As the cryptocurrency market matures, investors are becoming familiar with more sophisticated ways of leveraging their crypto assets. While the “Buy and HODL” mantra still remains popular among crypto holders, there’s now many ways that this passive strategy can be enhanced with yield-earning opportunities.

The Binance cryptocurrency exchange seems well aware of the demand for passive investments from cryptocurrency holders, and has created an entire range of investment products under its Binance Earn banner. In this article, we’ll be checking out Binance Dual Investment, an example of a high yield product offered by the exchange.

Depending on your investment goals, Binance Dual Investment can perform two roles – if you’re a Bitcoin or Ethereum holder, you can hedge against your BTC falling in price. If you have stablecoins, you get the opportunity of getting more BTC for you money, although at a later date. You’ll be earning interest in either case, but the overall profitability of your investment will still depend on market conditions – Binance Dual Investment is not a risk-free investment.

Binance Dual Investment explained

There are two kinds of Binance Dual Investments that you can invest in. You deposit BTC or ETH in the Up-and-Exercised products, while the Down-and-Exercised products accept stablecoin deposits. Let’s learn more about how these two products work.

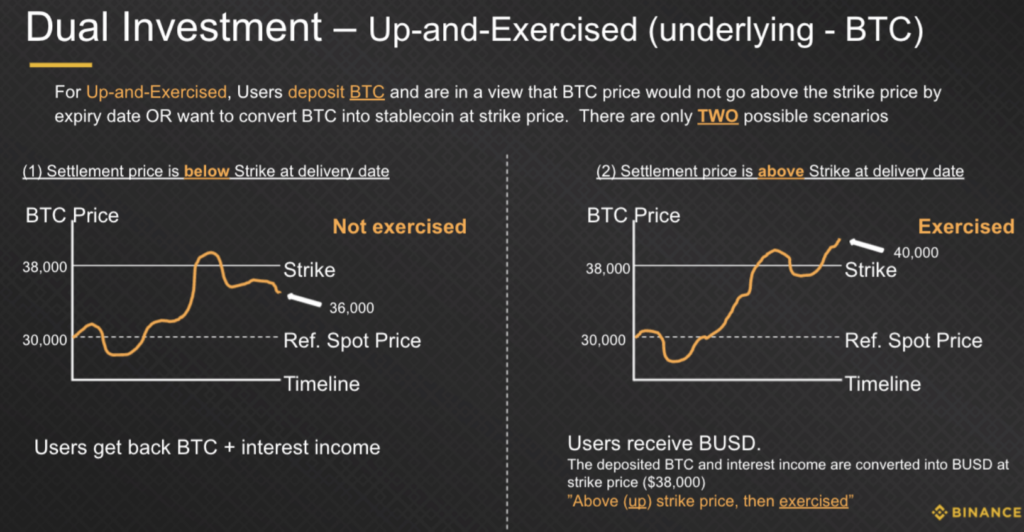

Up-and-Exercised

In this type of Binance Dual Investment product, your deposit is converted into the alternate currency if the settlement price of the underlying asset is above the strike price at the delivery date. Currently, you can only deposit BTC and ETH into Up-and-Exercised products.

Let’s say you’re using an Up-and-Exercised product with BTC as the underlying asset. If the price of BTC is higher than the strike price at the delivery date, your BTC and accumulated interest will be converted into BUSD.

If the product is not exercised, you’ll receive your deposited BTC, plus interest.

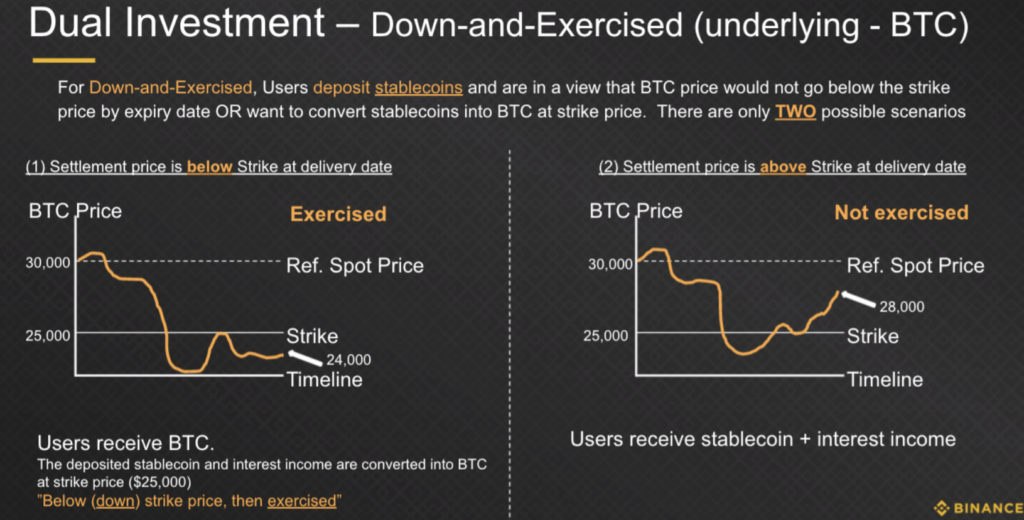

Down-and-Exercised

In Down-and-Exercised products, your deposit currency is converted into the alternate currency if the settlement price of the underlying asset is below the strike price at the delivery date. Currently, you can deposit either BUSD or USDT into Down-and-Exercised products. If exercised, your stablecoins will be converted into BTC or ETH (depending on which product you used).

For example, let’s say that you deposited BUSD into a Down-and-Exercised product that uses ETH as the underlying asset. If the price of ETH is lower than the strike price at the delivery date, your BUSD, plus the accumulated interest, will be converted into ETH.

If the product is not exercised, you’ll receive your deposited stablecoins, plus interest.

Important concepts

To understand how Binance Dual Investment functions, we should first explain some of the key terms associated with the product.

- Underlying asset: The asset that the reference price and strike price are referring to. Currently, the underlying assets offered by Binance for Dual Investment are BTC and ETH.

- Deposit currency: The asset that you are depositing into Binance Dual Investment. Currently, you can choose between BTC, BUSD and USDT.

- Alternate currency: The asset that your deposit currency will be converted into if the product is exercised.

- Reference price: The current price of the underlying asset.

- Settlement price: The current price of the underlying asset at 08:00 UTC on the delivery date. This price is then compared to the strike price to determine if the product should be exercised.

- Delivery date: The date when the price of the underlying is checked against the strike price. You cannot withdraw your funds before the delivery date.

- Strike price: The price level that determines whether the deposit currency will be converted or not. The strike price is checked against the settlement price to determine the result. The strike price is used as the conversion rate if the product is exercised.

- APY (Annual Percentage Yield): Each Binance Dual Investment product has an associated APY. The APY of each product fluctuates over time, but your personal APY will be locked in once you subscribe to the product. To avoid confusion and unrealistic expectations, we should note that this figure is annualized.

Typically, the APY is higher the further away the delivery date is. The difference between the reference price and the strike price and how it relates to the type of product (Up-and-Exercised or Down-and Exercised) also impacts the APY.

Now, let’s check out some of the main advantages and disadvantages of Binance Dual Investment:

The pros of Binance Dual Investment

- Opportunity to earn high yields

- Provides hedging opportunities

- Passive investment

The cons of Binance Dual Investment

- You cannot withdraw your assets during the duration of your subscription, so you’re giving up some liquidity

- If the price goes significantly above/below the strike price (depending on the product you’re subscribed to), you’d be better off simply holding your assets and not using Binance Dual Investment

Why would you want to use Binance Dual Investment?

Binance Dual Investments is one of the available options to earn yield on your crypto assets, whether it is BTC or stablecoins. Here’s some examples of the interesting use-cases for the product.

Binance Dual Investment allows you to essentially “lock in” a more favorable price for assets compared to the current price (but not necessarily the future price). Let’s say that 1 BTC is currently trading at $10,000, and you hold 1 BTC. If you want to hedge your portfolio against a Bitcoin price drop, you can deposit your 1 BTC in an Up-and-Exercised Binance Dual Investment product. Let’s say that the strike price is $11,000. At the delivery date, if the price is at $11,000 or below, you will receive 1 BTC + interest (paid in BTC), which means you’ll be better off than if you just held the 1 BTC in your wallet.

If the price is at $11,000 or above, you’ll receive $11,000 + interest. However, if the Bitcoin price is significantly higher than $11,000, you’d be better off if you just held the 1 BTC in your wallet. If the Bitcoin price increased all the way to $15,000, for example, you’d still only receive $11,000 + interest. If you did nothing, you would have $15,000 worth of BTC in your wallet, instead of the $11,000 + interest you got from Binance Dual Investment.

If you hold stablecoins and you’d like to buy BTC, the Down-and-Exercised Binance Dual Investment product can help you “lock in” a bigger amount of BTC than you could purchase right now. Here’s how it works:

Let’s say that you’re holding 10,000 USDT and Bitcoin is currently trading at $10,000. If you used the USDT to buy Bitcoin on a spot market, you’d get 1 BTC. Now, let’s see what happens if you put your 10,000 USDT in a Down-and-Exercised Binance Dual Investment product with a strike price of $9,000. If Bitcoin is trading below the strike price at the delivery date, you will receive 1 BTC + interest (paid in BTC), which is more than the 1 BTC you could have acquired with your 10,000 USDT before you deposited it into Binance Dual Investment.

If the Bitcoin price is higher than $9,000 at the delivery date, you’ll receive your 10,000 USDT back + interest (paid in USDT).

How to use Binance Dual Investment?

Before you can use Binance Dual Investment, you’ll have to create an account with Binance.

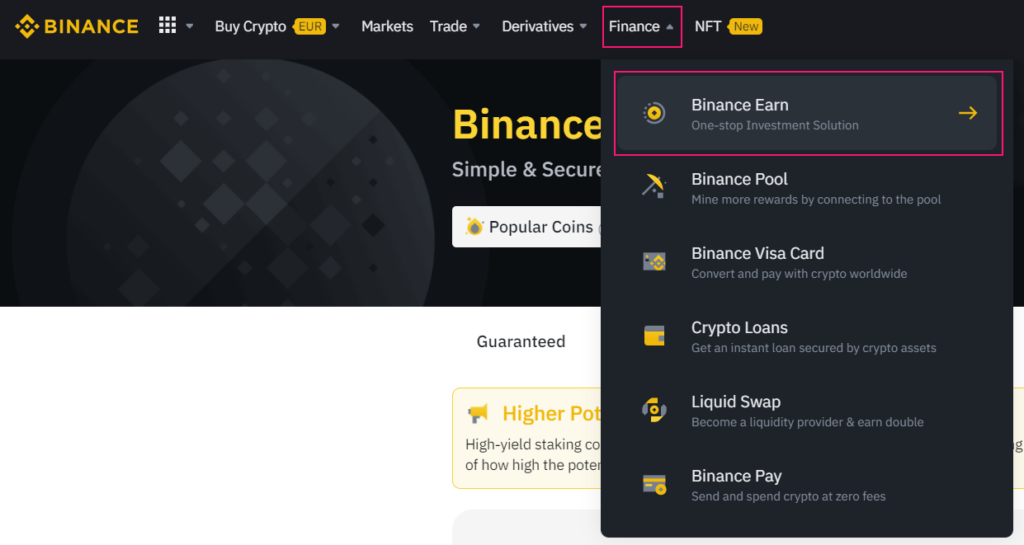

After your account is ready, head over to the “Finance” section at the top of your Binance interface and select “Earn”.

Then, select the “High Yield” option.

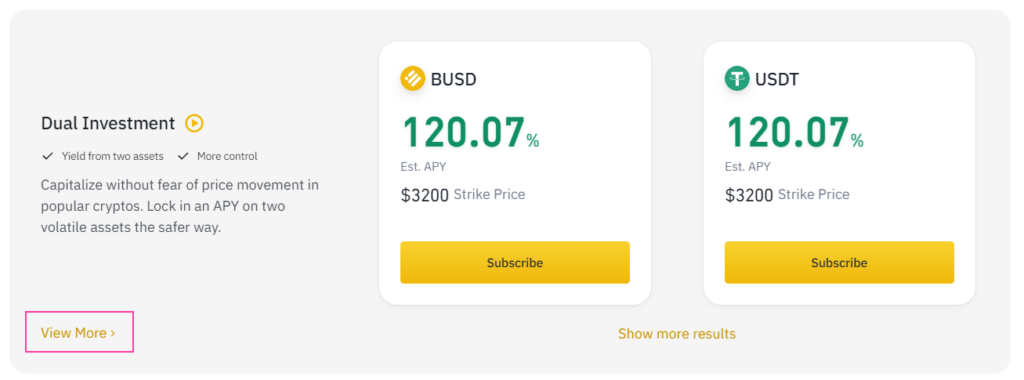

Scroll down to “Dual Investment”, and select “View More” to see all of the available Binance Dual Investment subscriptions.

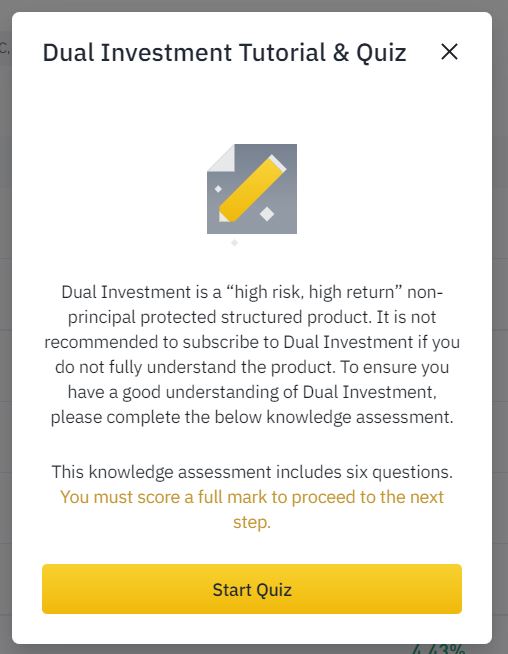

Before the platform allows you to use Binance Dual Investment, you’ll be asked to answer a quiz to show that you have adequate knowledge of the product. Hopefully, you’ll learn enough about Binance Dual Investment in this article, but you can also check out this helpful guide on Binance Academy, as well as Binance’s official product explanation. Make sure that you fully understand the product before investing any funds!

What are the risks of Binance Dual Investment?

Like any other income-earning opportunity, Binance Dual Investment comes with a certain degree of risk. If you’re depositing BTC in an Up-and-Exercised subscription, you’ll be in a losing position if the price of Bitcoin significantly exceeds the strike price at the subscription’s delivery date. Inversely, if you’re depositing a stablecoin in a Down-and-Exercised subscription, you’ll take a loss if the Bitcoin price is significantly below the strike price at the delivery date.

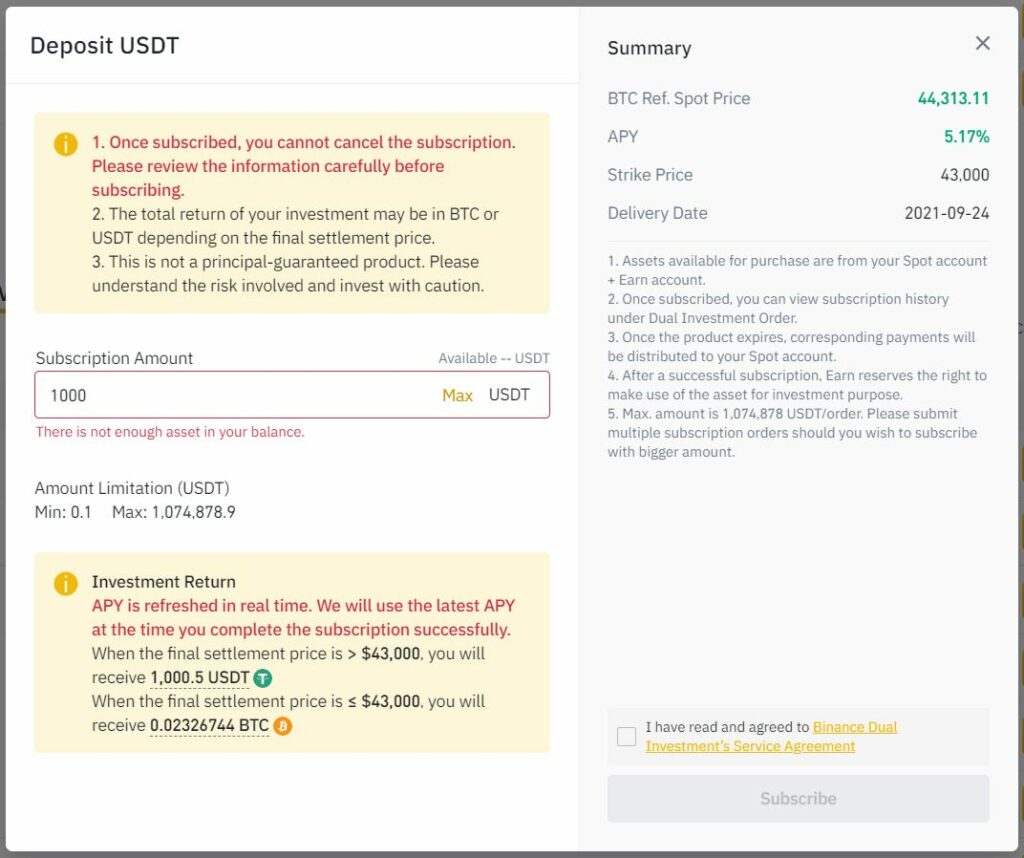

Let’s demonstrate this with a quick example. On September 20, you invest 1,000 USDT in a Binance Dual Investment product with the following parameters:

- Reference Bitcoin price: $44,313

- APY: 5.17%

- Strike price: $43,000

- Delivery date: September 24, 2021

When you’re subscribing to the product, you’re presented with the two possible scenarios that can happen at the delivery date.

- If the price of Bitcoin is higher than the strike price ($43,000), you will receive your 1,000 USDT investment back, plus interest.

- If the Bitcoin price falls below the strike price, you will receive 0.02326 BTC. This is roughly the equivalent to the amount of BTC that could be bought with the 1,000 USDT you’re depositing, plus the interest (annualized at 5.17% in our example).

The delivery date rolls around and due to a significant crash in the cryptocurrency market, Bitcoin is now trading at $35,000, far below the $43,000 strike price.

As per the terms of your subscription, you receive 0.02326 BTC. However, since Bitcoin is now trading at $35,000, the BTC you received is only worth $814, less than your initial investment of 1,000 USDT (for this example, we’re assuming that 1 USDT always equals $1).

In this scenario, simply holding your 1,000 USDT would have been better than putting it into Binance Dual Investment. If you held your 1,000 USDT until the expiration date and then purchased Bitcoin, you could have gotten 0.02857 BTC for your money.

The bottom line

Binance Dual Investment is a very unique product, and serves as a useful addition to Binance’s suite of products that let investors earn yield on their cryptocurrency holdings. Binance Dual Investment can be non-intuitive at first, but it does offer useful hedging options and can help you execute more sophisticated investment strategies and enhance the yield you’re earning on your crypto holdings. Still, you have to keep in mind that Binance Dual Investment is a non-principal protected product, and you can take losses if market conditions are unfavorable to your position.