Binance Loans is a platform that lets crypto investors borrow digital assets by staking their existing spot assets as collateral. In addition to “regular” assets like Bitcoin, Ethereum, and BNB, users can borrow cross-chain bridge tokens like BETH as well.

What is Binance Loans?

Binance Loans is a digital investment service that enables users to deposit their crypto assets as collateral to take out a crypto loan. In total, the service supports close to 100 loanable assets and over 70 collateral assets. The list of supported assets includes:

- Bitcoin

- BETH

- BNB

- Cardano

- Dogecoin

- Ethereum

- Polkadot

- Polygon

- Uniswap

- XRP

When borrowing crypto assets, Loans users can, as a rule of thumb, secure anywhere from 60% to 65% of the value of their collateral as a Binance loan – this is called the Loan to Value ratio (LTV). In other words, depositing $1000 worth of crypto assets as collateral, allows users to take out a crypto loan with a USD value of $600 – $650.

Borrowed crypto accrues interest, which can vary greatly depending on the asset type. For example, borrowing Bitcoin costs just 2.28% on a yearly basis, whereas borrowing Avalanche costs more than 50%.

There are considerable differences between various assets in terms of maximum collateral amount, interest rate, borrowing limit, and other loan parameters. You can see the standard values of these parameters, and their ranges, down below:

- Interest rate (Annually): 2.28% – 50.37%

- Initial LTV: 60% – 65%

- Margin Call: 75%

- Liquidation LTV: 83%

- Collateral limit: $2,000 – $3,500,000

- Minimum single loan amount: $100

- Borrow Limit: $10,000 – $2,200,000

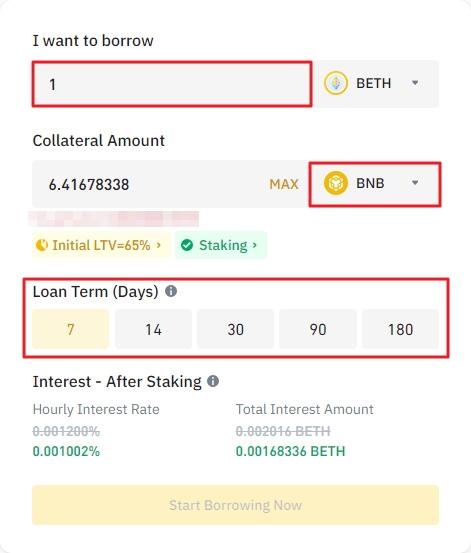

Crypto loans on Binance come in five different term durations, including 7, 14, 30, 90, and 180 days. It is worth noting that the loans can be repaid before their expiration date. Failure to repay a loan within 72 hours of its expiration results in the automatic closure of the position, with the remaining funds used for repayment.

A relatively new feature that is available on Binance Loans is the so-called Loan Staking, which allows users’ collateral to be staked and used to support on-chain operations. Staking rewards accrued are used to offset the cost of interest rates – in some cases, interest rates can fall all the way down to zero percent, making the option especially attractive for owners of supported Proof-of-Stake (PoS) coins.

What is a cross-chain bridge token?

A cross-chain bridge token is a digital asset that transfers the properties of a particular token from the source blockchain to a destination blockchain. Cross-chain bridge tokens are useful because blockchains are not natively designed to communicate with each other. Case in point, depositing BTC directly to the Ethereum network, and vice-versa, results in a loss of funds.

For this reason, interoperability products that are capable of connecting different blockchains have become quite popular in recent years. Usually referred to as token bridges, these tools allow a token’s value to be transferred from one blockchain to another. Tokens bridged to a destination chain are often referred to as wrapped tokens, although not always.

For example, Wrapped Bitcoin (WBTC) is an Ethereum ERC-20 token that represents BTC on the Ethereum network and can be swapped for BTC at a 1:1 ratio at any time. WBTC’s purpose is to allow BTC holders to participate in decentralized finance (DeFi) on Ethereum, which is not possible with “regular” BTC.

Another popular cross-chain bridge token is BETH, which is issued any time that ETH is staked on Binance Staking. BETH is a BNB Smart Chain-based token representing ETH at a 1:1 ratio. When deposited in a Binance Spot account, BETH allows holders to generate up to 5.2% APR in Ethereum staking rewards.

As mentioned previously, Ethereum holders can stake their ETH to gain BETH. But there are other ways for Binance users to get their hands on BETH – namely, the spot market and Binance Loans options. We’ll examine the latter option in more detail in the following sections.

How to borrow cross-chain bridge tokens using Binance Loans?

Borrowing BETH – or any other supported cross-chain bridge tokens on Binance Loans – is a very straightforward process that takes only a couple of minutes altogether. To start, you must first head to the Binance Loans platform. You can do so by clicking on the button below.

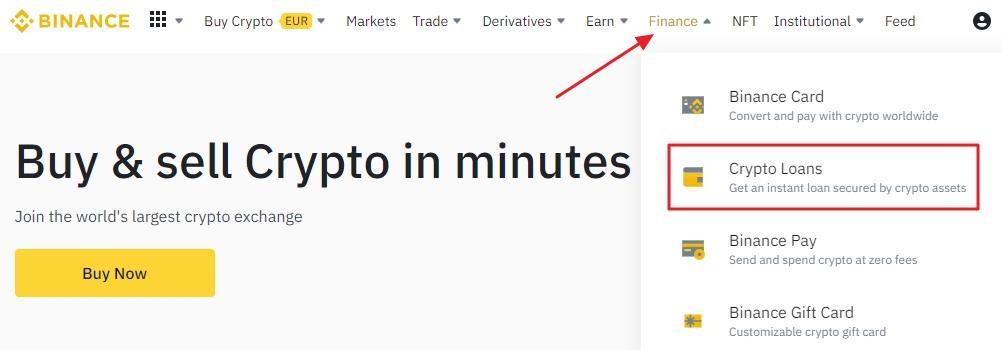

Step 1: Open Binance Loans

To open Binance Loans, navigate to the Crypto Loans button that is nested in the Finance drop-down menu on the homepage.

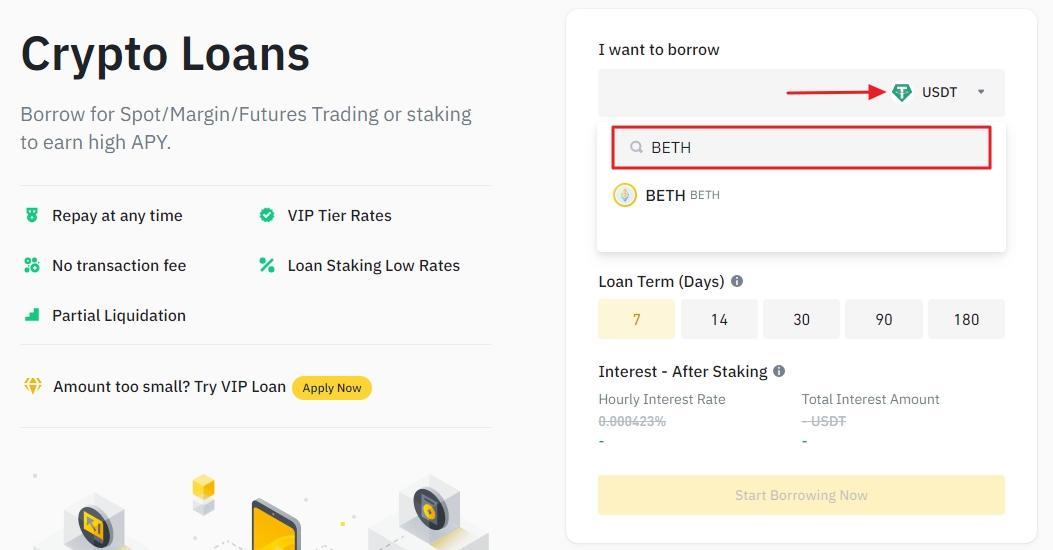

Step 2: Search for the token you want to borrow

Select the cryptocurrency you want to borrow. For the purposes of this guide, we’ll be borrowing BETH. Keep in mind that the process of finding the coin or token you want to borrow is the same no matter the asset.

Step 3: Select crypto collateral, borrowing amount, and loan duration

Proceed by selecting the collateral type you wish to secure your loan with. After that, select the duration of the loan and enter the borrowing or collateral amount. Both amounts are directly tethered to each other. You can see the interest rate data (and the reduced rate thanks to Loan Staking) at the bottom of the screen.

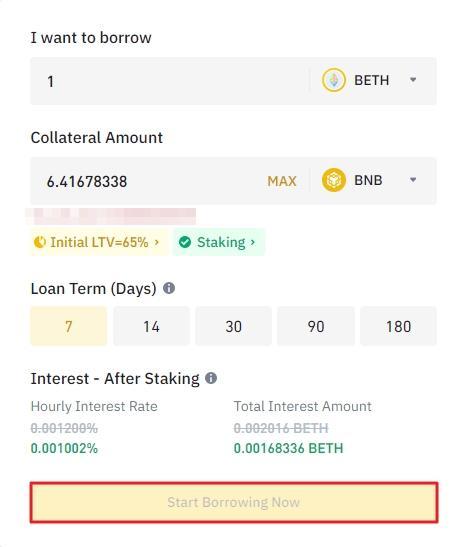

Step 4: Borrow crypto

If you are ready to confirm your loan, click Start Borrowing Now. You’ll be greeted by a popup that showcases all parameters of your newly created Binance Crypto Loan.

To manage ongoing orders and see your loan history, head to the Loan History section, which is located in the Orders drop-down menu on the account page.

Final thoughts

Binance Loans is a cryptocurrency investment service that enables crypto holders to leverage their existing spot assets to magnify their market exposure. Binance Loans supports a vast number of digital currencies, including cross-chain bridge tokens like BETH, which are quickly gaining in popularity in recent years.

Unlike traditional loans, which generally require a good credit score, are very rigid in loan terms, and sometimes disincentivize early repayments with poor repayment schemes, the borrowing service provided by the Binance crypto exchange suffers from no such drawbacks.

For more information, we kindly ask you to check this helpful repository of the most frequently asked questions about Binance Crypto Loans.