Combining the inherent volatility of crypto asset price movements with future price speculations and leverage is a recipe for major portfolio volatility. And that’s exactly what crypto futures entail.

While crypto futures do offer the potential for sky-high returns, they also carry inherent risks that can wipe out traders if they don’t practice caution and risk mitigation techniques.

Binance Futures, being the leading crypto futures trading platform in the industry, offers several ways for traders to limit the risk of ruin and boost their bottom line at the same time.

In this article, I’ll be going through different responsible trading features available on Binance Futures, and discuss how each of them has helped protect my crypto portfolio over time (mostly by preventing me from doing dumb mistakes).

What responsible trading features does Binance offer?

In the following sections, I’ll be examining different features and initiatives Binance offers that are designed to help protect crypto futures traders in various ways. Let’s start with the most basic one: Client-Knowledge Assessments.

Binance requires users to understand the intricacies of derivatives trading before they can trade futures

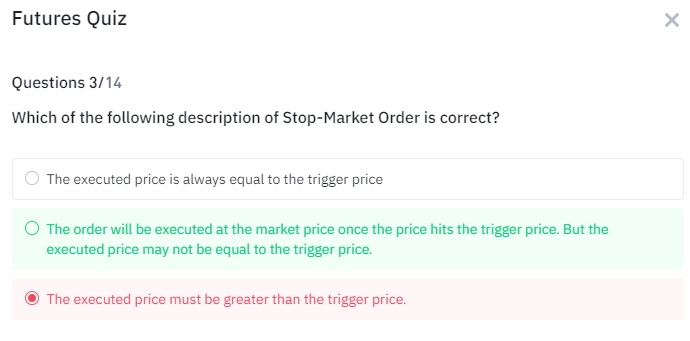

One of the most helpful features – that has certainly saved countless amounts of user dollars over time – is the so-called Client-Knowledge Assessments (CKA). While the name might sound very sophisticated, the features itself is very straightforward. Binance essentially requires users to watch short videos and then complete quizzes that showcase their understanding of Binance Futures and Options.

If users fail to answer the questions in the quiz correctly, they must invest more time in educating themselves about the topic. Given how easy it is to make less than optimal or even downright horrid derivatives trades – even among experienced traders – there is no chance that a user not understanding the basics can hope to be anything other than massively unprofitable.

Anti-Addiction Notice

In an effort to mitigate the potential negative consequences of impulsive trading behavior, Binance has implemented a range of preventative measures. One such feature are system-generated notifications that are triggered in the event that a trader experiences a prolonged period of losses or a significant financial loss.

These notifications – called Anti-Addiction Notices – serve to remind traders of the inherent risks associated with derivatives trading and encourage them to exercise caution in their trading activities.

It is essential that traders maintain a level of self-awareness and employ strategies to avoid falling into the trap of harmful excesses such as compulsive trading or gambling. By taking a proactive approach to risk management and personal accountability, traders can minimize the likelihood of experiencing negative outcomes and maximize the potential for long-term success in the volatile world of cryptocurrency trading.

The Anti-Addiction Notices are currently present only on the Binance Options platform. For Futures and Margin traders, Binance uses an even more sophisticated approach, which we’ll discuss in the next section.

Cooling-off Period

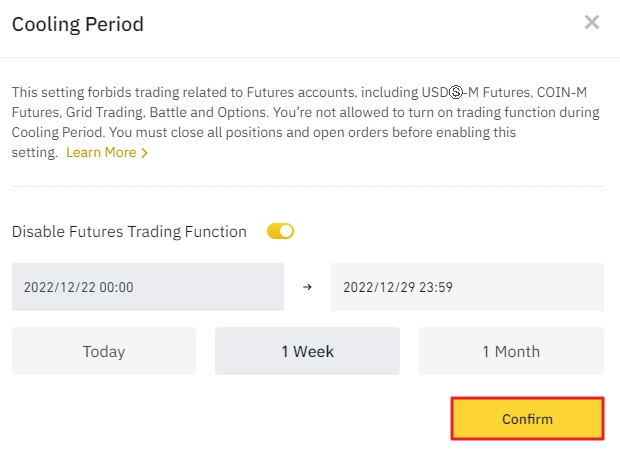

The Colling-off Period feature allows Futures and Margin traders on Binance to set a temporary trading ban on their accounts for a set period of time, ranging from 1 day to 1 month. During this time, no trades or borrowing of funds can be made.

The Cooling-Off Period is a great tool for traders who want to give themselves a break and avoid making hasty decisions that could lead to further losses. Just note that this feature is not available for spot trading on Binance.

How to turn on the Cooling-off Period feature?

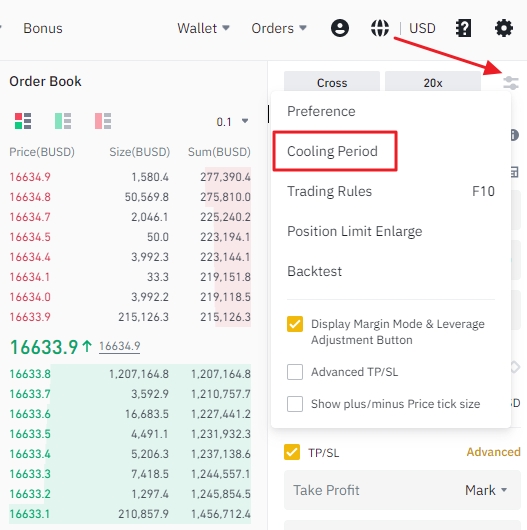

The process to enable the Colling Period feature is fairly simple. You can access it by heading to the upper right corner of the Futures homepage.

You can choose the self-exclusion time period of up to 1 month. The shortest colling-off time period is one day.

You’ll have to confirm your decision via a popup. After that, you won’t be able to trade derivatives on Binance for the duration of your self-imposed exclusion rule.

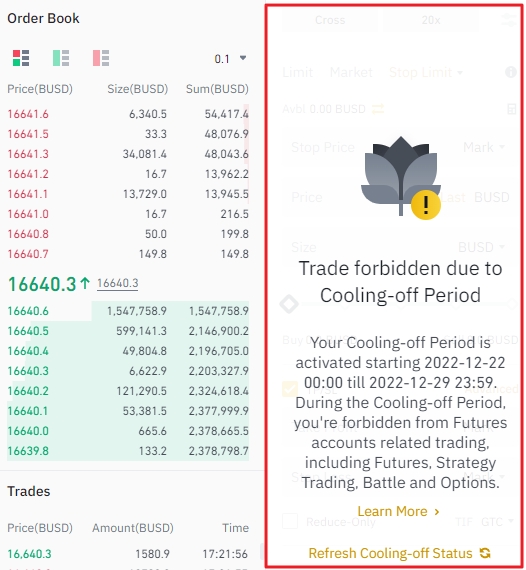

The trading section of the screen will become inaccessible, and its area will be occupied by the Colling-off Period notification. Cooling-Off Period cannot be circumvented once activated.

Price Protection

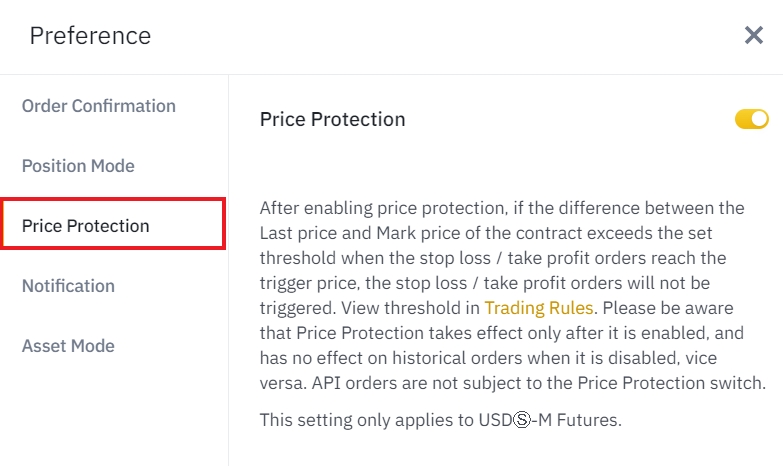

The Price Protection feature on Binance is a valuable tool for traders looking to safeguard their positions against extreme market movements. By enabling this feature, users can set a threshold beyond which their orders will not be executed, providing an additional layer of protection against unforeseen circumstances.

The threshold for Price Protection is determined on a contract-by-contract basis, taking into account the liquidity and popularity of the underlying assets. For example, popular contracts like BTC/USDT and ETH/USDT may have a threshold of 5%, while less widely traded contracts may have a higher threshold of 10% or more.

In addition to protecting traders from potential losses due to market fluctuations, Price Protection can also serve as a deterrent against nefarious market manipulation attempts. It is not uncommon for traders with large capital reserves to attempt to artificially move prices in order to trigger stop-loss or take-profit orders for other users. By setting a Price Protection threshold, traders can safeguard their positions against such manipulative tactics and ensure that their orders will only be executed under fair market conditions.

The Price Protection feature can be turned on under the general preferences located in the top right corner of the Binance Futures trading page (see the How to turn on the Cooling-off Period feature? section for more information.

Customized Default Leverage

In crypto trading, leverage refers to the use of borrowed capital to increase the potential return of an investment. When a trader uses leverage, they are essentially borrowing money from a broker or exchange to trade a larger position than they would be able to with their own capital alone.

For example, if a trader has $1,000 worth of Bitcoin (BTC) and decides to use 10x leverage, they would be able to trade a position worth $10,000. If the trade is successful and the value of the position increases by 10%, the trader would make a profit of $1,000, which is equivalent to a 100% return on their own capital.

However, it’s important to note that leverage also increases the risk of loss. If the trade goes against the trader and the value of the position decreases by 10%, the trader would suffer a loss of $1,000, which is equivalent to a 100% loss on their own capital – in this case, the entirety of the Bitcoin position.

Leverage can be a powerful tool for traders who want to increase their potential returns, but it’s important to use it cautiously and be aware of the increased risk that it brings.

Binance provides up to 125x leverage for certain trading pairs. If you are uncomfortable with leverage levels as high, you can adjust the default leverage level to something less drastic, like 3x or 5x. This should still give you plenty of room to pursue highly lucrative trades, but keep your portfolio less prone to being wiped out because of a single market swing.

Take-Profit/ Stop-Loss orders

Take-profit and stop-loss orders are used to close a trade at a predetermined price, either for a gain or a loss. They allow a trader to exit a position without having to constantly monitor the market.

The placement of these orders is often based on the trader’s preferred method of analysis, such as technical indicators or chart patterns. These orders can be used to mitigate risk and protect a trading account.

They can also be automatically executed, allowing a trader the flexibility to engage in other activities while a position is open. Take-profit orders are used to close a position for a gain, while stop-loss orders are used to close a position for a loss.

Binance allows traders to easily set up take-profit and stop-loss orders while entering a position. Simply select the Stop Limit tab on your trading screen and then enter the “Take Profit” and “Stop Loss” parameters. Your orders will be automatically executed upon the predetermined parameters are met.

Final thoughts

Cryptocurrency derivatives trading can be quite addicting, especially when you are on a streak of consecutive profitable trade. Recency bias is quick to take over in such instances, and it’s easy to overestimate your own skill level when the luck and market are on your side. However, staying humble and understanding how slim the margins of error between a profitable and unprofitable trader can be is of utmost importance.

If there is one thing that traders that have managed to retain their profitability over the long term seem to have in common is their reliance on risk-mitigating techniques. Binance Futures puts these tools at the forefront, so it is up to you to take advantage of them.