The emergence of decentralized financial (DeFi) products and services has completely transformed the cryptocurrency investing landscape over the last couple of years. Spot and futures trading is no longer the only game in town. Digital currency investors, particularly those who lack the time required to closely observe market movements to identify good buying and selling opportunities, can take advantage of passive income sources that are less risky and in some cases more lucrative.

While numerous decentralized and centralized crypto services have arisen that allow their users to take advantage of various financial instruments designed for passive income generation, few offer yield generating prowess of Midas.Investments.

Midas.Investments turns market inefficiencies into yield generating opportunities

Midas.Investments is a custodial digital asset investment platform that provides its users with an opportunity to build sustainable passive income streams and unlock the full potential of their crypto assets. The platform supports Bitcoin, Ethereum, and a long list of popular crypto assets.

The Midas.Investments team has developed a robust investing system that takes advantage of minute inefficiencies in the market to provide one of the highest yield generating services in the DeFi sector. The company utilizes its users’ digital holdings in order to distribute liquidity across the market in a peer-2-peer (P2P) manner. In return, Midas.Investments investors are rewarded with enticing APY rates that provide a great long-term investment opportunity.

Midas.Investments DeFi investing strategies

Midas.Investments investment strategies take into account price volatility, correlation, collateral asset models and hedging, for maximum yield generating efficiency while retaining a high degree of financial security.

Let’s take a look at some investing strategies Midas.Investments employs to grow user deposited crypto assets during opportune market conditions and in turn preserves them in times of market turmoil.

Concentrated liquidity provider for Uniswap V3

Staking assets in decentralized exchange (DEX) lending pools is one of the more popular ways of putting otherwise idle crypto assets to use. Liquidity providing is not risk-free, primarily due to the potentially high divergence in prices of the two pool assets, which can lead to dreaded impermanent loss. Midas’ self-collateralization method of lending target assets and liquidity negates much of the liquidity-providing risks. Midas aims for a 20% – 60% annualized percentage rate (APR) for deposited assets, earned from LP trading fees.

Borrowing for target asset’s collateral to free liquidity

Midas.Investments takes a strategic position on a target asset at a liquidation value higher than 40%. This method unlocks additional liquidity and serves best in a combination with another investment strategy; however, a loan can approach the liquidation level quickly if the price of the asset unexpectedly depreciates and then requires additional collateral, or debt repayment to maintain a safe loan-to-value (LTV) ratio.

Yield vaults

Another method Midas.Investments utilizes are the low-risk YFI strategies, which maximize interest rates on lending across different lending protocols and can accrue up to 15% APR. Insurance protocols and insurance funds ensure that user funds are completely safe at all times. Midas seeks to interact with smart contracts powering the platform during nighttime when the gas fees are at their lowest.

Asset and stable liquidity provider to hedge from market pullbacks

To hedge against market downturns, Midas provides liquidity in liquidity pools consisting of “regular” crypto assets and stablecoins, such as USDT or USDC. This approach nets significant profit in times of bearish market activity and can generate anywhere between 30% to 150% APR.

Leveraged liquidity farming

The riskiest method Midas.Investments uses. Combining assets with a stablecoin pair grows the asset amount during market pullbacks, which can net up to 75% APR if market conditions are optimal but introduces considerable risks during periods of flat markets with high volatility.

Midas.Investments uses a complex combination of different investing strategies, ranging from low to high-risk methods, to ensure up to 40% APR for a single asset regardless of market conditions.

To learn more about the different types of strategies the company employs to generate yield for its customers, check this insightful blog post from Midas.Investments.

Earn up to 28% annual interest on your investment in DeFi YAP

One of the better ways to grow your crypto portfolio is to invest in Midas’ DeFi Yield Automated Portfolios. The DeFi YAP consists of eight tokens by rapidly developing projects in the decentralized space, including ETH, LINK, SUSHI, AAVE, MIDAS, UNI, DAI, and SNX. Each of the listed DeFi assets accounts for the same share of the DeFi YAP, with 12.5%.

The Midas’ flagship DeFi investment vehicle provides users with an opportunity to earn a passive income of up to 28% annually. Since the DeFi sector is still very young and continuously changing, there is a higher degree of risk, but also a bigger upside, when investing in DeFi YAP than in Midas’ stable YAPs.

Earn stable passive income with Yield Automated Portfolios (YAP)

The Yield Automated Portfolios (YAP) are an excellent choice for investors that value asset stability over riskier approaches that can generate a higher yield but are wholly dependant on the state of the market. Midas offers two types of automated portfolios, which differ in the coins they support and the amount of yield they can theoretically generate. Both types provide great potential for long-term portfolio growth, feature weekly BTC payouts, and a reasonable fee structure.

Stable Yield Automated Portfolio (SYAP)

The investment in the Stable Yield Automated Portfolio is quantified with the SYAP token, which is not a blockchain token but a measuring unit for YAP investments. SYAP is backed by BTC, ETH, MIDAS, and USDT, and priced according to their market values.

The group of four tokens ensures maximum long-term stability and allows SYAP to generate a passive income stream of 23% APY. It is worth noting that automated portfolio rebalancing is done monthly to redistribute funds among different coins to optimize profits.

Masternode Yield Automated Portfolio (MnYAP)

Similar to SYAP, the Masternode Yield Automated Portfolio is managed by a special non-blockchain-based token MNYAP, which is priced based on the value of its underlying support assets.

The Masternode YAP consists of BTC, DIVI, ESBC, MIDAS, NRG, PHR, XZC, and ZEN, which were chosen according to their market performance and community engagement. Midas purchases the coins on their users’ behalf and uses advanced investing strategies to generate 20% – 25% APY rewards.

Platform security and fees

Midas.Investments uses a combination of various security measures to provide a maximum level of security and shield user funds from any malicious attacks. The first line of defense includes handling of all sensitive information through email and an IP-validation check. The investing platform also features 2 Factor Authentication (2FA), which means that user accounts are not accessible without a code that is sent via an email. As an added precaution, Midas performs automatic logouts every seven days. Finally, 90% of users’ funds are held in encrypted cold wallets, meaning that even if an unlikely breach occurs, it wouldn’t result in losses for customers.

The company charges a 5% fee on payouts before they are processed to the Bitcoin balance, and a 0.8% rebalancing fee, which is deducted after the monthly portfolio rebalancing has been processed.

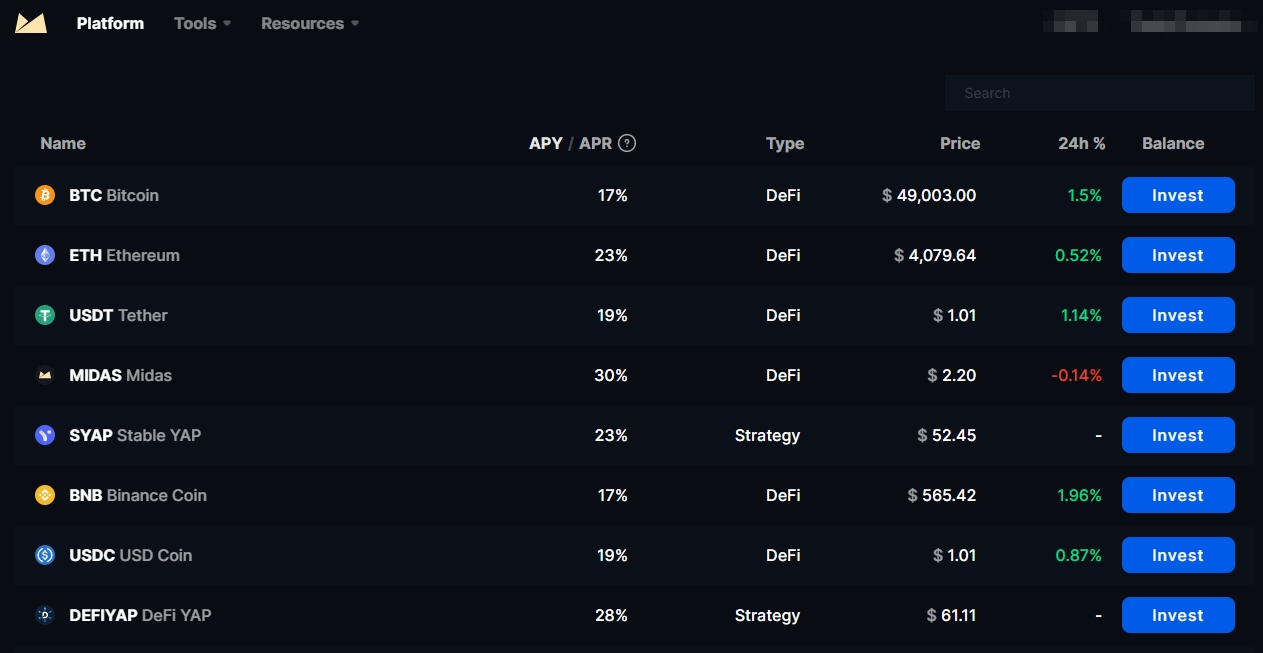

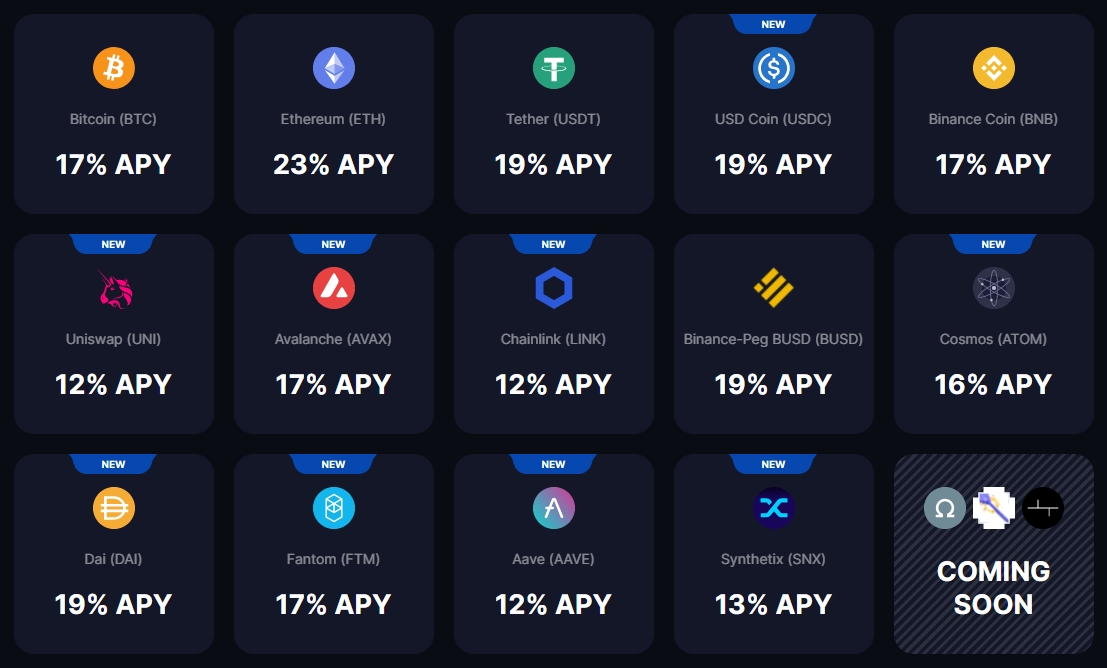

Supported crypto assets

Midas.Investments supports 28 digital currencies in addition to the platform’s native Fantom blockchain-based MIDAS token, which provides a long list of benefits to Midas platform users. For more information about the MIDAS token click here.

Here’s a complete list* of supported coins in alphabetical order: AAVE, ATOM, AVAX, BNB, BTC, BUSD, CELO, DAI, DASH, DEFIYAP, DIVI, ETH, FIRO, FTM, LINK, LTC, MIDAS, MN YAP, NRG, PIVX, SAPP, SNX, SUSHI, SYAP, TRTT, UNI, USDC, USDT, ZEN

*The list is subject to change. Data was collected on 6.12.2021.

Gain exposure to the growing DeFi market guided by expert insight by Midas team of analysts

Midas.Investments has emerged as one of the market leaders in providing enticing passive income streams for cryptocurrency holders. No lock-up periods, no limits on deposits, and innovative investment strategies make the Midas platform one of the more flexible and lucrative solutions in the sector.

There is no better argument supporting that claim than cold hard facts – more than 23,000 investors have a total of $51 million worth of crypto assets committed to the platform. In October 2021 alone, Midas.Investments helped its customers generate a whopping $780,000 in stable passive income.

Midas team consists of notable analysts and software developers with rich experience in product development and over 20 years of high-level investment decisions under their belt.

For more information about the high yield generating financial options of Midas.Investments check their official website.