Key takeaways:

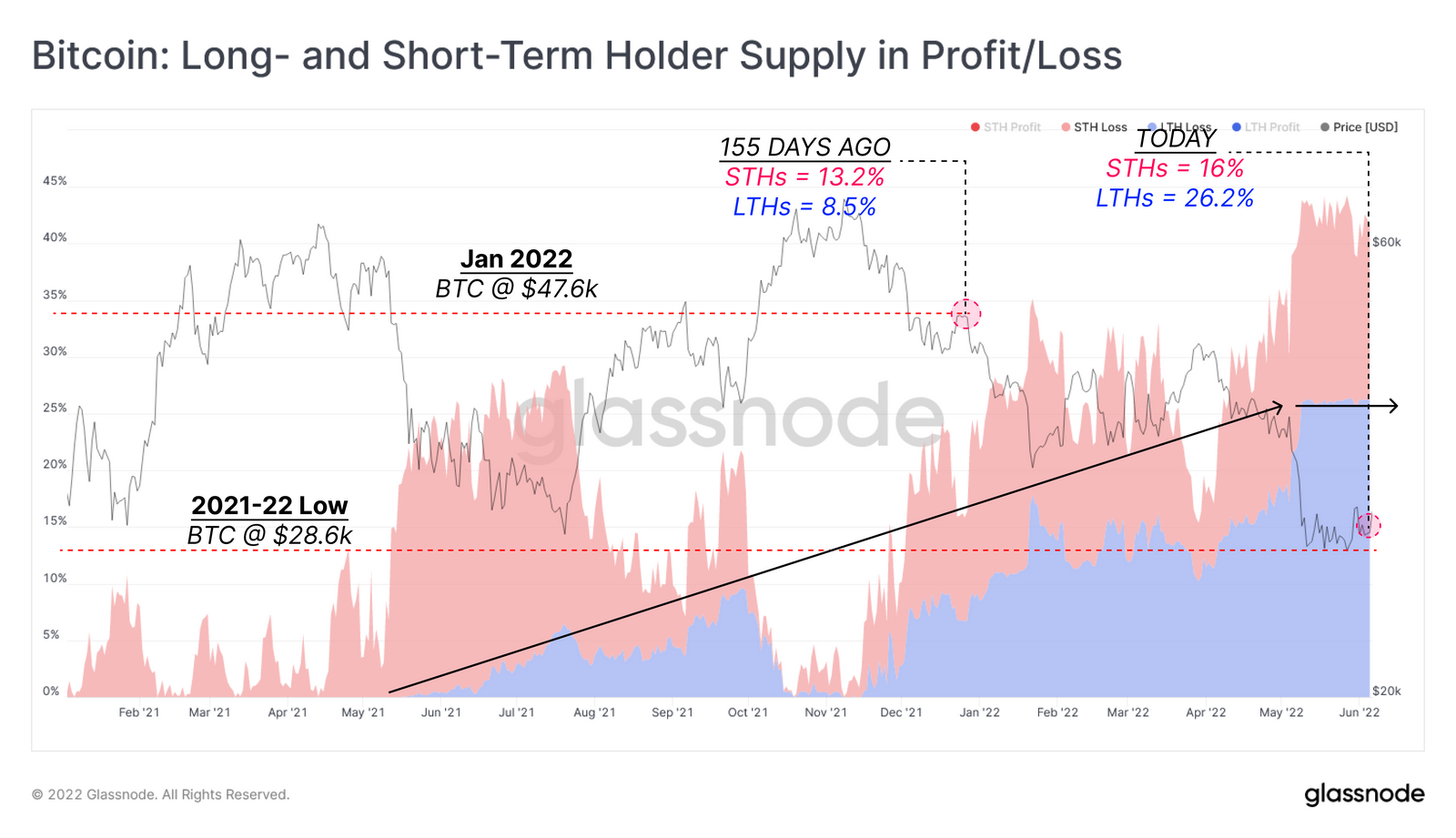

- Today’s Bitcoin retracement to sub $30,000 price levels increased the share of LTH supply in loss to the largest share since March 2020

- Despite the bearish activity in recent months, we have not yet seen drawdowns to the extent that in previous bear markets

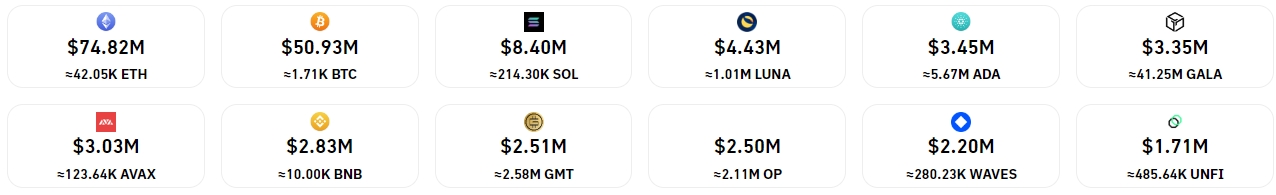

- The drop in the value of most digital assets has led to more than $200 million of longs being liquidated in the last 24 hours

Long-term holders are now suffering losses comparable to previous bear markets

The cryptocurrency market has been caught in a downward spiral of gradual price declines fueled by rising interest rates, growing inflation, and broader geopolitical uncertainty. Although several major digital assets surged by double-digits yesterday, the rally was apparently short-lived.

According to the latest report by blockchain analytics firm Glassnode, long-term holders (LTHs) of Bitcoin are absorbing the brunt of the losses due to negative price movements in recent months. “LTHs are shouldering more of the unrealized losses (a constructive reshuffling of coin ownership), and currently holds around 62% of the 2021-22 cycle supply in loss,” reads an excerpt from the report.

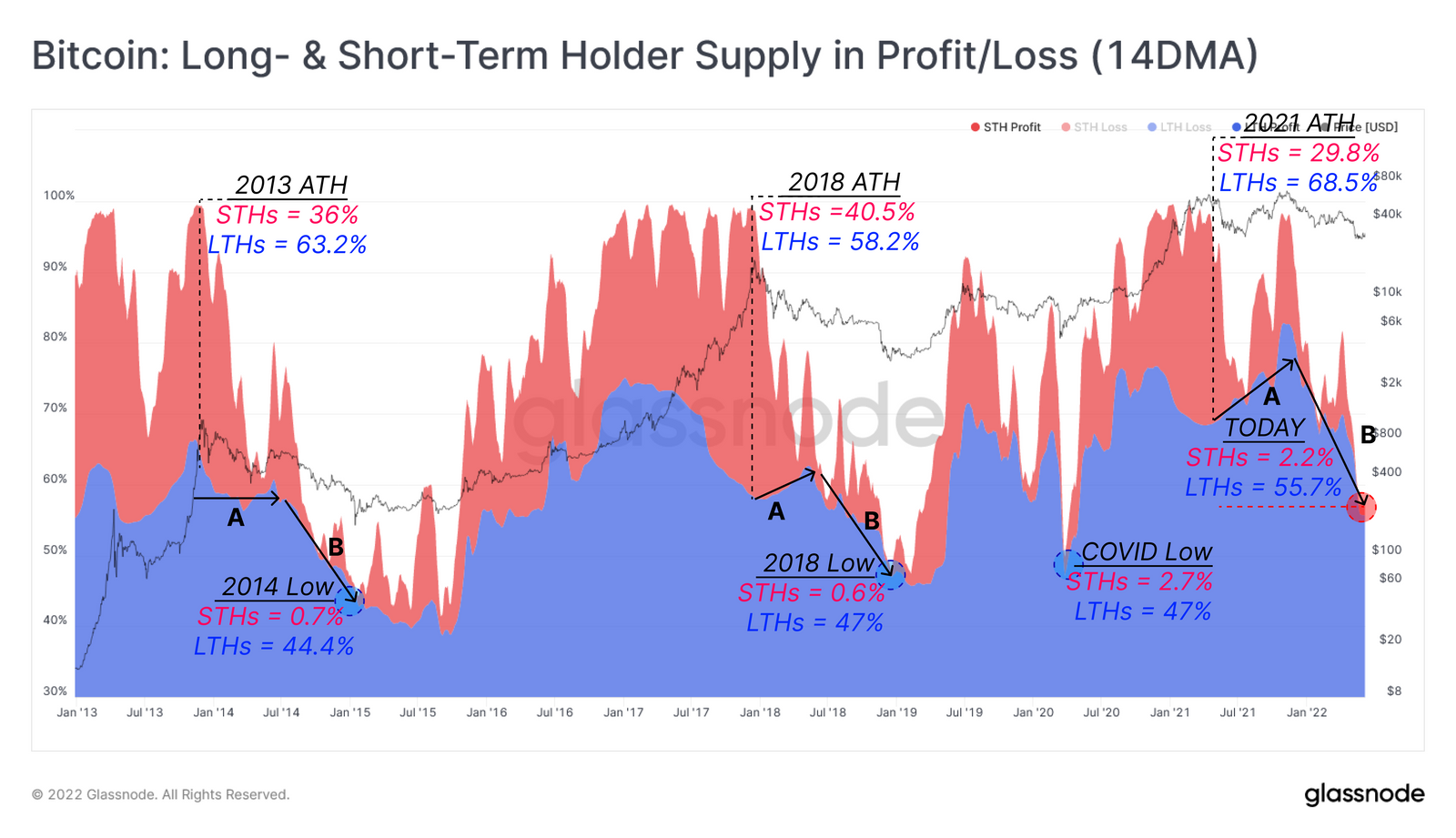

However, zooming out beyond the 2021-2022 cycle shows that LTHs still own by far the largest share of BTC supply that is in profit, with 55.7%, compared to STHs’ 2.2%. This is still substantially higher than in previous bear markets – during the 2014, 2018, and 2020 (COVID-related) lows, between 44.4% and 47% of the LTH supply was in profit.

This could mean that we have not yet reached capitulation levels and Bitcoin could shed more of its value going forward. Glassnode notes that we have not yet witnessed the 75%+ drawdowns from previous bear markets so any direct comparisons with previous bear markets could be off target for the time being. For context, the extent of the current drawdown is about 58% (measured as the relative distance from BTC’s peak in the previous bull cycle).

$125 million of BTC and ETH longs were liquated in the last 24 hours

Today’s retracement in the value of Bitcoin (-5.5%), Ethereum (-6.1%), and virtually every other digital asset has led to more than $207 million in liquidations over the past 24 hours. According to data curated by Coinglass, the largest share of the losses was accrued by traders going long on Ethereum, who lost nearly $75 million. Bitcoin long contracts liquidations were not far behind, with roughly $51 million being liquidated in the past day.

The dip in the value of major digital currencies saw the total cryptocurrency market cap shrink by roughly 5% today, to $1.27 trillion. For context, the lowest market capitalization value this year was reached roughly three weeks ago, at approximately $1.25 trillion. For an even lower point, we have to go all the way back to February 2021, when the total market capitalization stood at sub $1.2 trillion levels for the last time.