Key takeaways:

- As crypto ownership is becoming more prevalent, financial institutions are looking for ways to incorporate crypto into their offerings

- Visa will provide its particular set of expertise in fintech and crypto as a part of its newly launched Crypto Advisory Services to help its clients and partners develop a crypto strategy roadmap

- According to a recent survey conducted by Visa, 40% of crypto owners said they are likely to switch their banking provider to one that offers crypto-related services

Earlier today, the digital payment giant Visa announced the launch of the Global Crypto Advisory Practice offering, which will help the payment company’s clients and partners on their crypto journey.

Awareness of crypto is growing, banking institutions are looking for ways to stay relevant in the rapidly changing financial landscape

Visa’s new offering will tap into the growing anxiety of traditional financial institutions that lack blockchain expertise and face increased pressure from their clients to provide various cryptocurrency products and services.

According to a recent survey conducted by Visa, dubbed The Crypto Phenomenon: Consumer Attitudes & Usage, nearly 40% of crypto owners around the world said they would switch their primary bank to one that offers blockchain-based financial services in the next 12 months.

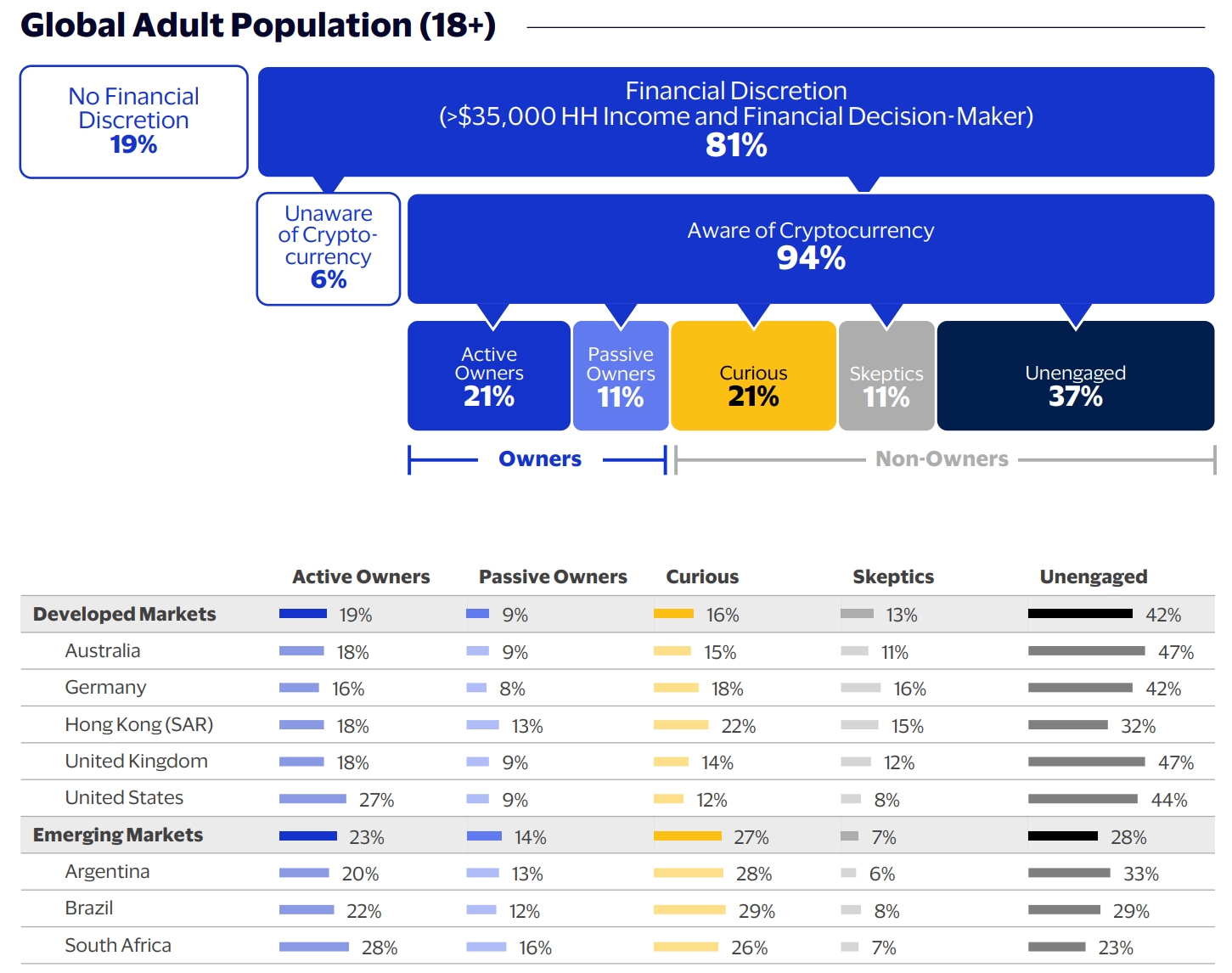

Additionally, out of 6,000 surveyed financial decision-makers, 94% said they have heard about digital currencies, while 32% revealed they own crypto assets. Interestingly, the share of crypto owners is higher in emerging markets, leading developed economies by 4%. Here’s the full breakdown of the survey’s data broken down by country and the level of crypto engagement.

According to Visa’s press release, Uma Wilson, executive vice president, CIO, and CPO at UMB Bank, said they turned to Visa to learn about new ways of serving their customers in the coming years. The digital payment processing giant helped UMB Bank produce a viable roadmap tailored to the bank’s specific set of needs and various business lines.

Terry Angelos, SVP and global head of fintech at Visa talks about the importance of having a crypto strategy as a financial institution:

“Crypto represents a technological shift for money movement and digital ownership. As consumers change their approach to investing, where they bank, and their views on the future of money, every financial institution will need a crypto strategy.”

Global Head of Visa Consulting & Analytics reiterated Angelos’ sentiment, “We’ve seen a material shift in our clients’ mindset in the last year,” and continued, “from a desire to explore and experiment with crypto, to actually building a strategy and product roadmap.”