Many retail investors are trying to chase the high returns that are achievable when buying assets via a public sale, whether it is in the form of a crypto-based initial coin offering (ICO) or during an initial public offering (IPO) on a stock exchange. While acquiring assets as soon as they are publicly available usually proves to be a great buying opportunity, average ICO and IPO returns on investment pale in comparison to yields generated in private markets.

Retail investors have had no convenient options of accessing private equity until now – enter prePO

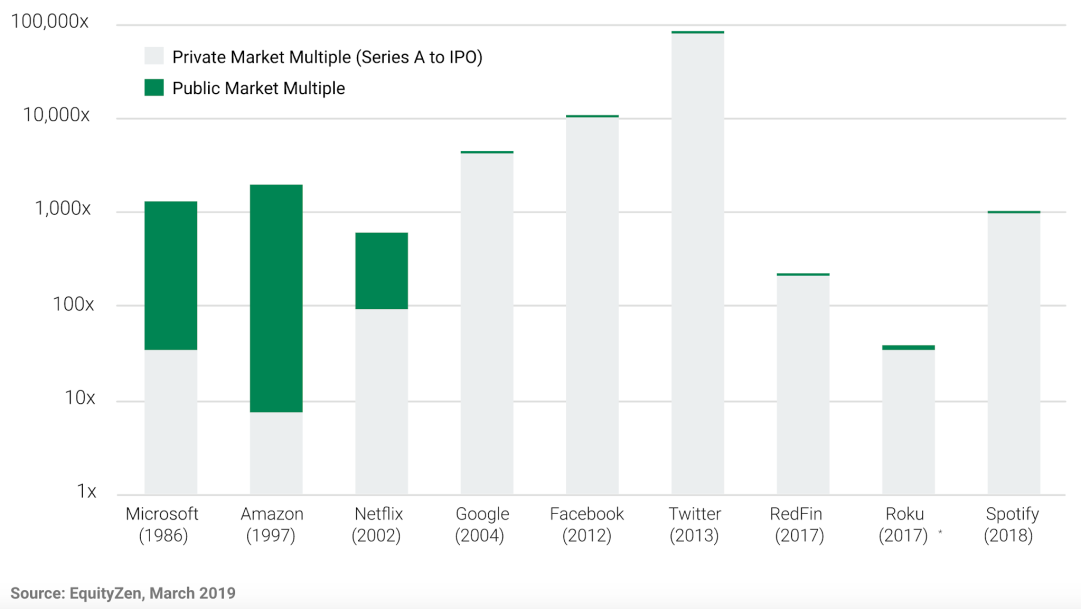

To get a sense of just how much disparity there is between private and public markets, we’ll use Facebook as an example. The social media giant opened its public trading in 2012 with a share price of $38. In nearly a decade post its IPO, Facebook’s stock has increased by 825% (at current market rates). A great return by any means.

However, more than an 8-fold increase in value is virtually nothing compared to the staggering 10,000x price growth the company has experienced between its Series A funding round leading up to its eventual IPO, according to data provided by EquityZen. Other tech giants, such as Twitter, Google, and Spotify have also experienced a vast percentage of their growth during the pre-public phase.

The unfortunate reality is that getting an equity allocation during private investment rounds is virtually impossible for regular investors. The access is mostly restricted to venture capitalists, family offices, and accredited wealthy investors. Enter prePO.

prePO is a decentralized trading platform that aims to democratize access to pre-public trading action, whether it is a pre-IPO company, or a pre-token blockchain project.

How does prePO work?

prePO (short for ‘pre-IPO’) leverages the capabilities of Ethereum Layer 2 scaling solutions to achieve high transaction speeds with low costs, while retaining a high level of security. prePO synthetic markets allow everyone to make a prediction on the expected initial public value of a specific company or a crypto project.

prePO protocol allows users to enter so-called ‘long’ or ‘short’ positions on pre-public companies, including SpaceX, Gemini, OpenSea, and many more.

As mentioned before, users can decide to take the trading route, and set parameters on their long or short orders, or take the less volatile approach of providing liquidity to synthetic markets. Liquidity providers (LPs) are compensated for their services with different types of rewards, ranging from collateral farming benefits to PPO token incentives. As all prePO synthetic assets are based on the ERC-20 standard, new features, such as multi-layered staking rewards and loan collateral, can be easily added.

The soon-to-be-released PPO token (prePO’s native governance token) will allow its holders to participate in the platform’s governance system. One of the most exciting features introduced by the token is the PPO holders’ ability to vote on which new private company or a blockchain project should be added to the list of available prePO markets.

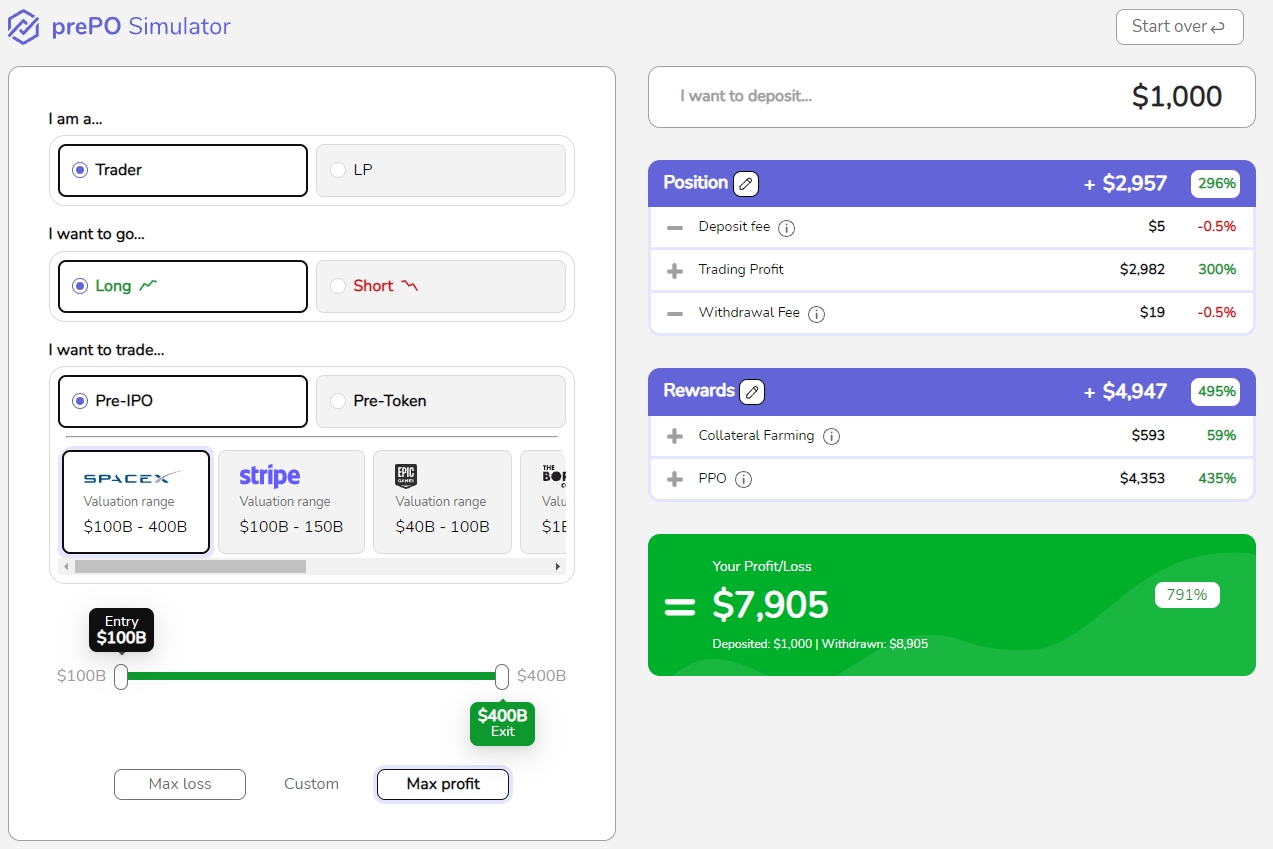

Interactive prePO Simulator allows you to explore the platform’s capabilities

If you are interested in what prePO is building, you can check out the prePO Simulator, which lets you familiarize yourself with the platform’s capabilities, and find out the differences between various synthetic markets.

The free simulation tool is meant to give an overview of prePO functionality, such as finding out how the rewards and trading position properties are calculated depending on the selected ‘Trader’ or ‘LP’ options, and how they vary as parameters are changed.

prePO has set out to achieve ambitious goals in the next couple of months. By the end of this year, the company is planning to release a working demo version of its products and services, launch the governance system as well as a testnet beta, and launch the PPO token.