People have been using loans for hundreds of years to start businesses, attain good education, and achieve a wide range of goals that wouldn’t be achievable without gaining access to extra capital.

Cryptocurrency loans take the old and proven formula and apply it to the blockchain space. While traditional loans are typically managed by banks, which require extensive paperwork, sufficient credit scores, and so on, cryptocurrency loans take just minutes to secure and are available to whoever owns digital assets.

What is a cryptocurrency loan?

A cryptocurrency loan is a type of blockchain-based financial instrument that allows users to put up their digital assets as collateral to gain access to additional crypto capital. Instead of risk assessment calculations that take into account a person’s credit score, the mechanics of crypto loans rely primarily on a principle known as Loan-to-Value (LTV) ratio.

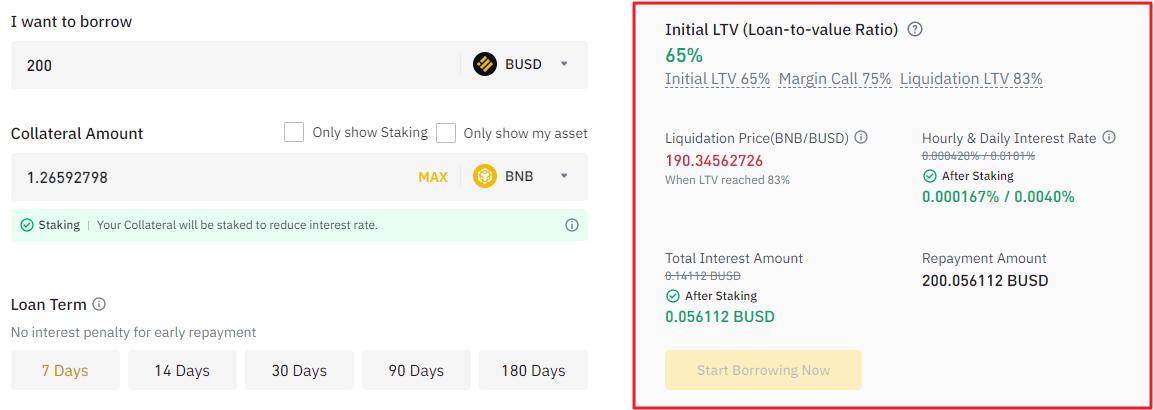

LTV determines how big of a loan a customer can obtain. Most cryptocurrency lenders lend funds with an LTV of about 65%, which means that a user can borrow about 65% of the amount of crypto they used as collateral via a crypto loan. For example, staking 1 BTC as collateral would enable you to borrow an additional 0.65 BTC, or the equivalent value of other crypto assets.

The duration of a cryptocurrency loan, the maximum LTV, supported borrowable and collateralizable digital assets, and other loan parameters can vary greatly depending on each individual crypto lender.

What are the pros and cons of crypto loans?

Broadly speaking, cryptocurrency loans can be a great way to increase exposure to crypto markets and leverage the power of an existing crypto portfolio to gain access to additional digital assets. However, same as with every type of financial product, there are some caveats with crypto loans. Here’s a quick overview of the main benefits and disadvantages pertaining to crypto loans.

Pros of using Crypto Loans:

- No credit score requirements

- Can be actively managed

- Borrowed funds can be used to pursue additional investment opportunities

- Easy to take out and repay

- Taking out a loan is not considered a taxable event

- Interest rates are typically lower than in traditional loan counterparts

Cons of using Crypto Loans:

- Susceptible to liquidation if collateral’s value falls below the requirements

- Users must monitor and adjust their LTV to accommodate for market fluctuations

- Late loans repayment can lead to liquidations and additional fees

The above list serves as a broad overview of cryptocurrency loans and shouldn’t be considered as the final verdict on the service.

Benefits of using Binance Loans

Binance’s Loan service easily ranks among the most comprehensive cryptocurrency loan offerings in the industry. Not only does the service feature numerous customization options and an easy-to-use interface – with in-depth and clear explanations of each setting readily available – it also supports an extensive list of crypto assets. At the time of writing, Binance Loans allows users to borrow more than 60 types of crypto assets, including Bitcoin, Ethereum, and other popular coins. In addition, users are able to stake more than 20 different crypto types to collateralize their loans.

Let’s examine the core benefits of Binance’s loaning service.

5 different loan duration types

Binance’s Loan offering is primarily suited for users who are looking to magnify their short-term and near-term market exposure. There are five loan terms available, including 7, 14, 30, 90, and 180-day loans. The terms outline the maximum loan duration, however, they don’t specify the loans’ shortest time spans, which brings us to our next point.

Borrowing funds without a credit check

As mentioned previously, a crypto loan on Binance can be taken out without supplying a credit check. This makes the product accessible to a broader spectrum of users. In addition, since there is no paperwork that needs to be supplied, crypto loans can be secured in minutes, which allows users to seize short-term trading opportunities and not miss out on potentially lucrative investments.

Repayment flexibility

One of the benefits of borrowing crypto on Binance is the ability to repay your loan at the time that best suits your needs. Loans can be repaid in part or in full before the end of the loan period outlined in the initial loan order. This makes it possible for users to pay off their debts at an opportune time, for example, during a market rally.

Loans staking

The Loan Staking feature allows users to decrease their interest rate when using crypto collateral that supports staking. The feature works in the following way. Binance uses the collateral supplied by users to support the operation of underlying blockchain networks.

When using BNB as collateral, for example, Binance puts supplied BNB towards supporting the Proof-of-Stake (PoS) operations on the BNB Chain. The staking rewards are then distributed to users via the slashed effective loan interest rate. In the case of using BNB as collateral, the interest rate is reduced by 60%.

Complete control over borrowed funds

Another benefit of using Binance Loans is complete freedom when it comes to using borrowed assets. Users are able to use borrowed crypto capital to pursue various investments on the Binance platform, including spot, futures, and margin trading, as well as a wide range of passive income-generating products available on Binance’s Earn platform. What’s more, borrowed assets can be transferred outside Binance and used on other exchanges or decentralized trading protocols.

When should you use Binance Loans?

Binance Loans can come in handy in different investment scenarios, ranging from spot trading to pursuing high yields through decentralized finance (DeFi) staking services. Here are some examples of when cryptocurrency loans can boost a user’s investment potential:

Borrowing funds without a credit check

As mentioned previously, a crypto loan on Binance can be taken out without supplying a credit check. This makes the product accessible to a wider range of users. In addition, since there is no paperwork that needs to be supplied, crypto loans can be secured in minutes, which allows users to seize short-term trading opportunities and not miss out on potentially lucrative investments.

Buying new coins without selling parts of crypto portfolio

Cryptocurrency owners are often faced with a common dilemma of whether it is worth it to sell an existing crypto portfolio, or a part of it, to buy new digital assets. With crypto loans, the decision becomes much easier. Instead of selling crypto and using the proceeds to buy new coins, existing assets can be used as collateral to gain exposure to new coins. Due to the maximum loan duration of six months, securing new spot assets is particularly beneficial for shorter-term investment moves.

Using borrowed capital to pursue passive income opportunities

Since the borrowed funds have no strings attached (except the borrower’s obligation to repay the debt within the loan duration window), they can be used to generate yield. Binance offers numerous Earn products that enable users to deposit their crypto in DeFi Staking products, flexible and locked savings options, and more. In addition, users can pursue additional yield-generating options on other centralized and decentralized crypto platforms

Final thoughts

Cryptocurrency loans provide another layer of utility for digital assets and bring the sector one step closer to realizing one of the core missions of crypto as a whole – the ability of an average consumer to “unbank” themselves and rely on algorithmic solutions instead of traditional intermediaries for financial needs.

Binance Loans is one of the leading crypto lending services in the sector, thanks to the extensive list of supported currencies and advanced management tools. Hopefully, this article helped you gain a better understanding of Binance’s Loan offering and cryptocurrency loans in general.