Key Takeaways

- Binance Loans enable users to borrow cryptocurrencies with ease

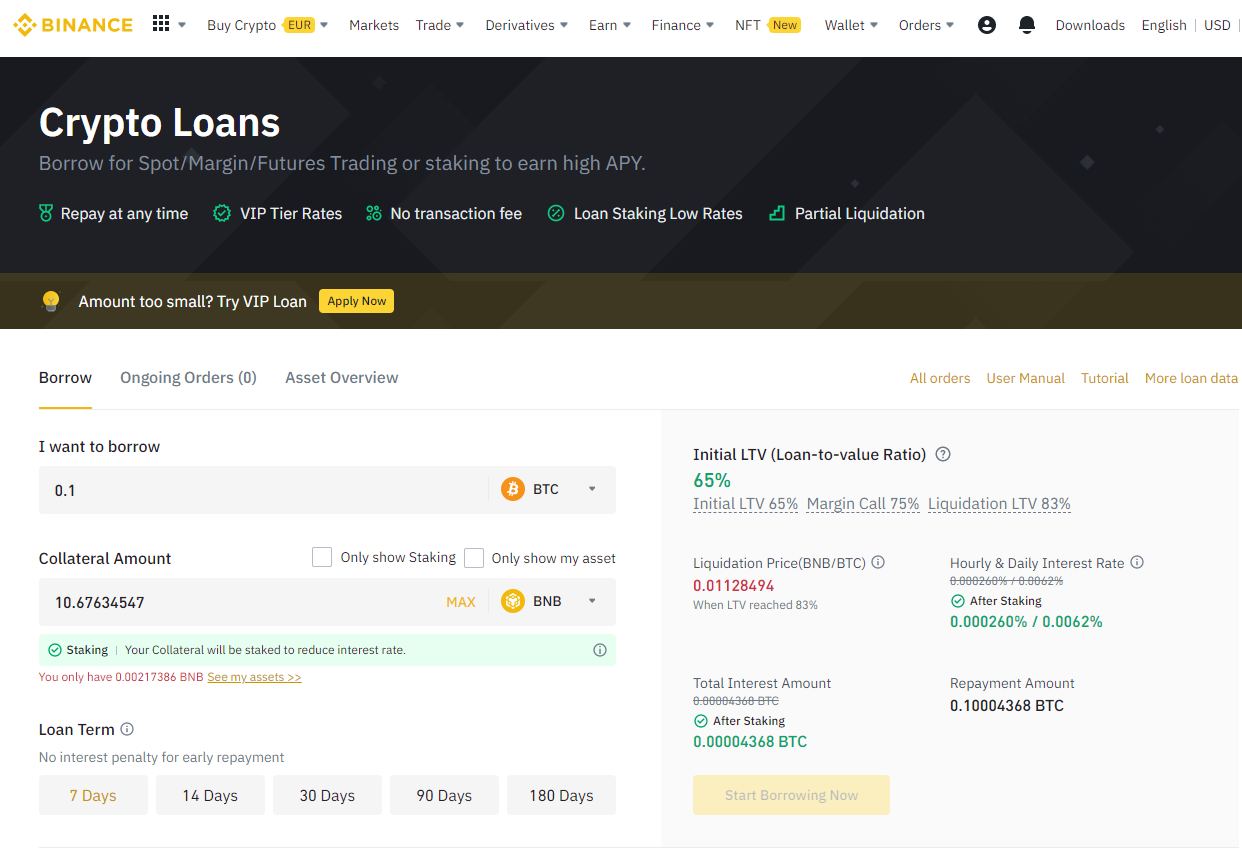

- Users can use Binance Loans to borrow up to 65% of their collateral’s value and use the funds wherever they like, both within and outside the Binance platform

- Getting a crypto loan is much easier than getting a traditional loan, though the crypto market is volatile and considered risky

The Binance crypto platform offers users various options and features to help make their crypto journeys easier and more rewarding. The Binance loan is another important feature on the exchange platform that users can explore to maximize gains and increase their crypto holdings. It is mostly beneficial for individuals who want to use funds without selling off their assets.

There are many reasons people who need crypto loans consider Binance ahead of other platforms. Introduced in 2017 Binance is now the biggest crypto exchange in the world, enabling more than a million transactions every second. On Binance, approximately 600 cryptocurrencies are offered, and about 90 million users are currently signed up on the platform.

Crypto Loans

Before delving fully into Binance Loans and their advantages, let’s briefly discuss crypto loans in general. In principle, they are similar to traditional loans. The major differences is that they are offered in cryptocurrencies, and users don’t need credit scores to access them. For crypto loans, Lenders will keep a portion of your crypto assets as security until you pay back the loan.

Crypto loans have shorter terms—ranging from seven to 180 days—and interest is computed hourly rather than monthly. This is because the crypto market is unpredictable and unstable for both lenders and borrowers. However, interest rates of crypto loans can be significantly smaller than interest rates of traditional loans.

Key Advantages of Crypto Loans

Here are some of the advantages of crypto loans for crypto users:

Ease of access: Underbanked groups, such as those with little or no credit history, restricted access to traditional institutions, and self-employed individuals who cannot meet the standards for conventional loans, have easier access to cryptocurrency loans.

Fast Processing: Processing time for crypto loans is always significantly faster than what it takes to process traditional loans.

Flexible: Borrowers can receive their loans promptly, with more flexible terms for repayment. Binance loans, for instance, can be repaid in a matter of days or weeks or months.

Low Interest Rate: A crypto-secured loan, ideally, offers lower interest rates to borrowers.

Uses of Crypto Loans

Users may find a crypto loan appealing for several reasons. It is advantageous to have the option of obtaining a loan because traders typically don’t want to sell their holdings when they may require funds urgently.

Traders can borrow more than 60 crypto assets pledging their existing crypto as collateral. The collateral is returned to the investor when the loan is repaid with interest.

Furthermore, market participants might favour crypto loans over conventional loans due to how quickly funds may be obtained. Crypto loans can be obtained almost instantaneously, making your cryptocurrency assets incredibly liquid and convertible so you can easily and swiftly take advantage of market possibilities.

How to Borrow Cryptocurrencies on Binance: Important Points to Consider

Borrowing crypto on the Binance platform makes it easy for users and investors to access funds when needed urgently. Understanding some necessary factors that play a big role when borrowing cryptos on the Binance crypto exchange is very important.

Here are some important points to consider when borrowing cryptocurrencies on Binance:

- Loan-to-Value Ratio: LVT ratio calculation shows investors how much their loan is actually worth in relation to the value of their collateral. The index price varies between coins and is used to determine this. As a result, the Loan-To-Value would vary between the collateral alternatives if any two coins of equal value were used as collateral.

- Liquidation: Liquidation happens when a borrower does not pay back a debt, even after being offered an extension past the initial due date. The initial collateral is liquidated to pay the loan in the event that the principal cannot be covered. Furthermore, a liquidation fee (2% on Binance Futures) is charged on top of the entire borrowed amount.

Why Use Binance Loans?

Here are some of the major reasons why users borrow with Binance Loans:

- Easy Access and Usability: You are entitled to use your borrowed cryptocurrency for any purpose within the Binance ecosystem, including trading and payment processing. You can also withdraw if you wish to utilize your funds elsewhere other than Binance.

- Flexible terms: Binance Loans provide loan durations of 7, 14, 30, 90, and 180 days. Based on the number of hours borrowed, interest is calculated.

- Loans Staking: As hinted earlier, there is hardly any restriction to what Binance loans can be used for. You can stake some or all of your borrowed funds to earn passive income in crypto.

- Quick Repayment: Repay at any time before the deadline and incur no penalties. Only an interest fee based on hours borrowed will be applied once the loan amount has been repaid.

How to Use Binance Loans

After creating a Binance account and completing the identity verification process, you are qualified to borrow using Binance Loans.

Here is a step-by-step guide on how to borrow a loan on Binance:

- Select the asset you want to borrow and the asset you want to use as collateral. You have a large selection of well-known cryptocurrencies at your disposal, such as BTC, ETH, BUSD, and others.

- Select the loan’s duration, normally between seven days and 180 days.

- Based on the value of your collateral, the system will automatically calculate the hourly interest rate.

- You may utilize your loaned fund both within and outside the Binance ecosystem.

How to Modify the Loan-To-Value Ratio?

Through the Binance Loans dashboard, you can easily manage your loan-to-value ratio by supplying additional collateral or repaying a part of the loan. Here’s how:

- Simply select [Ongoing Orders] and then [Adjust LTV]

- You can manually add or remove collateral or modify the LTV bar to change the LTV ratio.

- Depending on whether you want to add or remove collateral, click [Add Collateral].

How to Repay a Loan on Binance

When you are ready to repay your Binance loan, the process is always simple. Follow the steps below:

- Simply select [Ongoing Orders] and then [Repay].

- You can choose a repayment ratio or enter the [Repayment Amount] directly.

- Click [Confirm repayment] after carefully reading the information.

- After successfully processing the repayment, you will get a confirmation message.

How to Repay a Loan with Collateral on Binance?

Here are some simple steps on how to repay a loan with collateral on Binance:

- On the Loan Orders page, select [Repay].

- Choose [Repay with Collateral] after inputting the repayment amount. Verify the “interest repaid”, “principal repaid”, “total repayment”, “LTV after repayment”, and “returned collateral amount”. Please select [Confirm repayment].

How to Use the Auto Top-Up Feature?

- To maintain the initial Loan-To-Value ratio during a margin call, the Auto Top-up function automatically transfers the equal collateral assets to loan orders from your Spot Wallet. This helps you manage your loan positions more effectively.

- Turn on the [Auto Top-Up] button in the top right corner after selecting the [Asset Overview] tab.

Conclusion

A crypto loan is super-useful when you need extra funds but don’t want to sell your crypto assets. Binance is one of the top options for crypto traders who need loans. The range of available cryptocurrencies for borrowing and using as collateral on the platform has expanded, as has the market for trading. Anyone with crypto assets can open a loan at any time because users don’t need a credit score to apply for one. Furthermore, users can decide how they want to borrow funds.

Thanks to DeFi settings, users can borrow quickly and without interacting with other users. Also, loans are completed using smart contracts, which are great for security and other reasons.It’s crucial to keep in mind that the cryptocurrency market is unstable and that loans have their own set of risks. Before requesting a crypto loan, ensure you have enough funds in your portfolio or wallet to pay the interest, principal, and collateral. Are you interested in a crypto loan, Binance Loans are easier to get, and they offer several key advantages.