop blockchain building”, like a Polkadot developer Dan Reecer put it in one of his tweets.

While ChainLink nodes regularly publish price data in each block on Ethereum, allowing smart contracts to either use that data or simply ignore it, this will not happen on Polkadot. The choice to integrate the ChainLink Substrate pallet or not is up to each individual parachain, which means that the parachains that do not need price oracles for their operation can save up on blockchain space by not opting in. For those who integrate ChainLink oracles, however, this might enable several DeFi-centric use cases of their Polkadot or Kusama parachain. Nevertheless, experts warn that additional development work will likely be required to adapt the ChainLink pallet for use with smart contracts.

ChainLink is also one of the high market cap altcoins that is starting to see institutional involvement, as Grayscale launched a LINK trust along with some other altcoin trusts in mid-March. The launch of the Grayscale LINK trust triggered a 12% LINK pump the following day, but despite the initial surge things cooled off pretty fast for LINK. If we exclude the initial pump, when LINK was way more volatile (therefore also a riskier investment), ChainLink was underperforming when compared to Ethereum and Bitcoin. While LINK’s price chart closely resembled ETH’s one at the end of March, the gains of the popular oracle provider token are not again a few percent below the gains posted by ETH.

Relative price performance of LINK as compared to the one of BTC and ETH from March 17, when Grayscale Launched ChainLink Trust, to today.

According to data provided by ByBt.com Greyscale bought up 115,570 LINK tokens for its ChainLink Trust from the trust’s launch on March 17 until April 1. The purchase of 65,570 LINK on Thursday, April 1, helped push the price of LINK over $30, where it still trades. Currently LINK is changing hands at around $32.5, but the token is still believed to have a major upside potential.

3. Enjin Coin (ENJ)

Enjin Coin (ENJ) is an Ethereum-based cryptocurrency (ERC1155 token) used to directly back the value of next-generation blockchain assets. It is designed for social gaming as it allows virtual goods to be traded on the blockchain using smart contracts and ENJ as a payment method. The project aims to change the fundamental nature of virtual worlds by providing infinite high-speed transactions between players and game providers at zero cost. More than a million people are already using Enjin’s products to manage, create, and trade these blockchain assets.

A high-speed Bridge Network JumpNet Launched on April 6

JumpNet a high-speed two-way bridge network that facilitates free, swift, and secure on-chain transactions of ENJ and ERC-1155 tokens launched on April 6. JumpNet, which connects the Enjin blockchain with Ethereum and third-party chains is part of the Enjin Coin team’s continued strive to improve NFT compatibility and functionality. It makes minting, trading, and sending of NFTs much easier. In addition, the team have also announced that the launch of JumpNet will be accompanied by the popular GameTalkTalk joining the Enjin ecosystem.

In addition, Enjin is getting ready to launch Efinity, a next-generation NFT blockchain on the Polkadot network. The company recently concluded a private sale which raised more than $18.9 million for the development of the platform, but there is about to be a public sale as well. While JumpNet takes case of compatibility, Efinity, will address the scalability and accessibility as it promises around 700 to 1,000 forever free transactions per second (TPS). In addition, Efinity will bring a new level of utility for the Enjin Coin token: staking – users will receive rewards paid out in EFI for staking their ENJ. Furthermore, the NFTs held in wallets will be auto-staked, allowing their owners to earn a small amount of passive income just for holding Enjin-based items. It should go without saying that passive income coins are extremely popular among cryptocurrency investors and the coins that provide passive income have performed very well during the past bull runs.

To conclude, Enjin is one of the few projects that was the most successful at capitalizing on the NFT hype and the rapid growth of the Enjin ecosystem has also sparked up speculations whether Coinbase will list ENJ or not. While the prominent U.S. crypto exchange already supports ENJ custody, the Enjin Coin is not being traded on the platform yet. The Coinbase team recently accidentally published an ENJ support page, which additionally fuelled the speculations. The influx of new investors and fresh capital after a potential Coinbase listing would without a doubt cause ENJ to surge even higher.