Key takeaways:

- Mastercard has published the results of a survey on emerging payment technologies called New Payments Index 2022

- More than half of consumers from Latin America have made a crypto asset transaction in the past, according to the survey’s findings

- 54% of Latin American users say they are bullish on crypto as an investment

Crypto adoption in Latin America is growing at the expense of traditional payment methods

Leading payments network Mastercard has published the result of the annual New Payments Index, a survey designed to gauge consumer behavior pertaining to “emerging payment methods.” New Payments Index 2022 was conducted between March and April and included over 35,000 respondents from around the world.

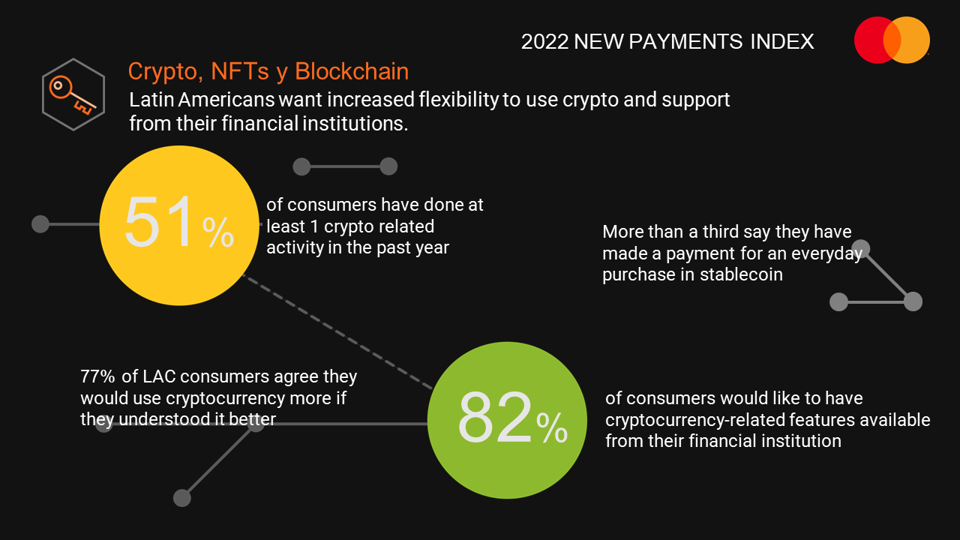

According to the survey – which included questions regarding fintech solutions as well as digital currencies, DeFi, blockchain, and NFTs – 51% of the Latin American population has made a cryptocurrency transaction in the past year. Also, 33% said they have used stablecoins to make at least one purchase in the last 12 months. Moreover, 54% of all respondents said they are bullish on crypto as an investment.

Judging by the survey’s findings, there is significant room for growth in the Latin American market – two-thirds of consumers said they want crypto payments to be more accessible in their “day-to-day operations.” In addition, 82% said they would like their current financial institutions to offer crypto products and services.

The survey also found that Latino users are becoming less dependent on cash payments, with 29% saying they have used less physical money in the past year.

The rate of cryptocurrency adoption in Latin America is arguably higher than in any other region in the world. Per Triple-A data, three countries from Latin America rank among the top 10 countries with the largest percentage of crypto owners – Venezuela with 9.02%, Brazil with 7.75%, and Colombia with 6.63%.