Key takeaways:

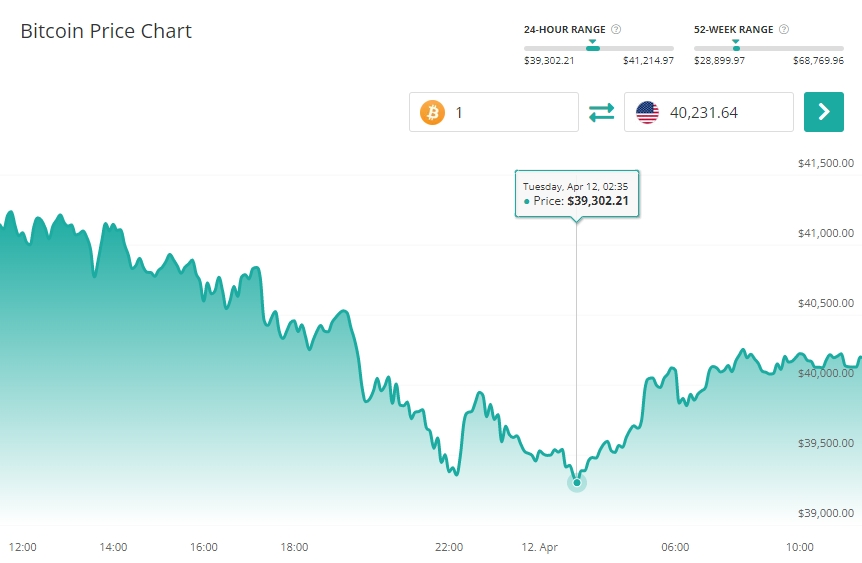

- The week-long market pullback continued today, with Bitcoin momentarily falling below $40,000

- The new Glassnode report shows that up to three-quarters of BTC owners are still in profit, despite the negative price movement

- Low on-chain activity and profit-taking nature of recent transactions suggest the bearish trend could continue

Bitcoin momentarily slips below $40k for the first time since mid-March

The bears continued to have the upper hand going into Tuesday. The cryptocurrency market cap shed an additional 2% and dropped to its four-week lows just above $1.9 trillion. The negative price movement saw Bitcoin momentarily lose its footing above the psychological $40,000 level earlier today as the world’s largest crypto fell to $39,300, its lowest price point since mid-March.

The market pullback has left its imprint on virtually every digital asset in the sector. Apart from Monero (+10.9%), Near Protocol (+8.1%), and Waves (+5.4%), virtually all other top 100 coins and tokens struggled to convincingly break into the green zone over the last 24 hours.

Three-quarters of BTC holders are in profit

Prominent blockchain analytics firm Galssnode has released a new report documenting the struggle of Bitcoin and the broader crypto market in the past week.

The researchers noted that Bitcoin transactions shifted from being predominantly accumulation-oriented to being profit-taking in nature. In addition, the network activity suggests the user base is relatively stagnant and consists mostly of investors with a “HODLer” mentality.

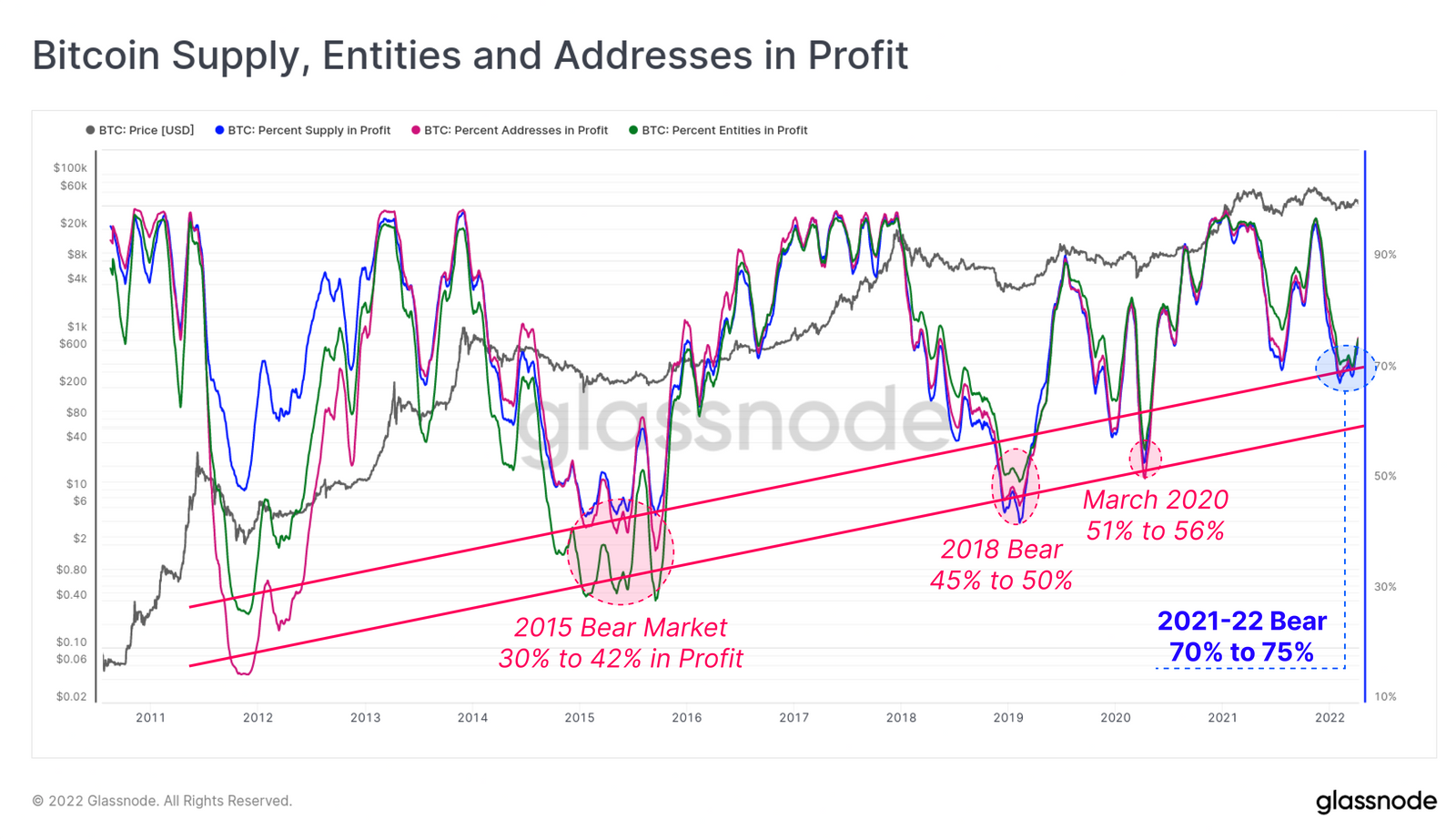

Despite Bitcoin losing 14% in the last 7 days and trading more than 41% removed from its last November’s peak, the vast majority of Bitcoin supply remains in the green, according to Glassnode. As of the second week in April, between 70% and 75% of the circulating BTC supply is in profit. For context, historical data shows that we are still far from the low-profit figures reached in previous bear markets.

It is worth pointing out that short-term holders are largely still in the green during the current market cycle, as opposed to January, when the sudden price drop pushed virtually the entire BTC supply of short-term holders into the territory of unrealized losses.

The Glassnode researchers concluded the report by highlighting the lack of new capital flowing in the market, which could mean bearish activity is likely to continue in the short–term.