Cryptocurrency loans are, in principle, very similar to traditional loans. In both cases, a borrowing party parts ways with their capital for a period of time in exchange for interest payments. However, they differ in one fundamental aspect – cryptocurrency loans are obtained by collateralizing digital assets and are entirely devoid of credit scores.

What are crypto loans?

Cryptocurrency loans represent a paradigm shift in the way individuals and businesses can obtain extra capital. Instead of relying on a good credit score to borrow funds, borrowers using cryptocurrency lending platforms such as Binance Loans can get additional capital based on the amount of crypto assets they own.

Crypto loans usually last for a shorter period of time than traditional loans, which is beneficial to both the borrower and lender due to the relatively high volatility of digital assets. With Binance Crypto Loans, you can borrow over 60 different types of crypto assets by staking over 25 types of collateral. The service supports major digital currencies like Bitcoin and Ethereum, stablecoins like Tether, USD Coin, and Binance USD, as well as smaller altcoins such as dYdX and Mdex.

The borrowed funds are entirely yours with no strings attached, apart from having to repay your loan in due time, of course. You can choose to trade them, stake them, or even transfer them from Binance to other crypto platforms.

Comparing Binance Crypto Loans and traditional loans

Binance’s loan offering boasts numerous benefits in to traditional financial products. Here’s a list of five of them in no particular order:

- Low-interest rates and no hidden fees – Binance charges hourly interest on borrowed funds, which typically range from 0.025% to 0.040% per day (approx. 9.1% to 14.5% on a yearly basis). For context, the US’s average credit card interest rate in February 2022 was 20.4%, nearly double what Binance charges. For a complete and up-to-date list of Loans fees and borrowing limits, click here.

- No credit score required – Perhaps one of the more noteworthy benefits of crypto loans. Binance treats all of its customers the same, meaning that the maximum loan amount and fee structure differ based on the individual’s portfolio of physical crypto assets and not on their arbitrarily set credit score. For context, in traditional financial circles, the rate between customers with good and bad credit scores fluctuates in excess of 20% on average.

- Shorter loan terms – Another benefit of Binance’s offering is the high flexibility when it comes to loan durations. The company provides five loan terms – 7, 14, 30, 90, and 180 days – ideal for increasing short-term exposure to crypto markets.

- Non-taxable – Since securing additional capital through Binance Crypto Loans doesn’t require any sort of interaction with fiat, you can obtain extra crypto capital without incurring taxes on your digital assets.

- Effortless loan management – Binance’s loans can be managed from the comfort of your home with no paperwork required. You can adjust your collateral amount, repay the whole loan amount or just a part of it, and more, at any time, directly from the Binance Crypto Loans dashboard.

How to use Binance Crypto Loans?

We’ve covered the intricacies of using Binance Crypto Loans in one of our previous posts. Click the link below for a step-by-step guide to Binance’s loan service and to learn more about the terminology and loan management aspects of Binance’s loan offering.

Below you can find a brief overview if you prefer a more condensed version to get you started with Binance Crypto Loans. In the following example, we’ll be covering how to stake BUSD as collateral to borrow Bitcoin for a duration of seven days.

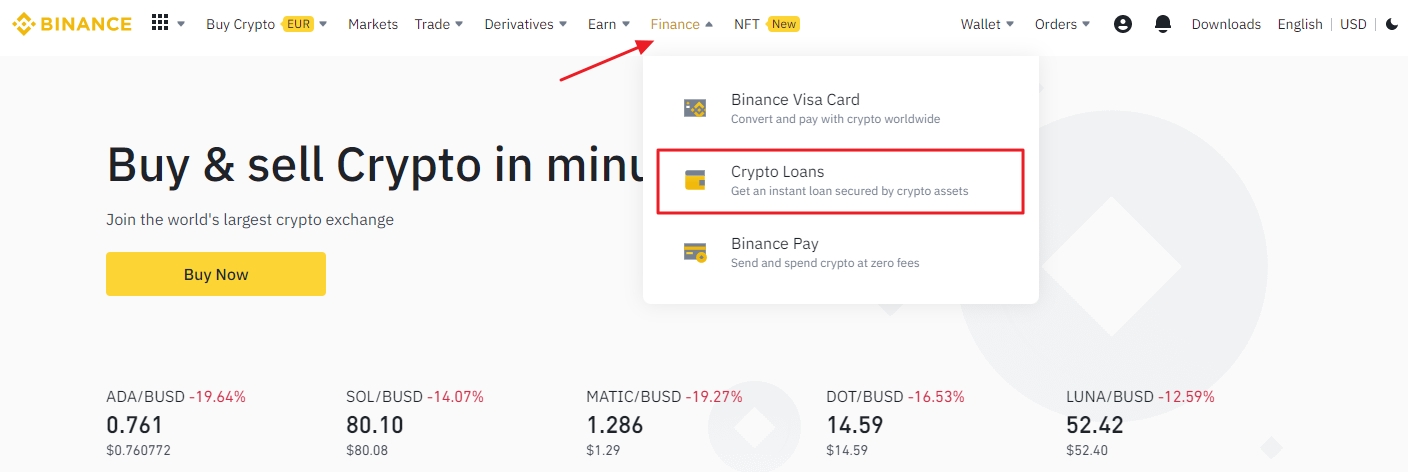

First, you’ll have to log in to your Binance account and click on “Crypto Loans”, located in the “Finance” drop-down menu on the Binance homepage.

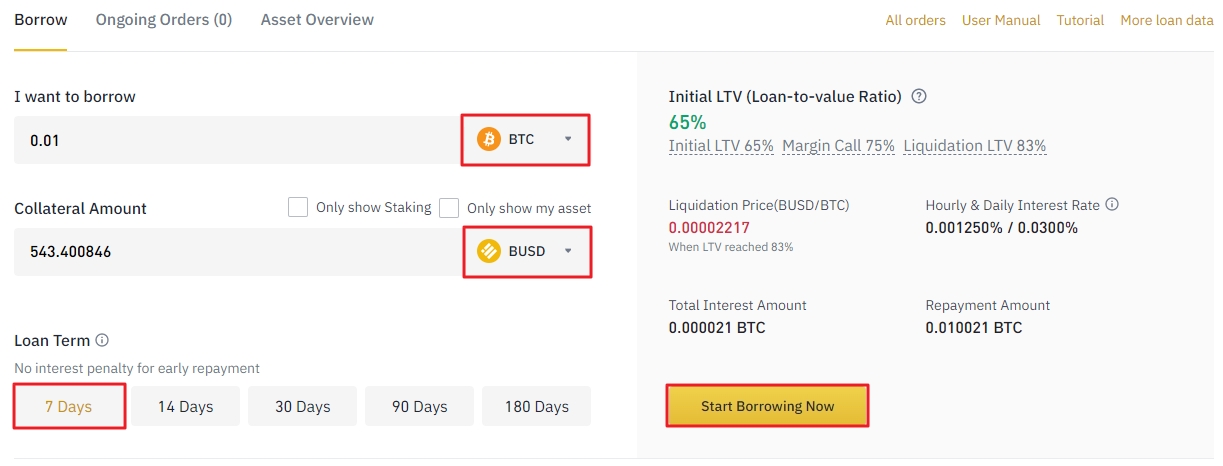

In the Loans dashboard, you can select the cryptocurrency and the amount you wish to borrow, type of collateral loan term, and more. As mentioned before, we’ll be borrowing 0.01 BTC for a week by staking BUSD as collateral. At BTC’s current market rates of roughly $35,400 and the loan-to-value ratio (LTV) of 65%, we’ll need to provide approximately 543 BUSD from our spot account as collateral.

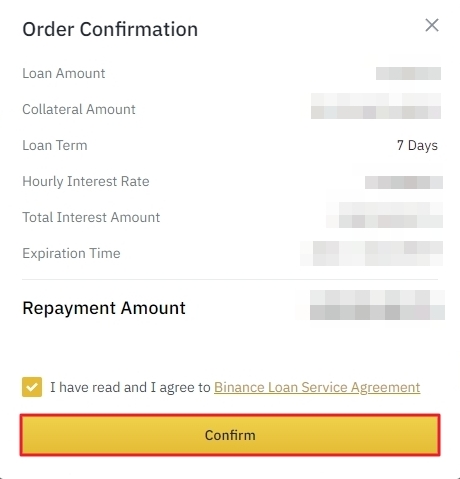

Once we’ve clicked on the “Start Borrowing Now” button, a confirmation message appears, asking us to confirm our loan parameters.

After agreeing to Binance Loan Service Agreement and clicking on confirming the loan order, the interest on our borrowed Bitcoin has started accruing at a rate of 0.00125% per hour. After borrowed funds and loan interests are paid back, the collateral (in our case, 543 BUSD) is sent back to the spot account.

At this point, we again invite you to check our previous guide on Binance Crypto Loans for more information about loan management, repayment process, and LTV adjustment.

What special functions do Binance Crypto Loans have?

In addition to some of the benefits we’ve listed earlier in this article, and apparent features like buying or selling Bitcoin with BUSD, for example, Binance Crypto Loans users also have the opportunity to take advantage of the service’s unique attributes.

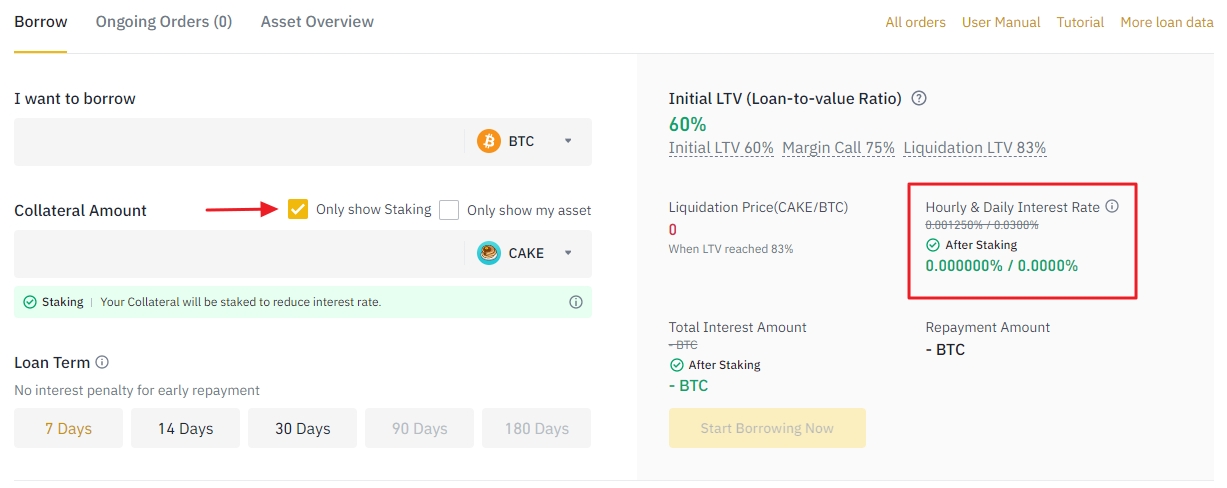

Loan Staking

Loan Staking is one of the more recent additions to Binance Loans. First launched last October, the new feature stakes loan orders with supported coins as collateral to reduce interest. As of the time of this writing, the staking feature is available for the following collateral assets: CAKE, CTSI, DOT, KSM, MDX, NEAR, and SOL.

The rewards generated by supporting the operation of the specific asset’s underlying blockchain network can offer considerable discounts on Loan interests. For context, using CAKE as collateral to borrow BTC drops the daily interest rate from 0.03% to zero.

Loan renewal

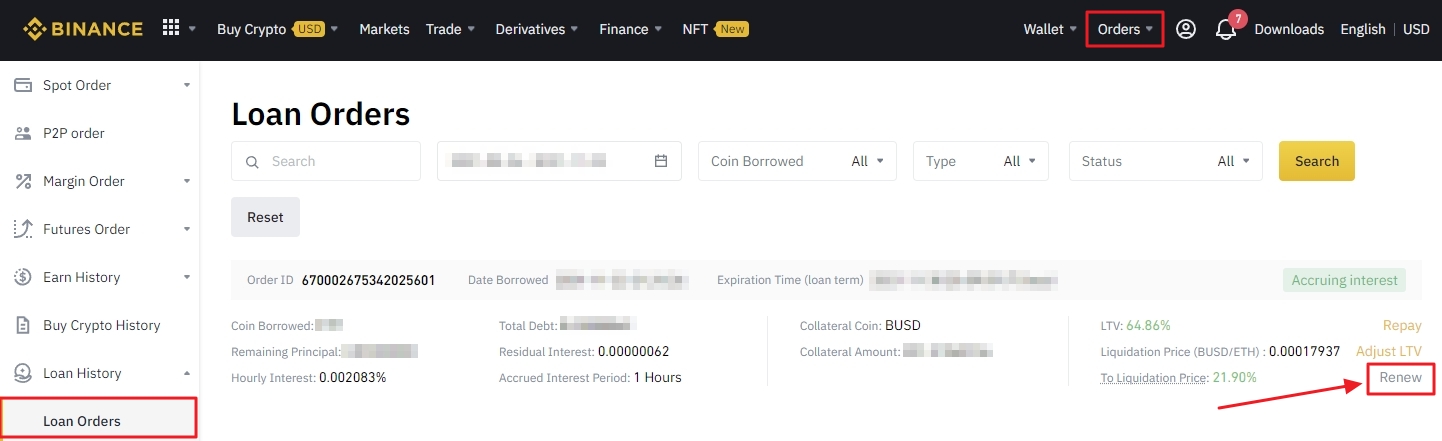

Binance Loans can be managed from the “Loan Orders” menu directly from your Binance account. If you wish to renew one of your past loans, you can do so by clicking on the “Renew” option that can be found on the right side of the loan orders list.

In addition to seamless access to loan renewal, you can also adjust your LTV ratio and repay your loan from the same menu.

What can you do with borrowed assets?

Assets borrowed through the Binance Crypto Loans service can be used as any other physical crypto assets. This means that you can trade your borrowed crypto in spot markets, engage in various passive-income generating opportunities, and even transfer borrowed funds from Binance to an alternative crypto platform or your own digital wallet.

Additionally, you can use borrowed crypto to trade Margin and Futures. Learn more about Binance’s flagship derivatives offerings in our in-depth reviews:

- Binance Margin – Amplify Your Trading Results and Earn ‘Friday Funday’ Rewards

- What are the Benefits of Trading on Binance Futures?

Supported coins

Binance supports over 60 borrowable crypto assets and over 25 types of collateral. Keep in mind that interest rates and the minimum and maximum loanable amounts differ quite substantially between various coins. To read more about Loans fees and limits, click here.

Here’s a list of supported digital assets in alphabetical order:

Borrowable coins: 1INCH, AAVE, ALICE, ATOM, AXS, ADA, AKRO, BAL, BAND, BAT, BAKE, BCH, BNB, BTS, BTC, BUSD, CTSI, CRV, COMP, CHZ, CTK, DOGE, DOT, DASH, ETH, ENJ, EOS, ETC, FIL, FLM, GRT, HNT, KNC, KSM, KAVA, LTC, LINK, MTL, MANA, MATIC, MITH, NBS, NEO, ONT, RUNE, SNX, SOL, SUSHI, SXP, STORJ, THETA, UNI, USDC, USDT, VET, XLM, XMR, XRP, YFI, ZEN, ZRX

Collateralizable coins: ADA, AXS, BCH, BNB, BTC, BUSD, CAKE, CTSI, DAI, DODO, DOGE, DOT, DYDX, EOS, ETH, FIL, KSM, LINK, LTC, MDX, SOL, UNI, USDC, USDT, XRP

Disclaimer: Note that the above lists are subject to change as Binance regularly updates its selection of supported assets.

Final thoughts

Borrowing and lending money is one of the tenants of any healthy financial system. It generates business opportunities, expands investment options, and allows for a seamless transfer of funds between individuals and businesses.

Binance Crypto Loans bring that financial paradigm to the blockchain industry. The service allows users to borrow more than 60 different cryptocurrencies by staking over 25 different coins. Loans are easy to obtain and boast a more competitive fee structure than most of their traditional finance counterparts.

Use your crypto assets to secure a loan in minutes, increase your exposure to crypto via spot market and derivatives trading, or utilize your borrowed assets to earn stable returns through Binance’s Earn platform.