Ethereum staking is widely regarded as one of the most popular passive income-generating opportunities in crypto. By staking their ETH, investors can look forward to earning up to 5.2% APR in exchange for putting their funds toward securing the network and transaction validation.

In this article, we will explain how you can stake ETH on the Binance Staking platform, clarify what is BETH, and briefly describe what Ethereum 2.0 entails.

About The Merge

On September 15, Ethereum switched from the energy-intensive Proof-of-Work (PoW) consensus mechanism to a much more efficient Proof-of-Stake (PoS) algorithm. The historic upgrade, called the Merge, not only brought significant efficiency improvements compared to PoW (up to 99.95%, according to Ethereum Foundation) but also set the stage for future Ethereum upgrades that will improve the network’s throughput from the current 30 transactions per second (TPS) to 100,000 TPS once Ethereum is fully developed.

There are four major upgrade phases scheduled for after the Merge, which will primarily focus on scalability improvements. That shouldn’t come as any surprise, as Ethereum co-founder Vitalik Buretin himself recently admitted that scalability is the biggest challenge facing the crypto industry in the coming months and years. Once the four upgrades are implemented, the deployment of the Ethereum platform will be considered fully complete.

Here is a list of post-Merge upgrades that are slated to go online in the coming years:

The Surge

Slated to go online in 2023, the Surge is expected to introduce sharding, a blockchain feature that splits the entire network into smaller parts (called shards), enabling better scalability and more efficient network operations. While not the official naming scheme, many people in the community see the deployment of the Merge and subsequent rollout of the Surge as the completion of the Ethereum 2.0 development cycle that started with the launch of Beacon Chain in December 2020.

The Verge

The next major upgrade is the Verge. It will bring so-called “verkle trees”, which is a significant improvement over Merkle proofs. The Verge is expected to decrease Ethereum’s reliance on powerful computer hardware, making the network more decentralized.

The Purge

The third on the list of major upgrades awaiting Ethereum is the Purge. Aptly named, the Purge will decrease the size of the Ethereum public ledger, or better said, decrease the hard drive space needed to store it. This upgrade is also expected to increase the network’s decentralization and make it easier for regular users to run Ethereum nodes.

The Splurge

The final upgrade, which will mark the full deployment of the Ethereum platform, called the Splurge, will bring a number of features aimed at increasing the platform’s security, and otherwise optimizing the network.

For more information about each upgrade, you can check out the detailed Ethereum development roadmap, shared by Buterin in late 2021.

What is Ethereum staking?

Ethereum Staking refers to the practice of depositing Ether into the ETH 2.0 smart contract for the purposes of powering the Proof-of-Stake consensus algorithm.

Sparring in-depth technical details, Proof-of-Stake is a type of consensus mechanism that randomly selects users staking a particular blockchain’s native asset (ETH in the case of Ethereum) as network validators. While the process is not exactly completely random, but rather takes into account each user’s stake amount, it is still considered more democratic than Proof-of-Work, where regular users have virtually no chance of competing against multi-million dollar mining farms.

Similar to PoW systems, where miners reap mining rewards associated with transaction validation and new blockchain block production, PoS network validators earn a share of transaction fees associated with the block they were chosen to validate.

Setting up one’s own node requires a lot of work and a minimum of 32 ETH (approx. $42,000 at current market rates) to be used as an individual stake, which essentially means the average Joe can’t take advantage of Ethereum staking’s passive income benefits.

In addition, the deposited ETH is locked up, meaning that the funds will remain non-withdrawable until the Shangai update goes live (expected in early 2023).

However, several cryptocurrency staking platforms, like Lido and Binance, provide an option for users to pool their funds, with every pool participant being eligible to earn a proportional share of ETH staking rewards. Such platforms use deposited ETH to run a large number of validators, thus increasing the chances of earning PoS rewards, which are then shared among customers.

What Are the Benefits of Binance ETH 2.0 Staking

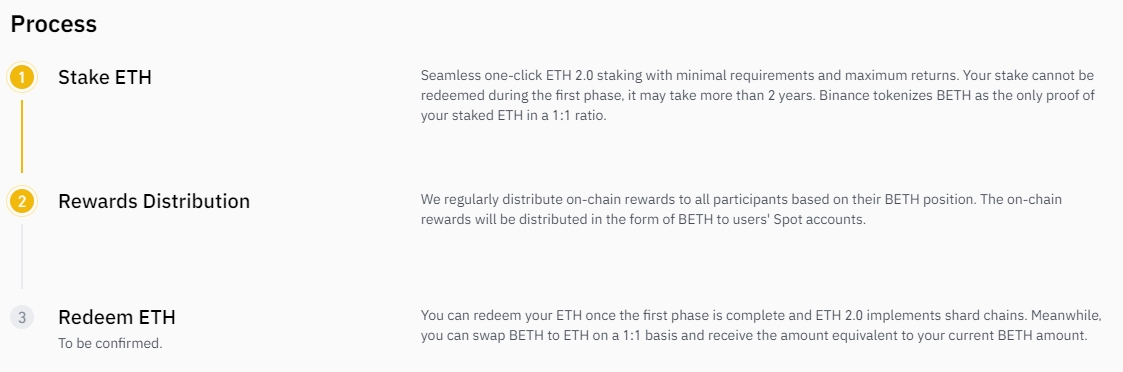

Binance ETH 2.0 Staking allows users to participate in Ethereum staking with as little as 0.0001 ETH and earn up to 5.20% APR. Once ETH is staked through the Binance Staking platform, users receive a corresponding amount of BETH at a 1:1 ratio. BETH, a tokenized asset representing your staked ETH, deposited in users’ Binance Spot accounts is used to calculate ETH staking rewards.

Compared to the “regular” way of staking 32 ETH to activate validator software, Binance’s staking solution is easier to use and requires a much lower initial investment. Perhaps even more importantly, users can retain much of locked ETH liquidity thanks to BETH.

It is worth noting that BETH acquired through spot markets and via the staking service are treated the same, with both options granting their users the ability to earn ETH 2.0 staking rewards.

Last but not least, ETH staked though Binance will remain locked up for the next 6-12 months, until the Shangai upgrade, which will unlock ETH deposited in the ETH 2.0 smart contract, goes live.

How to stake ETH and earn Ethereum 2.0 rewards on Binance?

Staking ETH via Binance is really straightforward – the whole process takes just a couple of clicks. Before you get started, you first need to login into your verified Binance account. If you have not yet registered an account on Binance, but want to partake in ETH staking, you can do so by clicking the button below.

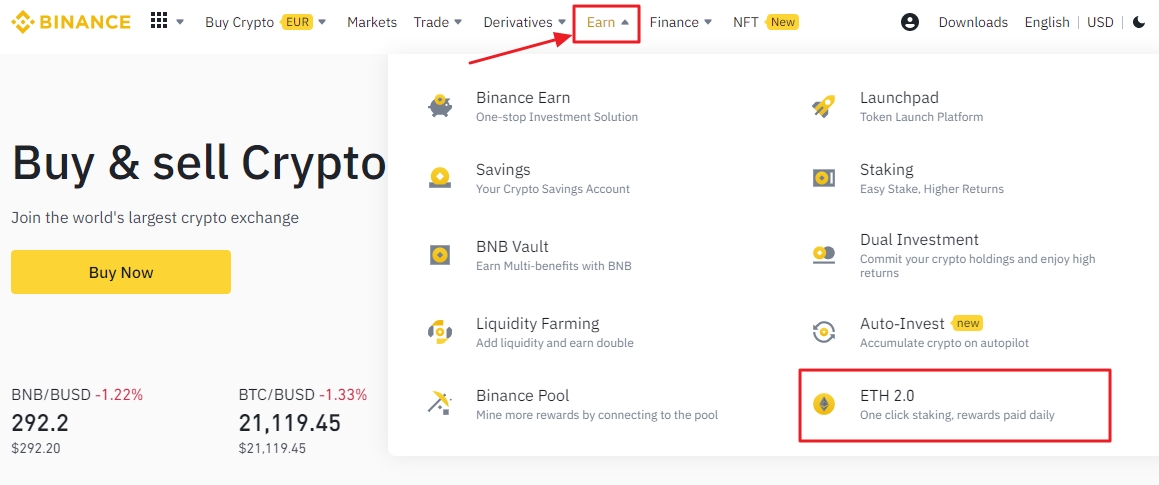

Step 1 – Navigate to ETH 2.0 offering via the Earn tab

After logging into your Binance account, click on the Earn drop-down menu on the homepage. Proceed by clicking on the ETH 2.0 option in the bottom right corner of the menu.

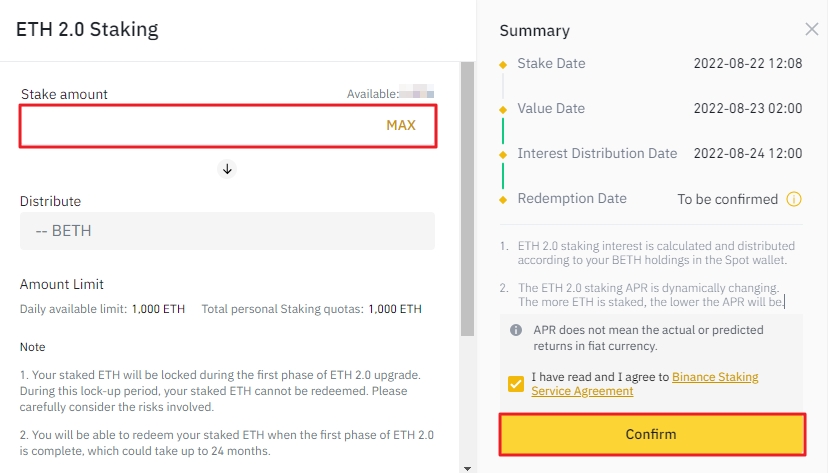

Step 2 – Enter your ETH stake amount and receive BETH

When on the ETH 2.0 Staking page, click on the Stake Now button located at the top of the screen. This will take you to a dedicated window where the exact stake amount, along with interest rate and BETH distribution data, is displayed. After you’ve entered the preferred stake amount, you are free to finalize the order by clicking Confirm.

Closing thoughts

Ethereum staking is one of the more popular ways to generate income with existing crypto funds, especially for long-term holders who have already decided they won’t be parting ways with their ETH for at least a couple of years. As of this writing, there is more than $18.6 billion worth of Ether (more than 10% of all circulating supply) deposited into the Eth2 smart contract, indicating a high degree of investors’ interest.

Binance Staking is one of the easier outlets to tap into Ethereum 2.0 staking rewards and join countless others in generating passive income while maintaining security and transaction validity on the world’s largest smart contract networks.