Cardano (ADA), one of the coins featured in our last week’s edition of Top 3 Coins to Watch, continued its bull run last week. For a brief moment, when the price of ADA neared the $1.00, Cardano even overtook Tether and claimed the spot of the world’s third largest cryptocurrency by market capitalization. However, there were quite a few other cryptocurrencies that managed to climb up a few spots on the leaderboard last week but stayed partly in the shadow of the changes happening at the top.

This week’s selection of top coins to watch consists of three cryptocurrencies that already performed well throughout Week 6 but we believe that this projects will be able to ride atop the wave of announcements and network upgrades towards even higher adoption and of course also higher valuation.

1. Binance Coin (BNB)

Binance Coin is the native token of the Binance Chain, launched and operated by the popular cryptocurrency exchange Binance. Binance users who utilize BNB to pay for trading, withdrawal and listing fees can enjoy significant discounts. While this used to be pretty much the only advantage of BNB, the Binance’s coin now has a far wider spectrum of utility.

BNB Reached a New ATH Price of $148 Following a Record token Burn

The BNB climbed over 100% last week and posted its new all-time high price of $148.26 on Feb 10, 2021. While the cryptocurrency market is in a bull phase for a few months already, the BNB price only took off recently. After a few weeks of sideways trading where $40 was established as a support level, BNB has seemingly gone parabolic in February and is now changing hands at around $130. While there is no single factor that this amazing growth could be attributed to, we believe that it is a consequence of a combination of several factors, including a record BNB token burn and an increasing utility of both BNB as well as the Binance Chain.

On January 19, the Binance cryptocurrency exchange announced it had burned 3.6 million BNB, worth around $160 million at the time. The 14th quarterly BNB token was thus the largest ever quarterly BNB burn by Binance and the first “accelerated token burn”, according to Binance CEO Changpeng “CZ” Zhao. When Binance conducted the ICO in 2017, it promised they would gradually destroy 100 million BNB tokens, or half of the token’s 200 million maximum supply cap. Following the largest BNB burn so far, “CZ” clarified that Binance is on a mission to ahieve 100 million BNB burned as fast as possible:

“Over the last three and a half years, we have burned about 13% of the promised amount, with a total USD equivalent value (nominal) of $426,304,000. Even though this is an impressive amount for a three-year-old startup, at that rate, it would take roughly 27 years to finish the burn. So, we thought it’s time we speed it up a bit. Exactly how much faster? We are not 100% sure. The current accelerated burn would put the trajectory to be around 5-8 years to finish the 100 million BNB.”

In addition, judging by the yet-again record trading volumes achieved in the first month and a half of this year, the next quarterly BNB burn would likely set the record of the largest one by far, at least in terms of dollar denominated value of the burned tokens.

Furthermore, Binance users can take place in the exchange’s IEOs only if they possess enough BNB tokens. Judging by the success of the Binance-backed project that had previously been introduced to the public through there Binance Launchpad, participating in a Binance IEO can be a very lucrative investment. The latest offering conducted on Binance, the SafePal IEO, boasts with a ROI of over 28x vs. USD in just two weeks.

Another possible explanation for the BNB rally could be the success of Binance Smart Chain (BSC), the Binance Chain’s smart contract-enabled sibling. Both chains run side by side, but the 2019 launched Binance Smart Chain features full compatibility with the Ethereum Virtual Machine (EVM). Due to lower fees and less congestion the BSC is recently attracting the attention of several DeFi projects. News have emerged that the yield aggregator Harvest Finance and multi-service platform Value DeFi, two currently Ethereum-native decentralized finance (DeFi) protocols announced planned expansions to Binance Smart Chain. Both projects combined have nearly a billion dollars in total value locked between them (TVL).

A large factor that helps drive the Binance chain adoption is the fact that transferring tokens to Binance Smart Chain is relatively easy. Even Binance CEO “CZ” recently tweeted a video made by the famous Crypto YouTuber Ivan on Tech, where he explains how Binance acts as the “natural bridge between Binance Chain and the Ethereum chain”:

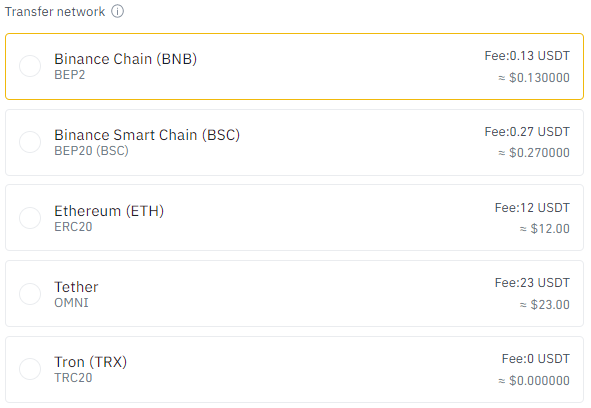

Nevertheless, the ease of use is clearly not the main driving factor of the user and developer migration towards the Binance Chain – the low transaction fees are the one to “blame”. With soaring ETH fees developers and holders are looking for alternatives, and the Binance Chain appears to be the one that gets the job done fast, secure and with a low fee. For example, the screenshot below shows how much it would cost you to withdraw USDT tokens through various networks on Binance. The fee on Binance Chain is merely 1% of the fee incurred when withdrawing USDT in the form of an ERC20 token on Ethereum.

With more utility coming to BNB, more users and trading volume on Binance, and consequently a higher the demand for BNB, the token’s price is expected to further increase. The price growth will likely be additionally boosted by the accelerated burn program.

2. Hedera Hashgraph (HBAR)

Hedera Hashgraph aims to develop the world’s first mass-adopted public distributed ledger that will be able to support a vast array of applications. Using their Hashgraph technology, users will be able to easily develop globally decentralized applications using and deploy them on the blockchain.

The Testnet V0.12.0 to be Released on February 18

According to Hedera official website the project will be deploying another upgrade to their project’s Testnet. The Testnet v0.12.0 launch procedure is scheduled to begin on Thursday February 18, 18:00 UTC. The upgrade and network restart will take approximately 2 hours to complete, the team noted. While the compatibility or data of the project that run on Hedera Testnet should not be affected, the network will be offline during this time. You can check the status of all Hedera networks, their scheduled maintenances and upgrade release notes here.

3. Cosmos (ATOM)

Cosmos is developing a network of blockchains that would facilitate the interoperability of multiple, otherwise incompatible, blockchain applications and cryptocurrencies. The scalable blockchain network built for developers had grown from a small ICO into a thriving ecosystem. At the time of writing, the network’s native cryptocurrency ATOM has a market capitalization of $2.35 billion, which is more than twice as much as it had merely 3 weeks ago.

Stargate Upgrade to Finally take Place on February 18

The Cosmos team have announced that the Cosmos Hub Stargate Upgrade will take place on February 18 at 06:00 UTC. The Stargate roll-out was initially planned for January 28, but got postponed due to issues with Ledger hardware wallet support, balance and metadata validations, and several bugs that were identified in the proposed code. Cosmos Governance halted the implementation of the upgrade described in Proposal 29 and approved by the vote on Proposal 35, by accepting a new Stargate upgrade schedule in the Proposal 36. You can find out more about Proposal 36 here.