Cryptocurrency loans can be a useful and lucrative method for blockchain users to gain access to additional capital to pursue various investment opportunities in the crypto space, such as crypto staking, spot market trading, and various derivatives trading options.

Binance offers one of the most comprehensive crypto loan offerings in the industry, both in terms of the sheer number of cryptocurrencies supported and in terms of advanced features such as loan staking.

Here is a quick overview of Binance Loans’ main advantages and disadvantages:

Pros of Binance Loans:

- User crypto holdings as collateral to take out crypto loans

- Renting out a crypto loan requires only a couple of clicks

- Low-interest rates and no penalty fees associated with early repayment

- More than 60 borrowable cryptocurrencies and 25 types of crypto collateral

- Decrease service fees with loan staking assets

Cons of Binance Loans:

- The maximum loan duration is 180 days

- 2% liquidation fee is applied if a loan is not repaid in the allotted time

Let’s take a closer look at Binance Loans’ core features, benefits, and the process of obtaining a crypto-backed loan.

What is the Binance Loans service?

Binance Loans is a cryptocurrency loan platform that allows users to stake their crypto assets as collateral to gain access to additional capital. The platform lets users take out a loan in dozens of different digital currencies, ranging from industry-leading Bitcoin (BTC) and Ethereum (ETH), DeFi-centric coins like Polkadot (DOT) and Kava (KAVA), metaverse and gaming-oriented The Sandbox (SAND) and Decentraland (MANA), to popular stablecoins like Tether (USDT) and Binance USD (BUSD).

In exchange for a loan, users must supply their existing spot digital assets as collateral, which ensures the loan is secured and allows Binance to charge low-interest rates on loaned crypto. For more information about the importance of crypto collateral when taking out a crypto loan, click here.

Contrary to their traditional counterparts, crypto loans don’t require consumers to fill out lengthy legal forms or provide credit scores – instead, the entire process takes minutes and requires only a few clicks.

What are the benefits of Binance Loans?

In addition to the user-friendly interface, low-cost service, and numerous supported cryptocurrencies, Binance Loans boasts several features that make it stand out from other similar offerings in the industry.

Flexible loan duration terms

With Binance Loans, users can decide between five loan duration options, depending on their needs and goals. The loan duration terms that are available on Binance include 7, 14, 30, 90, and 180-day options.

Early loan repayment incurs no additional charges

The loan amount can be repaid in part or in full before the loan duration reaches its allotted time. In practice, this means that a loan can be repaid at any point in time before the loan duration runs out without having to pay any early repayment fees.

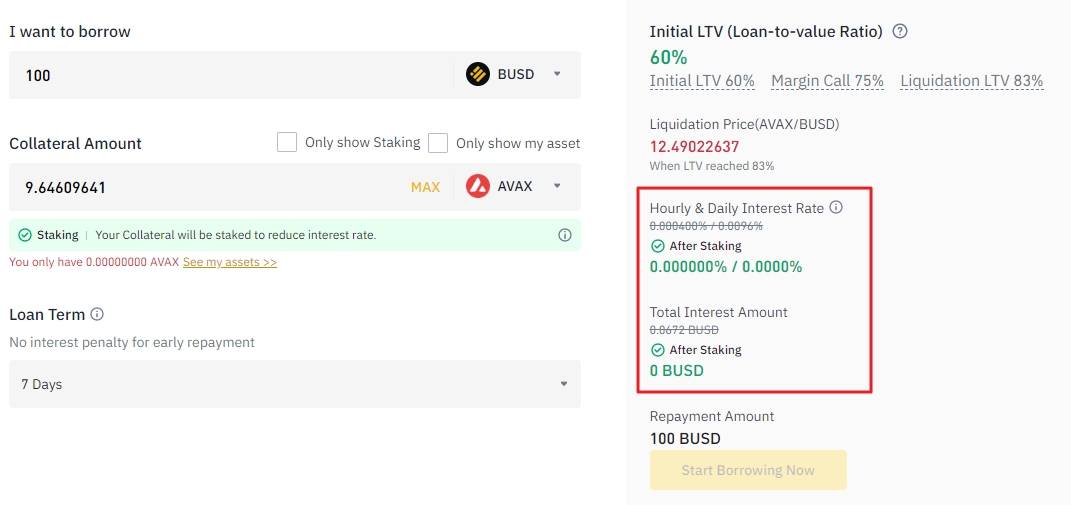

Reduce interest rates with loans staking

Loans staking is a feature that allows tokens used as collateral to be used to support operations of their respective blockchain platforms via staking. The rewards generated by staking are employed to cover the cost of Binance Loans’ interest rates. In some cases – such as with Avalanche (AVAX) and PancakeSwap (CAKE) – the hourly and daily interest rates can be reduced to zero.

No strings attached to borrowed funds

Digital assets secured via Binance Loans can be used in the same way as any other cryptocurrency in a user’s account. They can be used for spot and derivatives trading purposes, decentralized finance (DeFi) use cases like token staking, and even transferred to external blockchain wallets. The only thing a user must be concerned about is repaying the loan before the loan duration expires.

How to use Binance Loans?

Taking out a cryptocurrency-backed loan with Binance Loans is simple, fast, and accessible even to those who lack extensive knowledge about crypto. If you want to obtain a crypto loan on Binance, follow our step-by-step guide below.

Step 1 – Login to your Binance account and navigate to Binance Loans

Navigate to the Binance Loans product by going to the Binance homepage, and then select the “Crypto Loans” option from the “Finance” dropdown menu.

Step 2 – Select the cryptocurrency and amount you wish to borrow

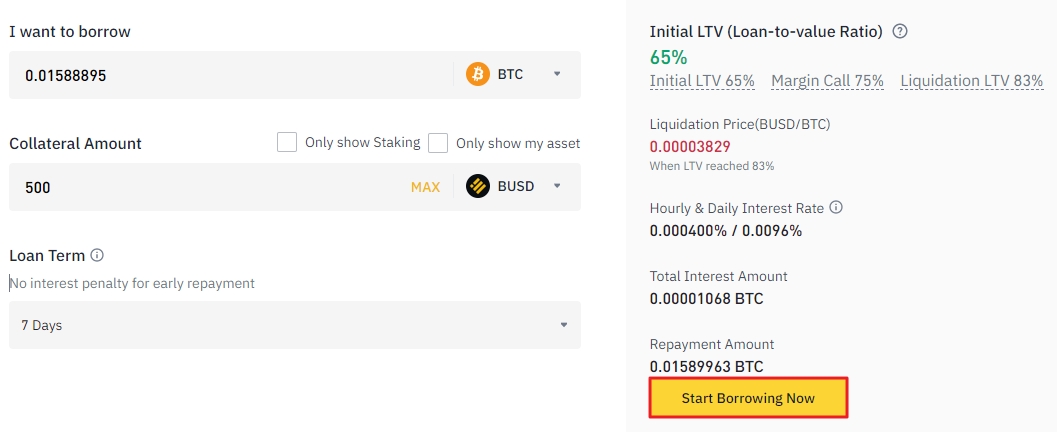

Select the cryptocurrency and amount you want to borrow. Proceed by selecting the collateral type and the loan term duration. Click “Start Borrowing Now” once you are ready.

With a loan-to-value ratio (LTV) of 65% – as is the case when borrowing BTC with BUSD – you will get $325 worth of BTC by supplying $500 worth of BUSD as collateral. In most cases, Binance is offering the initial LTV of 65%, however, the final ratio depends on the underlying volatility of borrowed and collateral assets used.

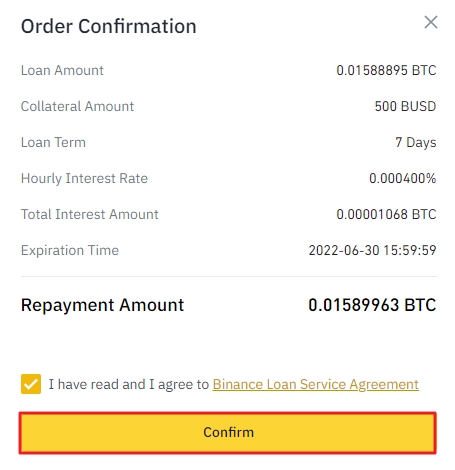

Step 3 – Confirm cryptocurrency loan order

Once greeted with the popup informing you about the crypto loan order, tick the box next to the Binance Loan Service Agreement link and click “Confirm” to borrow funds.

Binance charges very competitive rates for its cryptocurrency loan service. In the case of borrowing $325 worth of BTC using $500 BUSD as collateral for the duration of 7 days, you would have to pay the total interest amount of roughly 20 cents worth of BTC. It is worth noting that interest rates and maximum loan amount differ based on the cryptocurrency borrowed and collateral type.

Closing thoughts

Binance Loans can be an excellent choice for those who are looking to take out a crypto loan using their existing digital asset holdings as collateral. The user-friendly product boasts low costs, numerous features, and supports the vast majority of major crypto assets. Hopefully, this article answered all of your questions about Binance Loans and helped you decide whether you should give it a try.