As a rule of thumb, crypto traders are usually interested in spot trading. While trying to make a profit by trading physical assets is certainly a great option, Binance enables users to pursue derivative investments, which can be much more lucrative than their spot counterparts.

While futures and margin trading is inherently riskier than spot trading, Binance Futures traders can take advantage of the ability to make profits regardless of the direction of the market. The same can’t be said for spot investors, which are almost entirely dependent on upward price movements to turn a profit.

In the three years since its launch, Binance Futures has greatly expanded its product range, managed to increase the amount of liquidity many times over, and rolled out support for dozens of new digital assets.

In this article, I am going to explain why I choose Binance as my main platform to trade cryptocurrency futures, and why I believe it is one of the best futures offerings in the entire crypto space.

Why Binance Futures?

The main reasons why Binance Futures is a premier destination for derivatives traders can be attributed to how the exchange handles security, trading fees, and adding of new cryptocurrency trading pairs.

Security: Binance has a $300 million Insurance Fund to protect traders from negative losses and ensure that profits are paid in full for users who make a profit. In addition, the exchange has security features such as 2FA, KYC, Anti-Phishing Code, and whitelist wallet addresses. I am confident that my funds are safe when trading on Binance.

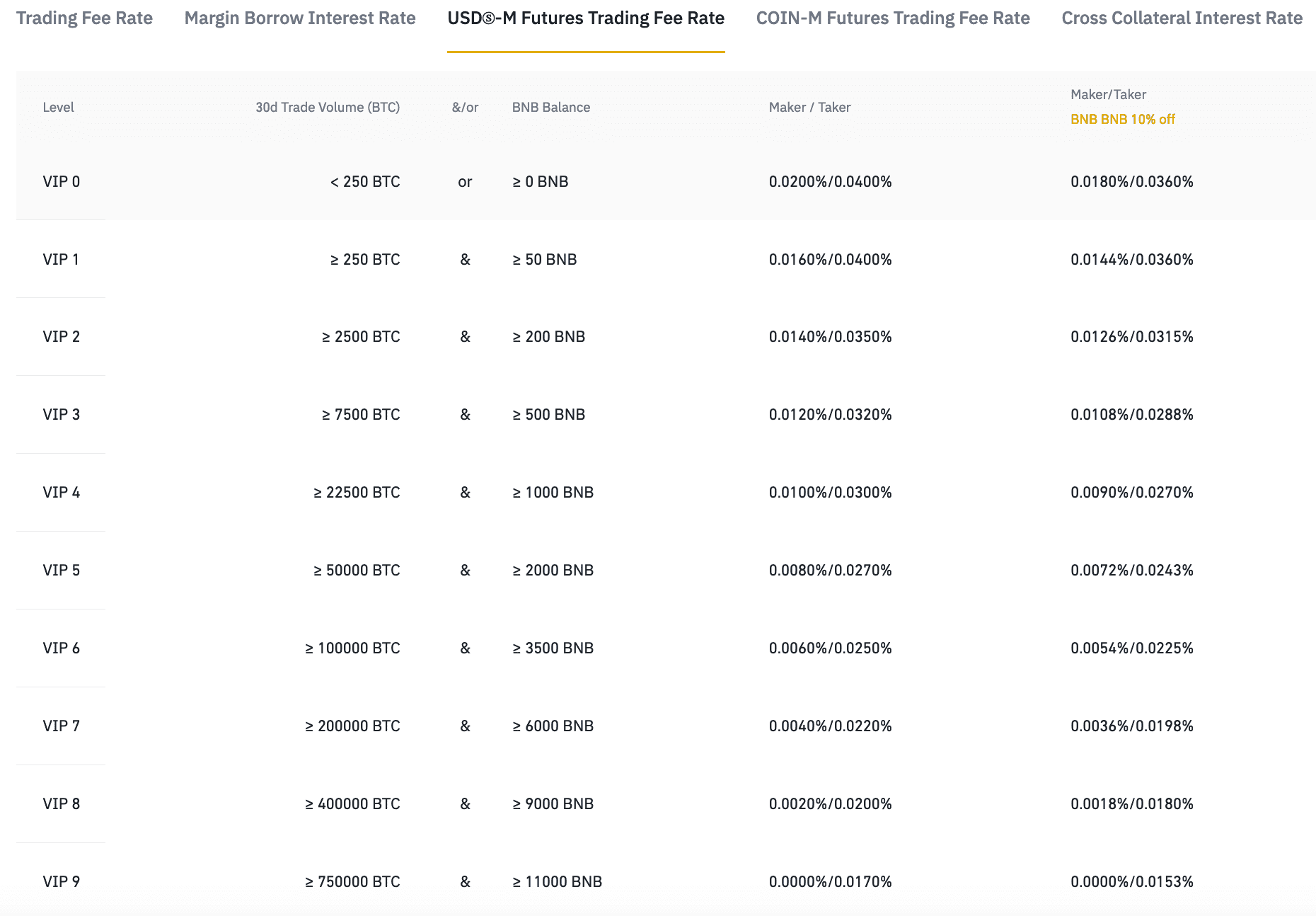

Trading fees: Binance charges very low Futures trading fees compared to its competitors. Although the commission varies depending on being a member with a discounted referral link and the amount of BNB and BUSD held in the wallet, the trading fees of Makers can be reduced to 0% and Takers to 0.017%. These rates are great considering we are trading high volumes in Futures.

Wide range of cryptos: Binance Futures has around 600 cryptocurrency trading pairs. This number will continue to increase as new cryptocurrencies and trading pairs are constantly listed.

Grid Trading – My favorite Binance Futures feature

Trading Strategies: Binance allows us to trade with TWAP and Grid Trading strategies. In this way, we can get the maximum benefit from price fluctuations. Binance also allows us to automate our trades using indicators, thanks to its API.

I have integrated the indicators I use in TradingView into 3commas, a popular crypto trading bot, and automated trading using the Binance API. Moreover, if things go wrong and the liquidation price approaches, I can automatically add additional margin to the position and reduce the risk of liquidation. If you have your eyes set on an indicator, or a group of indicators that you think works well for you, you can easily set trading parameters following crucial market data. Ultimately, I gave up on this approach and started using Grid Trading, which has not only proven to be more efficient but has also become my favorite Binance Future feature.

As a side note, I prefer to use small leverage like 4x or 5x as I know the risks of Futures trading and how big swings can negatively impact my capacity for making, what I believe, are “good” trades.

Binance already provides many indicators and technical analysis tools. If I can determine a certain range for the buy and sell orders of a crypto, I can open as many long and short positions as I want, thanks to Grid Trading.

I can go to the relevant page by clicking on the Futures Grid option inside Strategy Trading. By switching to manual input on the right-side panel, I can create a price range by specifying the upper and lower prices. Futures Grid will automatically execute a buy order when the market price of crypto falls below the middle of these two extremes. I can also specify how many times I want to place a purchase order with the Grid option. When the price is within the specified range, the system will place as many buy orders as we want.

When the price of crypto starts to rise above the middle range, Futures Grid will start selling crypto by closing open positions. We will make a profit by closing the positions we opened at a low price at a higher price with a preset cut-off. The bigger leverage we choose to use, the higher are the profits we can bank. However, there is a very important point to note here – if the price of a coin or token falls below the bottom price and the leverage is too high, we risk liquidation. In this case, we must stop the Futures Grid bot we have created and then either add margin to the position or close the position with a loss.

With Binance’s Futures Profit Calculator, we can calculate how much profit we can make from our futures positions, which can come in handy to test out the viability of potential trades before making an actual order.

What makes me appreciate Binance Futures and its functions

The cryptocurrency market is sometimes very volatile, and sometimes fluctuates for a long time in certain price ranges. For example, Bitcoin has been changing hands in a tight trading range between $18,500 and $24,800 since June 16. Having exhibited these fluctuations for more than 3 months, Bitcoin was well suited for the Futures Grid trading strategy during this period. Even with small leverage of just 3x, Grid Traders were able to turn a huge profit in the process.

If you can predict what range the prices of certain cryptos might be in during certain periods, I can only recommend Grid Trading. Thanks to this feature, you don’t have to follow the market constantly to open and close new positions, and you can get the maximum profit from price oscillations.

Binance Futures offers many educational resources and a demo account for beginners. Thanks to the demo account, you can gain experience and prepare yourself to make real transactions without sacrificing any of your hard-earned money beforehand. While perhaps misguided, I believe I’ve had a very good experience with Binance Futures because I did just that.

Although the spot market and Futures trading are similar, the risks of Futures trading increase in direct proportion to the leverage ratio. So, getting experience with a demo account can be a lifesaver for real trades.

Binance Futures is already one of the highest trading volume futures exchanges, but that doesn’t stop the company from trying to attract new users to the fold. Case in point, Binance rewards users with high trading volumes by organizing trading competitions. But these competitions are less frequent and do not appeal to those who do not trade in high volumes. I am sure they will have even more futures traders when they make these organizations accessible to everyone.

How could Binance improve its futures trading platform?

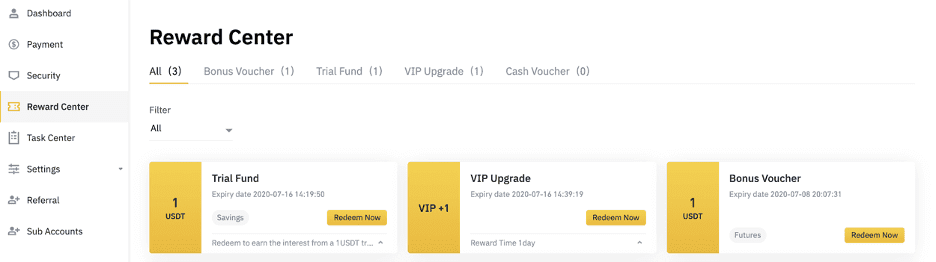

When trading on Binance Futures, steps can be taken by Binance to further improve our experience. For example, some exchanges give their active users coupons valid for Futures Trading. These coupons with values as low as $5, $10, and $20 can be used with limited leverage. Binance could also consider rewarding active users with such coupons.

Another feature that Binance could improve is its notification system. As of right now, we can receive SMS and e-mail notifications when a position is opened, closed, or close to liquidation. However, this should not be limited to trading orders or positions. When an indicator provides suitable conditions, we should receive notification from Binance so that we can act accordingly to live market movements.

Binance should also consider improving its automated trading facilities. People are very interested in automated crypto trading these days, and more possibilities and strategies usually mean more users.

While it would be nice to see the exchange implement the features listed above, the futures trading marketplace run by Binance