2020 will likely go down in history as the year of the largest and most wide-spread pandemic of the modern era – the COVID-19 pandemic. The novel coronavirus, which quickly spread across the globe forced most of the global population to drastically change their daily habits to contain the spread of the disease. Governments around the world quickly figured out that the effects of the economic crisis triggered by lockdowns and other containment measures is going to exceed the ones of the health crisis if they do not act fast, so they started issuing fat stimulus checks and printing money to numb the economic impact of the pandemic.

As dire as the situation with COVID-19 currently is, the economic response to the pandemic has created a macroeconomic environment that arguably favours the cryptocurrency asset class, especially Bitcoin. The fear of the imminent inflation and currency debasement risks caused institutional investors as well as retail investors to flock into the cryptocurrency sphere. This is how the biggest news of 2020, the pandemic, consequently positively affected the crypto markets. However, there were also several other factors, such as important upgrades, regulatory changes, acquisitions, and other events that influenced the world of cryptocurrency and blockchain in 2020. This article is an overview of what we think were the top 10 cryptocurrency and blockchain related events of 2020.

1. Third Bitcoin Halving slashed block reward to 6.25 BTC

On May 11, 2020, the much anticipated third Bitcoin halving took place. There was an abundance of speculation in the cryptocurrency space about how the halving would affect Bitcoin’s blockchain and the coin’s price, which stood at around $8,700 at the time of halving. The event that halved the block reward from 12.5 BTC to 6.25 BTC, in did not immediately spark a Bitcoin bull run as some expected, but the effects of the reduced influx of freshly mined BTC can still be felt today. However, the halving did have a short-term impact on the Bitcoin mining ecosystem as some miners’ operations became obsolete and unprofitable, which resulted in a sudden drop of the network’s hashrate. Nevertheless, the Bitcoin hashrate recovered completely over the course of a few weeks and posted a new all-time high already less than 2 months after the halving. As far as Bitcoin’s price is concerned, Bitcoin changed hands at $11,650 3 months after the halving (+35%). Seven and a half months after the halving, Bitcoin is trading a bit under the $29,000 mark (+230% from halving). Although we cannot attribute the price growth to the halving alone, Bitcoin’s deflationary issuance schedule surely played an important role.

2. MicroStrategy Allocated a total of $1.1 Billion into Bitcoin

Year 2020 will also go down in history as the year in which interest in Bitcoin from institutional investors really took off. Furthermore, some companies really went all-in on Bitcoin this year – for example MicroStrategy, a previously relatively unknown business intelligence and cloud services company founded in 1989. The company first stepped into the limelight of crypto community’s attention in August, when it announced that they are steering away from cash and will be using Bitcoin as their primary treasury reserve asset as well as revealed they have made a massive $250 million Bitcoin purchase. The company made additional purchases in September even issued convertible senior notes to raise more capital to buy even more Bitcoin.

As of the end of 2020, the company has spent more than $1.1 billion on Bitcoin and now owns slightly less than 70,500 BTC. Considering that an average purchase price was $15,964 per coin, the company is up by over 70% on its Bitcoin investment at current prices. MicroStrategy’s success has apparently led other companies to gain some Bitcoin exposure. Although no one else got that deep into it, several other companies, including the financial services firm Square (acquired $50 million worth of Bitcoin) and the insurance company MassMutual ($100 million stake in the world’s largest cryptocurrency) allocated some of their reserve assets into Bitcoin.

3. ETH Staking Begins in the Phase 0 of Ethereum 2.0 Roll-out

The transition process to the improved and PoS-enabled version of Ethereum, the Ethereum 2.0 has begun with the launch of the Beacon chain on December 1. In the Phase 0 of what will likely turn into a multi-year upgrade process, Ethereum ecosystem got a new blockchain, that is intended to act as the main chain of the new protocol. The Beacon chain will manage the Ethereum 2.0’s staking system and crosslink the 64 shards that will comprise Ethereum 2.0. Its launch was a historical moment for the cryptocurrency world as it represents the beginning of migration to a Proof-of-stake consensus algorithm on the second largest cryptocurrency by market cap. When fully rolled out, Ethereum 2.0 will significantly improve the networks throughput while reducing Ethereum’s environmental footprint at the same time.

Right now, ETH holders are already able to stake their coins by sending them to the deposit contract deployed on the beacon chain. Once the coins are locked in the contract stakers will start earning staking rewards. However, this is not a full-featured staking yet, since the deposited ETH cannot be withdrawn until Phase 1.5 of Ethereum 2.0 goes live. Even under this condition, over 2.1 million ETH have already been staked, and the amount of ETH in the contract is still growing. 32 ETH is needed to run a validator node on Ethereum 2.0, but most of the leading cryptocurrency exchanges, including Binance, Coinbase and Kraken, have introduced services that allow users to participate in ETH staking and earn associated rewards even if they hold less than 32 ETH.

4. PayPal Rolls-Out Cryptocurrency Buying and Selling Feature

The payments giant PayPal officially announced its entrance to the cryptocurrency world on October 21, by revealing it would launch a cryptocurrency buying, holding, and selling feature. Although the PayPal’s announcement did not come as a major surprise, as rumours and insider reports have been circulating within the crypto community since June, the announcement did cause the crypto market to rally. As far as Bitcoin is concerned, PayPal’s entry is considered one of the key factors that pushed its price past $20,000 and set the ground for the currency’s new all-time highs.

While PayPal’s crypto functionality is currently limited to U.S. customers, the payments processing company has revealed its plans to expand its crypto services in 2021. PayPal’s representatives even said that they would allow users to spend their crypto balances at all merchants that support PayPal. In addition, PayPal’s crypto account is not a cryptocurrency wallet as it does not allow for crypto to be sent from it or received to it. What PayPal does allow, is to buy some cryptocurrency and hold it on their platform until the user decides to sell it at some point in the future. Doing so, PayPal actually degraded the functionality of crypto assets to a speculative investment, which, to be fair, is the primary use case of most cryptocurrencies.

5. The Great Market Crash of March 12

While 2020, has been mostly a great year for cryptocurrency holders, it would be unfair to only list the positive news and events that took place this year. There were also some negative events, such as the market crash that took place between March 12 and March 13. The market crash, induced by the fear of COVID-19 pandemic, started to take hold in the traditional markets at first but the uncertainty quickly spread to the cryptocurrency markets as well. The total cryptocurrency market cap almost halved, dropping to below $150 billion at the low-point in mid-March.

Bitcoin started the month at around $8,600 and even saw some gains in the first week of March, causing it to change hands at a price above $9,000 for two days. On March 8, the BTC price quickly slipped to $7,800, but the price drop did not end there. Between March 12 and 13, BTC further fell and only reached a bottom in the sub-$5,000, and even sub-$4,000 levels on some exchanges.

Despite the severity of the crash, the cryptocurrency market was relatively quick to recover in the coming months. In addition, following the crash of March 2020, the cryptocurrency market moved in high correlation with the U.S. stock market and even the precious metal market, only to outperform them all towards the end of the year.

6. The DeFi Craze of Summer 2020

While the decentralized finance (DeFi) protocols existed already in 2019, the sector really took off in the summer of 2020. During the so-called “DeFi summer”, “DeFi Hype” or “DeFi Craze”, we saw novel DeFi protocols popping up almost every day and aggressive price performances of the DeFi-related tokens.

The DeFi hype was kickstarted by Compound’s launch of their own governance token called COMP. Compound, being one of the most popular DeFi protocols, also introduced a special business model, where users are rewarded in the protocol’s governance token for simply using Compound. Many other protocols copied the model, and this sparked a new cryptocurrency niche called yield farming. Special yield farming protocols, which interacted with various DeFi protocols with the goal of obtaining the maximum possible yield, soon emerged.

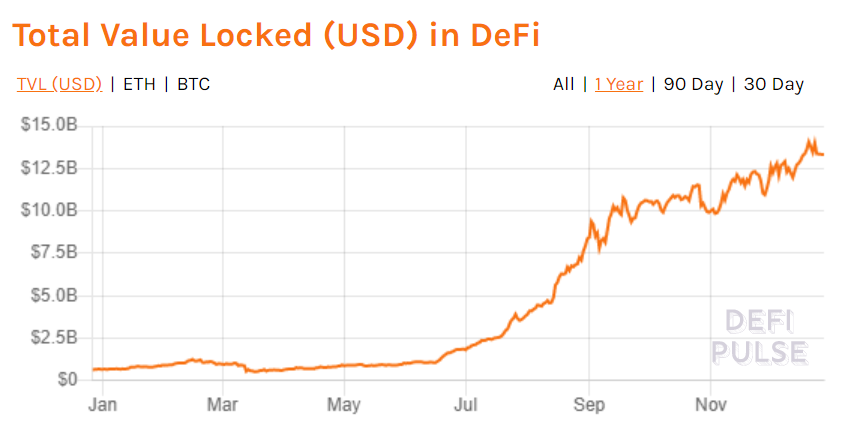

Also due to yield farming, the total value locked (TVL) in DeFi surged from just $670 million at the start of the year to over $13.3 billion at the end.

7. Record Issuance of Stablecoins

As we all know, classic cryptocurrencies can get super-volatile. To solve this problem, stablecoins emerged as alternative currencies that offer almost all the benefits of the cryptocurrency but remove, or at least minimize the risk of rapid price swings. Because they exist on the blockchain they are also more suitable to be traded on exchanges in various crypto trading pairs.

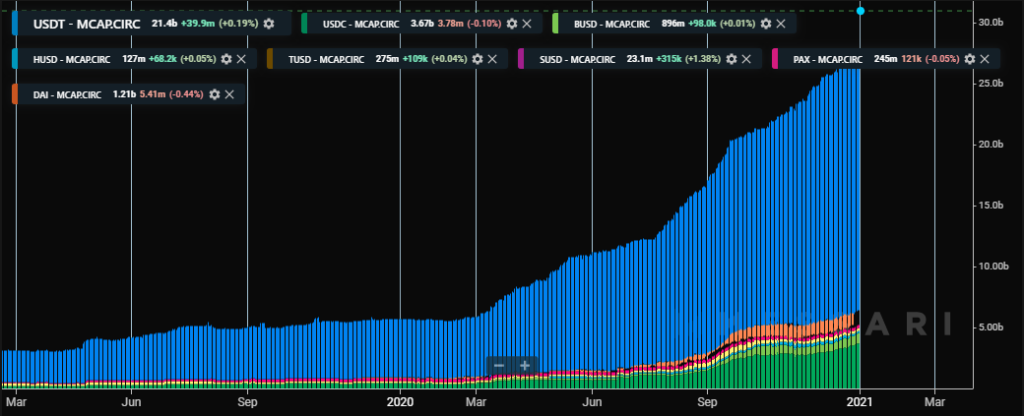

Although stablecoins faced rigorous regulatory pressure in 2020, their total market cap more than quadrupled this year, rising from $5.7 billion at the beginning of 2020 to more than $26 billion today. The largest market share belongs to Tether (market capitalization above $20 billion), which also saw the biggest absolute growth in 2020. The stablecoin transaction volumes also climbed throughout the year and surpassed a monthly adjusted transaction volume of $50 billion for the first time in June 2020.

8. Bitcoin Surges past $20,000 and posts Several Consecutive ATH Prices

Judging by the number of important and positive events linked to Bitcoin, you could imagine that the world’s largest cryptocurrency performed well this year. In fact, Bitcoin surpassed its all-time high price set on December 27, 2017 this year. After hoovering at around $10,000 since May, Bitcoin finally managed to lift off from the $10K line in mid-October 2020. The market gained additional traction following the PayPal’s news, but then struggled to break through $20,000 for a few weeks. Bitcoin first broke its ATH from 2017 on November 30, when it surged as high as $19,850. Nevertheless, this spike was short-lived, and Bitcoin faced a quick readjustment to around $19,150. The price than tried to break the psychological barrier of $20,000 several times, but only succeeded on December 16, when it surged to above $20,600. Only one day later, on December 17, Bitcoin posted a fresh new ATH price again, this time at $23,421. Bitcoin than continued the rally by breaking the $24,000 mark for the first time ever on Christmas day, and posting a yet again new ATH of $28,314 exactly three years after the peak of 2017’s bull run. The current ATH price stands at $29,250 and was set on December 31, 2020. At the time of writing, Bitcoin is trading just 0.5% below its ATH so, new fresh ATH prices in 2021 or even this year are very likely.

9. Uniswap’s Massive Airdrop of its governance token UNI

Uniswap is an automated market maker (AMM) and a decentralized exchange (DEX) built on Ethereum that allows users to swap between different cryptocurrencies directly on the Ethereum blockchain. Uniswap was the undisputed king of AAMs until SushiSwap, a project that forked the open-source code of Uniswap emerged and spiced the things up by introducing an attractive incentive model for liquidity providers. SushiSwap sucked a lot of liquidity from Uniswap but lifted a lot of dust in the community and sparked a heated debate whether such practice is healthy for the ecosystem as a whole.

During the “DeFi Summer” Uniswap was one of the few leading DeFi projects without its own token. This changed on September 17, when Uniswap launched their own governance token called UNI. The tokens were distributed in the form of an airdrop, with each Ethereum address that interacted with Uniswap protocol prior to the announcement receiving 400 UNI tokens. The UNI airdrop was massive as one could sell the 400 UNI for over $1,000. You could imagine that this made over 250,000 Ethereum addresses owners eligible for the airdrop very happy. With the airdrop, Uniswap also popularized the token distribution strategy, which rewards users who gave the platform a shot before there were any direct incentives to do so.

10. The U.S. Securities and Exchange Commission sues Ripple over XRP

Ripple was created in 2012 as a cryptocurrency gross settlement and cross-border transaction platform. The creators of the XRP Ledger “gifted” the majority of XRP supply to Opencoin, a company known as Ripple today. In a recently filed lawsuit the U.S. Securities and Exchange Commission (SEC) alleges that Ripple’s sales of XRP constituted an unregistered security offering. Ripple on the other hand claims that XRP is not a security as owning XRP does not give its holders any rights pertaining to the company. In addition, Ripple believes that the price of XRP is not determined by the company’s activities. Nevertheless, the fintech company owns over 50% of the XRP supply and regularly liquidates their holdings. In fact, Ripple CEO Brad Garlinghouse stated that his company would not be turning a profit if it was not for its XRP sales in March.

The news of the SEC coming after Ripple caused the price of XRP to drop over 60%, before finding the new ground around the price of $0.20. In light with the impending lawsuit, several major exchanges, including Coinbase, announced that they would be halting XRP trading on their platforms, trying to distance themselves from the alleged unregistered security offering. The decision of the court in the case of the SEC vs. Ripple could have a major influence on the cryptocurrency regulatory landscape and could set a precedent for all cases that will follow. If the court ends up siding with the SEC, other cryptocurrency projects could be negatively affected as well.

2021: Bring it on!

We saw plenty of developments, regulatory changes, and innovation in 2020. Bitcoin emerged as a popular hedge against inflation, which combined with institutional investors entering the game caused its price to surge to a new ATH, while the second largest cryptocurrency is making everything ready to move to Proof-of-stake and increase its capabilities by upgrading to Ethereum 2.0. Combined with the rapid progress of several other altcoins and the increased usage of stablecoins, we can confidently say that the whole cryptocurrency space grew, both in terms of valuation and maturity, quite a lot in 2020. At CoinCheckup, we are already looking forward and hoping for more similar or even better developments in 2021.