The cryptocurrency markets have again moved in downward direction as the total crypto market capitalization decreased from $990 billion to slightly less than $910 billion. Almost every major cryptocurrency (excluding stablecoins, of course) depreciated by around 10% last week. As the general downtrend might continue throughout this week as well, we have prepared a selection of three coins that have a potential to surge or at least deliver gains in the following days.

3. Centrifuge (CFG)

Centrifuge is a decentralized asset financing protocol that aims to bridge the worlds of Decentralized Finance (DeFi) and non-digitally native assets. Through Tinlake, Centrifuge’s lending dApp, businesses can tokenize real-world assets such as consumer credit, mortgages, and invoices, to create blockchain-based asset-backed pools and access financing in the form of digital assets. Investors, on the other hand, can benefit from a stable yield that is unaffected by the volatile cryptocurrency prices. While Centrifuge chain operates on Polkadot, its lending application Tinlake is built on Ethereum due to the ecosystem’s massive liquidity. The CFG token is the protocol’s native asset that serves as an incentive for blockchain validators and grants governance rights to its holder.

CFG price spikes following the launch of Centrifuge Connectors

Centrifuge has launched Centrifuge Connectors, a cross-chain solution that aims to bridge the Real-World Asset (RWA) market with the broader DeFi ecosystem. By utilizing Nomad Bridge technology, Connectors allows investors to provide liquidity into Centrifuge pools without having to bridge over to the Centrifuge chain. It is a hybrid solutions that is not a classical bridge nor a chain fork but takes the best features of both worlds. Because Connectors provides a fully native experience for users on any supported chain, both investors and DeFi protocol developers will benefit from its deployment. The launch of this innovative cross-chain solution comes roughly a month after Centrifuge revealed the formation of a strategic alliance with BlockTower, which was set up to accelerate the development of RWAs in the DeFi sector. Centrifuge also raised $3 million through a treasury token sale as part of the BlockTower partnership deal. The latest developments around the Centrifuge project were apparently well received by investors as the project’s native CFG token spiked by close to 50% on several occasions last week. While the price always retraced back to between $0.21 and $0.22 the price spikes have shaken up the CFG market enough for the downtrend to reverse, as the token’s price line now seems to have established a slight uptrend.

2. Cardano (ADA)

Cardano is a decentralized blockchain platform focused at creating a smart contract-enabled environment on which developers can build decentralized applications (dApps). By utilizing a proof-of-stake (PoS) consensus model, Cardano aims to deliver a more sustainable, scalable, and transparent operation compared to other smart contract blockchains. The project was started in 2017 by Charles Hoskinson, a mathematician who was once part of the Ethereum developer team. Together with a team of co-workers, Hoskinson raised $62.2 million for Cardano’s development through an ICO. Today, the development of the project is overseen by three main organizations: the IOHK, Cardano Foundation and Emurgo. Hoskinson and IOHK stive to follow the principles of academic peer review in the project’s development process. The native asset of the Cardano blockchain is called ADA, but in 2021 the project rolled-out an update, which allows users to issue other tokens on Cardano blockchain as well. In September 2021 smart-contracts debuted on the Cardano mainnet, which was a major milestone for the ecosystem.

Cardano Mainnet will soon undergo the Vasil Hard Fork

On June 20, the Input Output Global (IOG) team working on the Vasil upgrade revealed that the hard fork was almost ready to be deployed on Cardano testnet. Nevertheless, the team decided to postpone the hard fork of the testnet as there were still seven non-crucial bugs in the code. Cardano testnet than finally and successfully forked on June 28:

Consequently, also the Vasil hard fork of the Cardano mainnet, initially scheduled for June 29, 2022, will be implemented with a slight delay. IOHK’s post indicated that the mainnet will fork sometime by the end of July or in early August. Historical market data shows that ADA tends to intensely rally in expectation of important updates but often faces a sell-off soon after the updates are implemented. If the Vasil hard fork will have the same effects on ADA price as previous hard forks, now is the best time to acquire ADA. While technical analysis shows that ADA’s price is poised to drop (it is forming the bear pennant pattern), the Vasil upgrade will make Cardano much more developer friendly. This could end up attracting projects and developers from rivalling layer-one blockchains, leading to a higher demand for ADA and negating the projected downtrend indicated by the technical analysis.

1. XRP (XRP)

XRP is a cryptocurrency that was launched in 2012 by Chris Larsen, Jed McCaleb and Arthur Britto. Ripple’s network uses a unique Ripple Protocol consensus algorithm (RPCA), which is neither proof-of-work nor proof-of-stake, to facilitate fast and cheap transactions. The maximum supply of XRP is 100 billion coins and all the coins were created at launch. Back than 80% of the total XRP supply was given to fintech firm Opencoin, a company that renamed to Ripple Labs in 2015. As of today, Ripple Labs still hold more than half of the total XRP supply. However, most of the company’s XRP holdings are locked in escrow and can only be accessed periodically. In December 2020 Ripple became entangled in a lawsuit with the US SEC, which accuses that the company of selling unregistered securities. The legal battle between Ripple and the SEC remains one of the key factors influencing XRP’s price.

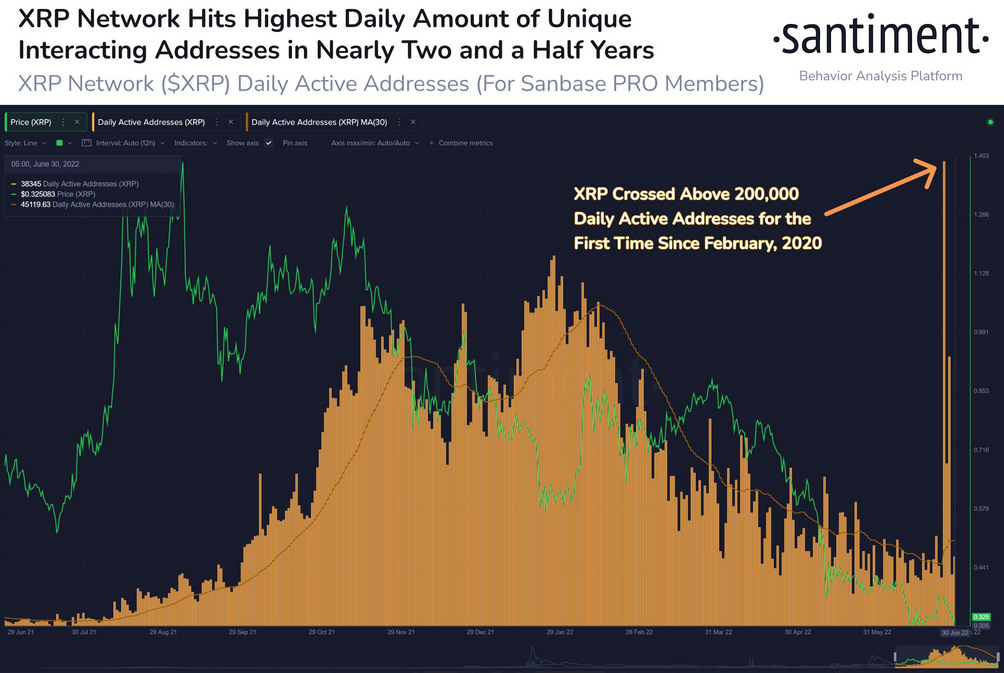

The legal battle with the SEC is nearing an end

XRP has been in a more than a year and half long lawsuit with the SEC. With the legal proceedings nearing their end, the court’s decision on whether XRP is a security could play a massive role not only for XRP and the Ripple Labs company, but also for the broader crypto sector. Earlier this year Ripple Labs CEO Brad Garlinghouse disclosed that he is very optimistic that Ripple will come out as the winner of this long-lasting legal battle. A few months after that, he attracted a lot of attention by saying that the company is looking to explore an IPO after the case with the SEC comes to an end. Although Ripple’s representatives are staying optimistic, they are apparently getting prepared for the worst-case scenario as well since the company is expanding its presence outside the US. In June, for example, Ripple Labs opened a new office in Toronto, Canada, in which they will employ up to 50 new developers. In addition, there is a plan to move Ripple Labs overseas, if the court decides in favour of the SEC and deems XRP a security as well. Although the Ripple network’s fundamentals often stay in the shadow of the developments on the court floor, they must not be overlooked. Just recently, the number of daily active addresses on the XRP Network hit 200,000, which puts this metric on a 2-year high.